Use a clear and simple template for cash collection receipts to ensure transparency in all financial transactions. A well-structured receipt provides an organized way to track payments and maintains clarity for both the collector and the payer. The template should include key details such as the date, amount received, purpose of the payment, and the signature of the collector.

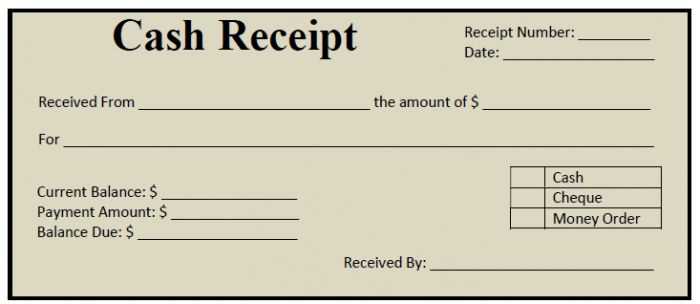

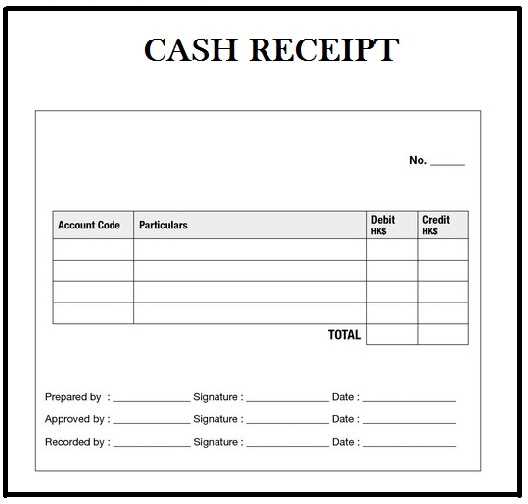

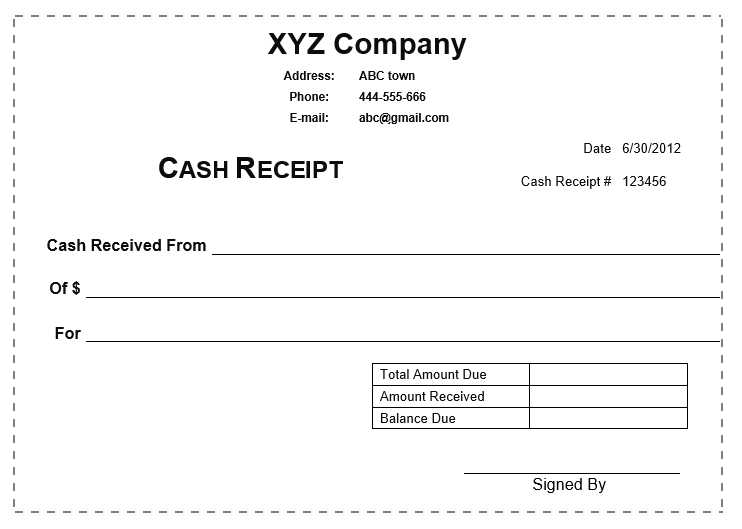

Start with a clear heading to identify the receipt’s purpose. A basic format typically includes the name of the business or individual, the amount of cash collected, and the method of payment. Make sure to include any relevant reference numbers or invoice details to link the payment to specific transactions. This will help in keeping records accurate and up-to-date.

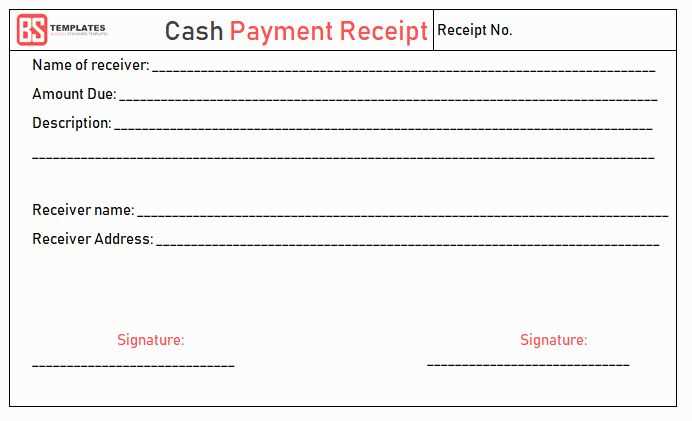

Be concise but thorough in capturing all relevant data. Include the payer’s name, the date of the transaction, and a brief description of the reason for the payment. It’s helpful to include a section for both parties to sign off, confirming the details of the exchange. This small step can significantly reduce misunderstandings and errors in financial documentation.

