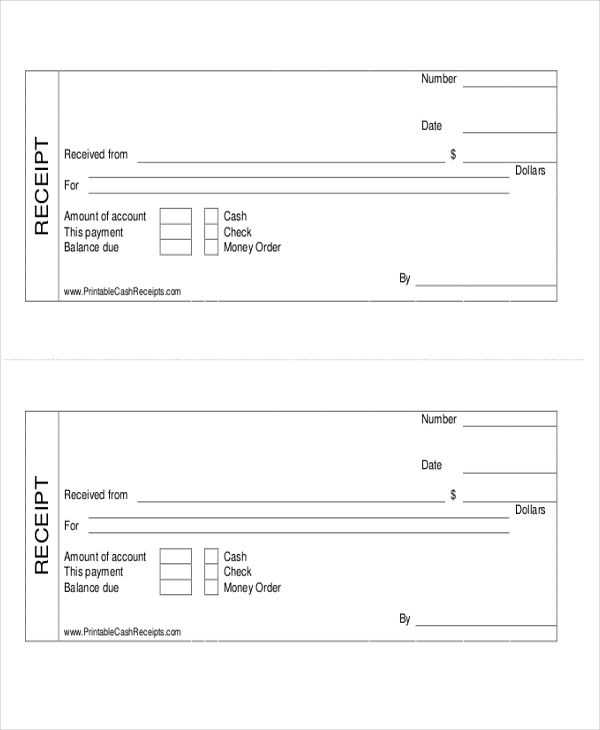

To streamline your financial records, a cash cheque receipt voucher template is a practical tool. This template helps ensure accuracy when documenting payments received via cheques, making it easier to track transactions for both personal and business finances. By using a voucher, you can clearly record essential details like the payer’s name, cheque number, amount, and the date of receipt.

Consider including specific fields such as payment purpose and signature lines to enhance clarity and accountability. These simple additions will make your records more reliable and easier to refer back to when needed. You can create your own template or use pre-designed formats available online, which can save time and effort.

Using a consistent format will help in managing receipts, especially when you need to reconcile accounts or address discrepancies. Make sure your voucher clearly states that it is a receipt, includes the transaction date, and is signed by the person receiving the cheque. Having these elements in place can protect both parties and simplify financial auditing.

Cash Cheque Receipt Voucher Template

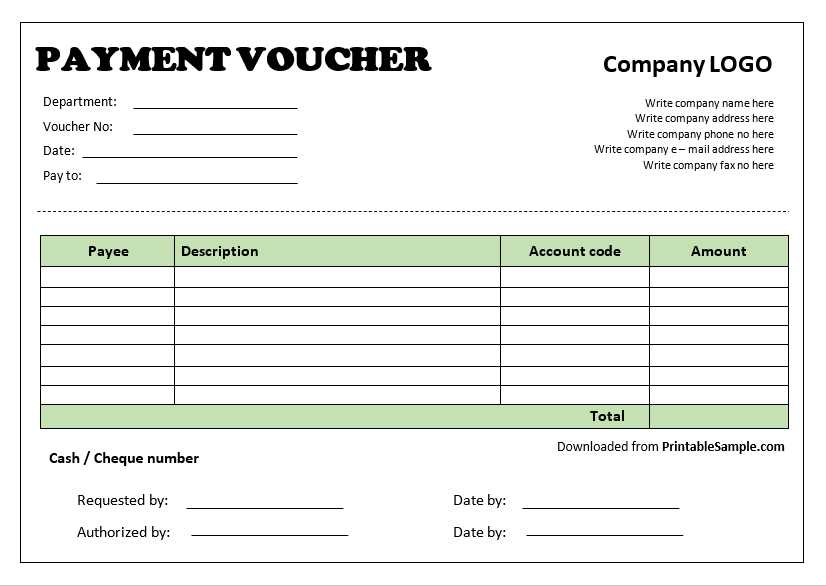

A cash cheque receipt voucher template helps track cheque payments and receipts accurately. This template should include specific sections for essential details to avoid confusion and ensure transparency in financial records.

Key Elements of a Cash Cheque Receipt Voucher

- Date: Always include the date of the transaction for proper record-keeping.

- Receipt Number: Assign a unique number to each receipt for easy tracking.

- Payee Details: Include the name and address of the person receiving the payment.

- Cheque Details: Mention the cheque number, bank name, and cheque date to link it to the transaction.

- Amount: Clearly state the amount in both words and figures to avoid discrepancies.

- Received By: The person receiving the payment should sign or initial the voucher.

- Payment Mode: Specify whether the payment was made by cheque or another method.

How to Use the Template

When filling out the voucher, ensure all information is accurate. Double-check cheque details and amounts to avoid errors. The template should be printed or saved digitally for future reference. Keep a copy for your records and provide the original voucher to the payee.

A well-organized cash cheque receipt voucher provides clarity and transparency in financial transactions. It helps both parties confirm the receipt and makes tracking easier during audits or reviews.

Creating a Cash Cheque Receipt Voucher Template in Excel

Open a new Excel workbook and start by labeling key columns. Include “Receipt Number,” “Date,” “Cheque Number,” “Payer Name,” “Amount,” “Bank Name,” and “Signature.” This will ensure all the necessary details are covered in the template.

Use Excel’s data validation feature to create dropdown menus for fields like “Bank Name” and “Cheque Number” to reduce errors. This is especially helpful if you work with multiple banks or need to standardize cheque numbers.

