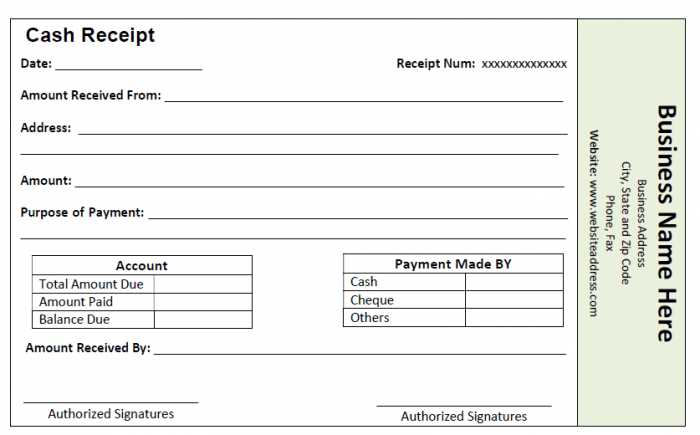

A properly structured cash receipt certification template ensures accurate record-keeping and protects both parties in financial transactions. This document confirms the receipt of cash payment and provides essential details, such as the payer’s name, amount received, date, and purpose of payment.

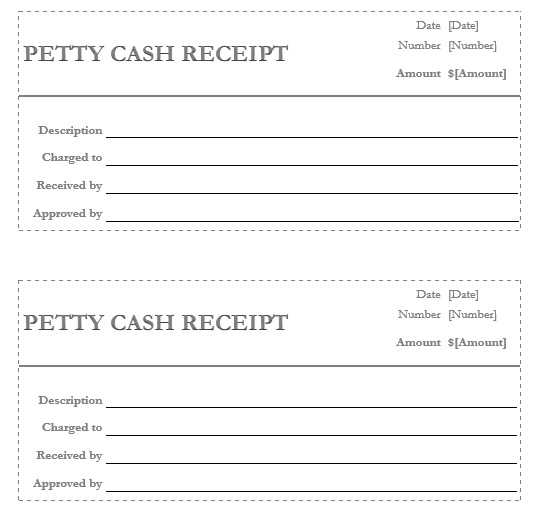

Include fields for transaction details, such as the method of payment, description of goods or services, and any relevant identification numbers. A well-designed template should be clear, concise, and free of unnecessary information while maintaining all legal and accounting requirements.

Ensure that the template contains a section for signatures or electronic verification to add authenticity. Digital formats, such as PDFs or spreadsheets, allow easy customization and storage, reducing paperwork while improving accessibility. Whether for business or personal use, a standardized template helps maintain financial transparency and simplifies bookkeeping.

Cash Receipt Certification Template

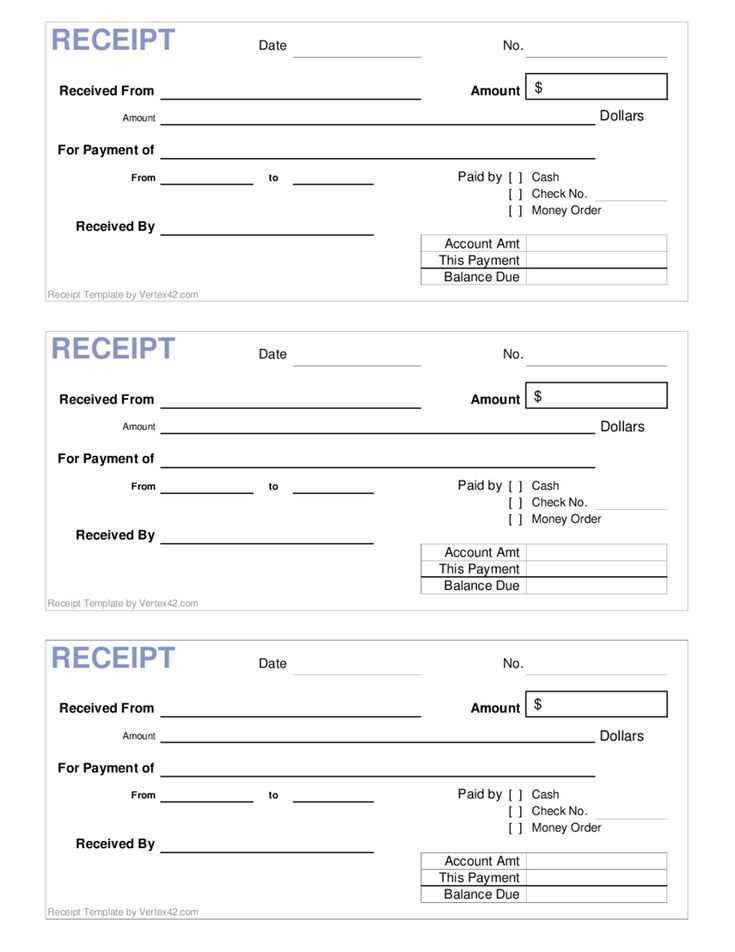

Use a structured template to ensure every receipt includes key details. Specify the payer’s name, payment date, amount, and method (cash, card, or transfer). Clearly state the purpose of payment, linking it to an invoice or agreement if applicable.

Include a declaration confirming receipt of funds. Example: “Received from [Payer’s Name] the sum of [Amount] for [Purpose].” This eliminates ambiguities and strengthens the document’s validity.

Ensure each receipt has a unique number for tracking. Sequential numbering simplifies record-keeping and prevents duplication. Add the issuer’s name, position, and signature for authenticity.

If required, include tax details or legal disclaimers. Businesses may need to reference tax codes or local regulations. Always provide a copy to both parties for transparency.

