Creating a blank cash receipt template simplifies the process of documenting cash transactions for businesses and individuals alike. A well-structured template ensures accuracy and consistency every time you issue a receipt. Whether you’re accepting payments for goods or services, this template offers a clear, organized format to record transaction details.

The template should include essential fields such as the date of the transaction, payer’s name, the amount received, and the reason for the payment. Additionally, leaving space for both the issuer and receiver’s signatures adds an extra layer of authenticity and agreement to the document.

By having a ready-to-use template, you can eliminate the need for creating receipts from scratch each time. This saves time, reduces the chances of errors, and maintains professionalism in your financial documentation. Customize it according to your needs to reflect the unique nature of your transactions, while still keeping the core elements intact.

Here’s the corrected version:

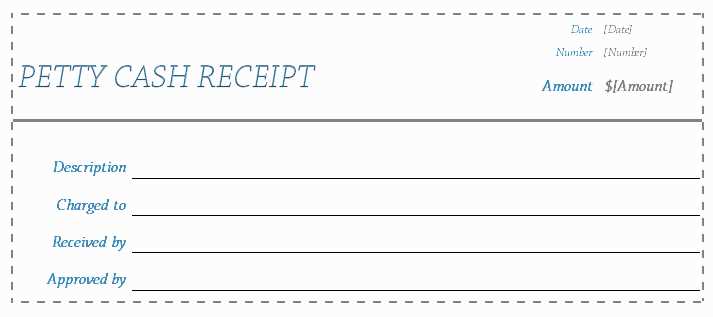

If you’re working with a blank cash receipt template, it’s important to ensure the key details are included clearly. The receipt should contain the following core elements to maintain proper record-keeping:

Required Information

Ensure that the following fields are included in your template:

- Receipt Number: A unique identifier for each transaction.

- Date: The exact date when the payment was made.

- Amount Paid: The total payment received.

- Payer’s Information: Name and contact details, if applicable.

- Payment Method: Specify whether the payment was made by cash, check, or card.

- Purpose of Payment: Describe what the payment is for (e.g., invoice number, product, or service).

Example Table Layout

Here’s how the template could be structured to clearly present all necessary details:

| Field | Details |

|---|---|

| Receipt Number | 00123 |

| Date | February 4, 2025 |

| Amount Paid | $150.00 |

| Payer’s Name | John Doe |

| Payment Method | Credit Card |

| Purpose of Payment | Service Fee for Consulting |

This clear structure will help both parties stay organized and ensure that all the necessary details are easily found. Adjust the template based on your needs, but these elements should remain constant for consistency and accuracy.

- Blank Cash Receipt Template: A Practical Guide

A blank cash receipt template helps you create a professional and accurate record for cash transactions. Whether you’re a small business owner, freelancer, or managing personal finances, this template serves as a straightforward tool for documenting payments made in cash.

Start by including key elements such as the date of transaction, amount received, and payer’s details. These pieces of information ensure that the receipt is legally valid and useful for future reference. Here’s what to include:

- Date: Clearly state the date when the cash payment was received.

- Payer’s Name: Include the full name of the person or entity making the payment.

- Amount Received: Specify the exact amount of cash received. Use clear currency formatting.

- Payment Method: Since it’s a cash receipt, note that cash was the form of payment.

- Transaction Purpose: Describe the reason for the payment or what it was for (e.g., service rendered, product purchased, rent payment).

- Receipt Number: Assign a unique receipt number for record-keeping purposes.

- Signature: Add a signature line for the person issuing the receipt and, if necessary, the payer.

Ensure the receipt layout is clear and well-organized. Using tables or sections helps break down information logically, making it easy to read and understand.

Once you have a blank template, you can customize it to your needs, such as adding a logo or business name, if applicable. Always print and keep a copy of the receipt for your records. For digital transactions, save the template as a PDF for easy sharing and archiving.

To customize a cash receipt template for your business, begin by adjusting the header. Replace generic fields with your company name, logo, and contact information to give the receipt a personalized touch. Ensure your business address and phone number are clearly visible to make it easy for customers to reach you if needed.

Next, tailor the payment details section. Specify the method of payment, whether it’s cash, check, or card, and include any transaction reference numbers or account details. This makes the receipt more transparent and helps both you and your customers track payments accurately.

Include fields for itemized purchases if applicable. Customize the layout to reflect the type of products or services your business offers, adding columns for quantity, description, and price. This will provide a clearer breakdown for the customer and ensure all items are listed correctly.

