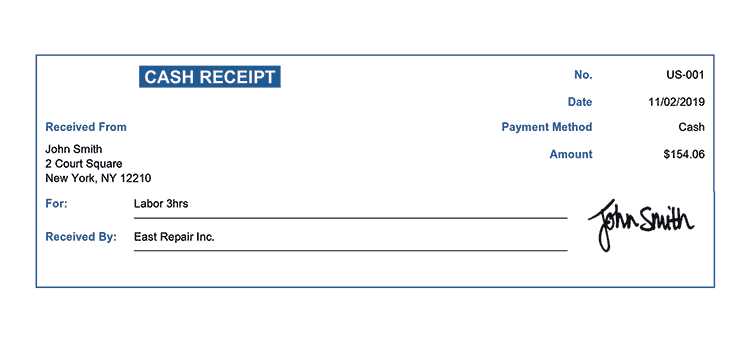

If you’re managing a business, creating a reliable and simple receipt template is key to staying organized and ensuring proper record-keeping. A well-structured receipt can help you track transactions, maintain customer trust, and meet compliance requirements. One practical solution is using a self-businesscheck receipt template, which streamlines the process and provides clarity on both sides of the transaction.

Start by including essential details such as the business name, contact information, and tax identification number. Make sure the receipt clearly outlines the items or services provided, along with their respective prices. Providing a breakdown of any applicable taxes and the total amount due is crucial for transparency and to avoid confusion with customers.

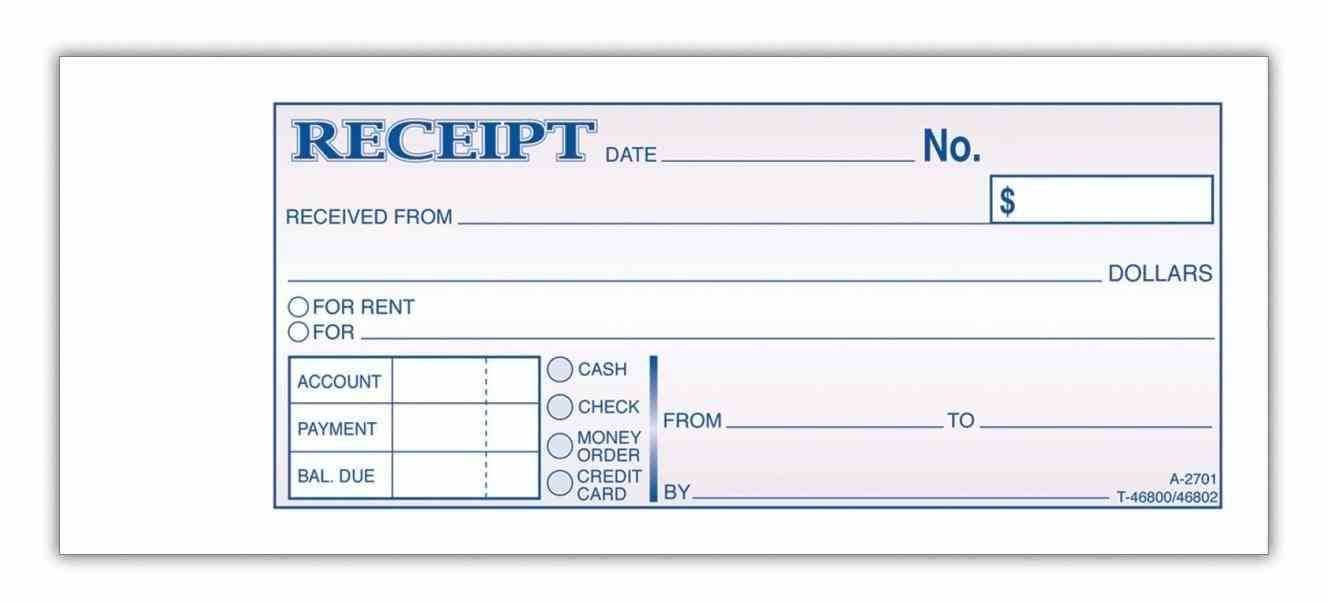

Additionally, including a unique receipt number is a smart move for future reference and to track purchases efficiently. Offering clear payment terms, such as whether payments are made in full or partially, also adds to the clarity of the document. Incorporating a signature line can further authenticate the receipt, especially in situations requiring physical proof.

