To manage cash receipts smoothly, use a clear template that organizes your financial inflows. Create columns for the date, source of income, amount, and payment method to ensure nothing is overlooked. This simple setup provides a clear snapshot of your finances at any given time.

Track payments consistently to prevent any discrepancies. Make sure each payment is categorized properly, whether it’s from a customer, client, or other sources. This helps in tracking the flow of funds and identifying trends in your business’s income.

Adjust your budget regularly to accommodate changes in cash flow. If you notice certain periods with higher receipts, adjust your projections for future months. This dynamic approach ensures that your cash receipts remain well-managed, even when facing fluctuations.

Here is the corrected text without word repetition:

For managing cash receipts effectively, consider implementing a well-organized template. These templates help track income, monitor spending, and ensure clarity in financial reporting. By categorizing receipts into different types, you can easily analyze the data and keep everything in order. It’s important to customize templates based on your specific needs and avoid unnecessary complexity.

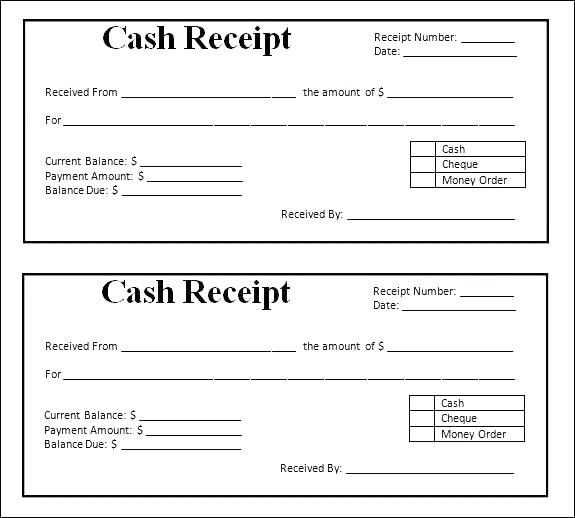

Template Structure

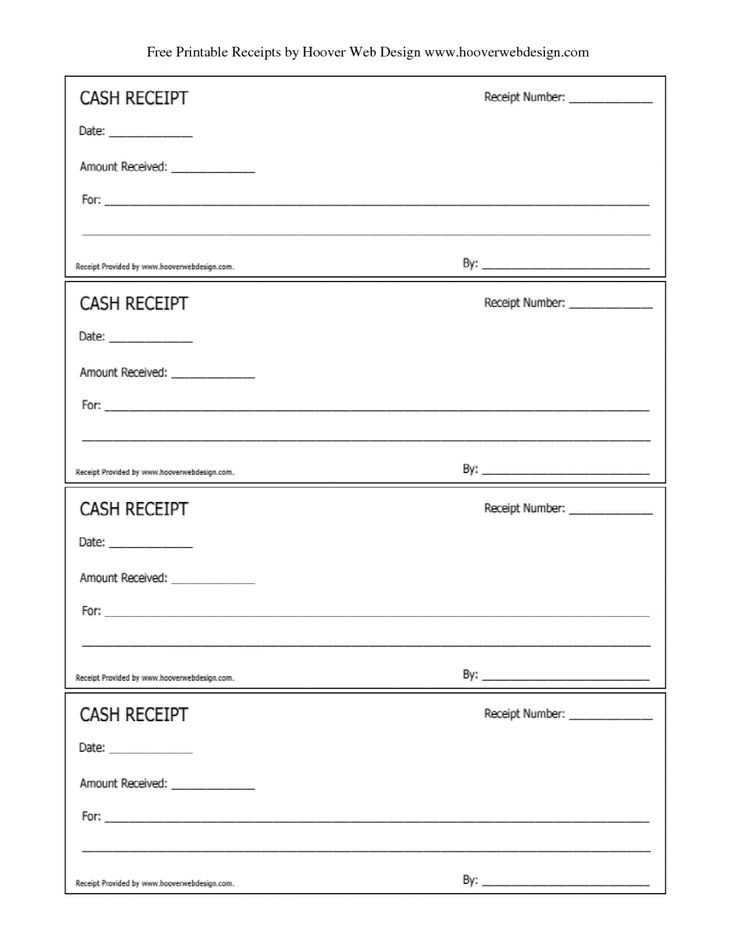

A simple cash receipt template should include the following fields: date, description, amount received, and payment method. Additional sections for notes or reference numbers can be added for better record-keeping.

Key Features

When choosing or designing a template, focus on user-friendliness and flexibility. Include options for multiple payment methods, such as cash, check, or credit card. You may also want to incorporate a summary section for easy reconciliation of totals at the end of the month.

| Date | Description | Amount Received | Payment Method |

|---|---|---|---|

| 01/01/2025 | Service Payment | $500 | Cash |

| 02/01/2025 | Product Sale | $250 | Credit Card |

| 03/01/2025 | Consultation | $150 | Check |

Regularly updating and reviewing these templates will ensure accurate financial tracking and support better decision-making. Adjust fields as necessary to fit your specific cash receipt needs.

- Cash Receipt Budget Templates

Choose a template that aligns with your specific financial tracking needs. A well-designed cash receipt budget template helps you maintain organized records of income and cash flow, which is crucial for ensuring accuracy in accounting and forecasting.

