A cash deposit receipt template is a practical tool for documenting any cash transactions made at a bank or other financial institution. It provides a clear record of the amount deposited, the date, and the relevant account information. This template helps both businesses and individuals track cash flow with accuracy.

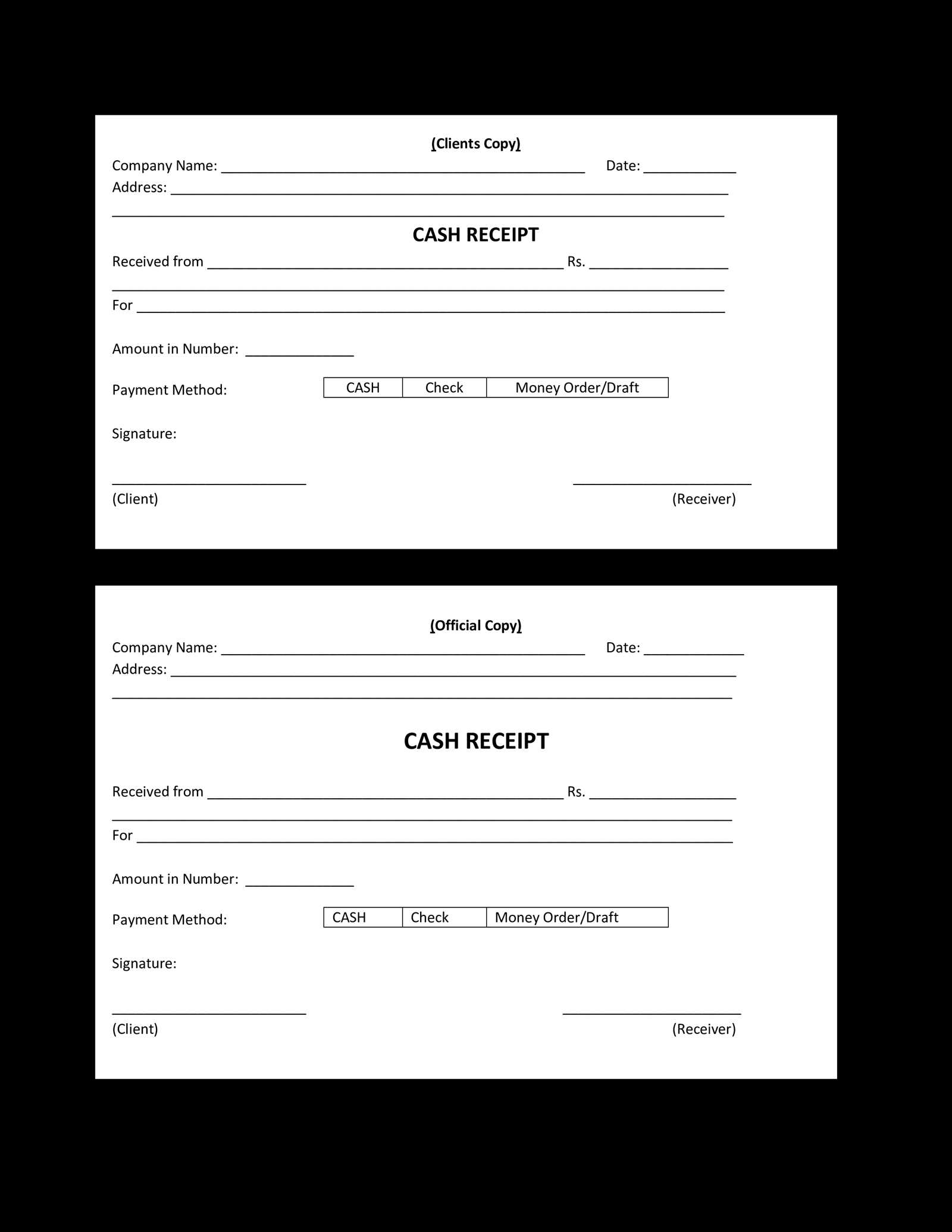

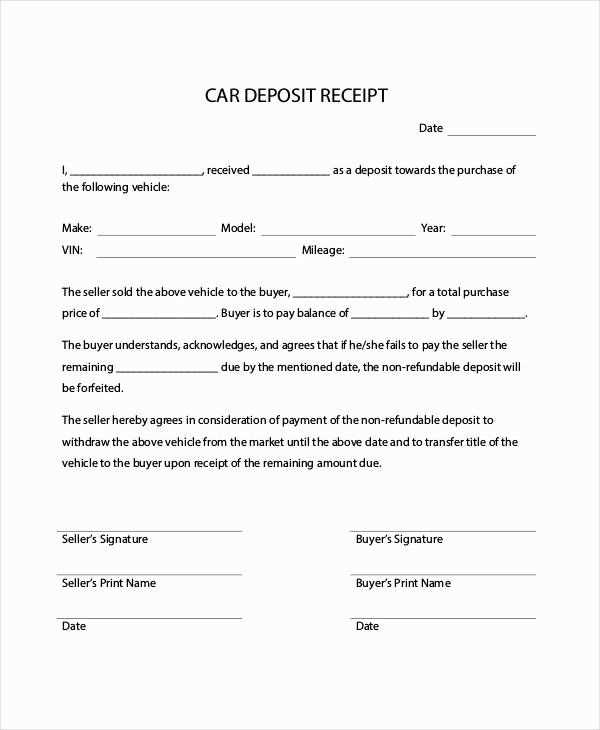