Set the column widths to fit the data comfortably and apply borders to make the table clear and easy to read. You can adjust the alignment of the text to keep it neat. For example, center-align the receipt number and date for uniformity.

For the amount, format the cell to display currency. This will ensure that the numbers are consistent and correctly formatted. If needed, add a formula to automatically calculate totals or other financial summaries at the bottom.

Incorporate a signature line at the bottom to acknowledge receipt, and leave space for any additional notes or instructions. You can create a simple line by merging a few cells in the row labeled “Signature.”

Save the template for easy reuse. You can also password-protect the file if sensitive information is included to prevent unauthorized edits.

Customizing the Template for Different Transaction Types

Adjust the cheque receipt voucher template for different types of transactions by focusing on the specific data each type requires. For a simple cash receipt, include fields for the payer’s name, amount, date, and purpose of payment. If it’s a deposit transaction, add a bank account number and reference number for further clarity.

Cash Transactions

For cash-based transactions, add sections that specifically highlight the payment method (e.g., “Paid by Cash”) and specify the serial number of the cheque or cash received. Make sure the template has a field for the cashier’s or receiver’s signature, confirming the cash exchange.

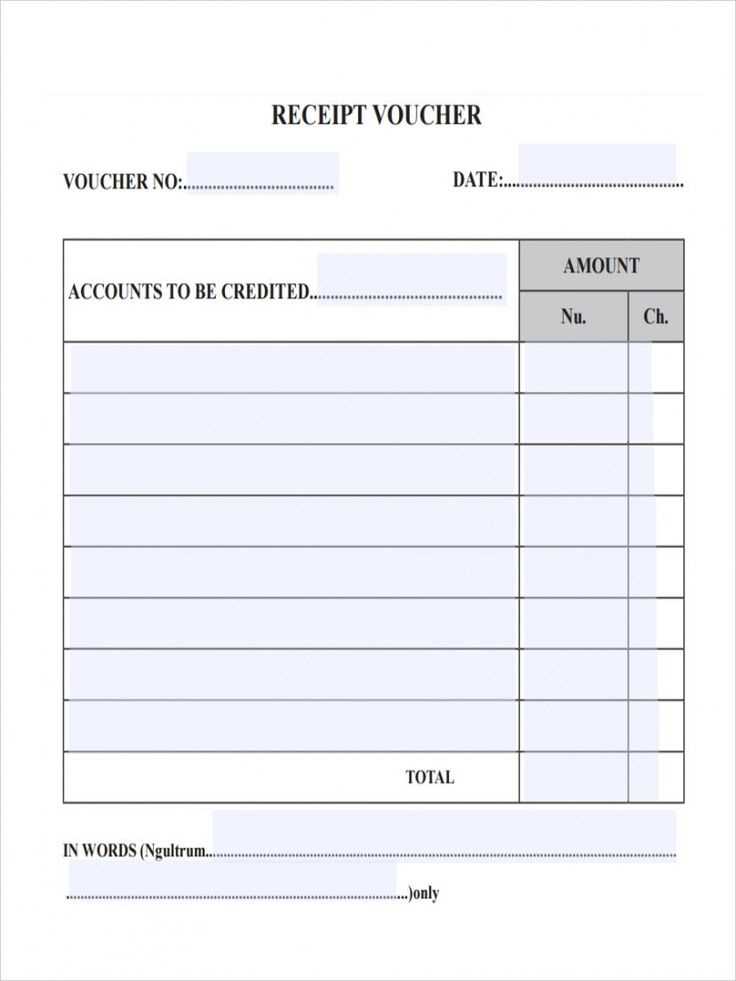

Bank Transfers or Cheque Payments

In case of bank transfers or cheque payments, include a space for transaction reference numbers or cheque numbers. Provide fields for the bank’s name and transaction date. For cheque payments, ensure the cheque’s issue date and bank details are clearly mentioned.

Customize the template to match the workflow of your business. Add necessary fields and remove irrelevant ones, focusing on clarity and ease of tracking. This allows you to easily differentiate between transaction types and quickly retrieve important details.

Best Practices for Maintaining Cash Cheque Receipt Records

Organize receipts systematically. Store each cheque receipt in a dedicated folder or database. Label receipts with unique identifiers, such as the cheque number or transaction date, to make future reference quick and accurate.

Record every receipt immediately. As soon as a cheque is received, log it in your records. Include details such as the payer’s name, amount, and cheque number. This reduces the risk of missing any transactions.

Keep digital and physical copies. While digital records provide convenience, maintaining physical copies can act as backups in case of technical issues. Use high-quality scans for better clarity and legibility.

Reconcile your records regularly. Cross-check your records with your bank statements to ensure that all cheques are properly deposited and recorded. Regular reconciliation helps identify discrepancies early.

Store records for the appropriate duration. Depending on local regulations, keep receipts for a set period, usually several years. This ensures you’re prepared for audits or future reference.

Secure your records. Protect both physical and digital records from unauthorized access. Use secure storage for physical receipts and encrypted systems for digital ones to avoid fraud or data loss.

Implement a backup plan. Regularly back up your digital records to an external drive or cloud storage. This prevents loss of data in case of device failure or cyber threats.

Train your staff. Ensure everyone involved in handling cash cheque receipts is familiar with the process and understands the importance of accurate record-keeping.