Here are the corrected lines:

Ensure you use clear and concise language for the business check receipt template. Focus on the specifics, such as the exact items or services rendered, and ensure all fields are clearly labeled. Below are some key adjustments:

- Correct the date format to a consistent one, preferably MM/DD/YYYY, for clarity.

- Ensure the total amount is correctly calculated and displayed, without ambiguity.

- Clearly state the payment method used (e.g., credit card, cash, bank transfer). Avoid general terms like “Paid” or “Received”.

- Specify the transaction ID or reference number for tracking purposes.

- Provide space for customer signatures if required, with an instruction if needed (“Sign here”).

By implementing these changes, your receipt will be more professional and easier for both you and the customer to understand. Double-check for any missed details before finalizing the template.

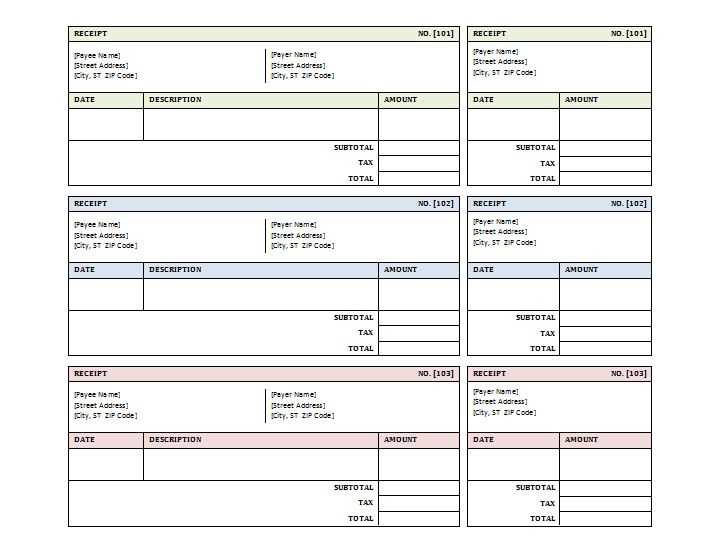

- Self Businesscheck Receipt Template

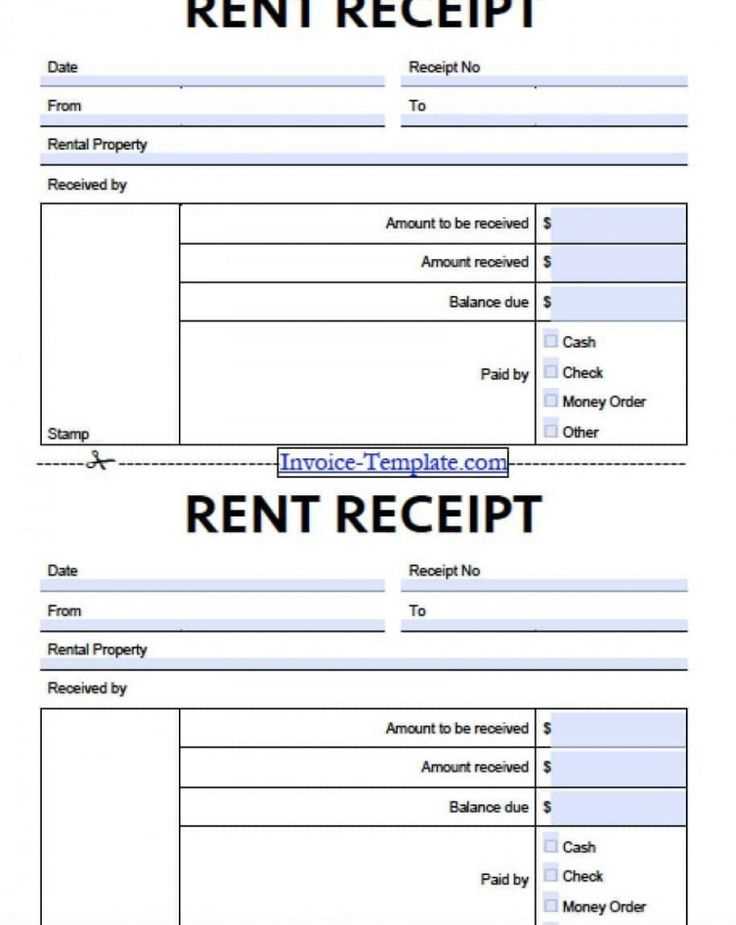

For a well-structured receipt template tailored to a self businesscheck, focus on these key elements:

- Business Details: Include the business name, address, phone number, and email. Ensure it’s easy to locate for both you and your client.

- Receipt Number: Assign a unique, sequential receipt number for tracking purposes.

- Date of Transaction: Indicate the exact date the businesscheck was processed. This helps to avoid confusion in future records.

- Description of Service or Product: Provide a brief description of the services or products sold, with clear quantities and pricing breakdowns. This gives transparency.

- Total Amount: Clearly list the total amount charged, with taxes and fees if applicable.

- Payment Method: Specify the payment method used–whether by check, cash, card, or another option. This provides an additional layer of clarity.

- Signature: Space for both parties to sign, confirming the transaction has been processed.

Make sure to format this template clearly for ease of understanding. Align all sections to be easily distinguishable, and include a small footer with your business’s legal details, such as tax ID or registration number if needed. This format ensures both you and your client have all the necessary documentation to keep records organized.

Keep your businesscheck receipt template clean and easy to understand. Focus on key elements that customers expect to see, such as the transaction details, business information, and a clear breakdown of costs.

