To properly document a cash lease agreement for farmland, it’s critical to use a clear and concise cash lease receipt template. This template serves as a formal acknowledgment of the payment made for the lease of agricultural property. Make sure your template includes key details, such as the names of both parties, the leased land’s description, the agreed-upon rent amount, and the payment schedule.

Start by clearly stating the full names and contact information of the lessor (landowner) and lessee (tenant). Specify the total rent for the period, including the payment frequency and the exact due dates. This helps ensure transparency and avoids any misunderstandings between the parties. Always include the property’s legal description or parcel number to precisely identify the land in question.

To make the receipt official, add a section for both parties’ signatures. This confirms the transaction and protects both sides in case of disputes. Keep a copy of the signed receipt for your records. This simple but effective approach will streamline the leasing process and ensure that both parties have the necessary documentation for future reference.

Here’s the revised version of the text:

For creating a cash lease receipt for farm ground, ensure all necessary details are included to make it clear and legally binding. This should include the lease period, payment amount, due dates, and any other terms related to the agreement. Avoid vague language and be specific about the payment schedule and responsibilities.

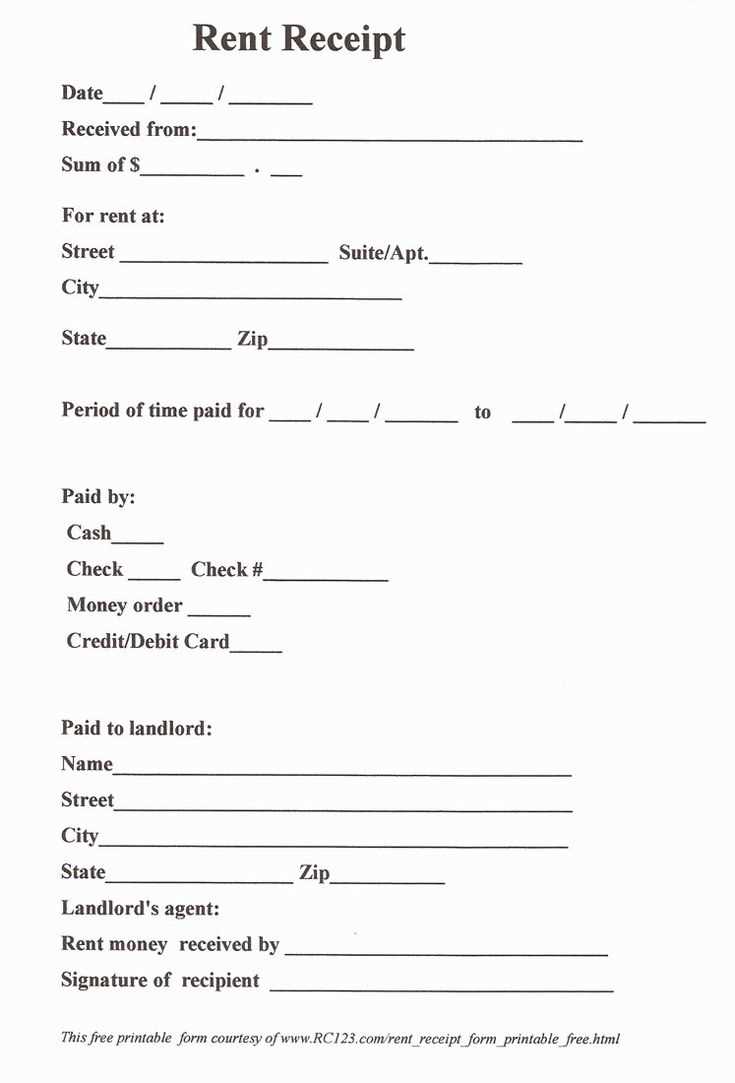

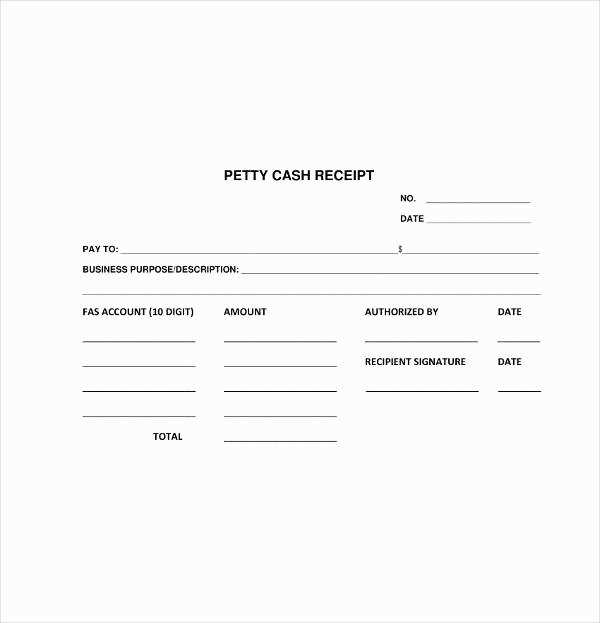

Here’s a sample template you can follow:

| Item | Description |

|---|---|

| Landowner Name | [Enter Landowner’s Full Name] |

| Tenant Name | [Enter Tenant’s Full Name] |

| Lease Start Date | [Enter Start Date] |

| Lease End Date | [Enter End Date] |

| Annual Rent Amount | [Enter Rent Amount] |

| Payment Schedule | [Monthly/Quarterly/Annual Payments] |

| Payment Due Date | [Enter Due Date] |

| Late Fee | [Enter Late Fee Terms] |

| Additional Terms | [Any additional terms or conditions] |

Ensure the document is signed by both parties and keep a copy for reference. If adjustments are made during the lease, provide written notice and update the terms accordingly.

- Cash Lease Receipt for Farm Ground Template

A cash lease receipt serves as formal documentation for the rental of farm ground. It should include key details such as the landowner’s and tenant’s names, the payment amount, the lease term, and any specific terms and conditions. Be sure to list the full address of the property, the lease rate per acre, and the total amount due. The payment method should also be specified, whether it’s by check, bank transfer, or another method. The lease receipt should be signed by both parties to confirm that the transaction has taken place.

