For anyone lending or borrowing money, creating a clear and concise receipt is crucial for both parties. A well-structured cash loan receipt provides a written record of the transaction, outlining the agreed-upon terms, amount, and repayment schedule. This can be vital in preventing misunderstandings or disputes down the road.

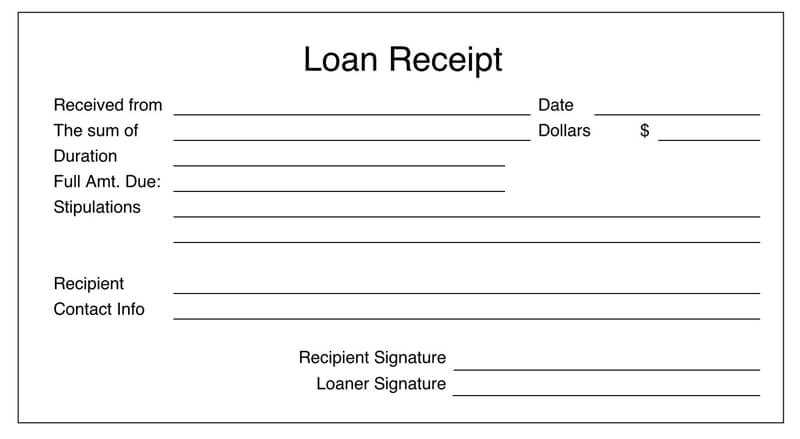

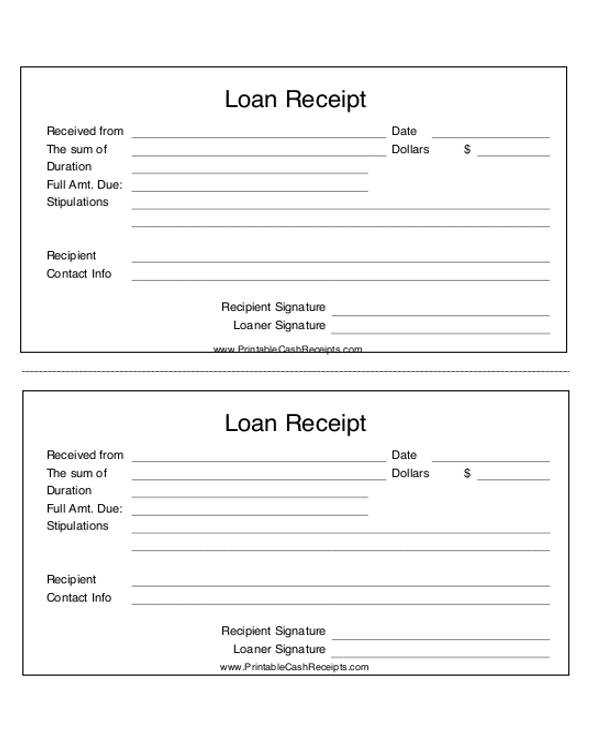

To create a straightforward receipt, start by listing the full names of both the lender and borrower, along with the exact amount of money exchanged. Clearly mention the date of the transaction and specify the loan’s terms, such as repayment deadlines, interest rates (if applicable), and any collateral. Keep the language simple and direct to avoid any confusion.

Additionally, make sure to include a signature section for both parties. This adds a layer of accountability and confirms that both the lender and borrower agree to the terms outlined. If needed, an optional section for any notes or special conditions could also be added for further clarification.

Here is the corrected version where repeated words are replaced while maintaining the meaning:

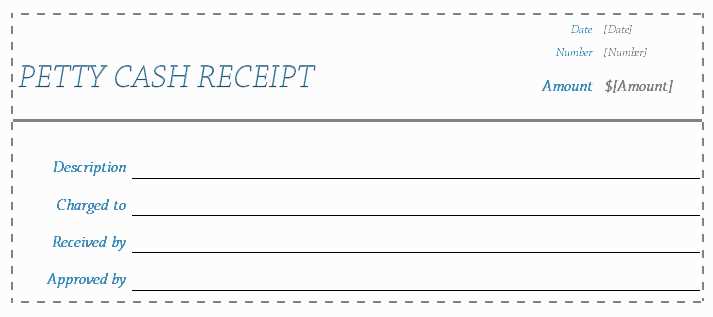

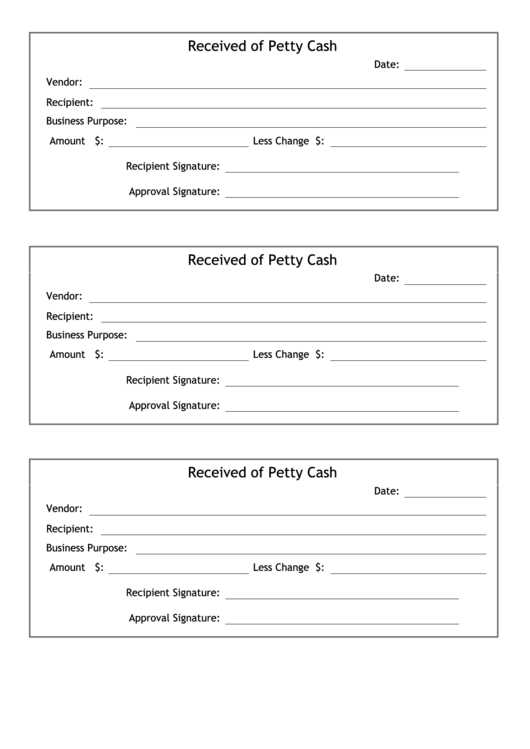

When drafting a cash loan receipt, it is crucial to ensure that all necessary details are included to avoid confusion. Clearly state the amount loaned, the date of the transaction, and the names of both parties involved. The receipt should also mention the terms of repayment, including any interest or fees, and specify the payment schedule if applicable.

Make sure to include a unique reference number for tracking purposes. This helps in future communications and clarifies the transaction details. Don’t forget to include signatures from both the lender and borrower to confirm the agreement and its terms.

Lastly, always retain a copy of the receipt for your records. This will protect both parties should any dispute arise in the future.

Cash Loan Receipt Format

How to Structure a Receipt for Clear Documentation of a Cash Loan

Key Elements to Include in a Loan Receipt Template

Understanding the Importance of Loan Amount and Repayment Conditions

Common Mistakes to Avoid When Drafting a Loan Receipt

Legal Aspects of Loan Receipts in Different Jurisdictions

How to Customize Your Receipt for Personal or Business Needs

Start with a clear header that identifies the document as a cash loan receipt. Include the lender’s and borrower’s names, addresses, and contact information. The date of the loan transaction should follow. Specify the loan amount in both numerical and written formats to avoid confusion. Ensure the repayment terms are outlined, including due dates, interest rates (if applicable), and any penalties for late payments.

For effective documentation, make sure the loan receipt includes a section for partial repayments, noting the date and amount paid. Always use simple, straightforward language to describe repayment conditions. Avoid vague terms and make sure both parties understand their obligations. If there is a collateral involved, include details about the item and its value. This section guarantees transparency in the loan agreement.

List any relevant terms such as late fees or prepayment penalties. Specify the method of payment–whether by cheque, bank transfer, or cash. If there are specific conditions, such as a grace period or renegotiation clause, mention those clearly. A properly structured receipt helps ensure that both parties are on the same page and can prevent future disputes.

Common mistakes in loan receipts often involve unclear payment terms, incorrect loan amounts, or missing signatures. Make sure both the lender and borrower sign the document, acknowledging the loan terms. This protects both parties legally. Also, avoid using overly complex language that could lead to misunderstandings.

In many jurisdictions, loan receipts are legally binding documents. Ensure that the receipt complies with local laws, especially regarding interest rates and repayment terms. Depending on the country or state, certain disclosures might be required, or there may be limits on the interest rates that can be charged. Always check the legal requirements in your area.

Customize your receipt by adjusting the terms to suit personal or business needs. For businesses, you may need additional fields for tax identification numbers or business licenses. For personal loans, you may prefer a simpler format without too many formalities. A well-designed receipt protects both the lender’s and borrower’s interests in any scenario.