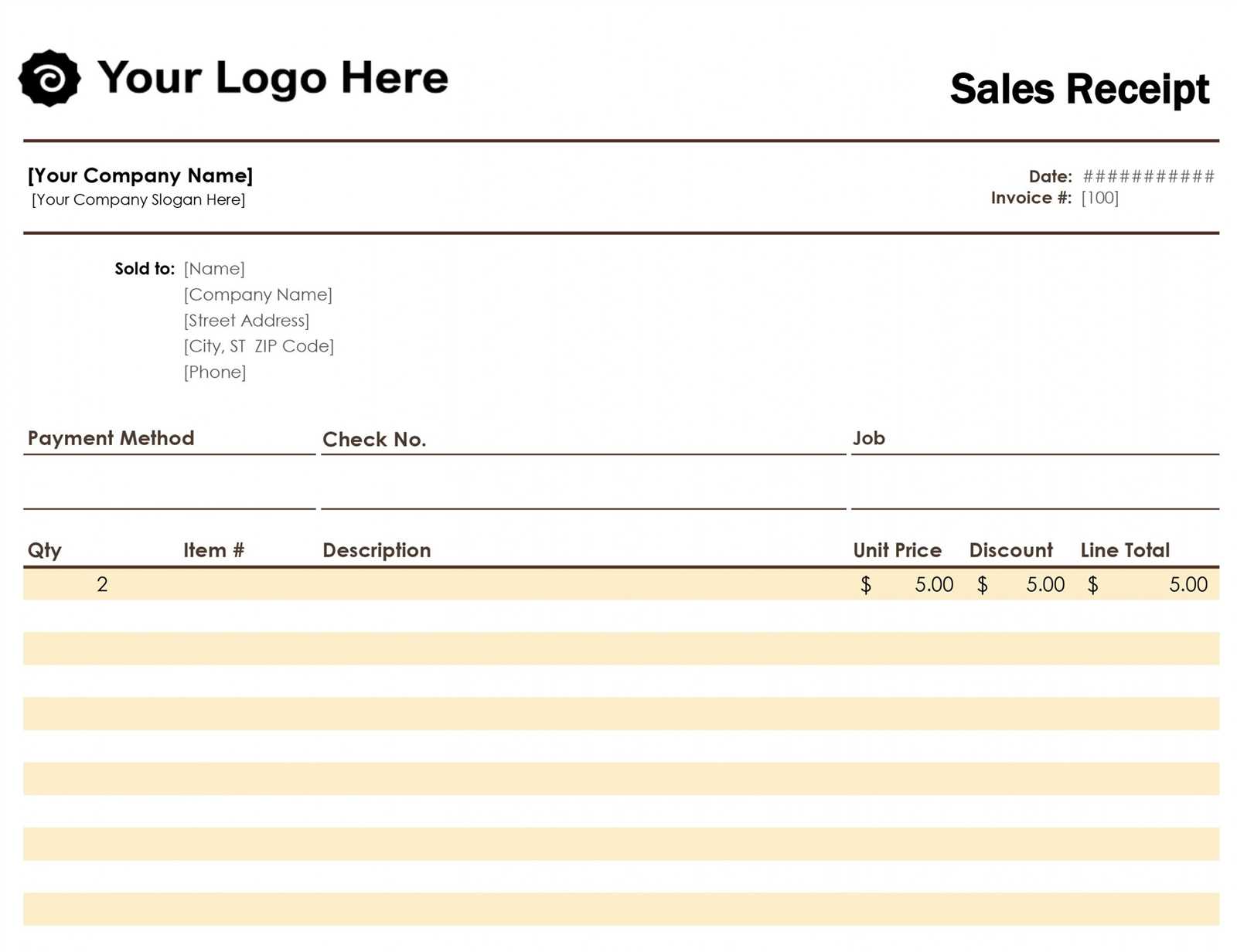

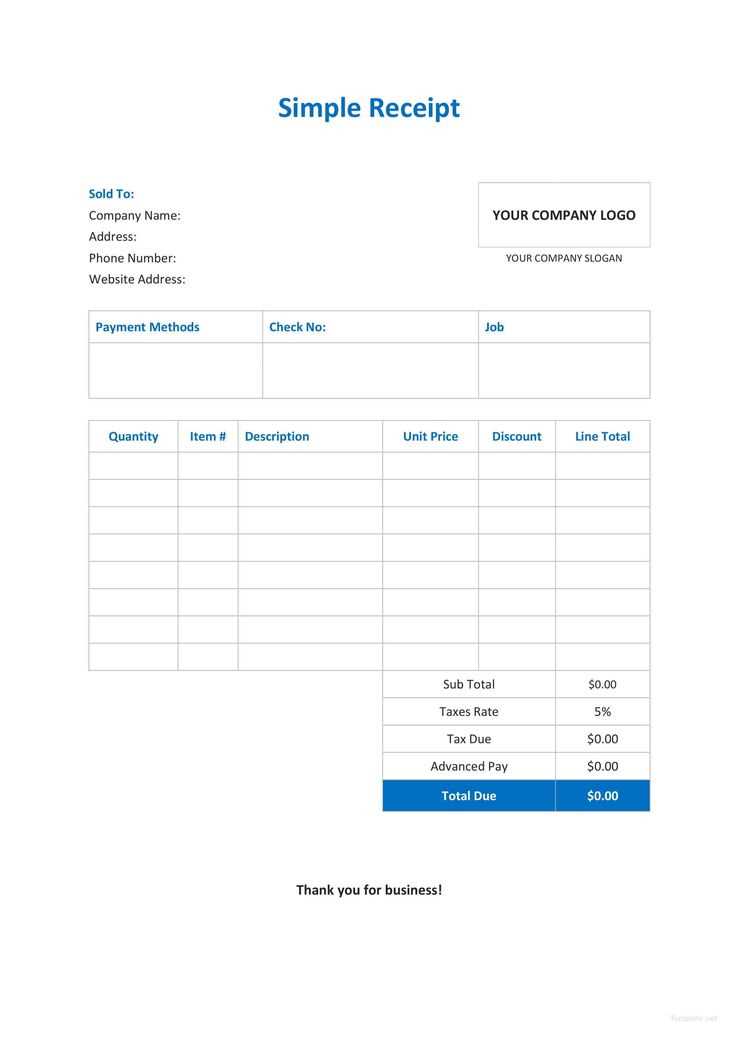

Include the following components in your template:

| Component | Description |

|---|---|

| Business Name & Contact Information | Place your business name at the top, followed by address, phone number, and email. |

| Receipt Number | Assign a unique receipt number for easy reference and record keeping. |

| Date & Time of Transaction | Ensure the date and time of the transaction are clearly listed. |

