To create a simple yet functional cash receipt, include the date, the amount received, and the payer’s details. Make sure to record the payment method–whether cash, check, or electronic transfer–along with a unique reference number for tracking purposes. Always indicate the purpose of the transaction, whether it’s for goods, services, or a donation.

Each receipt should clearly state the name of the payee or business entity. This is especially important if the receipt serves as proof for both parties in case of any disputes. Include a short description of the transaction, with a clear breakdown of items or services provided, to avoid any confusion later on.

Make sure to leave space for signatures. Both the payer and the payee should acknowledge the transaction to confirm its accuracy. Lastly, remember to keep a copy of each receipt for your records and ensure that it is accessible for future reference, particularly during tax season or audits.

Here is the corrected version:

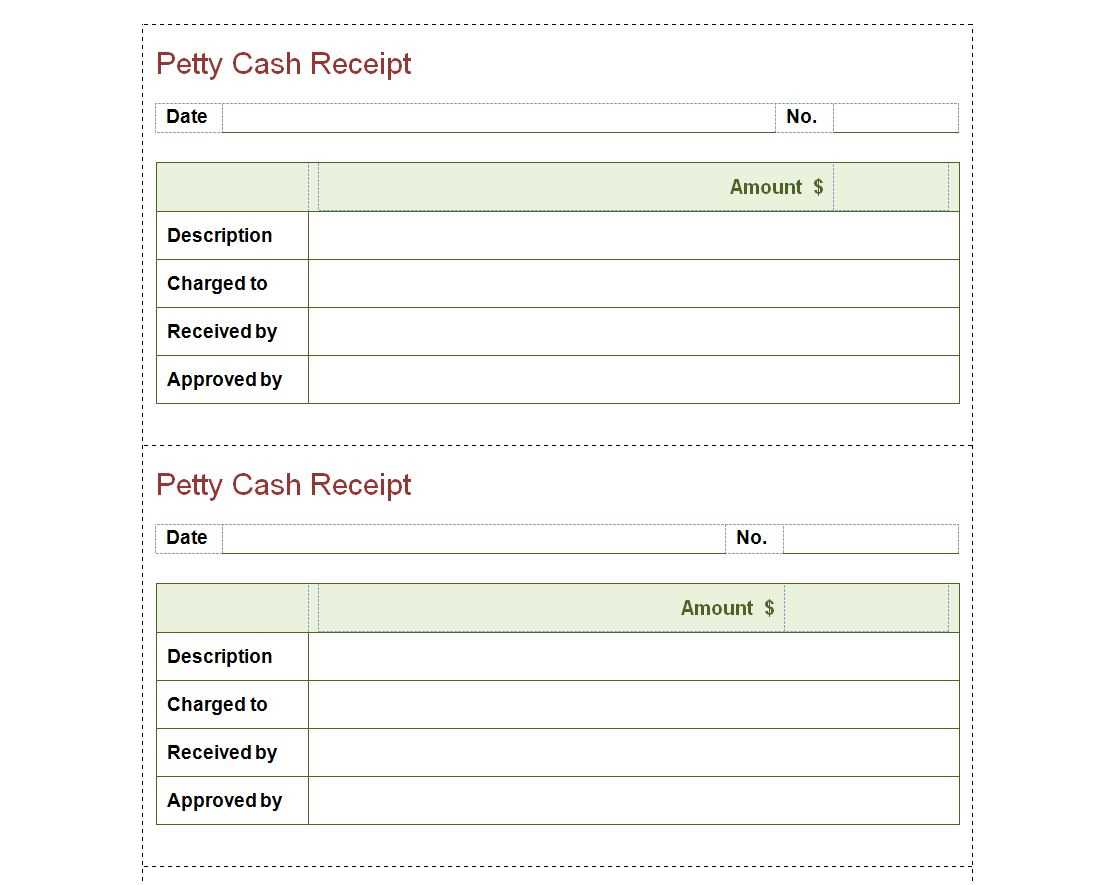

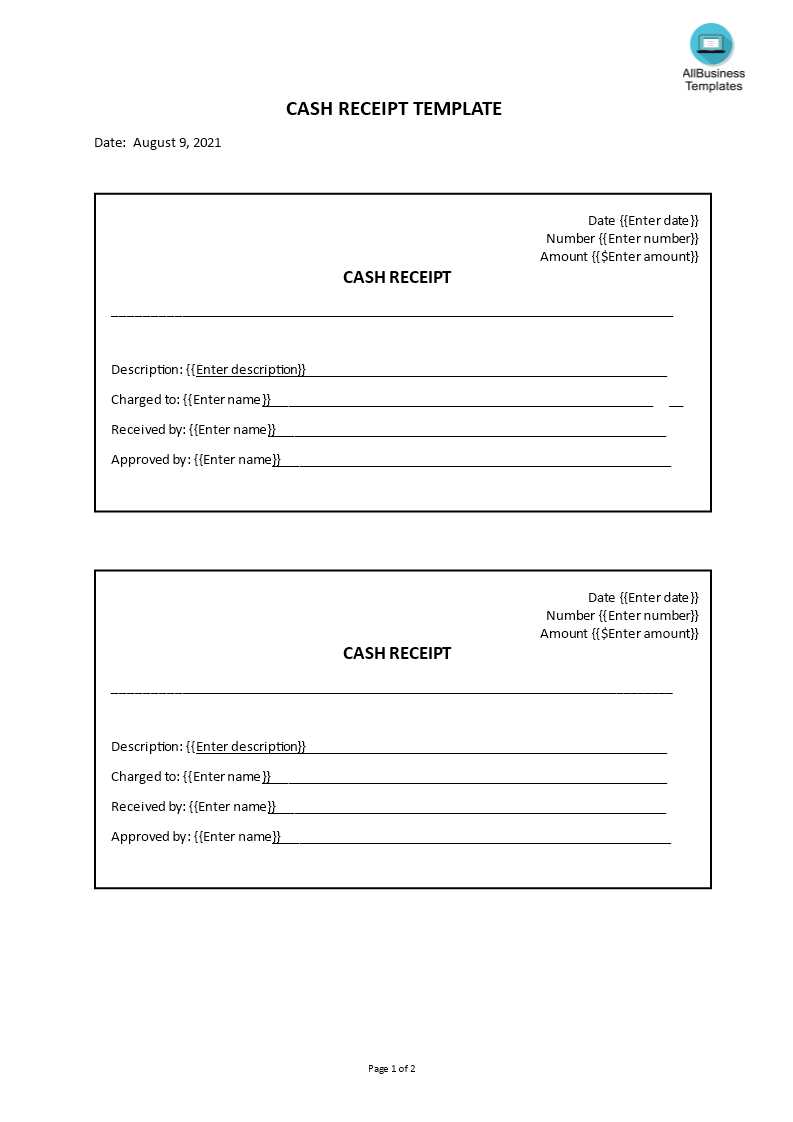

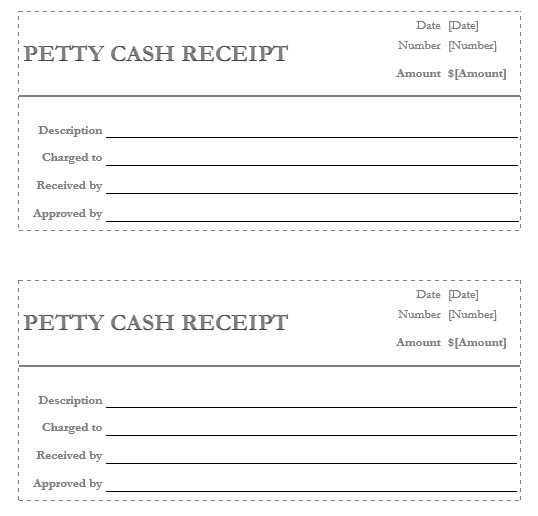

To create a clear and accurate cash receipt, follow this structure:

- Date: Clearly display the transaction date at the top.

- Receipt Number: Assign a unique receipt number for tracking purposes.

- Seller Information: Include the seller’s name, address, and contact details.

- Buyer Information: Add the buyer’s name, address, and contact details if necessary.

- Items or Services Provided: List the purchased items or services, with quantity and price breakdown.