When drafting this template, ensure that all dates are clearly mentioned, including the start and end of the lease period, as well as the date the payment is made. If applicable, note any late fees or adjustments that may apply in the future. By doing this, the receipt becomes an official, binding document that can be referred to in case of any disputes or issues related to the farm ground lease.

To create a clear and legally sound cash lease receipt for agricultural land, include the following details:

Include Basic Information

Start by listing the full names and contact details of both the landlord and the tenant. Ensure the property’s address or description is precise. Include the lease period, whether it’s for one year or a longer term, and the total cash amount paid for the lease. Specify the payment method–whether it’s cash, check, or bank transfer.

Detail the Lease Terms

Clearly state the amount paid, and break it down by the period covered (monthly, quarterly, or yearly). Mention whether the payment is due upfront or in installments. Include any late fees or penalties if applicable. Also, if the lease includes specific provisions like maintenance or crop sharing, outline them briefly.

Conclude by adding a signature line for both parties to confirm the receipt and its terms. If necessary, include space for a witness to sign the document for added validity.

To create a precise and legally sound cash lease receipt, ensure the following elements are clearly stated:

- Names of Parties Involved: Clearly list the full names and contact details of both the lessor (landowner) and lessee (tenant).

- Property Description: Provide a detailed description of the leased land, including its legal description, location, and size.

- Lease Amount: Specify the total amount of rent paid, the payment period (e.g., annual, quarterly), and any additional fees, if applicable.

- Payment Method: Mention the method used for payment (cash, check, bank transfer) and any relevant transaction details.

- Payment Date: Indicate the date on which the payment was made, ensuring both parties have a clear record of the transaction.

- Lease Term: State the duration of the lease agreement, including the start and end dates, or the renewal terms, if applicable.

- Signatures: Both parties should sign the receipt to validate the transaction and acknowledge their agreement.

Ensure all these details are accurate to avoid potential disputes in the future and maintain clear records of the lease agreement.