| Itemized List of Products/Services | Provide a breakdown of purchased products or services, with prices for each item. |

| Total Amount | Display the total amount due, including taxes or discounts if applicable. |

| Payment Method | Indicate the payment method used (credit card, cash, etc.). |

| Thank You Message | A simple thank-you message adds a personal touch to the receipt. |

Keep the layout simple. Use a clear font and sufficient spacing between sections to make the receipt easy to read. Avoid overloading the template with unnecessary information.

Finally, consider offering a digital version of the receipt that customers can access via email or a mobile app. This will improve convenience and reduce paper waste.

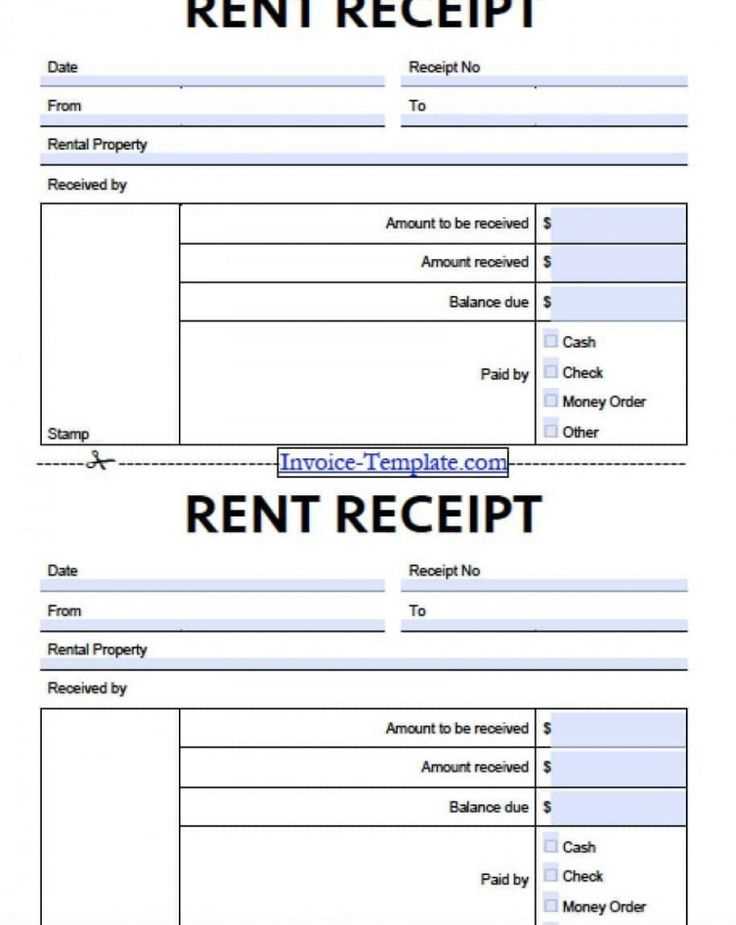

Include the transaction date at the top of your businesscheck receipt. This ensures you have a clear record for tax filing and auditing purposes. The date should match the actual date of the transaction, with both the day and year specified.

