A well-structured cash receipt invoice template simplifies financial documentation and ensures clarity in every transaction. Whether managing a small business or handling personal sales, using a standardized format eliminates confusion and maintains accurate records. This approach helps track payments, prevent disputes, and streamline bookkeeping.

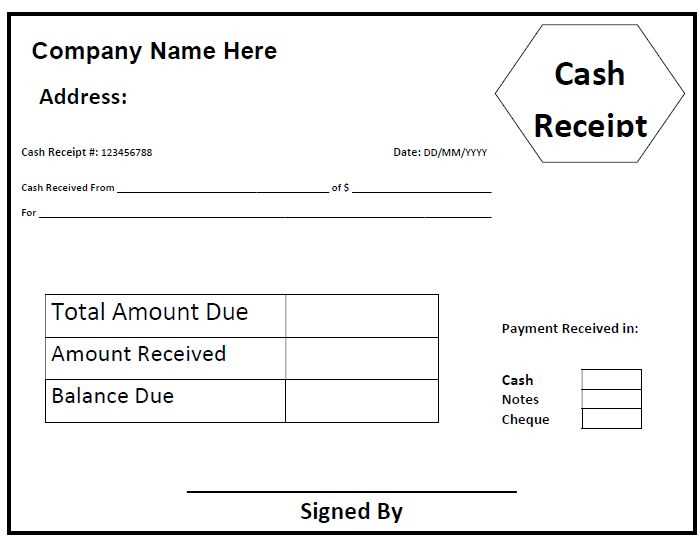

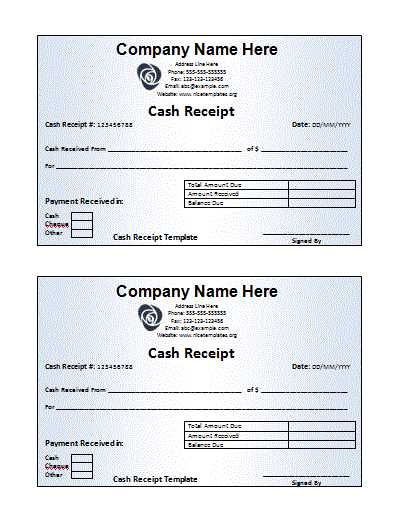

Key elements of a reliable template include date of transaction, payer and payee details, amount received, and payment method. Adding a unique invoice number enhances traceability, while a detailed breakdown of goods or services clarifies the transaction for both parties. A designated space for signatures adds an extra layer of authentication.

Customizing a template to fit specific needs can improve efficiency. Digital formats allow for easy sharing and storage, while printable versions offer a traditional option for in-person exchanges. Including business branding, such as a logo or contact details, enhances professionalism and strengthens credibility with clients.

Here is the edited version with redundant repetitions removed:

