For smooth record-keeping and transparency in financial transactions, a cash receipt letter is indispensable. It serves as an official document confirming that payment has been received for goods or services. Crafting an effective cash receipt letter ensures both parties–buyer and seller–are on the same page regarding payment details.

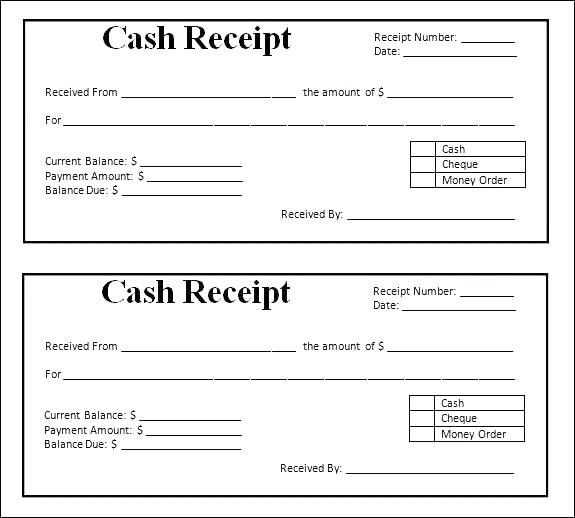

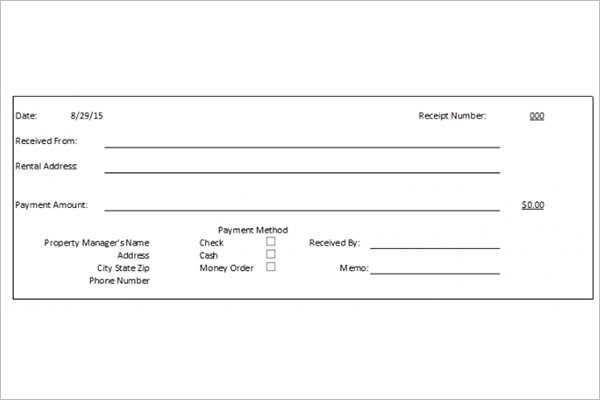

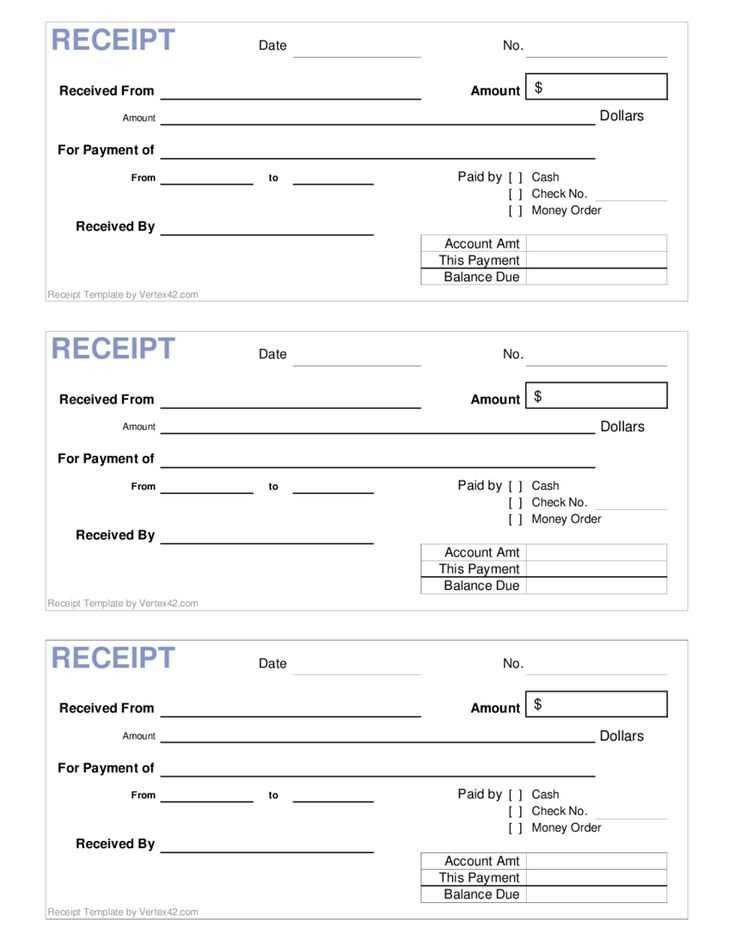

Begin the letter by clearly stating the amount received, the date, and the method of payment. This removes any ambiguity for both parties. Make sure to include identifying information about the transaction, such as invoice number or transaction reference, for easy tracking in the future.

