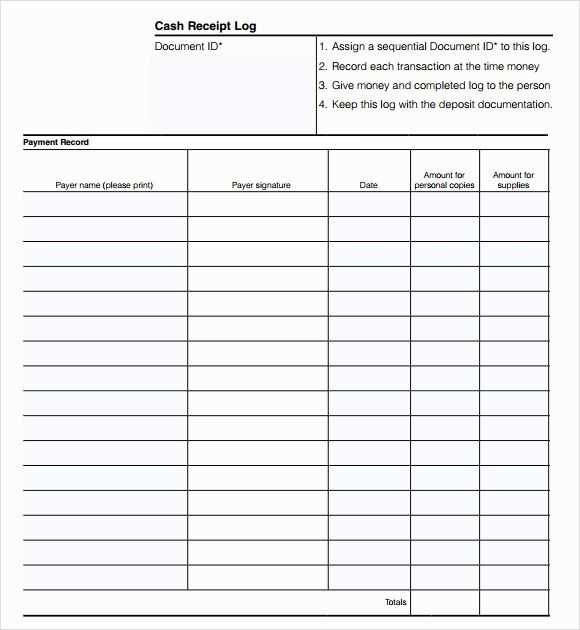

Implement a cash receipt log template to streamline your financial tracking. This tool provides a structured way to record transactions, ensuring that you capture essential details like date, amount, and payer information.

Start by designing columns that reflect your business needs. Include headers for transaction dates, receipt numbers, payment methods, and descriptions. This format enables you to quickly locate information and maintain organized records.

Regularly update your log to avoid discrepancies. Schedule a weekly review to reconcile your records with bank statements, which helps identify any errors promptly. Maintaining this routine cultivates accuracy in your financial management.

Utilize software or templates available online for added convenience. Many tools offer customizable features, allowing you to adapt the log to your specific requirements. Choose a template that fits your workflow to enhance usability.

Incorporating a cash receipt log template into your practices not only improves organization but also aids in preparing for audits or tax submissions. Consistent use will provide clarity in your financial dealings and contribute to the overall health of your business.

How’s your project on those pinouts going? Need any help with more specific topics or content structure? I can help brainstorm or fine-tune things for you!