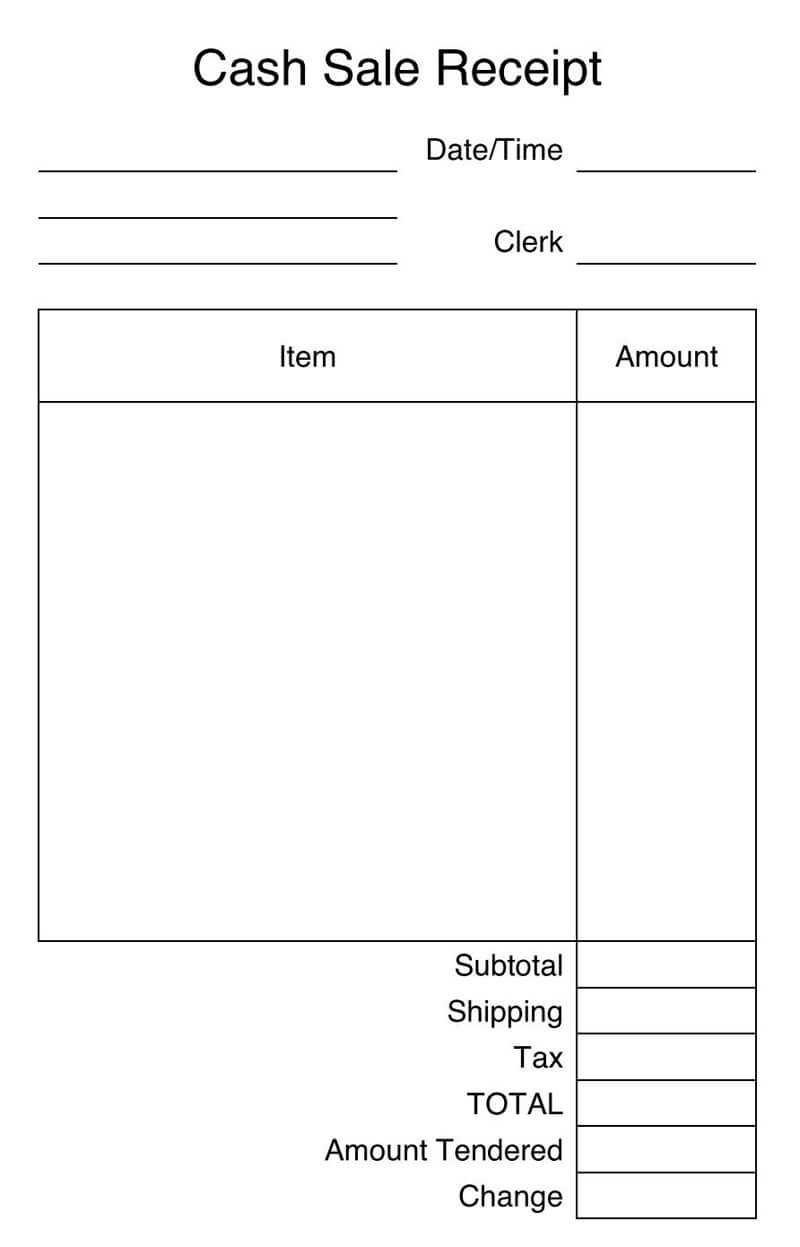

Focus on providing the most relevant details on the cash receipt. Start with the customer name, followed by the amount received and the payment method. Include the transaction date, a brief description of the goods or services, and any applicable tax information.

How to Structure the Invoice

Clearly separate each section for easy reference. Use simple formatting for the amount and total fields. This enhances clarity and helps avoid confusion. Make sure to adjust the layout according to the business type.

Tips for Better Clarity

Use a clean, legible font and appropriate margins to give the document a professional look. Double-check the transaction details for accuracy before sending. Include contact information at the bottom for any follow-up inquiries.

- Cash Receipt Invoice Template

For accurate tracking of payments, a cash receipt invoice template should include the following key elements:

- Invoice Number: Assign a unique number to each receipt for easy reference.

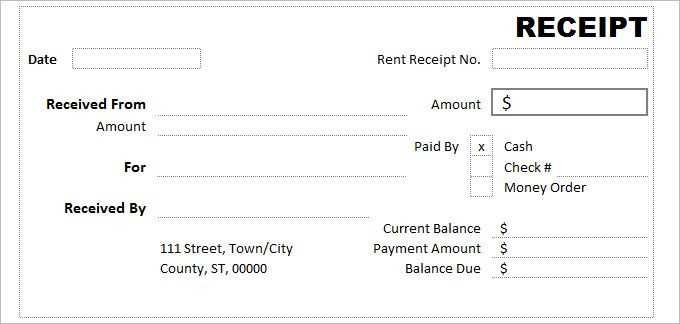

- Date of Transaction: Clearly mark the date the payment was received.

- Payer Information: Include the name, address, and contact details of the person or business making the payment.

- Amount Received: Specify the exact amount of cash received, and include both the numerical value and the word format (e.g., “One Hundred Dollars”).

- Payment Method: Indicate that the payment was made in cash to avoid confusion with other payment types.

