Need a simple way to document sales and payments? A well-structured Excel template keeps your records clear, reduces errors, and saves time. Instead of manually writing receipts or juggling multiple spreadsheets, use a pre-designed format that calculates totals automatically and organizes data efficiently.

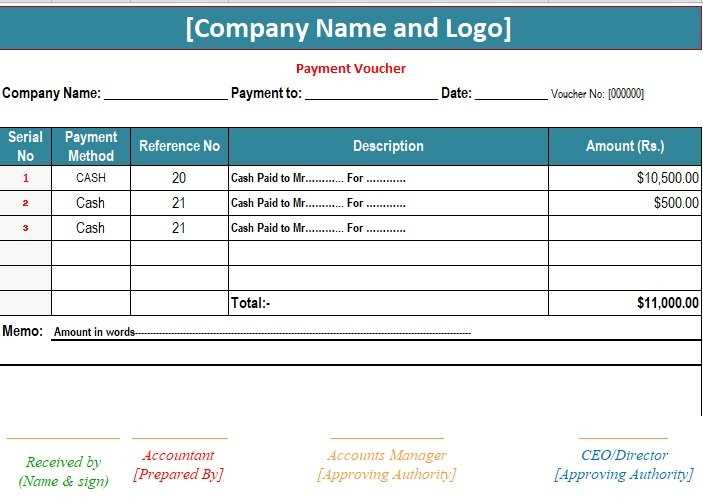

An effective template includes essential fields such as date, transaction ID, payment method, and itemized charges. Built-in formulas can sum amounts, apply taxes, and even generate running balances. With conditional formatting, overdue payments stand out instantly, helping you stay on top of outstanding amounts.

Customize the template to match your business needs. Add a company logo, adjust currency formats, or include dropdown menus for faster data entry. If automation is a priority, integrate VBA scripts to generate PDF receipts or send email confirmations with a single click.

Accuracy and consistency matter in financial records. A structured Excel template ensures every receipt follows the same format, reducing discrepancies and simplifying audits. Whether for retail sales, freelance work, or rental payments, a well-designed template streamlines documentation and improves organization.

Cash Receipt Excel Template

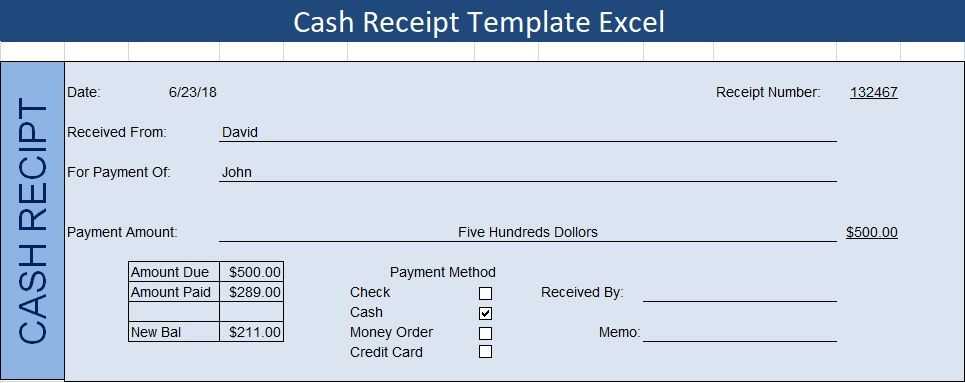

Use a structured format with labeled columns to ensure clarity. Include “Date,” “Receipt Number,” “Payer Name,” “Payment Method,” “Amount,” and “Description” to track transactions accurately. Add automatic calculations for totals using Excel formulas like =SUM(B2:B100) to avoid manual errors.

Enhance usability with drop-down lists for payment methods. Select “Data Validation” in Excel, choose “List,” and enter options like “Cash, Card, Bank Transfer” to standardize entries. Conditional formatting helps highlight overdue payments–set rules to change cell colors based on due dates.

Save the template as a protected file to prevent accidental changes. Use “File” > “Save As” > “Excel Template (*.xltx)” for reuse without overwriting. Lock important cells with the “Protect Sheet” option while allowing data entry in designated fields.