Clearly outline payment expectations in your lease agreement to avoid misunderstandings. Payment terms specify how and when the payments will be made, whether on a monthly, quarterly, or annual basis, and may also include late payment penalties and interest rates. Ensure both parties agree on the exact method of payment, such as check, wire transfer, or another form, and document any agreed-upon conditions for adjustments due to inflation or market changes.

Types of Payments

- Fixed Lease Payments: A set amount paid on a specific schedule, regardless of crop yield or market conditions.

- Variable Lease Payments: Payments based on a percentage of the farm’s income or production, often tied to harvest yield.

- Hybrid Lease Payments: A combination of fixed and variable payments, offering flexibility based on farm performance.

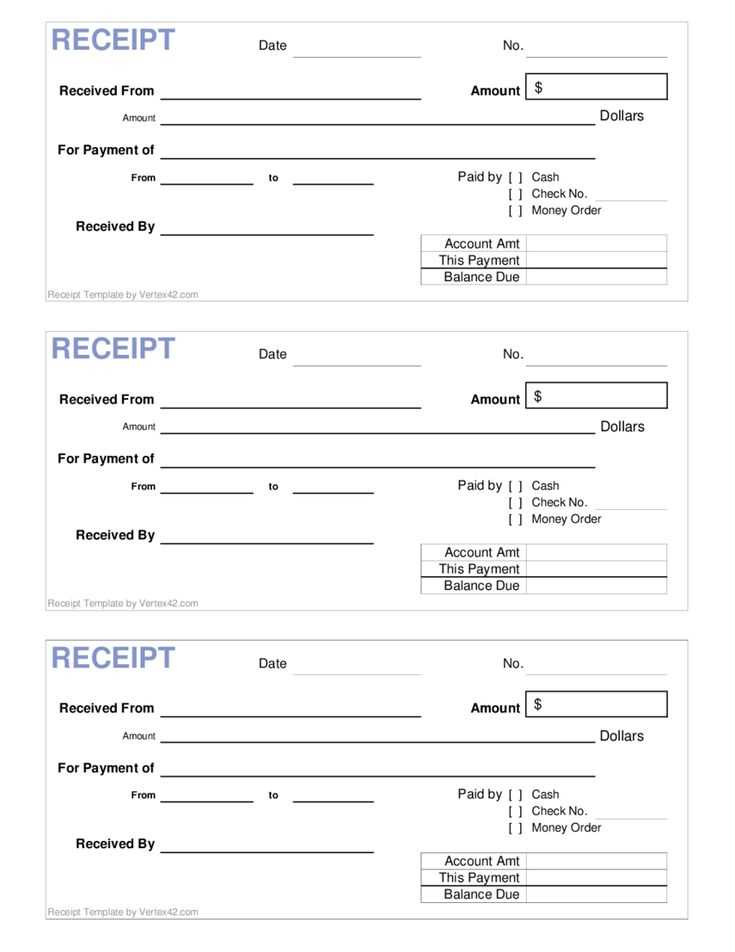

Payment Documentation

Keep clear, detailed records of every payment made and received. Both parties should sign a receipt each time a payment is made. This receipt should include the payment amount, date, method, and any adjustments or late fees applied. Additionally, maintain a running total of any outstanding balance or prepaid amounts. This documentation protects both parties and ensures transparency throughout the lease term.

To guarantee that your farm lease receipt meets legal standards, it’s critical to include specific details that align with local and federal regulations. Ensure the lease agreement specifies the rental amount, payment schedule, and both parties’ responsibilities clearly. The inclusion of property boundaries and a description of the leased land is mandatory to avoid any confusion or disputes in the future.

Accurate Documentation

Provide accurate details about the property, including its size, legal description, and any structures or equipment included in the lease. Inaccuracies in the lease description can lead to legal complications. Also, remember to include the start and end dates of the lease term, along with any provisions for lease renewal or termination.

Clear Payment Terms

The payment terms should clearly state the amount due, the method of payment, and the payment intervals. If there are late fees or penalties for missed payments, they must be outlined. These terms prevent misunderstandings and can protect both the landlord and tenant legally if disputes arise.

