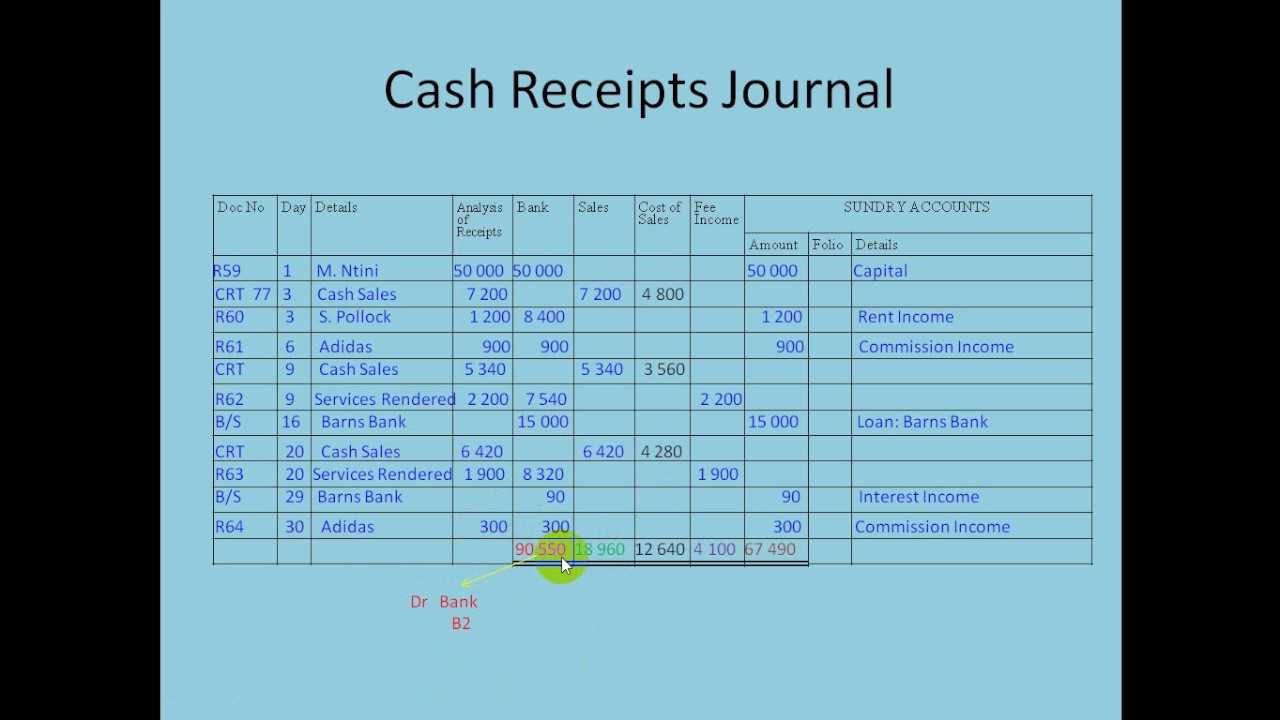

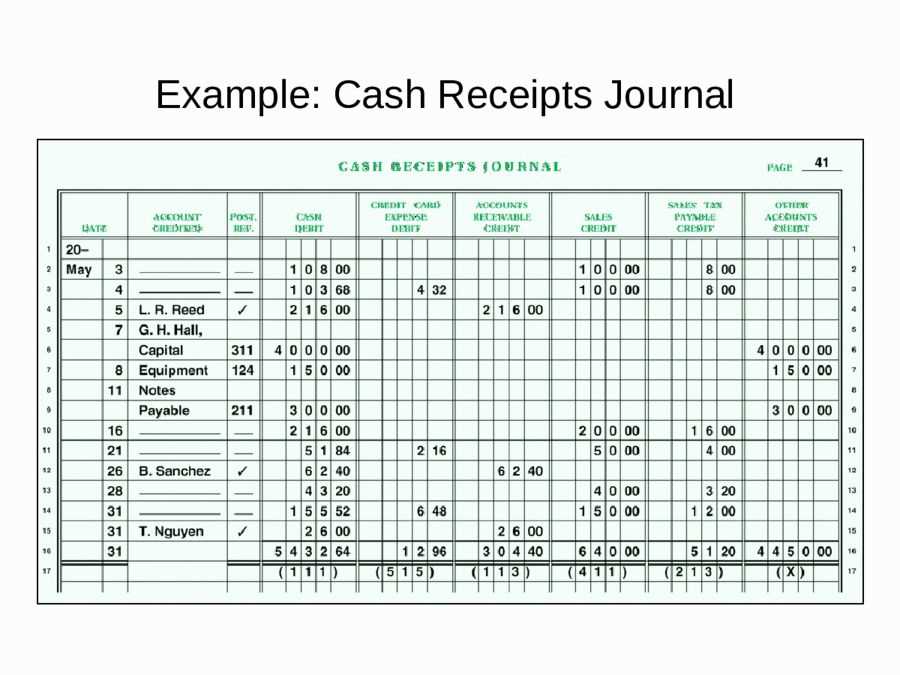

For accurate tracking of all incoming payments, implementing a cash receipts journal is a must. A well-structured template ensures that every transaction is recorded clearly and consistently. The template should include fields for the date, description of the payment, payer’s details, amount received, and the account where the payment will be posted.

Using a cash receipts journal template simplifies the process of categorizing payments and saves time during financial reporting. Instead of manually entering data into various ledgers, the template can automate calculations and highlight discrepancies, improving accuracy. For businesses that deal with frequent transactions, this tool provides an organized way to stay on top of finances.