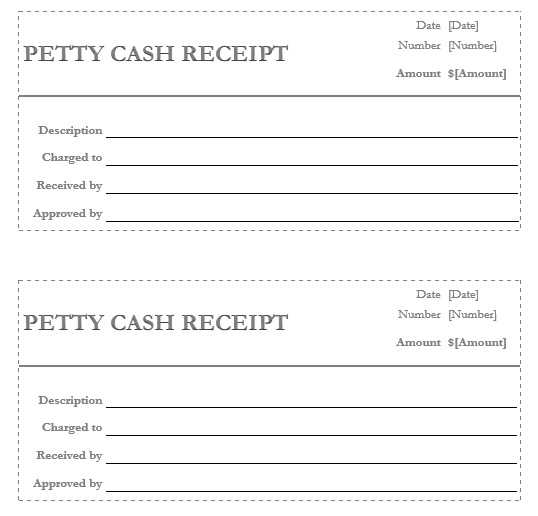

Also, note the purpose of the payment in the receipt, whether it’s for a specific service rendered or a product sold. This helps maintain clarity on what the payment was for, preventing potential disputes down the line. Finally, don’t forget to add a polite closing that reaffirms the receipt of funds and invites the recipient to reach out for any further questions or clarification.

How to Create a Professional Cash Receipt Letter

Begin by clearly stating the purpose of the letter at the top. Mention the date, the amount received, and the form of payment (cash, check, etc.). Include the name of the payer and the purpose for which the payment was made. Use a concise, direct language to avoid any confusion about the transaction.

Include All Relevant Details

Always list the transaction details in an organized manner. This should cover the payment amount, the name of the person or company making the payment, and the specific goods or services paid for. If necessary, reference any invoices or receipts associated with the payment. This helps establish transparency and ensures both parties are on the same page.

Provide Confirmation of Payment

Conclude the letter by confirming the receipt of the payment and affirming that all obligations regarding the transaction have been met. A brief statement such as, “This letter serves as confirmation of the payment received on [date]” will reassure the payer that their payment has been processed correctly.

Important Elements to Include in a Cash Receipt Letter

A cash receipt letter should be clear and contain specific details to avoid any confusion. Begin with the name of the person or company receiving the payment and the name of the payer. Next, include the date of the transaction. This helps both parties keep track of when the payment was made.

Transaction Details

Clearly specify the amount of money received, including the currency used. If the payment is for a specific product or service, describe it briefly. Also, indicate whether the payment was made in cash, check, or another form. This will prevent misunderstandings about the nature of the transaction.

Signature and Contact Information

End the letter with the signature of the person issuing the receipt. Provide contact information, such as an address, email, or phone number, for follow-up questions. This ensures that the recipient knows where to turn if there are issues or discrepancies with the transaction.

Common Mistakes to Avoid When Writing Cash Receipt Letters

One of the most common mistakes is failing to clearly state the payment amount. Always include the exact sum received, written both in numbers and words, to avoid confusion.

Don’t overlook the date of the transaction. A missing or incorrect date can lead to disputes or misunderstandings later on. Make sure the date matches the day the payment was made.

Ensure that the name of the payer is accurate. Mistakes in the payer’s name or company details can cause problems, especially if the receipt is used for legal or accounting purposes.

Be specific about the reason for the payment. Vague references like “payment received” aren’t sufficient. Instead, include a description of what the payment covers–whether it’s for a product, service, or other transaction.

Avoid using unclear or ambiguous terms in the letter. Phrases like “partial payment” or “deposit” should be followed by an explanation of the remaining balance or the terms associated with those payments.

Don’t forget to include the payment method. Whether it’s cash, check, or bank transfer, specifying how the payment was made provides transparency and can help resolve any future issues.

Lastly, ensure your contact information is included. If there are any questions or issues, providing a phone number or email address makes it easier to resolve them without delay.