If you are managing finances, having a cash receipt ledger template can simplify tracking incoming payments. This template will help you accurately record cash transactions, providing clear and easy-to-read entries. You can use it to log each payment made, the date, the source, and the amount received.

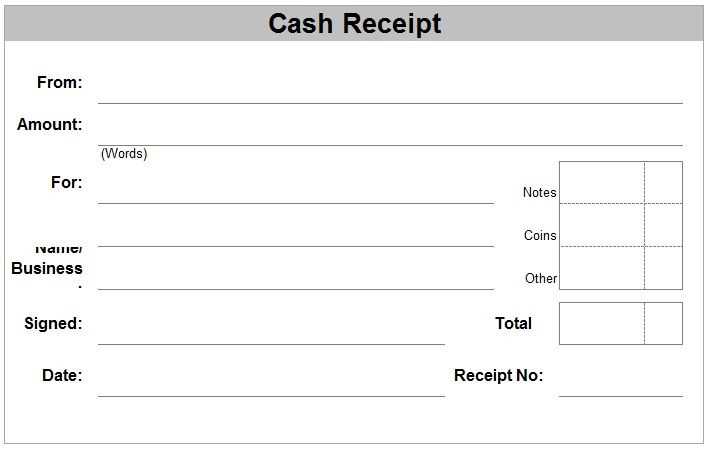

Ensure that each entry is precise, with columns for the payer’s name, receipt number, and purpose of payment. This layout will help you quickly identify discrepancies or errors. A well-organized ledger supports transparency and accountability, which are key for maintaining a healthy cash flow.

For those who deal with frequent transactions, creating a consistent routine for entering data into the ledger will prevent backlogs. You can tailor the template to fit your specific needs, adding categories for different types of payments or customers. By keeping this template updated, you maintain an accurate financial record that can be used for reports or audits.

Here’s the revised version:

Make sure your cash receipt ledger template is straightforward and easy to navigate. Include columns for the date, receipt number, payer name, payment method, amount, and any notes for additional details. This ensures clarity and prevents confusion later on. Always update the ledger immediately after receiving payments to avoid missing transactions. Consider using color coding or bold text for outstanding payments or important details. This will help you spot discrepancies or follow-ups at a glance. Keep your records in a secure place and back them up regularly to prevent loss. A well-maintained ledger not only tracks cash flow but also provides you with valuable insights into your financial activity.

- Cash Receipt Ledger Template: Practical Guide

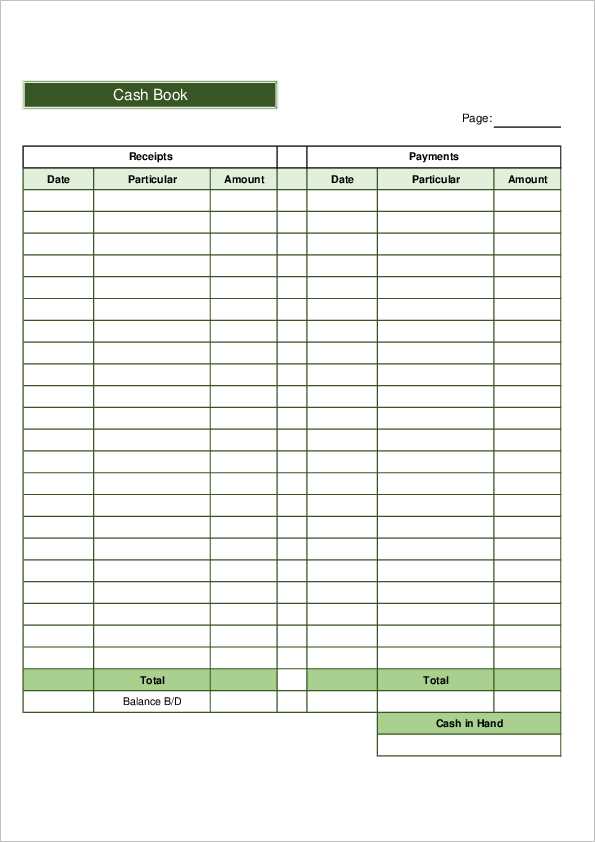

To create a well-organized cash receipt ledger, begin by listing each transaction date, customer name, payment method, and amount received. This basic structure ensures that every entry is clearly documented for easy reference.

Each entry should be accompanied by a unique receipt number for tracking purposes. This helps prevent errors and ensures that the ledger is accurate and reliable. Record any adjustments or refunds separately to maintain transparency in financial reporting.