In addition, customizing the template to suit your specific business needs enhances its utility. Whether you’re dealing with credit card payments, cash deposits, or other forms of revenue, having distinct columns for each type of transaction helps in quick identification and sorting. This not only streamlines the workflow but also ensures that no payments are missed or incorrectly classified.

Here’s the corrected version:

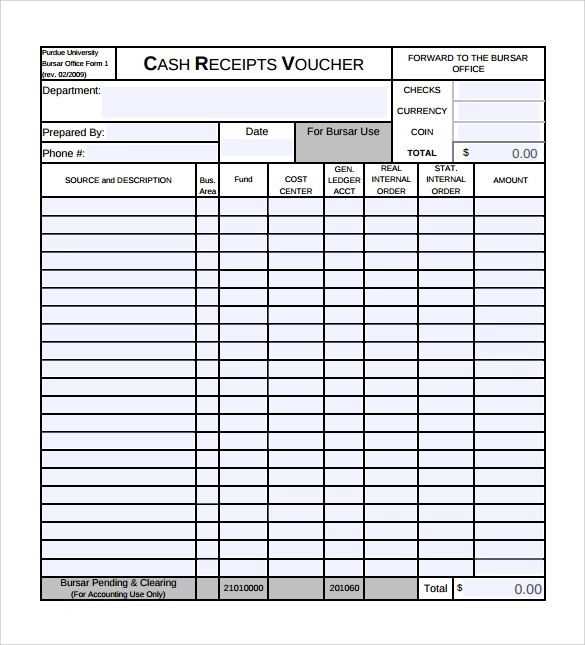

Ensure that all columns in your cash receipts journal are clearly labeled. Include the date, receipt number, customer name, payment method, amount, and account affected. Avoid clutter by separating each section with clean lines, so the data is easy to read and follow.

In the ‘Payment Method’ column, specify whether the payment was made by check, cash, or other methods. This will help you keep track of any differences in how payments are processed.

In the ‘Amount’ column, double-check your figures. Errors in this area can lead to serious discrepancies in your financial reporting.