Ensure that the receipt includes the correct date. Mistakes in the date can lead to confusion or disputes later on. Double-check that the payment amount matches the terms of the lease agreement.

Clearly list the land parcel or property description. Avoid vague terms that could lead to misunderstandings regarding the specific area under lease.

Include both the lessor’s and lessee’s names. It’s crucial to have both parties identified properly to avoid potential legal issues or claims of incorrect payments.

Don’t omit any agreed-upon payment details. If the payment is part of a larger schedule, indicate the total rent paid and the balance remaining, if applicable.

Avoid using non-standard formats for signatures. Include both the signature of the lessor and lessee, and ensure that both parties understand their obligations before signing.

Check for proper documentation of payment method. Whether paid by check, wire transfer, or cash, it should be clearly mentioned on the receipt.

To claim tax deductions related to leased farm ground, keep your cash lease receipt organized and accessible. The receipt acts as proof of the amount you paid to the landowner, which is a deductible expense for the tenant. When filing taxes, report the cash lease payments as part of your farm’s operating expenses. Ensure that the receipt clearly lists the lease amount, payment date, and the terms of the lease agreement. This documentation supports your claims in case of an audit.

Additionally, if the lease covers both land and other farm-related services, break down the total amount in your records to match the correct tax category. Maintain a copy of the lease agreement alongside the receipt for reference. If you paid in installments, document each payment to avoid any confusion during tax filing. The IRS may require details about the purpose of the lease, so keeping a clear, itemized receipt helps avoid errors or delays.

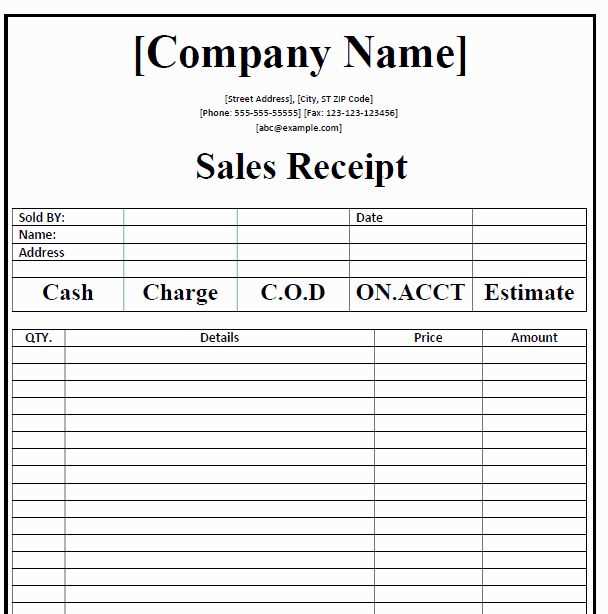

Template for Cash Lease Receipt for Farm Ground

Begin by clearly stating the names of both parties involved in the lease agreement. Specify the lessor (property owner) and lessee (farmer or tenant). Include their full legal names and contact information to avoid any confusion.

Next, provide a detailed description of the leased land. This should include the exact acreage, location, and any identifying features of the property such as parcel numbers or GPS coordinates. Ensure the description is as precise as possible to prevent future disputes.

Outline the terms of the lease agreement. Clearly state the lease amount, payment schedule (monthly, quarterly, etc.), and the method of payment. If applicable, include late payment penalties or early termination conditions.

Include a clause that specifies the lease’s duration. Mention the start and end dates and conditions under which the lease may be renewed or extended. It’s also advisable to note any automatic renewal clauses if they exist.

Clarify any rights and responsibilities associated with the lease. For example, outline who is responsible for property maintenance, taxes, insurance, and any improvements or modifications to the land.

Ensure that both parties acknowledge and sign the receipt to confirm agreement to the terms outlined in the document. Include a line for signatures, dates, and space for any notarization, if required by local laws.

Finally, keep a copy of the signed receipt for record-keeping purposes. It’s also recommended to have a professional review the document to ensure compliance with local agricultural laws and regulations.