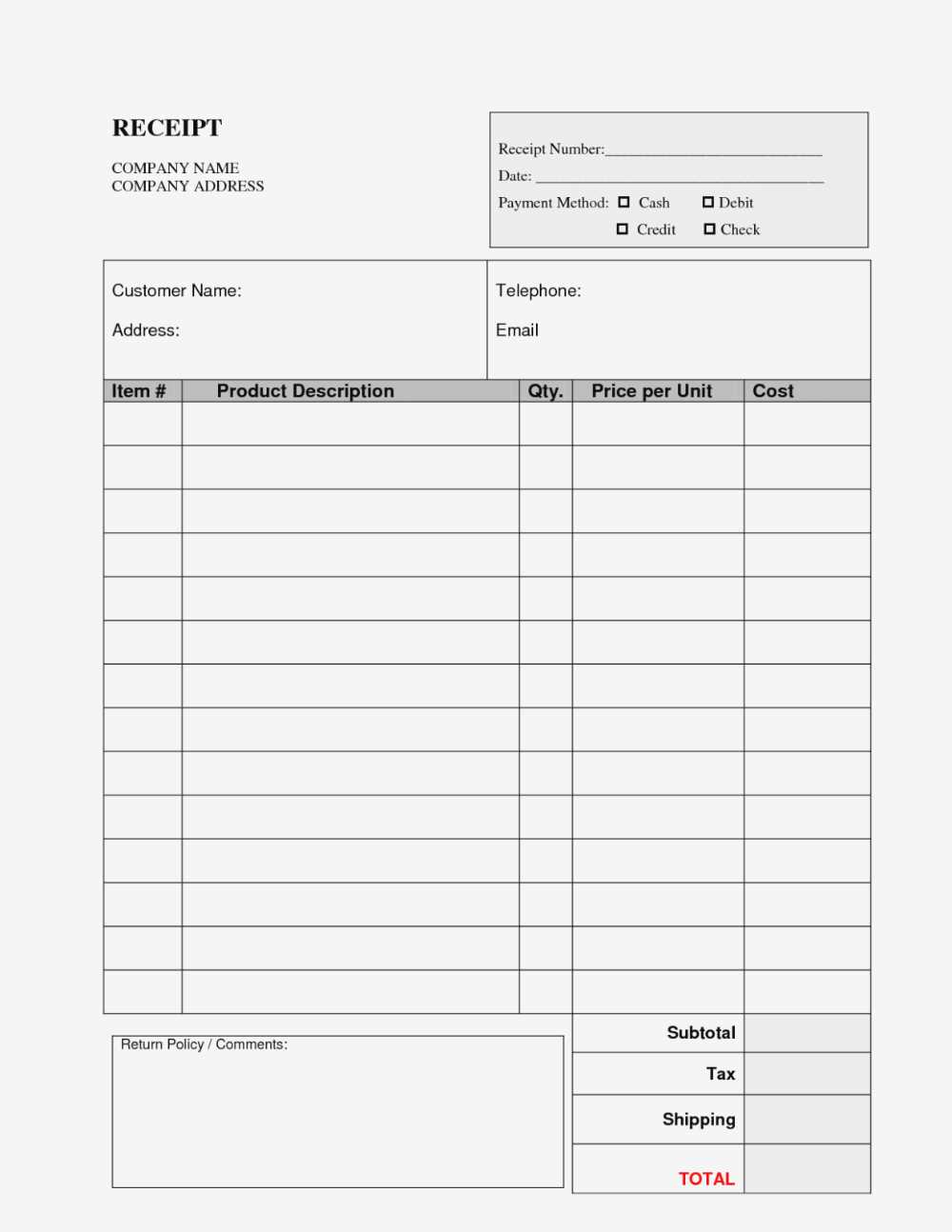

- Product/Service Description: Briefly describe the product or service the payment is for, including quantities and prices if necessary.

- Seller Information: Include the seller’s name, business name, and contact information.

- Signature: Ensure space is provided for both the payer and receiver to sign, confirming the transaction.

Always keep a copy of the receipt for both the payer and seller. This template is essential for simplifying record keeping and ensuring transparent financial documentation.

To create a clear and professional payment receipt, include these elements:

1. Date of Payment

Include the exact date of the transaction to keep track of payment history and provide a clear timeline for both parties.

2. Payer and Payee Details

List both the payer’s and payee’s full names, addresses, and contact details. This ensures the receipt is personalized and avoids confusion in case of disputes.

3. Amount Paid

Specify the exact amount paid, along with the currency used. This avoids any misunderstanding regarding payment values.

4. Payment Method

Note the payment method used, whether it was cash, check, credit card, or bank transfer. This adds clarity and may be required for record-keeping.

5. Description of Goods or Services

Clearly outline what was purchased or paid for. Providing a brief description can help in future reference or for tax-related purposes.

6. Transaction ID

If applicable, include a unique transaction ID for reference, especially if the payment was made electronically.

7. Signature

If relevant, include a space for the payer’s or payee’s signature. This can serve as verification for both parties involved.

8. Terms and Conditions (if any)

If there are any special terms regarding refunds, exchanges, or warranties, include them in the receipt for transparency.

To ensure clarity, begin with a clear heading that states the document is an invoice. Include the invoice number, date of issue, and payment due date right at the top. Follow this with the seller’s and buyer’s contact information, including company name, address, phone number, and email address, as needed. These details should be positioned on opposite sides for easy reference.

List the items or services provided in a table format. Each line should display the product description, quantity, unit price, and total cost. This breakdown makes it easy for both parties to verify the charges. Here’s an example:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Item A | 2 | $25.00 | $50.00 |

| Service B | 1 | $75.00 | $75.00 |

After listing the items, include the subtotal, applicable taxes, and the final total. Label these clearly to avoid any confusion. Make sure the final total is prominently displayed, making it easy for the buyer to see the amount due.

Lastly, provide clear payment instructions, including acceptable methods (e.g., bank transfer, credit card) and due dates. If there are any late fees, mention them in a separate section at the bottom.

Use a standardized template for every payment record to ensure consistency. This template should include fields such as the date, amount, payer’s information, and a description of the service or product paid for. This helps avoid errors and makes it easier to track transactions over time.

Organize Records Logically

Store records in a well-organized system. Group payments by date, client, or project. This organization ensures quick retrieval when needed, whether for audits, disputes, or tax purposes.

Use Secure and Backup Storage Methods

Store payment records in secure, password-protected systems, both digitally and physically. Use encrypted cloud storage for digital files, and ensure backup copies are available in case of data loss or system failure. Regularly update these backups to avoid losing valuable information.

Cash Receipt Invoice Template: Key Recommendations

Ensure that the template includes essential details like the date of the transaction, the amount received, and the payer’s information. These elements help to verify and confirm the payment. Make sure to list the goods or services provided along with their individual costs for clarity. A clear breakdown of the total amount received and any applicable taxes or discounts will also improve transparency.

Including Payment Methods

Always specify the payment method used–whether it’s cash, credit, or electronic transfer. This ensures that the transaction record is accurate and provides a point of reference for future queries or audits.

Clear and Simple Formatting

A well-organized invoice helps prevent errors and confusion. Use a clean layout, and keep the font legible. Make sure the transaction information is easy to find and read at a glance. This small step goes a long way in improving the document’s usability.