Don’t forget to set up tax fields according to your location’s regulations. Include space for sales tax and any other relevant charges, along with the total amount, ensuring that the final sum is easily distinguishable from individual line items.

Lastly, personalize the footer section. Add a thank-you message, warranty or return policy, or any additional notes that reflect your business’s style. This creates a professional, welcoming finish and can leave a lasting impression on your customer.

A receipt template should include specific details to ensure accuracy and transparency for both the buyer and seller. Here are the key elements to include:

1. Business Information

Clearly list the name of the business, address, contact details (email, phone number), and any registration numbers if applicable. This ensures customers know how to reach you in case of inquiries or issues.

2. Date and Time of Transaction

Always include the exact date and time of the transaction. This helps in record-keeping and is crucial for warranty or return policies.

3. Itemized List of Purchased Goods or Services

Each item or service purchased should be listed separately along with its quantity, unit price, and total price. This breakdown makes it easy to verify the transaction and avoid confusion.

4. Total Amount Paid

Clearly display the total amount paid, including taxes and any discounts applied. This gives the customer a clear understanding of what was charged.

5. Payment Method

Specify the method of payment used, whether cash, credit card, debit card, or digital payment. This detail can help in case of a payment dispute or refund request.

6. Unique Receipt Number

Assign a unique receipt number to each transaction. This allows for easy tracking and reference for both the business and customer.

7. Refund or Return Policy

Including information about your refund or return policy on the receipt clarifies the terms for customers and helps manage expectations.

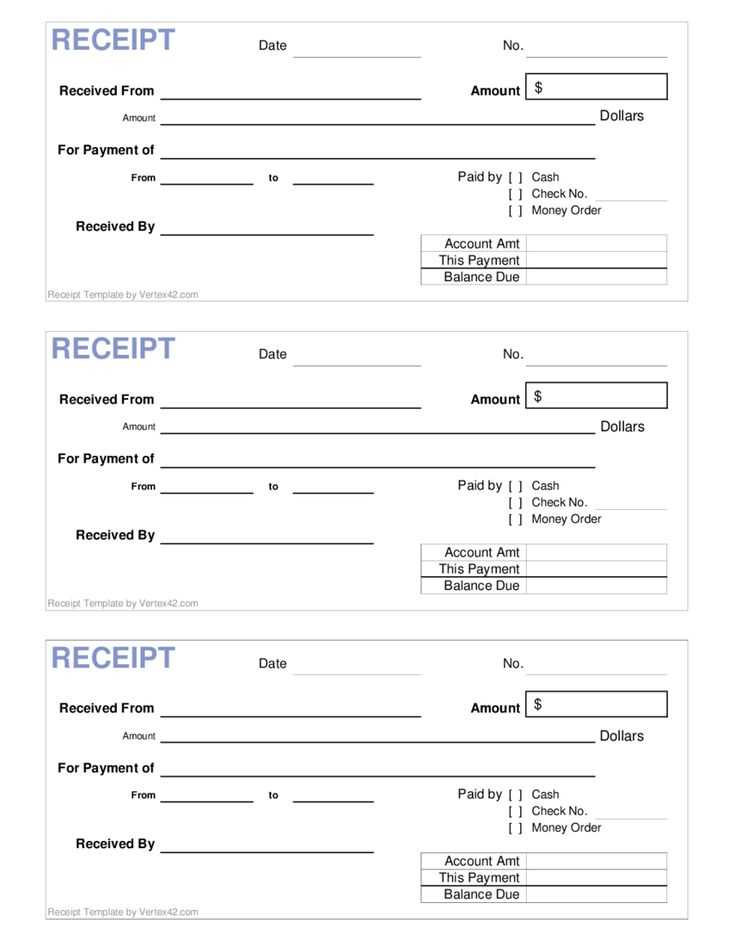

Reliable blank cash receipt templates can be found on a variety of platforms. Here are some trusted sources for downloading them:

1. Template Websites

- Template.net offers a wide selection of downloadable cash receipt templates, both free and premium. The templates are fully customizable and available in multiple formats, such as Word, Excel, and PDF.

- Vertex42 provides simple and professional receipt templates that can be used for both personal and business purposes. Their templates are highly rated for ease of use and formatting.

2. Office Software Platforms

- Microsoft Office offers pre-designed receipt templates in Word and Excel. Simply search for “receipt” in the template section to find various blank templates ready for use.

- Google Docs provides free receipt templates that can be accessed and edited online. These templates are ideal for users who need quick access and prefer cloud storage.