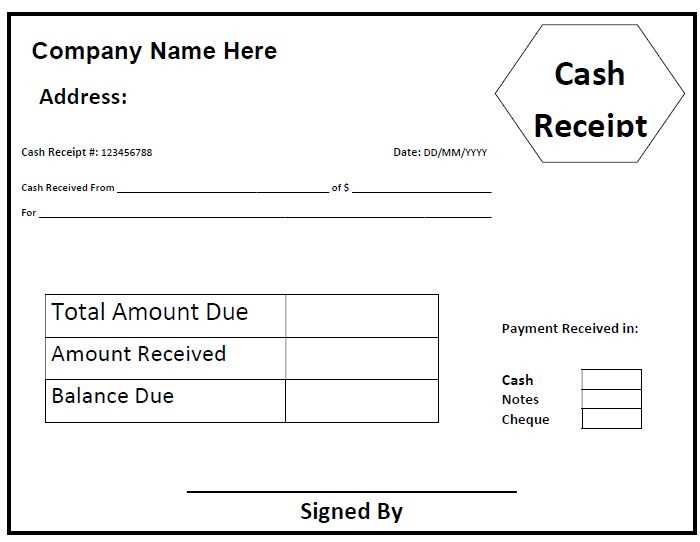

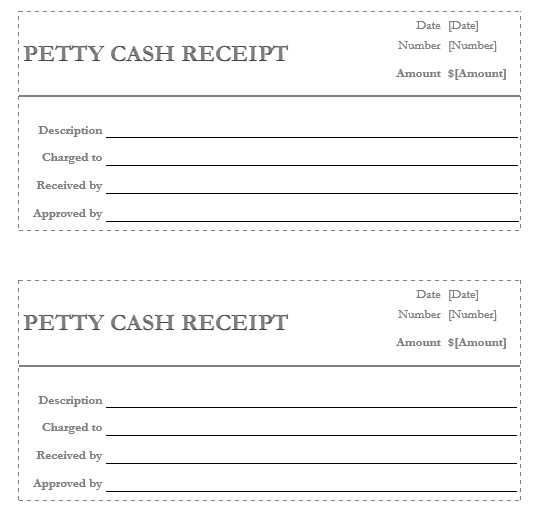

When creating a cash deposit receipt, ensure that it includes fields for the depositor’s name, deposit amount, date, and account number. It should also specify the bank or financial institution where the deposit was made. For easy verification, include a space for the teller’s signature and a receipt number for reference.

