If you need to confirm a cash transaction, a receipt letter is a simple yet formal way to do so. The letter should clearly state the details of the payment, including the amount, date, and purpose, ensuring both parties are on the same page. This written confirmation can be crucial for both buyers and sellers, providing an official record of the exchange.

Start by addressing the letter to the recipient and include their contact details. Then, briefly describe the transaction, specifying the amount received and the purpose of the payment. Always mention the date of the payment and ensure that the tone is polite and professional. The letter should also indicate any additional details, such as the method of cash transfer (whether in person or by another means).

Ensure that both parties have a copy of the letter for their records. This serves as a safeguard in case any disputes arise regarding the payment. A clear, well-structured letter avoids confusion and strengthens the trust between the parties involved.

Here is the revised version:

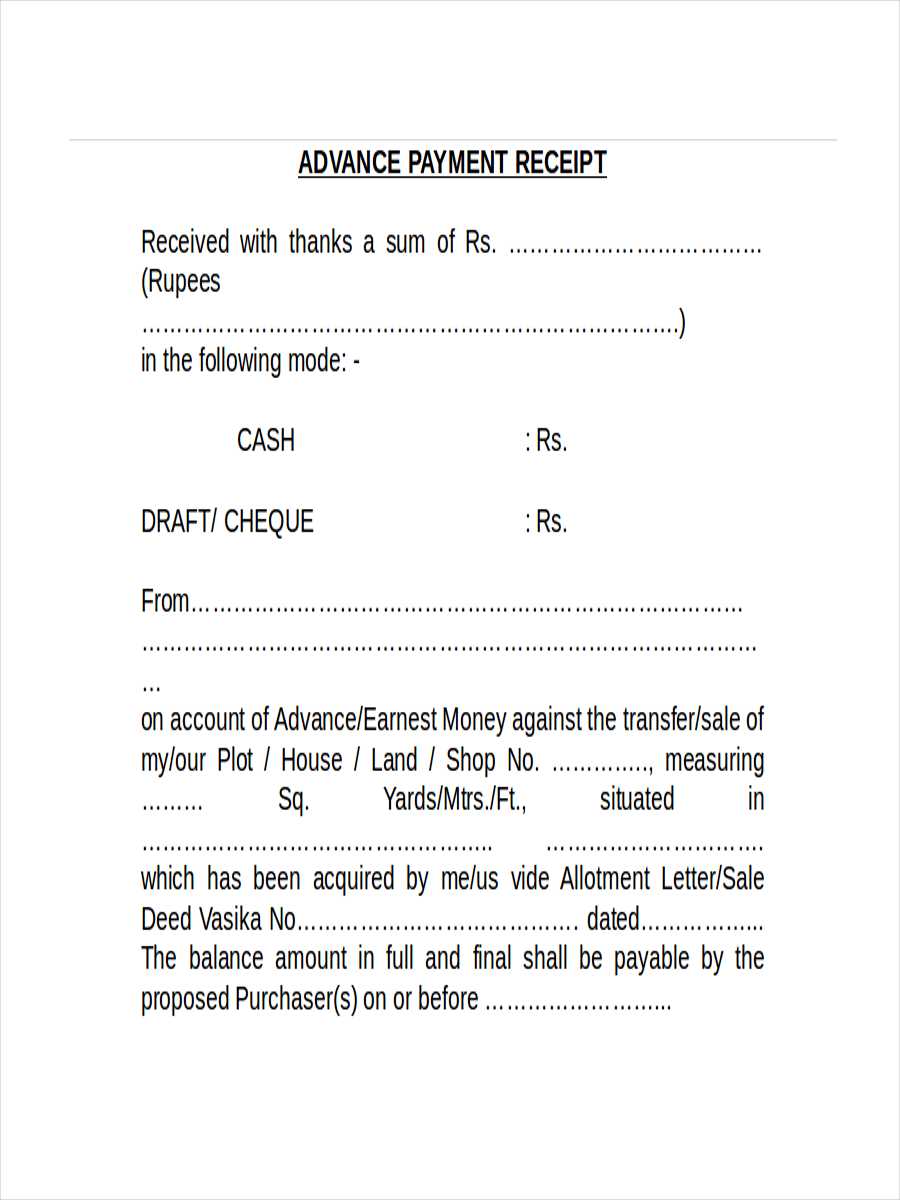

Ensure that your cash payment receipt clearly includes the following details: the date of the transaction, the amount paid, and the method of payment. The receiver should provide their name, and both parties must acknowledge the receipt with a signature. This will create an accurate record and avoid any misunderstandings.

Key Elements

For clarity, include a brief description of the transaction or goods/services exchanged. Mention the purpose of the payment, such as for a product purchase, service rendered, or deposit made. This ensures the receipt is not just a record of payment but a clear documentation of the transaction.

