If you are looking for a clear and organized way to track cash receipts, a journal template can simplify the process. A well-structured template ensures that all transactions are recorded accurately and can be easily reviewed when needed. For students in grade 8, this task can help reinforce important concepts like accounting basics and financial literacy.

The template should include key sections such as the date of the transaction, the amount received, the source of the cash, and any relevant notes. This will help students track their financial records while practicing critical thinking and organizational skills. It’s also a great way to prepare for future lessons in accounting or business.

When using a cash receipt journal template, make sure to input information consistently and double-check entries for accuracy. Regular use of the template can improve attention to detail and provide an easy reference for financial review or analysis.

Here are the revised lines with reduced word repetition:

To create a streamlined cash receipt journal template, remove unnecessary phrases and simplify. Focus on key information like transaction date, amount received, payer, and payment method. Each entry should be clear and concise, avoiding excessive details that do not add value.

Example of Revision:

Before: “The total amount received from the customer on the 15th of March 2023 was $500. The payment made by the customer was cash.”

After: “On March 15, 2023, the customer paid $500 in cash.”

Key Adjustments:

1. Eliminate redundancy: Use specific details without restating information. The date and payment method do not need to be repeated.

2. Simplify the structure: Keep sentences short. Directly state the essential information.

3. Avoid excessive descriptions: Only include details relevant to the transaction. Remove any unnecessary adjectives or adverbs.

- Cash Receipt Journal Template for Grade 8

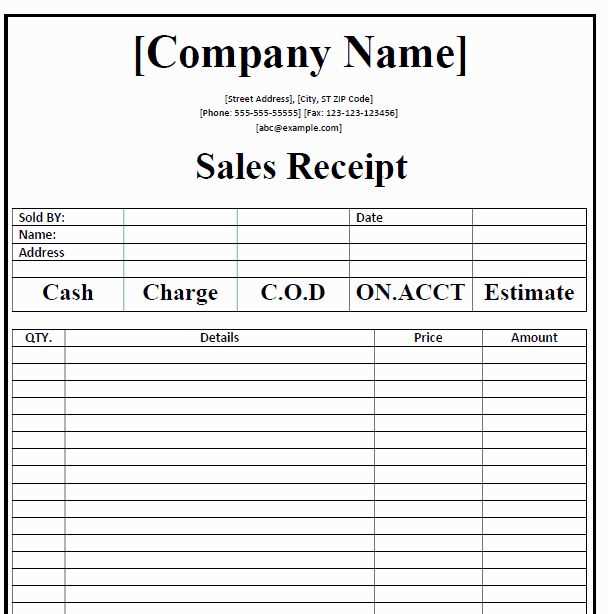

Creating a cash receipt journal template is a straightforward task that helps keep track of all the money received. For Grade 8 students learning financial management, this can serve as a practical exercise. Here’s how to set it up efficiently:

Steps to Set Up the Template

- Date – Include the date when the payment is received. This ensures accurate record-keeping.

- Received From – Name the person or organization that made the payment.

- Amount – Specify the exact amount of money received, ensuring no discrepancies.

- Payment Method – Indicate whether the payment was made in cash, check, or electronically.

- Purpose – Record the reason for the payment, whether it’s for goods, services, or any other transaction.

- Reference Number – Assign a reference number for tracking purposes, especially when dealing with multiple receipts.

Template Example

- 1. Date: 01/01/2025

- 2. Received From: John Doe

- 3. Amount: $50.00

- 4. Payment Method: Cash

- 5. Purpose: Payment for book purchase

- 6. Reference Number: 001

By following this format, students can easily record cash receipts in a structured manner, which is a critical skill in financial literacy. This template can also be customized depending on specific needs or preferences, making it a versatile tool for keeping financial records clear and organized.