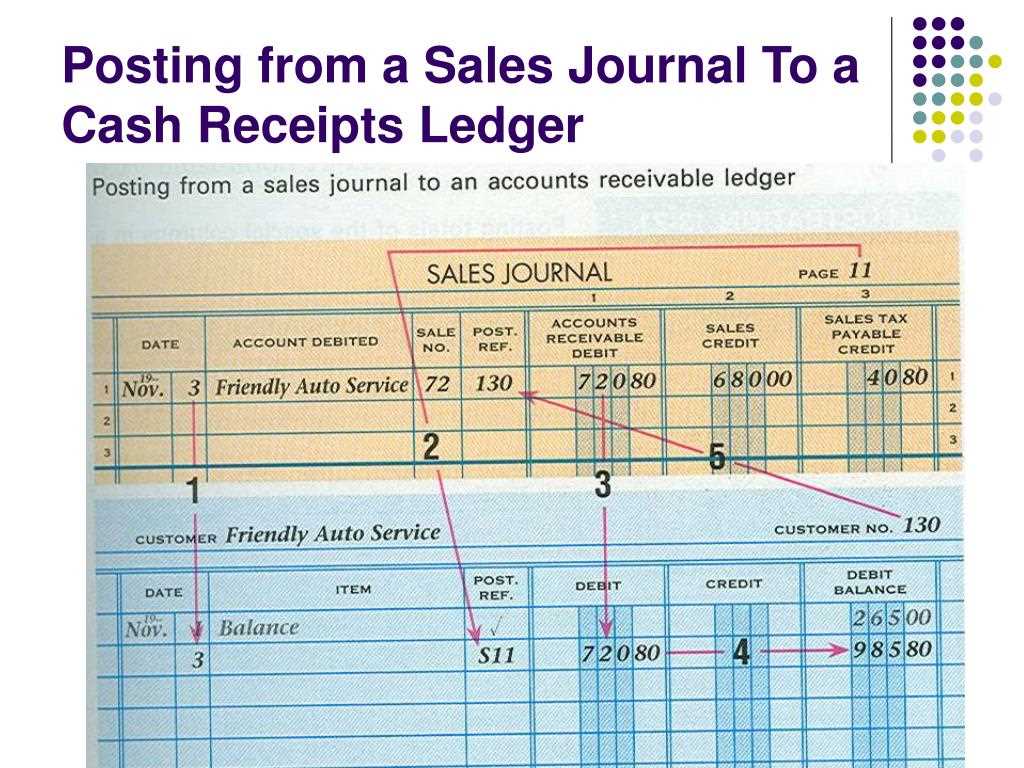

When allocating payments, use the ‘Account Affected’ column to specify whether the payment was applied to accounts receivable, sales, or other relevant accounts.

Finally, ensure you have a reconciliation process in place. Periodically compare the journal entries to your bank statements to identify any potential errors and maintain accurate records.

- Accounting Cash Receipts Journal Template

A well-structured accounting cash receipts journal template helps businesses track all incoming payments effectively. The journal allows clear documentation of cash inflows, ensuring that every transaction is properly recorded for accounting purposes.

Key Components

Incorporate the following key sections in your template for accurate data tracking:

- Date: Enter the date of receipt for each transaction.

- Receipt Number: Assign a unique identifier for each payment received.

- Customer Name: Record the name of the customer making the payment.

- Payment Method: Indicate whether the payment was made by cash, cheque, credit card, or bank transfer.

- Amount: Specify the exact amount of money received.

- Account Credited: Identify the account that the payment is credited to, whether it’s a sales revenue account or a liability account.

- Remarks: Add any notes that may be relevant for future reference or to explain the transaction details.

Best Practices for Using the Template

Use consistent formatting for easy reference. For each transaction, fill in every field accurately and review the entries regularly to ensure no details are overlooked. Having this template in place also simplifies financial reporting and audits, as it provides a detailed and organized record of cash receipts.

To create a cash receipts log in Excel, follow these simple steps:

- Create a New Spreadsheet: Open Excel and start a new workbook.

- Label Your Columns: Label the columns to track necessary details. Typical columns include:

- Date of Receipt

- Receipt Number

- Customer Name

- Amount Received

- Payment Method

- Account Credited

=SUM(B2:B100) in a separate cell to total the values in the Amount Received column.By following these steps, you can set up an organized and efficient cash receipts log in Excel, ensuring accurate tracking of all incoming payments.

Accurate logging of payments and modifications is crucial for maintaining transparency in financial records. Begin by recording each payment in the appropriate column of the cash receipts journal. Note the date of the transaction, the amount received, the payer’s details, and the specific account it is applied to. Use consistent naming conventions to avoid confusion.