Track Income Efficiently

Utilize templates with clearly defined sections for each income source. This allows you to separate payments by category, such as sales, services, or interest. Including a date field will also help monitor cash receipt timing and prevent discrepancies in records.

Include a Balance Summary

Ensure the template offers a section for tracking balances after each entry. This helps you easily assess cash availability and identify any potential shortfalls or discrepancies. Look for templates with built-in formulas that automatically update your balance as you enter new receipts.

Choose a template that fits your workflow–whether it’s for daily, weekly, or monthly tracking–and adjust it based on your business or personal needs. This flexibility ensures that your financial records stay aligned with your goals.

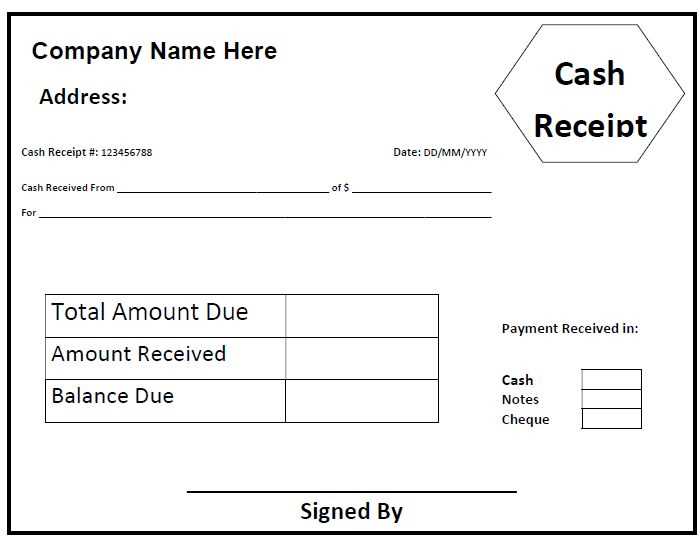

Design a clear structure to include all necessary information. At the top, display your business name, logo, and contact details for easy reference. Ensure your business name is bold and noticeable to leave a professional impression.

Include Transaction Details

For each receipt, clearly list the date of the transaction, the items or services purchased, their individual prices, and any applicable taxes. Organize this section with rows and columns for clarity. The total amount should stand out at the bottom, making it easy to identify the final price.

Payment Method and Receipt Number

Include a section that specifies the payment method (e.g., cash, card, etc.). Number each receipt to ensure traceability and avoid confusion, especially for accounting purposes. Keep the numbering sequential to maintain organization.

Finish with a thank you note or reminder for your customers to keep the receipt for warranty or return purposes. This adds a personal touch and can help build customer loyalty.

Tracking your finances accurately requires more than just recording expenses. A good budget should include clear categories that align with your goals and spending habits. Break down your income sources, such as salary or side projects, and track them separately. This ensures you have a realistic view of your financial flow.

Clear Categories for Income and Expenses

Start by defining key categories for both income and expenses. For example, split monthly spending into fixed and variable costs, like rent and utilities versus groceries or entertainment. This helps you identify areas where you can adjust spending to save more or allocate funds efficiently.

Set Specific Goals and Track Progress

Establish concrete savings or debt repayment goals, and regularly assess your progress. This includes tracking contributions to an emergency fund, retirement savings, or debt reduction. Monitoring these figures monthly ensures you stay on target and adjust when needed.

To avoid errors, ensure clear alignment of key information. For instance, transaction details like date, amount, and itemized list should be aligned neatly. Misalignment makes the receipt harder to read.

- Overcrowding information: Don’t cram too much on one line or in a small space. Keep text legible by using appropriate spacing. Clear sections for each category (items, totals, taxes) prevent confusion.

- Missing essential fields: Always include key details such as store name, payment method, transaction number, and terms. Omitting any of these details could render the receipt incomplete.

- Poor font choices: Avoid using overly decorative fonts. Stick to readable fonts like Arial or Helvetica. Ensure that the font size is consistent and large enough for easy reading.

- Unclear item descriptions: Each item on the receipt should have a clear description. Avoid vague terms like “miscellaneous.” If you list a product, include its full name and price.

- Incorrect tax information: Double-check tax calculations. Incorrect rates or missing tax details can create confusion and lead to discrepancies.

- Lack of branding: A receipt without the company logo or branding elements can feel impersonal. Including these details ensures customers can easily identify the source of the transaction.

- Ignoring legal requirements: Make sure the template meets local tax or regulatory requirements. Failing to include the necessary information can result in legal issues.

When designing, always test the template with real transactions. This ensures all critical elements appear correctly and the layout remains readable in different printing formats.

Use a clean and simple layout for your cash receipt budget template. This ensures easy tracking and prevents confusion. Each section should focus on specific categories such as income sources, expenses, and the total balance. By categorizing the entries clearly, you can easily identify where funds are coming from and going.

Clear Categorization

Group similar transactions together. For example, list all payments from clients under one heading and all other income sources under a separate heading. This helps maintain transparency and allows quick reviews at any time.

Consistency in Amount Entries

Maintain consistency in how amounts are entered. Always use the same format for currency (e.g., USD, EUR) and ensure that every amount has corresponding dates and descriptions. This keeps the document organized and prevents errors when updating or reviewing the template.

Regularly update the template with actual figures to compare against projected amounts. This helps you track discrepancies early and adjust your budget accordingly.