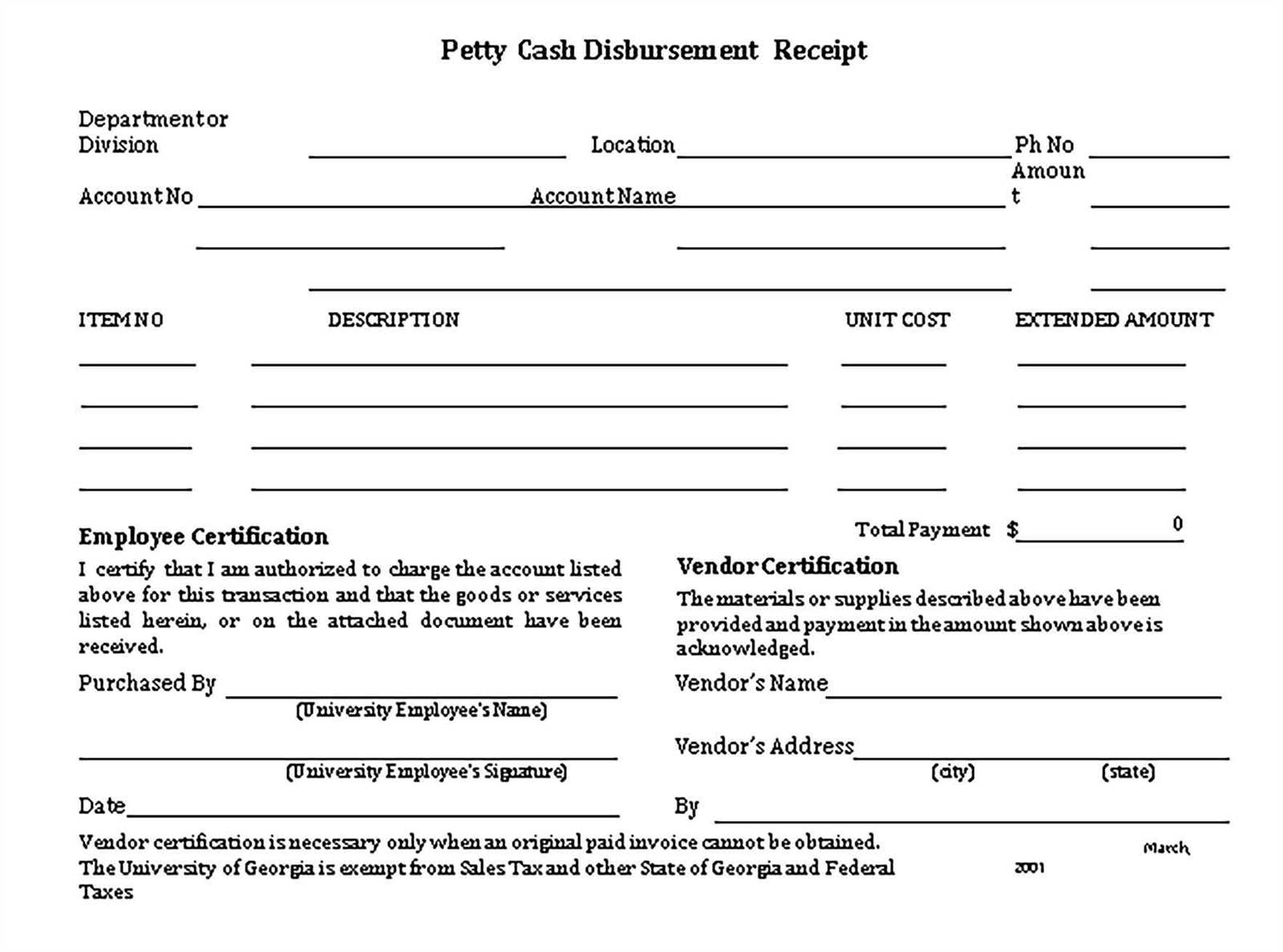

To organize cash transactions in a ledger, follow these straightforward steps:

1. Set Up Columns

- Label columns for Date, Description, Cash In, Cash Out, and Balance. This will help track all cash movements clearly.

2. Record Each Transaction

- For every cash transaction, note the date and a brief description of the source or reason for the cash movement.

- For cash inflows, write the amount under the “Cash In” column, and for expenses, enter the amount in the “Cash Out” column.

3. Keep the Balance Updated

- After recording each transaction, update the balance by adding or subtracting the respective amounts from the previous balance.