Formatting Tips

Keep the format simple but thorough. Use a clear, readable font and structure the receipt logically with distinct sections for each detail. This makes it easier for both parties to review and refer back to if necessary.

Cash Payment Receipt Letter Template

To create a clear and formal cash payment receipt letter, follow this straightforward structure:

1. Header – Include your business name, address, and contact information at the top of the letter. Add the date of the transaction for reference.

2. Receipt Title – Clearly state “Cash Payment Receipt” as the title to ensure the purpose of the document is evident at a glance.

3. Payer’s Information – Provide the name and contact details of the person who made the payment. This helps in case any follow-up is needed.

4. Payment Details – Specify the amount received, including the currency type (e.g., USD, EUR). Mention any breakdown if the payment covers multiple items or services.

5. Purpose of Payment – Clearly state what the payment is for, whether it’s for goods, services, or a deposit.

6. Acknowledgment – Write a short sentence acknowledging the receipt of payment and confirming that the transaction was completed.

7. Signature – Include a space for the signature of the person issuing the receipt. This adds authenticity and confirms the transaction.

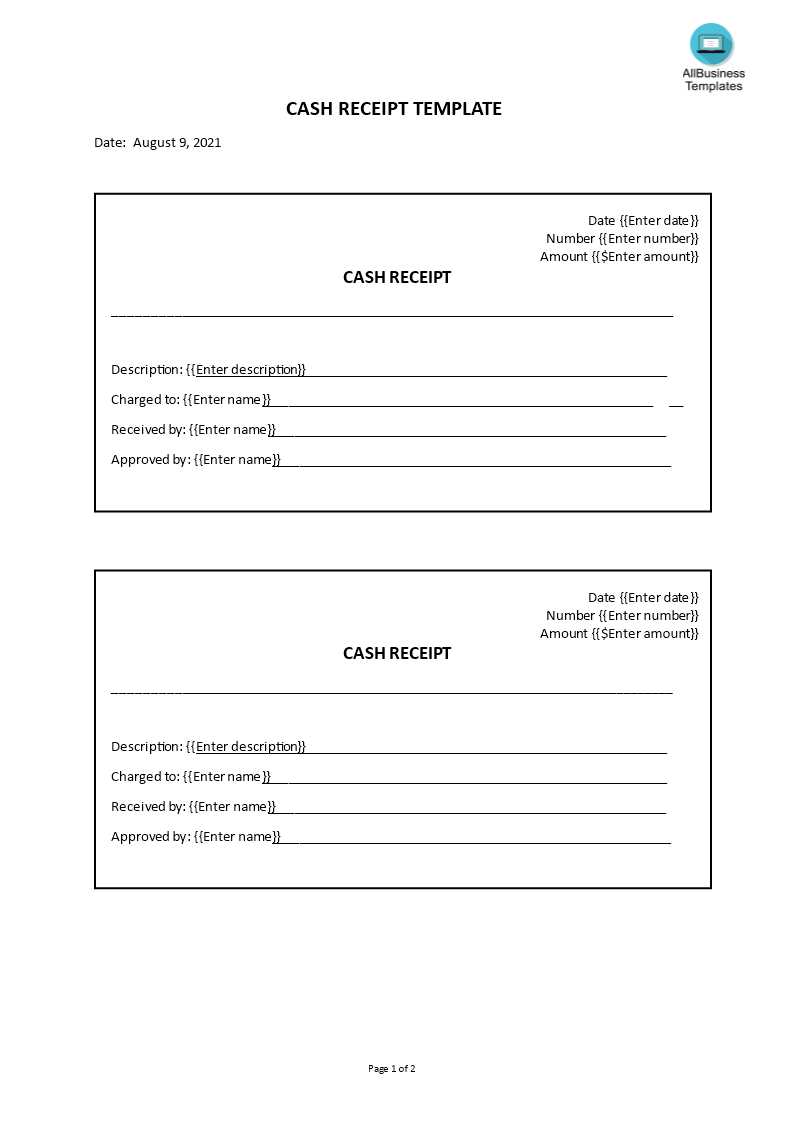

Here’s a simple template for reference:

[Business Name]

[Business Address]

[Phone Number]

[Email]

[Date]

CASH PAYMENT RECEIPT

Received from: [Payer’s Name]

Amount: [Amount in Words] ([Amount in Figures])

Payment for: [Description of Goods/Services]

We acknowledge receipt of the above amount. Thank you for your payment.