Recording Payments

When recording payments, ensure that the payment amount matches the amount on the transaction record. If you receive a partial payment, note the outstanding balance for future reference. For checks, include check numbers, and for electronic payments, list the transaction reference number. Double-check all information before confirming the entry.

Making Modifications

If a modification is necessary, adjust the original entry by noting the change in the same journal entry. Make sure to document the reason for the modification and the exact nature of the adjustment. This can include correcting errors or updating amounts based on new information. Keep track of all modifications separately for audit purposes.

To reconcile your cash receipts record with bank statements, follow these steps:

1. Compare Deposit Dates: Check if the deposit dates in your cash receipts journal match the dates on your bank statement. If a deposit is missing, look for any outstanding transactions that may have not cleared yet.

2. Check for Errors: Review your cash receipts journal for any data entry errors. Ensure all receipts are properly recorded with accurate amounts and dates. Compare each entry with the corresponding bank transaction to confirm correctness.

3. Match Amounts: Compare the total cash receipts recorded in your journal with the deposit totals shown on the bank statement. Any discrepancy should be flagged and reviewed for possible reasons, such as errors or unaccounted transactions.

4. Account for Fees or Charges: Your bank may charge fees that are not recorded in your cash receipts journal. Include these charges in your reconciliation to ensure the balances match correctly. Common fees include transaction fees or bank service charges.

5. Reconcile Unmatched Items: If you find any entries in your cash receipts journal that don’t match with your bank statement, investigate them. Look for timing differences, unprocessed checks, or deposits that might have been made after the statement cutoff.

6. Create a Reconciliation Statement: Prepare a summary table to track discrepancies and adjustments. This will help identify where the differences lie, allowing you to make necessary corrections. A simple table can include the following columns:

| Journal Entry | Bank Statement Entry | Discrepancy | Adjustment Made |

|---|---|---|---|

| Deposit #1 | Bank Deposit #1 | None | No adjustment |

| Deposit #2 | Bank Deposit #2 | $50 Short | Adjusted in journal |

Once you’ve reviewed all transactions and made necessary adjustments, your cash receipts record should match your bank statement, ensuring accuracy in your financial reporting.

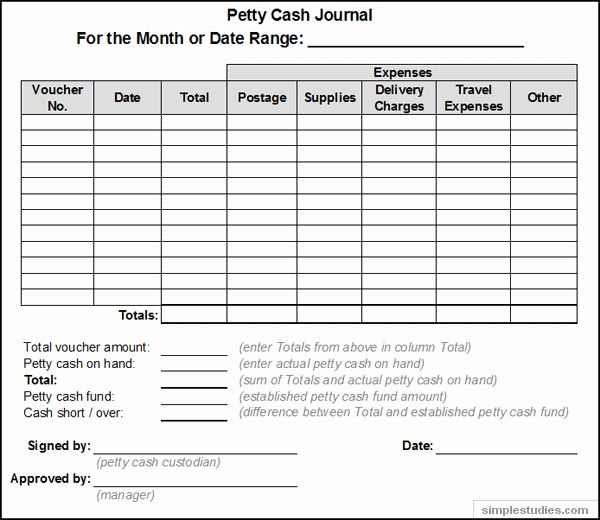

To optimize your cash receipts journal, focus on maintaining clarity and accuracy. Begin by organizing entries in chronological order, ensuring no transaction is overlooked.

- Record each payment with a corresponding date and amount. This will help streamline tracking and prevent errors.

- Use separate columns for payment type (e.g., check, cash, bank transfer) to simplify categorization and reporting.

- Group similar transactions under specific account headings. For example, categorize payments received for different services or sales separately.

Regularly review entries to verify all amounts match actual deposits. Create a monthly reconciliation routine to ensure consistency between the journal and bank statements.

- Consider automating your journal entry process if possible, using accounting software that can import transaction details directly from your bank.

- Set up alerts for discrepancies or unrecorded transactions to avoid missing critical updates.

Lastly, keep the format consistent. A well-structured, easy-to-read template ensures both accuracy and efficiency in your financial records.