For businesses dealing with frequent transactions, consider grouping payments by customer or payment method for better categorization. This approach streamlines the reconciliation process and minimizes confusion during audits.

Periodically review your ledger to ensure all entries are complete and accurate. Any discrepancies should be addressed immediately to prevent potential issues with cash flow management or tax filings.

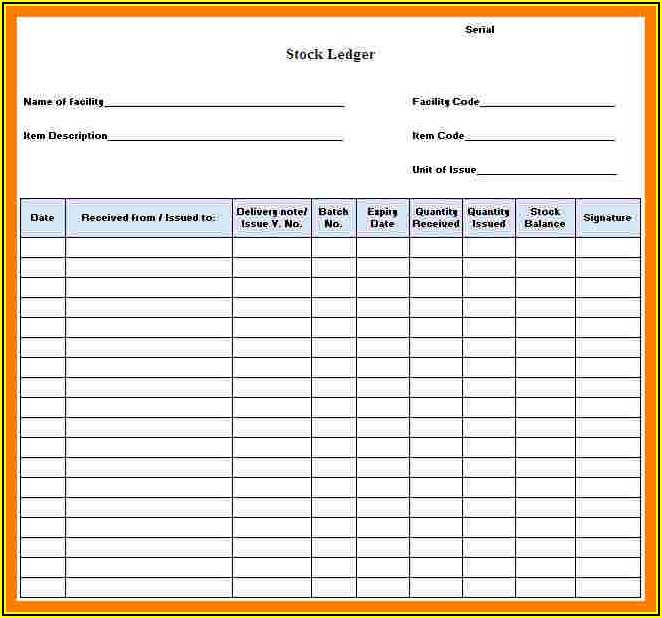

Choose a ledger format that aligns with the type and volume of transactions you handle. For straightforward transactions, a simple table format can keep records clear and organized. If your business involves multiple categories or detailed tracking, consider a more structured format, such as a column-based template with separate fields for dates, amounts, payment methods, and customer information.

Prioritize ease of use when selecting a format. A clear and intuitive layout will minimize the time spent managing entries and reduce errors. Make sure that columns are appropriately labeled and that each entry is easy to fill in and review. For instance, columns should have distinct categories like “Date,” “Description,” “Amount,” and “Balance,” to help track transactions at a glance.

If your transactions are frequent, explore ledger templates with automatic calculation features. These templates often provide real-time balance updates, saving you the effort of manual calculations and improving accuracy. Depending on your needs, consider a customizable template that allows you to add specific fields relevant to your business operations.

Begin by determining the main categories that best fit your cash receipts. Categories help organize the data and simplify tracking over time. Common examples include “Sales Revenue,” “Loan Payments,” and “Refunds.” These categories will act as the primary groups for your transactions.

1. Create Clear and Specific Categories

- Sales Revenue: Track all income generated through sales.

- Other Income: Record any miscellaneous receipts such as donations or interest payments.

- Refunds: Separate refunds issued to customers or adjustments to previous sales.

Once categories are established, create columns under each category to capture specific details about each transaction. These columns can include the date, description, amount, and payment method. Each column helps capture the critical data necessary for accurate financial reporting.

2. Add Relevant Columns

- Date: Track the date of each transaction.

- Description: Provide a brief note about the source of the receipt.

- Amount: Record the exact monetary value of the transaction.

- Payment Method: Include whether the payment was made by cash, cheque, or credit card.

With categories and columns set up, your ledger will be more organized, making it easier to track and manage cash receipts. This setup allows for quick identification of trends and patterns in your income, and ensures accuracy in financial reporting.

Record each cash transaction promptly and accurately. This helps maintain clear financial records and reduces errors in tracking your income and expenses. Be sure to enter the date, amount, and description for every entry to avoid confusion later. Categorizing transactions by type (e.g., sales, refunds, adjustments) ensures clarity when reviewing your financials.

Regularly reconcile your ledger with bank statements or receipts. This will help spot discrepancies early and ensure your cash flow is correctly represented. If discrepancies arise, investigate immediately to avoid mistakes from compounding over time.

Use the ledger to track trends in your finances. With consistent entries, you can identify patterns such as peak sales periods or frequent expenses, helping you make informed decisions about future financial strategies. A well-maintained ledger offers a reliable foundation for any financial planning.