- Total Amount: Clearly state the total amount paid.

- Payment Method: Indicate the method of payment (cash, card, etc.).

- Signature: Provide space for the seller’s and/or buyer’s signatures, if required.

This layout ensures all necessary details are captured and the receipt is both legible and professional.

- Basic Cash Receipt Template: Practical Guide

Begin by including the following key elements in your cash receipt template: a clear header stating “Cash Receipt,” the date of the transaction, the payer’s name, and a description of the payment made. Ensure that you clearly indicate the amount paid, both in words and numerically, along with any applicable taxes or additional charges. It’s also helpful to include a reference number for tracking purposes.

| Field | Details |

|---|---|

| Receipt Number | Unique identifier for the transaction |

| Date | The date when the transaction occurs |

| Payer’s Name | The person or organization making the payment |

| Description | Details about the goods or services for which payment was made |

| Amount Paid | Amount received, written both numerically and in words |

| Signature | Signature of the payer or authorized person |

Provide a space for the payer’s signature to confirm the payment. A receipt with this information ensures transparency and can serve as a reference for both parties. Avoid adding unnecessary or confusing details that could make the document more complicated than needed.

To finish the template, include your business or organization’s contact details, including address and phone number. This ensures the payer can reach out in case of any inquiries.

Creating a straightforward cash receipt involves listing key details about the transaction. Start by including the date, amount received, and a brief description of the goods or services sold. Make sure the receipt has a unique number for record-keeping.

Details to Include

Include the name of your business and contact information, such as an email address or phone number. This makes the receipt valid and traceable. Be sure to clearly state the payment method, such as “Cash,” to avoid confusion. If applicable, list taxes separately to ensure transparency.

Final Touches

Close the receipt with a signature line or a note confirming that the transaction was completed. This adds a personal touch and ensures both parties are clear about the agreement. Store receipts properly for future reference and auditing purposes.

Include the transaction date and time to track the exact moment of purchase. This allows for accurate chronological records.

Clearly list the items or services purchased, including descriptions and quantities. This provides transparency and avoids confusion over what was bought.

Specify the total amount paid, breaking down individual prices, taxes, and any discounts. This ensures transparency and facilitates future reference.

Include payment method details, such as cash, card, or electronic payment. This clarifies how the transaction was completed and can help in reconciling accounts.

Ensure that the receipt includes the business name and contact details. This allows for easy follow-up in case of disputes or refunds.

Provide a unique receipt number or identifier for easy reference and tracking. This helps organize and retrieve receipts when needed.

Double-check the amounts. Ensure the total matches what was received. Mistakes here can lead to accounting errors or confusion with the customer.

Always include the correct date. A missing or incorrect date can cause issues with tracking payments and tax reporting.

Provide clear and accurate details. Include the full name of the payer, the reason for payment, and the payment method. This avoids misunderstandings later on.

Avoid vague descriptions. Be specific about the items or services paid for. Ambiguities can cause problems if there are disputes in the future.

Do not forget to sign or validate the receipt. A signature ensures the receipt is officially issued and prevents potential challenges to its authenticity.

Keep your receipts consistent. A standard format for all transactions helps maintain organization and makes it easier to track payments.

Don’t overlook the importance of providing a copy to the customer. Both parties should have a receipt to maintain accurate records of the transaction.

I’ve removed unnecessary repetitions while preserving the meaning and structure of the sentences.

Avoid overcomplicating your cash receipt template. Focus on including the essential fields: the amount paid, payment method, payer’s name, and date of transaction. Ensure that these details are clearly labeled and easy to find. A simple, organized format reduces confusion and speeds up the process.

Key Details

When creating a receipt, make sure to include the following elements:

- Amount Paid: Clearly state the exact sum received.

- Payment Method: Indicate whether it was cash, credit, or another form of payment.

- Payer’s Name: Include the name of the individual or company making the payment.

- Date: Make the date of payment prominent on the receipt.

Tips for Clarity

Keep the language concise. Avoid long, complex sentences and unnecessary details. The simpler the receipt, the easier it will be for both you and the payer to understand. Double-check for errors to prevent any confusion later on.