3. Accounting Software Platforms

- QuickBooks offers customizable receipt templates as part of their invoicing feature. It is designed for users who need integrated accounting features along with receipt generation.

- Wave Accounting provides free receipt templates in addition to their accounting software. Their receipts are ideal for small businesses needing quick documentation for cash transactions.

All of these platforms provide reliable and professional options for generating blank cash receipts. Depending on your needs–whether for personal use or business–you can choose the platform that offers the best customization and ease of use.

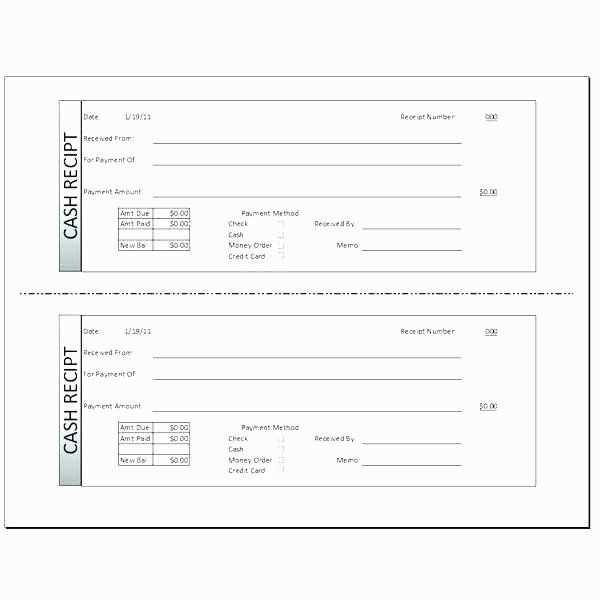

When using a receipt template for different payment methods, make sure the template includes clear sections to capture the details specific to each method. For cash payments, input the exact amount received and the corresponding change given. For credit or debit card payments, include the last four digits of the card number and the type of card used. This adds transparency and ensures your records are accurate.

For checks, write the check number, the issuing bank, and the date of the check. If payment is made through an online service like PayPal, indicate the transaction ID and payment gateway used. Always ensure the date of payment is listed and the total amount matches the transaction details.

For multiple methods, such as a combination of cash and card, break down the total amount into its respective parts and show them clearly. This will help avoid confusion and keep your records organized for future reference.

Lastly, save a digital or hard copy of the receipt to maintain a clear record of all transactions, which can be helpful for accounting or reimbursement purposes.

Secure your receipts by using a combination of digital and physical safeguards. Store receipts digitally as soon as possible by taking clear photos or scanning them with an app. This way, you have a backup in case they are lost or tampered with. For physical receipts, keep them in a designated folder or box, away from direct sunlight and humidity to prevent fading or damage.

1. Use Secure Storage Options

Online storage solutions like cloud services offer encrypted environments, protecting your receipts from unauthorized access. Ensure your cloud account has strong passwords and two-factor authentication enabled. If you store physical receipts, choose a lockbox or a fireproof container for added security.

2. Watch for Signs of Tampering

Inspect receipts for any unusual marks or altered details, especially after handling. Look for discrepancies like unusual fonts or mismatched formatting, which may indicate a fraudulent change. Avoid accepting receipts from unfamiliar sources if you’re uncertain about their authenticity.

| Action | Reason |

|---|---|

| Store receipts digitally | Reduces risk of loss or damage, allows quick access |

| Use lockboxes for physical receipts | Prevents theft and exposure to elements |

| Check for discrepancies | Helps detect fraud and ensures authenticity |

Stay proactive with these steps to avoid the risks associated with fraudulent receipts. Regularly audit your receipts to spot any inconsistencies early, and report suspicious activity immediately to the appropriate authorities or vendors.

Always ensure that receipts reflect accurate transaction details to avoid legal disputes. The receipt should include the correct date, amount, and description of the transaction. Misleading information can lead to claims of fraud or financial misrepresentation.

- Tax Compliance: Receipts must comply with local tax regulations. Businesses are required to provide proper documentation to customers for tax reporting purposes. Failure to issue receipts could lead to fines or penalties.

- Data Protection: Be cautious when collecting personal information for receipts. Avoid including unnecessary personal details such as social security numbers or credit card information unless required by law. Secure data handling practices are critical for compliance with privacy regulations.

- Record Keeping: Keep copies of all issued receipts for accounting and audit purposes. Most jurisdictions require businesses to retain financial records for several years. Failing to store receipts properly can result in issues during audits or tax reviews.

- Refund and Return Policies: Clearly outline your refund or return policy on the receipt. This helps prevent misunderstandings or legal disputes if a customer decides to return a product or service.