Finally, consider saving the template digitally or printing it for physical use. A good template ensures that both the collector and the payer have a clear record of the transaction, streamlining financial operations and providing a reliable reference in case of future inquiries.

Here’s the corrected version:

Ensure that the receipt template includes all necessary fields such as the payer’s name, the amount paid, payment method, and the date of the transaction. It’s critical to avoid cluttering the document with unnecessary details that could confuse the user.

- Start with a clear heading identifying the receipt type.

- List the date and time of the transaction to avoid ambiguity.

- Include a breakdown of the payment amount, including any taxes or fees, if applicable.

- Include the payer’s contact information or an identifier if needed for future reference.

- Provide a unique receipt number to easily track the transaction.

Check that the formatting is consistent and easy to read. Use simple fonts and clear distinctions between sections. Include space for a signature if the transaction requires one.

- Cash Collection Receipt Template

Begin by clearly stating the transaction details: the date, amount received, and payer information. Include fields for the payer’s name, payment method, and purpose of the payment. This ensures both parties have a clear record. Make sure the receipt also mentions whether the payment was made in full or partially, and note any pending balance if applicable. For added clarity, add a space for any additional notes or references related to the transaction. Include a receipt number for easy reference and record-keeping.

To avoid confusion, use simple, readable fonts and organize the layout logically. The receipt should be brief yet detailed enough for future verification. Ensure that the document includes a signature line, confirming the receipt of the funds by the receiver. This can help prevent any misunderstandings later on. Save a copy for your records or print multiple versions if needed.

Design your receipt with the key elements that reflect your business’s identity. Include your logo, business name, and contact information at the top for easy recognition. Make sure the receipt clearly lists the products or services purchased, their prices, any applicable taxes, and the total amount paid. Providing a breakdown of the cost helps with transparency and builds trust with your customers.

Clear and Organized Layout

Choose a layout that is easy to read. Use a clean, simple design with distinct sections for the date, transaction number, items, and totals. This makes it easy for customers to quickly review the receipt details. Avoid cluttering the receipt with unnecessary information; focus on the essentials.

Customizable Fields for Your Business

Ensure your receipt template includes customizable fields like discounts, promotional offers, or loyalty rewards. This allows you to tailor each receipt to the specific transaction. Additionally, leaving space for a thank-you note or customer feedback helps personalize the experience.

Start with the receipt date. This provides a clear record of the transaction time, essential for both parties. Include the name of the person or entity making the payment, ensuring clarity on who is responsible for the transaction. The amount paid should be prominently displayed, along with the method of payment–whether cash, check, or electronic transfer. This ensures transparency and can help avoid disputes later.

Next, add a brief description of the goods or services for which the payment was made. This detail helps link the payment to its purpose and clarifies any misunderstandings. If applicable, include any invoice or reference numbers to ensure the payment can be easily tracked and cross-referenced.

Be sure to indicate any remaining balance, if the payment was partial. This lets the payer know what is owed and keeps records clear. Lastly, provide the contact information for the party receiving the payment, making it easy for both sides to follow up if needed.

Ensure receipts are issued for every transaction, regardless of the size or value. This guarantees a clear and verifiable record of financial activity. Always include relevant details like transaction date, amount, and the payer’s information for full transparency.

Consistency in Format

Adopt a standard template for receipts, ensuring that all necessary fields are covered. This allows for easier tracking, whether for audits or customer queries. The format should remain consistent, providing a professional appearance and avoiding confusion during review.

Timely Issuance

Provide receipts immediately after completing a transaction. Delays can create confusion and leave room for errors in documentation. Customers should always have a receipt in hand, confirming the transaction details right away.

Record every receipt issued in a secure digital or physical system, organized by transaction type or customer. This ensures easy retrieval when needed for reference or verification, whether during internal audits or customer support inquiries.

Ensure that receipts are stored securely. Whether in digital format or paper, they should be protected from unauthorized access or loss. Regular backups of digital records can prevent the loss of important transaction data.

For creating a clear and accurate cash collection receipt, it’s important to include key details that ensure both parties are aware of the transaction. The receipt should outline the amount collected, date, and the method of payment. Be sure to include a section for both the payer’s and receiver’s names and contact information.

Receipt Content Guidelines

Clearly state the total amount received, specifying the currency and any relevant taxes. If multiple methods of payment were used, list them separately (e.g., cash, card, check) to avoid confusion.

Formatting Recommendations

Use simple formatting that’s easy to read. Ensure each section is well-organized, with sufficient space between the payer and receiver details, transaction summary, and payment method breakdown. A clean, well-structured layout helps avoid mistakes and improves clarity for both parties.