Connecting your cash receipt ledger with accounting software streamlines data entry, reduces errors, and enhances reporting accuracy. Select a software that supports import or synchronization of ledger data. Many modern accounting systems offer automated integration, saving time and effort.

Steps for Integration

Follow these steps to integrate your ledger with accounting software:

- Ensure the software is compatible with your ledger format (CSV, Excel, etc.).

- Set up a secure connection between your ledger and the software, either through direct import or API integration.

- Test the integration by uploading a small sample of your ledger data and verifying accuracy in the software.

- Adjust settings to categorize cash receipts correctly, ensuring proper allocation to accounts in the software.

Benefits of Integration

Integration improves data accuracy by eliminating manual entry. It also allows real-time updates and enhances financial oversight. You’ll have quicker access to up-to-date reports, and accounting tasks become more streamlined, freeing up resources for other priorities.

Common Integration Issues

Some issues to be aware of include mismatched formats and incorrect data mapping. It’s essential to address these before large-scale data transfers to avoid discrepancies.

| Feature | Benefit |

|---|---|

| Automated Data Sync | Reduces manual work, ensuring accurate entries. |

| Real-Time Reporting | Provides immediate financial insights, aiding decision-making. |

| Error Reduction | Minimizes human errors in data entry and reconciliation. |

Do not forget to consistently record all transactions, including smaller ones. Missing even small receipts can lead to inaccurate records and discrepancies over time.

Failing to categorize receipts properly is another common mistake. Always ensure each receipt is assigned to the correct category, whether it’s for office supplies, travel, or customer purchases. This makes it easier to track expenses and identify trends.

Don’t mix personal and business expenses. Keep your business receipts separate to prevent confusion and potential issues with tax reporting.

Using inconsistent formats or abbreviations can complicate your record-keeping. Stick to a clear, consistent method for entering data, so anyone reviewing the ledger can understand it without ambiguity.

Finally, avoid neglecting regular audits of your ledger. Reviewing your records periodically helps catch mistakes early and ensures the accuracy of your financial data.

Keep your ledger updated regularly, preferably on a daily basis, to avoid backlog and ensure accuracy. Record transactions as they occur, rather than waiting until the end of the week or month. This prevents errors and reduces the risk of missing important details.

1. Use Clear and Consistent Categories

Ensure that all entries follow a uniform structure. Use categories that are relevant to your business or personal finance, such as sales, expenses, and refunds. This will make it easier to track financial data and analyze trends.

2. Double-Check Entries

Verify the information before finalizing each entry. Small errors can snowball, so take a moment to ensure that the amounts, dates, and descriptions are accurate. This reduces the likelihood of discrepancies during reconciliation.

3. Keep Supporting Documents Organized

Maintain a folder (physical or digital) for receipts, invoices, and other supporting documents. This helps in cross-referencing entries and provides a backup in case of audits or discrepancies.

4. Perform Regular Reconciliations

Set aside time weekly or monthly to reconcile your ledger with bank statements or payment processor reports. Reconciliation ensures that your records are consistent with actual transactions and balances.

5. Back Up Your Data

Always keep backups of your ledger, especially if you use digital tools. Store them in a secure location, such as a cloud service or an external hard drive, to prevent data loss from unexpected failures.

6. Stay Consistent with Formatting

Use consistent formatting for all entries, including dates, amounts, and descriptions. This improves readability and allows for quicker identification of errors or patterns.

7. Implement Regular Audits

Perform quarterly or yearly audits of your ledger to catch any errors or inconsistencies that may have been missed. Audits help in ensuring that your financial records remain trustworthy and accurate.

To organize cash receipts effectively, a ledger template is an ideal tool. It simplifies tracking transactions and ensures accuracy. A well-designed template helps you maintain clarity in recording payments, identifying discrepancies quickly, and streamlining financial management.

Key Components of a Cash Receipt Ledger

- Date – Record the date when the payment was received to maintain chronological order.

- Received From – Specify the party or entity making the payment to ensure transparency.

- Amount – Clearly state the total amount received to prevent any confusion.

- Payment Method – Note whether the payment was made in cash, by check, or electronically.

- Reference Number – Include any reference number or receipt ID to assist with later verification.

Benefits of Using a Cash Receipt Ledger Template

- Consistency – Helps maintain a standardized approach to recording cash receipts, ensuring no detail is missed.

- Accountability – With each entry properly logged, it becomes easier to track discrepancies or errors in financial records.

- Time-saving – Saves time during audits or monthly reconciliations, as all transaction details are already organized.