Choosing the Right Layout for Your Cash Receipt

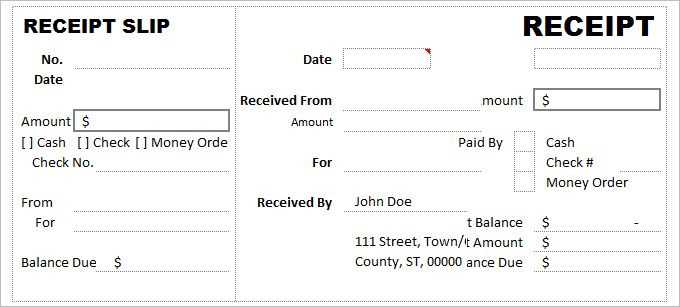

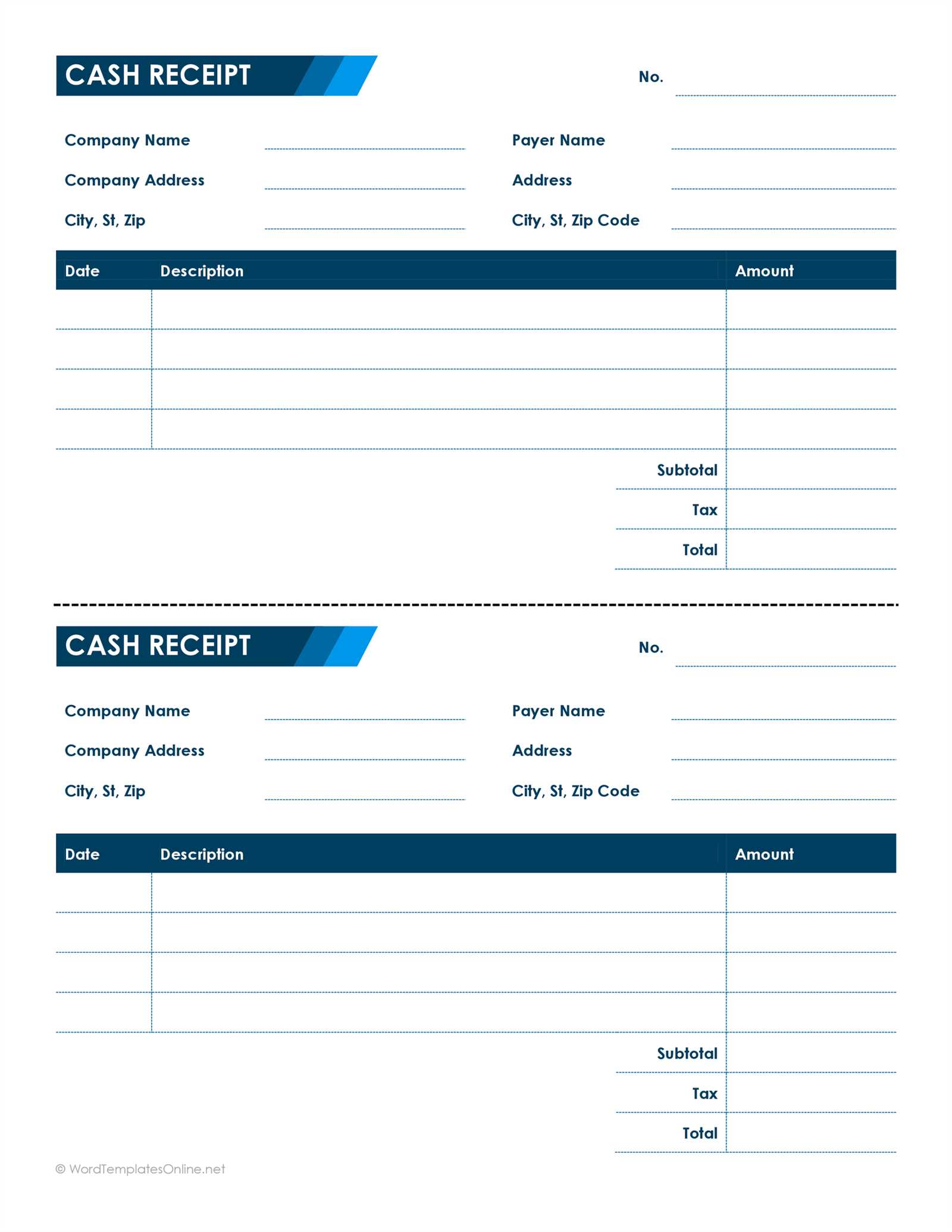

Use a clean and structured format to ensure quick data entry and easy reading. A well-organized receipt reduces errors and simplifies bookkeeping. Focus on clarity by placing essential details–date, amount, payment method, and recipient–at the top.

Prioritize Readability

Align key elements in distinct sections. Use separate rows or columns for transaction details, taxes, and totals. If using an Excel template, format numeric fields for currency and apply conditional formatting to highlight overdue or paid receipts.