Key Components of a Valid Cash Receipt Certification

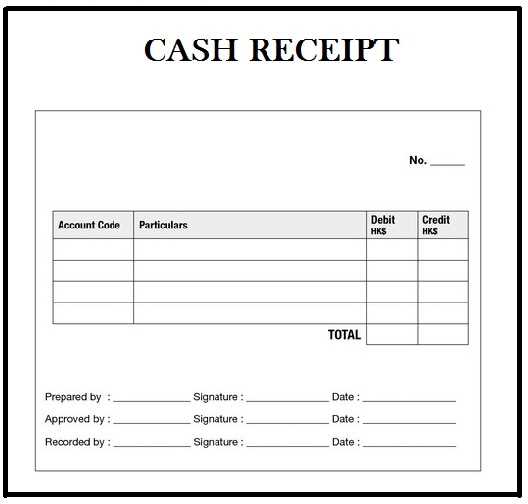

A properly structured cash receipt certification ensures clarity, accuracy, and compliance. Every document must include specific elements to be legally and operationally valid.

- Business Information: Clearly display the name, address, and contact details of the issuing entity. This identifies the source and establishes credibility.

- Transaction Date: Record the exact date of the transaction. This is necessary for tracking payments and resolving disputes.

- Unique Receipt Number: Assign a distinct identification code to each receipt for easy reference and audit purposes.

- Payer Details: Include the full name and contact information of the person or entity making the payment.

- Payment Amount: Specify the exact sum received, including currency symbols. If applicable, itemize tax amounts separately.

- Payment Method: Indicate whether the payment was made in cash, by check, or through electronic transfer.

- Purpose of Payment: Provide a brief but clear description of the reason for the transaction.

- Authorized Signature: Include a signature or stamp from an authorized representative to validate the receipt.

Consistently including these components ensures accountability, simplifies financial tracking, and strengthens compliance with regulatory requirements.

Legal Considerations and Compliance Requirements

Ensure every cash receipt includes the payer’s name, amount, date, and payment method. Tax regulations may require additional details, such as a unique receipt number and a business identification code. Check local laws to confirm mandatory elements.

Store copies of receipts for the legally required period. Many jurisdictions mandate retention for at least three to seven years. Digital copies should have secure backups to prevent data loss.

Confirm that receipts comply with consumer protection laws. Some regions require refund policies or disclaimers on receipts. If your business operates internationally, align receipt formats with the legal requirements of each country.

Audit cash receipts regularly to detect discrepancies. Inconsistent records may signal accounting errors or fraudulent activity. Implement internal controls, such as sequential numbering and restricted access to receipt templates, to maintain accuracy.

Consult a legal expert to verify compliance with tax reporting obligations. Certain businesses must submit summaries of cash transactions to tax authorities. Failure to meet reporting requirements can result in penalties or audits.

Customization Options for Different Business Needs

Adjust receipt templates by modifying layout, branding, and content to fit specific business requirements. Add a company logo, choose a font style that matches your brand, and set a color scheme for a consistent look. Ensure legal compliance by including tax details, business registration numbers, or disclaimers where necessary.

Industry-Specific Adjustments

Retail businesses benefit from itemized receipts with product descriptions and return policies. Service providers may include detailed work descriptions and hourly rates. Restaurants often add tipping suggestions and table numbers, while medical offices might include insurance information and patient details.

Integration with Business Systems

Enhance receipts by connecting them to accounting software, CRM systems, or inventory management tools. Automate numbering for easy tracking, generate digital receipts for online transactions, and offer multiple formats like PDF or SMS-based confirmations.

Common Errors and How to Avoid Them

Ensure that all mandatory fields are completed before finalizing the receipt. Missing details, such as date, amount, or payer information, can render the document invalid.

| Error | Solution |

|---|---|

| Incorrect tax calculation | Verify tax rates and apply consistent rounding rules to avoid discrepancies. |

| Unreadable formatting | Use clear fonts, proper spacing, and align columns for easy reading. |

| Duplicate receipt numbers | Implement a sequential numbering system to prevent conflicts. |

| Omitting payment method | Specify whether the payment was made by cash, card, or bank transfer to maintain accuracy. |

| Incorrect date format | Standardize date entries (e.g., YYYY-MM-DD) to eliminate misinterpretation. |

Review each receipt for accuracy before issuing it. Automated validation tools can catch common mistakes and reduce manual errors.

Digital vs. Paper-Based Certification: Pros and Cons

Choose digital certification for speed and convenience. It reduces costs, eliminates printing delays, and allows instant verification. Secure encryption prevents forgery, and automated backups protect records from loss.

- Accessibility: Digital certificates are available anytime, anywhere, while paper copies require physical storage.

- Security: Digital formats include encryption and authentication, whereas paper documents can be lost, stolen, or altered.

- Cost: Printing and mailing paper certificates add expenses. Digital options cut these costs.

- Environmental Impact: Going digital reduces paper waste, benefiting sustainability.

Paper-based certification remains useful where digital access is limited or legal requirements mandate physical copies. However, its higher costs, slower processing, and vulnerability to damage make it less practical in most cases.

For long-term reliability, digital certification offers better security and efficiency. If paper is required, consider hybrid solutions that include digital verification.

Best Practices for Record-Keeping and Verification

Ensure accurate documentation by maintaining detailed, time-stamped receipts for all transactions. Each entry should include transaction amounts, payer details, and the purpose of the payment. This allows easy tracking and prevents errors from occurring over time.

Maintain Consistent Documentation

Create a standard format for all receipts and documentation, making it simple to verify and cross-check information later. Consistency in data entry reduces the risk of omissions or mistakes and improves the reliability of your records.

Use Technology for Enhanced Accuracy

Leverage accounting software or digital tools that automatically generate receipts and store them securely. These tools reduce human error and streamline the verification process, especially during audits or reviews.