- Accurately calculating the balance after every entry ensures you maintain up-to-date records.

4. Double-Check for Accuracy

- Review entries to confirm they are accurate, especially the amounts and descriptions of each transaction.

- Cross-reference with receipts or invoices when necessary to ensure correctness.

5. Reconcile Periodically

- At the end of each period (week, month, etc.), compare the ledger balance with the actual cash available.

- If discrepancies arise, investigate the cause and adjust the ledger accordingly.

By following these steps, you will have a well-organized ledger to manage cash transactions effectively.

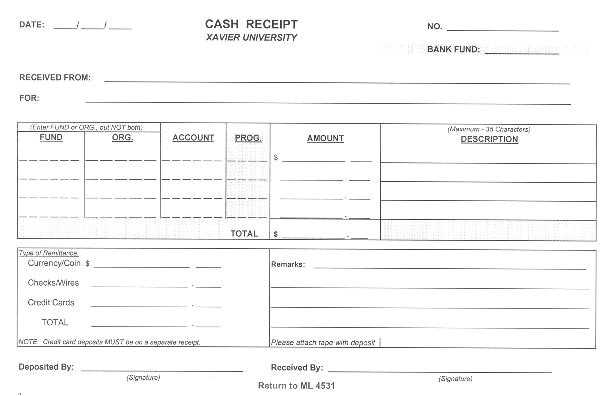

The columns in a cash receipt template provide critical data about transactions. Each column serves a distinct purpose, offering clarity and structure to financial records. Here’s a breakdown of each key column:

| Date | This column records the date when the payment was received. Keeping accurate dates helps track payment history and aligns with accounting periods. |

|---|---|

| Receipt Number | Each payment is assigned a unique receipt number. This ensures all receipts are traceable and helps avoid confusion during audits. |

| Customer Name | The customer’s name is recorded here, making it easier to match payments to specific clients or accounts. |

| Payment Method | This column indicates how the payment was made, whether by cash, check, or electronic transfer, aiding in reconciling the cash flow. |

| Amount | The exact sum of money received is noted here. This column is vital for tracking total income and ensuring that the receipt matches the payment. |

| Account Credit | Used to record which account or invoice the payment is applied to. This is crucial for maintaining accurate balances and tracking outstanding amounts. |

| Remarks | This optional column can include any relevant notes, such as discounts, adjustments, or specific transaction details. |

Each column is designed to streamline record-keeping, helping maintain organized and accurate financial data. Properly filling out each section enhances transparency and simplifies financial management.

To balance your receipt journal, first ensure all entries are correctly listed under their respective categories. Double-check that the amounts recorded align with the actual receipts, noting any discrepancies. It’s helpful to compare your journal totals with bank statements to verify the consistency of reported receipts.

Start by adding up the totals in your receipt journal. Ensure that all debits match the amounts deposited. If you’re using a spreadsheet, use formulas to automate this process and minimize human error. After totaling the receipts, subtract any adjustments or refunds to obtain your final amount.

Next, cross-reference your entries against your original receipts or payment records. Confirm that each entry matches the source document. Pay attention to small details like date discrepancies or misallocated amounts. Once you’ve verified the entries, ensure your final total matches the balance from your accounting system or bank statement.

If there’s a mismatch, investigate the specific transaction or entry causing the discrepancy. Adjustments or corrections might be needed. Regular reconciliation between your journal and bank records helps maintain accuracy and ensures no missed receipts.

Reducing Repetitions of “Cash”, “Receipt”, and “Journal”

To avoid unnecessary repetition, focus on using alternative phrases while maintaining clarity. For example, instead of repeating “cash receipt journal,” refer to it as “financial log” or “income record.” By varying your language, you can create a more engaging and less monotonous text. Additionally, consider using abbreviations like “CRJ” once the term has been introduced. This not only simplifies the writing but also ensures that the meaning remains clear. Maintain the structure and intent of your sentences, but swap in synonyms where appropriate to keep the reader’s attention. Whether discussing transactions or accounting entries, diversifying your vocabulary ensures readability and flow.