Customize the template to meet your needs by adding additional fields like transaction ID or deposit type. A well-designed receipt can simplify accounting, reduce errors, and provide clear documentation in case of disputes.

Here’s the HTML plan for the informational article “Cash Deposit Receipt Template,” structured with specific and practical headings:htmlCash Deposit Receipt Template

To create a clear and functional cash deposit receipt template, follow this structure:

Key Components of a Cash Deposit Receipt

A cash deposit receipt should include:

- Date of Transaction: The exact date of the deposit.

- Depositor’s Information: Name or business details of the person making the deposit.

- Deposit Amount: The exact cash value being deposited.

- Account Number: The account where the money is being deposited.

- Branch Information: The bank branch where the transaction takes place.

- Receipt Number: A unique number for tracking the receipt.

HTML Template for a Cash Deposit Receipt

Here’s a basic HTML structure for a cash deposit receipt:

<html>

<head>

<title>Cash Deposit Receipt</title>

</head>

<body>

<h1>Cash Deposit Receipt</h1>

<p>Date of Transaction: [Insert Date]</p>

<p>Depositor's Name: [Insert Name]</p>

<p>Deposit Amount: $[Insert Amount]</p>

<p>Account Number: [Insert Account Number]</p>

<p>Branch: [Insert Branch Name]</p>

<p>Receipt Number: [Insert Receipt Number]</p>

</body>

</html>Why Use This Template?

This template provides a standardized and easy-to-use format for creating receipts. It ensures all necessary details are captured and can be printed or saved for future reference, helping with accounting and verification processes.

How to Create a Cash Deposit Receipt

Begin by adding the deposit date. This marks the exact time of the transaction.

Include the depositor’s full name or company name. This ensures proper identification of the individual or organization making the deposit.

Clearly state the deposit amount in both numbers and words. Break down the cash into denominations (e.g., number of $20 bills) for transparency.

Indicate the account number or reference number linked to the deposit. This will help connect the deposit to the correct account.

Assign a unique receipt number for each transaction. This keeps track of all issued receipts and simplifies record-keeping.

End with a signature, either from the person receiving the deposit or issuing the receipt. This confirms the legitimacy of the transaction.

Key Information to Include in the Template

Begin with the date of the transaction. This ensures clarity regarding the timing of the deposit. Include the deposit amount, specifying both the numerical value and the currency. If multiple forms of payment are involved, break down each one separately.

Clearly state the name of the depositor and, if applicable, the recipient or business receiving the deposit. The depositor’s contact details, such as an email address or phone number, are helpful for any future communication or clarification.

Include a description of the deposit, which could be a reference number, invoice number, or the purpose of the deposit. This makes tracking and accounting easier for both parties.

If the deposit is related to a service or product, include relevant details about the transaction, such as terms of payment or an agreement reference. This helps establish the context for the deposit.

Finally, ensure a clear signature line or a digital equivalent, where the depositor can confirm the deposit details. This adds a layer of authenticity to the document.

How to Customize the Template for Different Uses

To tailor a cash deposit receipt template, focus on the fields that are most relevant to your specific requirements. Adjust the structure to suit different types of transactions, whether personal, business-related, or for specific industries.

- Add or remove fields: Depending on the transaction, you may need additional fields such as customer ID, payment method, or transaction reference number. For business use, consider adding tax information or invoice references.

- Modify the design: Ensure the layout aligns with your branding or personal preferences. Customizing font style, size, and logo placement can make the receipt look more professional or personal.

- Change date and time formats: Adjust the date and time format according to local standards or the needs of your clients. Use a clear format to avoid confusion.

- Include or exclude disclaimers: Some receipts require disclaimers, especially in financial or legal transactions. Make sure to add relevant legal text if necessary, or remove it if not required.

When customizing for different uses, always consider the key details of the transaction and your audience’s needs. This ensures the receipt remains clear, accurate, and useful.