Issued by: [Your Name]

Signature: ______________________

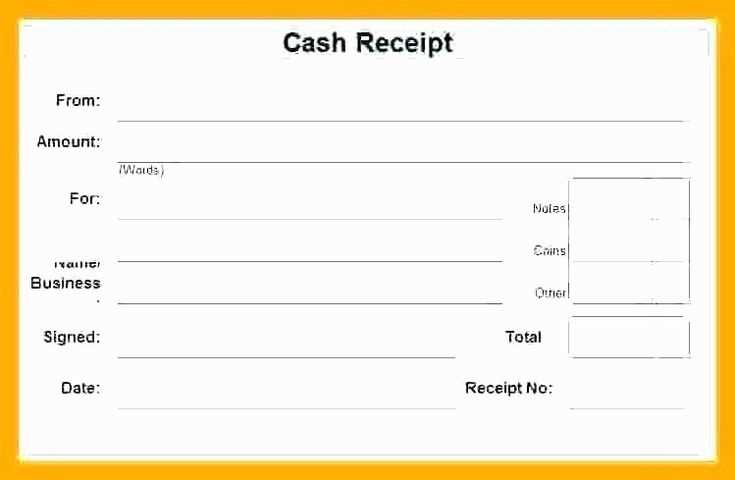

Begin the cash receipt letter with the date at the top. This ensures the transaction is documented with a clear timeline.

Next, include the full name and address of the payer. This is key for identification and record-keeping purposes.

State the amount paid, written both numerically and in words. This minimizes confusion and serves as a clear reference.

Describe the reason for the payment. Be specific whether it’s for services rendered, goods purchased, or any other relevant detail.

Clearly mention the method of payment–cash in this case–and include any necessary notes about the payment’s condition or any receipt number if applicable.

Conclude by including your name, the signature of the person receiving the payment, and contact details for any follow-up inquiries.

Include the payment amount clearly. State the exact sum in both numbers and words to avoid any confusion. Specify the currency used, especially if dealing with international transactions.

Record the date and time of the transaction. This helps in tracking payments and providing reference points for both parties.

Include the name of the person or company receiving the payment. This ensures there is no ambiguity about who is involved in the transaction.

State the payer’s name. This confirms who made the payment and adds clarity to the receipt.

Provide a unique receipt number. This serves as a reference for future communication and ensures proper documentation.

Describe the purpose of the payment. This is crucial for both parties to understand the reason for the transaction, whether it’s for goods, services, or other financial obligations.

Specify any applicable taxes, if relevant. If taxes are part of the transaction, itemize them separately to avoid misunderstandings.

Include the method of payment. Even for cash, it’s useful to note whether the payment was made in bills or coins, or if any change was given.

If applicable, provide a space for signatures. Both parties should sign to confirm the transaction, though this may not be necessary for small, simple exchanges.

One common mistake is failing to include the exact amount paid. Clearly state the payment sum in both words and numbers to avoid confusion. If the amount is ambiguous, it can lead to misunderstandings or disputes later.

Another mistake is omitting the date of payment. Always include the exact date the payment was made to provide a clear record. This helps both parties track financial transactions accurately.

Leaving out details like the payment method or purpose is also a mistake. Specify whether the payment was made in cash, and if possible, provide additional context (such as an invoice number or reference to a contract) to clarify the reason for the payment.

Not obtaining the proper signatures is another critical error. Ensure that both parties sign the letter to confirm that the transaction has been completed. Without signatures, the receipt lacks legal validity and may be difficult to enforce if disputes arise.

Be careful not to make the letter too vague. A vague letter can be open to misinterpretation. Instead, ensure all relevant details are included: the amount, date, method of payment, and purpose.

| Error | Consequence |

|---|---|

| Missing payment amount | Confusion or disputes over the payment sum |

| Omitting date of payment | Difficulty tracking the payment |

| Not specifying payment method or purpose | Unclear record of the transaction’s context |

| Lack of signatures | Potentially invalid receipt |

| Vague wording | Misinterpretation of the payment’s terms |

Lastly, review the letter before finalizing it. Small errors in grammar or punctuation can make a big difference in how the letter is interpreted. Always double-check to ensure clarity and accuracy.

To create a clear and concise cash payment receipt letter, follow these steps:

- Specify the date and time: Begin the letter by clearly stating the date and time the payment was received. This provides a precise reference for both parties.

- Include payer details: Write the name and contact information of the person making the payment. This helps in identifying the payer in case of any issues or follow-ups.

- State the amount received: Clearly mention the exact cash amount that was paid. Ensure that the figure is written both in numbers and words for clarity.

- Define the purpose of the payment: Briefly describe what the payment is for, such as goods or services rendered. This adds context and removes any ambiguity.

- Note the method of payment: Even though the payment is cash, specifying this helps in record-keeping and ensures both parties are clear on the transaction method.

- Provide the receiver’s details: Include the name and position of the person or company receiving the payment. This ensures accountability on both sides.

- Include a signature line: End the letter with a space for both the payer and the receiver to sign. This confirms the transaction as complete.

Make sure the letter is formatted neatly and the content is easy to read. Using bullet points or numbered lists can help organize information efficiently.