- Consumer Rights: Inform customers of their legal rights in relation to the transaction. Certain consumer protection laws may require that customers receive specific information or benefits, such as warranty coverage or the right to cancel orders within a set period.

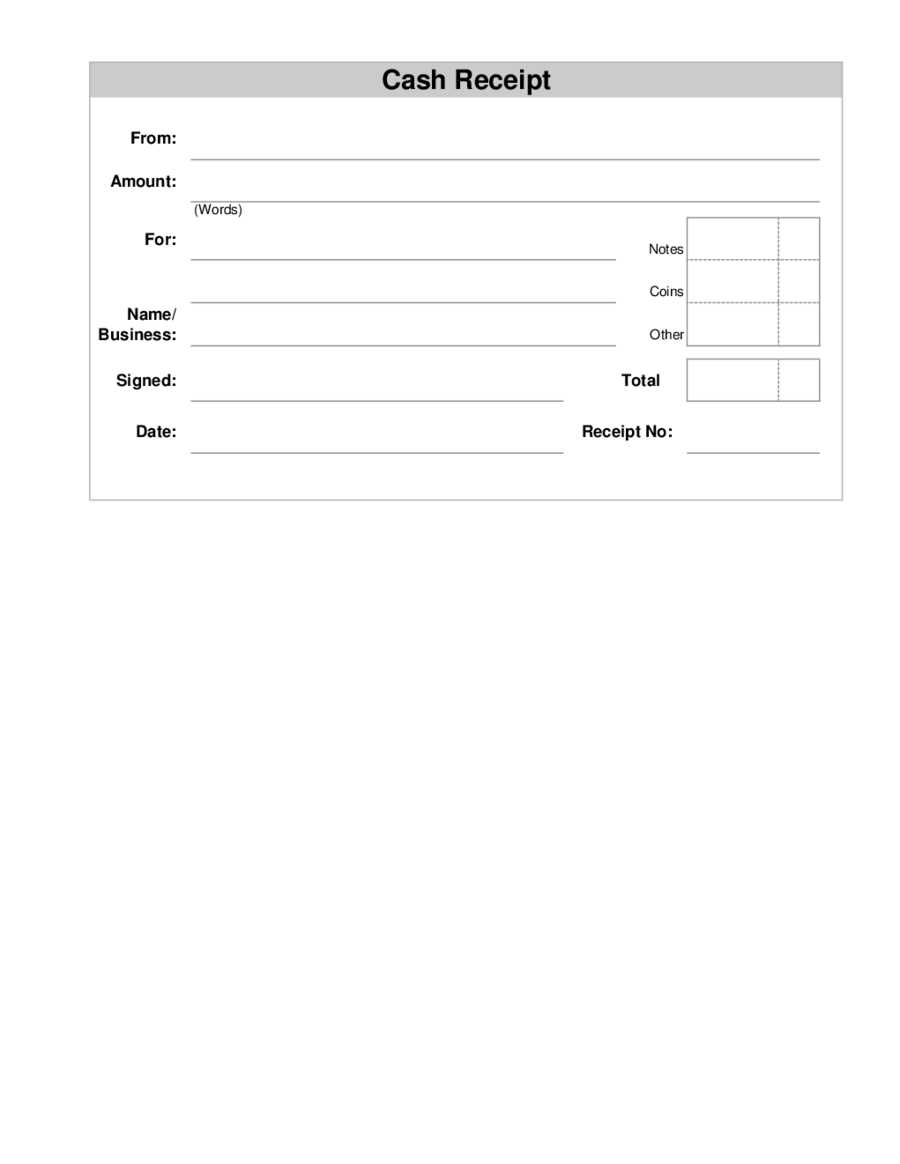

Use a blank cash receipt template to streamline the process of recording payments. Customize the template to meet your specific needs, ensuring it includes sections for the payer’s details, amount paid, and the purpose of the transaction. Make sure the template has clear spaces for both the issuer’s and recipient’s signatures for validation.

Key Components

Include the date and transaction reference number at the top for easy tracking. A description field allows you to specify the nature of the payment (e.g., for goods or services). Double-check that the amount field clearly separates the number and currency symbol to avoid confusion. Leave enough room for notes or additional details if necessary.

Customizing Your Template

Adapt the template’s layout based on your business’s needs. If you’re handling multiple currencies, add a currency selection option. Ensure the font is legible, and the format is simple enough for quick completion. Include a field for payment method to track whether the transaction was made by cash, cheque, or electronic transfer.