Adapt to Your Needs

For frequent transactions, choose a template with auto-filled fields for business name, tax rates, or client details. If handling multiple currencies, ensure space for currency conversion. For digital receipts, leave room for e-signatures or QR codes linking to payment confirmation.

Configuring Formulas for Automatic Calculations

Set up automatic calculations by using Excel formulas that update in real time. Define key fields, such as total amount, tax, and discount, to streamline data entry and reduce manual errors.

Applying SUM and IF Functions

Use =SUM(range) to total amounts across multiple rows. If conditional logic is required, apply =IF(condition, value_if_true, value_if_false). For instance, to apply a 10% discount if the total exceeds $500, use:

=IF(SUM(B2:B10)>500, SUM(B2:B10)*0.9, SUM(B2:B10))

Automating Tax and Discounts

To calculate tax dynamically, multiply the subtotal by the tax rate:

=B10*0.07 (for 7% tax)

For automatic discount adjustments, use:

=B10*(1-D2), where D2 contains the discount percentage.

Ensure that formulas extend across new rows by formatting cells as tables (Ctrl + T), allowing calculations to apply automatically to additional entries.

Adding Conditional Formatting for Better Readability

Highlight overdue payments instantly by setting up conditional formatting. Select the column with due dates, open the “Conditional Formatting” menu, and choose “New Rule.” Pick “Format cells based on their values” and set the condition to format dates older than today in red.

Improve clarity by applying color scales to transaction amounts. Select the amount column, go to “Conditional Formatting,” and choose “Color Scales.” Opt for a gradient where high values appear in green and low values in red to make trends visible at a glance.

Make key categories stand out using text-based rules. Select the category column, create a new rule, and use “Format cells that contain” to assign different background colors to specific labels. This makes it easier to scan receipts and identify expense types quickly.

Ensuring Proper Print Settings for Physical Copies

Set the correct paper size before printing to prevent misalignment. Choose the appropriate format, such as A4 or Letter, in both the Excel and printer settings.

Adjust scaling to fit the receipt on a single page. Use the “Fit to Page” option or set a custom scaling percentage to maintain readability without cutting off details.

Enable gridlines and headers if needed. In the “Page Layout” tab, check “Print Gridlines” and “Print Headings” to improve clarity and structure.

Check margins under “Page Setup.” Narrow margins maximize space, while standard settings ensure compatibility with different printers.

Select the right print quality for crisp text. Draft mode saves ink, while “High Quality” ensures sharpness for professional use.

Preview before printing to catch errors. Use “Print Preview” to verify alignment, content visibility, and formatting before committing to paper.

Protecting Data with Locked Cells and Passwords

Prevent unauthorized changes by locking specific cells and applying a password. This ensures that only designated users can modify critical information while allowing data entry in other sections.

Locking Cells in Excel

- Select the cells to remain editable and press Ctrl + 1 to open the Format Cells window.

- Go to the Protection tab and uncheck Locked, then click OK.

- Open the Review tab and click Protect Sheet.

- Set a password and define allowed actions, then confirm by clicking OK.

Adding a Password to the Entire Workbook

- Click File, then choose Save As.

- Select a location, then click Tools and choose General Options.

- Enter a password in the Protect Workbook field and confirm it.

- Save the file and distribute the password securely.

Use strong passwords with a mix of uppercase, lowercase, numbers, and symbols. Store them securely to prevent loss, as Excel does not provide recovery options for forgotten passwords.

Integrating Receipt Data with Accounting Software

Linking your cash receipt data directly with accounting software helps streamline financial reporting and reduce the risk of errors. To integrate this data smoothly, export the receipt details from the Excel template into a format compatible with your software, such as CSV or XML. Many accounting platforms support these formats, making the transfer quick and hassle-free.

Steps for Integration

Follow these steps to connect your receipt data with accounting software:

| Step | Action |

|---|---|

| 1 | Export the Excel receipt data as a CSV or XML file. |

| 2 | Open your accounting software and navigate to the data import section. |

| 3 | Select the file format (CSV or XML) and upload the receipt file. |

| 4 | Map the fields from the receipt data (e.g., amount, date, payment method) to the corresponding fields in the software. |

| 5 | Confirm and complete the import process. |

Benefits of Integration

Automating the import of receipt data eliminates the need for manual entry and helps maintain accurate records. This ensures better financial tracking and reporting. The integration also enables quicker reconciliation of transactions, improving the overall efficiency of your accounting workflows.