The receipt should display the business name and contact details, such as address, phone number, and email. This provides clarity about the source of the payment and allows tax authorities to verify the legitimacy of the transaction if needed.

Next, list the itemized goods or services purchased, including descriptions, quantities, and prices. If applicable, break down any taxes or discounts separately to avoid confusion during tax calculations.

Ensure the total amount paid is clearly shown. Include any additional fees or charges that may be involved, such as handling or shipping costs. This will help avoid discrepancies when calculating deductions or income.

The payment method should also be clearly stated, whether it’s by cash, check, credit card, or bank transfer. This can help track the movement of funds for proper financial reporting.

Don’t forget to include a unique receipt number. This number can help you quickly locate specific transactions in your records, which is useful for both tax purposes and future audits.

Finally, include a statement or reference to confirm that the payment is being received for a valid transaction, especially if the payment was made for an invoice or contract. This serves as proof of the transaction and supports tax filing compliance.

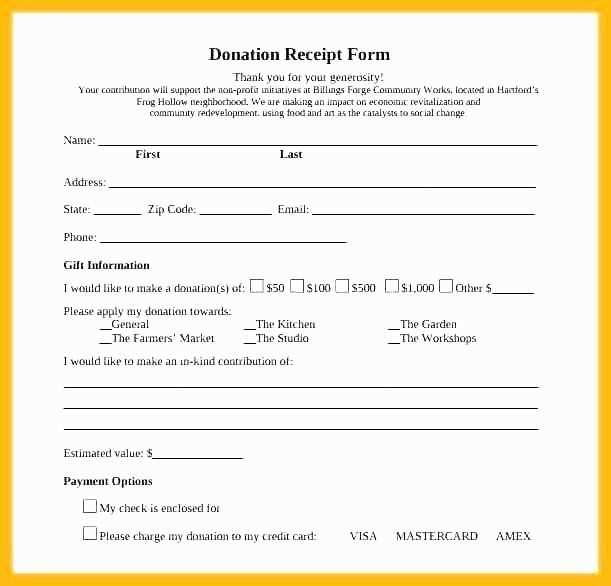

To ensure clarity and transparency, adapt your receipt template based on the payment method used. Customizing the template for different types of payments will help maintain accurate records and make the transaction process smooth for both parties.

Cash Payments

For cash transactions, include the total amount paid and the amount of change given. This prevents any confusion and provides a clear record of the cash exchange. Make sure the change is clearly itemized to avoid future discrepancies.

Credit and Debit Card Payments

For card payments, specify the card type (Visa, MasterCard, etc.), the last four digits of the card number, and the authorization code if applicable. This ensures that the transaction can be referenced and traced back to the correct payment method without exposing sensitive data.

Online Payments

When dealing with online payments through services like PayPal, Stripe, or others, include the transaction reference number and payment provider. This allows both you and the customer to track the payment easily. Make sure the details match what’s shown in your online account for consistency.

Customizing your receipt for various payment methods creates a more professional experience for your customers and ensures accurate documentation of all transactions.

Creating a self businesscheck receipt template requires clear and straightforward details for both you and your client. Make sure to include a header with the business name, address, and contact details. This ensures your receipt looks professional and contains all necessary information at first glance.

Receipt Structure

Start with the transaction date, which allows both parties to keep track of when the service or product was provided. Include a clear description of the product or service, along with any applicable quantities and pricing. Avoid any unnecessary jargon–clarity is key.

Key Elements to Include

- Receipt Number: Helps with organization and tracking.

- Payment Method: Specify whether it was cash, card, or other methods.

- Total Amount: Highlight the total charge, including taxes if applicable.

- Signature Line: Allow space for signatures if needed to confirm the transaction.

Once completed, double-check all the details for accuracy and make sure the design is easy to read. A clean, no-frills layout keeps the focus on the key details.