- Choosing the Right Format for a Cash Receipt Log

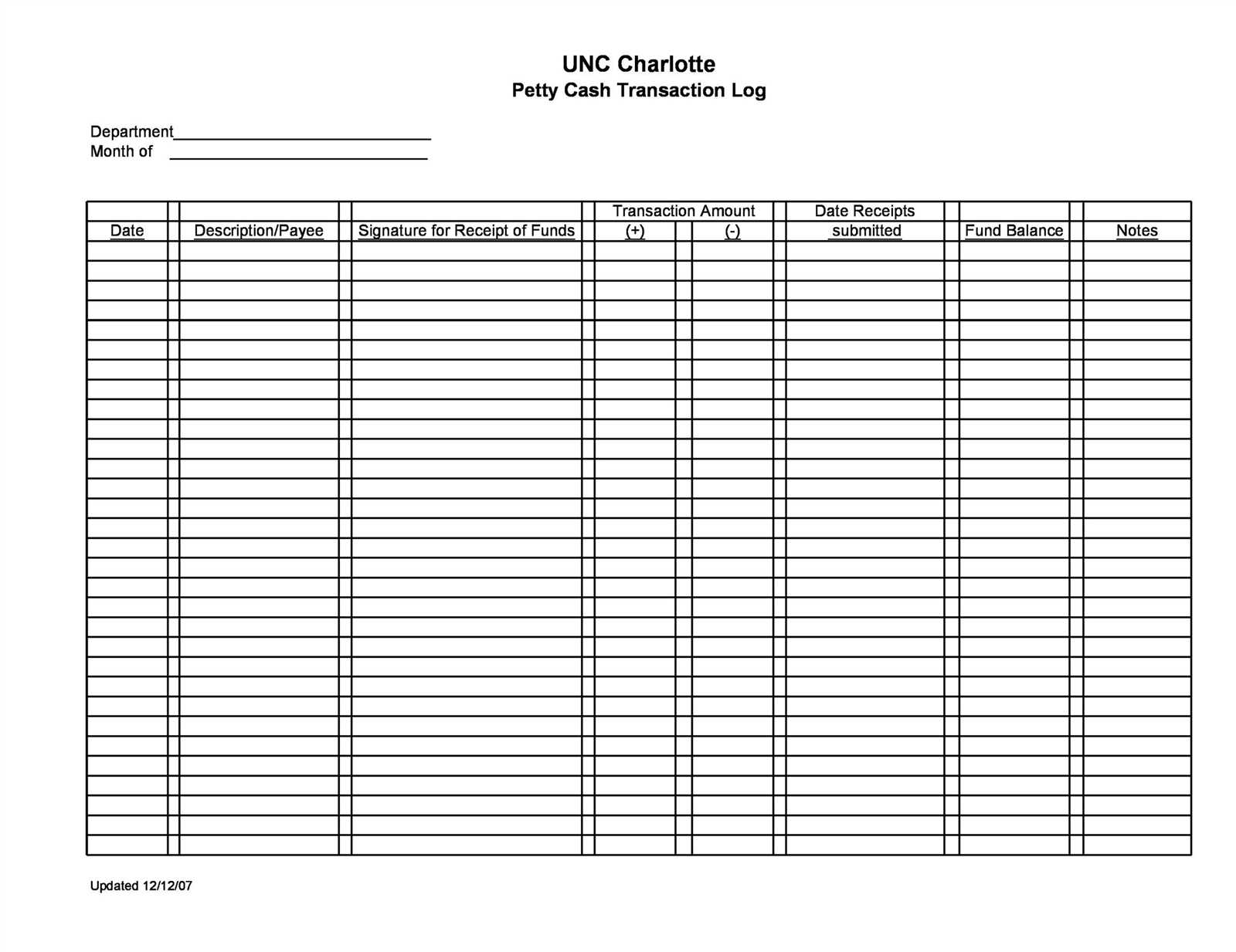

For a cash receipt log to be effective, it needs to be tailored to the business’s specific needs. The format should allow for easy tracking of transactions and quick access to details when needed. Consider a format that includes columns for the transaction date, receipt number, amount, and description of the transaction.

When deciding between paper or digital formats, prioritize accessibility and organization. Digital logs are easier to search and can be backed up to prevent data loss. If opting for a paper format, ensure the log is organized in chronological order and has space for all necessary details.

The layout of the log should also allow for clear categorization. For instance, separating transactions by type–such as cash, check, or card–can improve clarity and simplify tracking. Additionally, provide a column for signatures to confirm receipt of funds or goods, which can serve as a legal reference if needed.

| Field | Description |

|---|---|

| Date | The date the transaction occurred |

| Receipt Number | A unique identifier for each transaction |

| Amount | The total amount of the transaction |

| Transaction Type | Cash, check, or card |

| Description | A brief note explaining the nature of the transaction |

| Signature | For confirmation of receipt |

Choosing a format that can scale with the business is also key. If the volume of receipts increases over time, a more structured or automated system may become necessary. A digital template with predefined fields will make updating the format easier as business needs change.

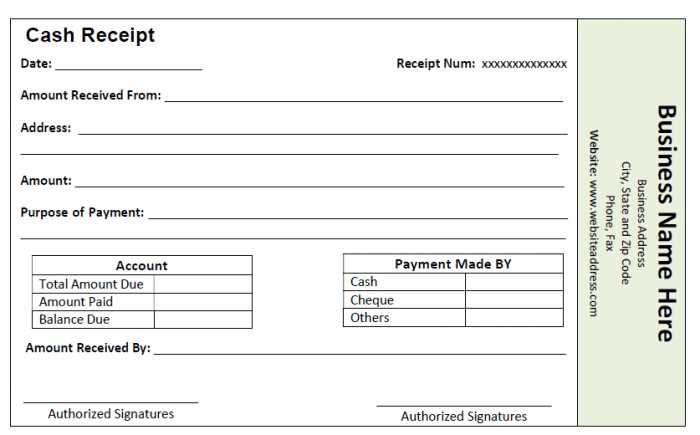

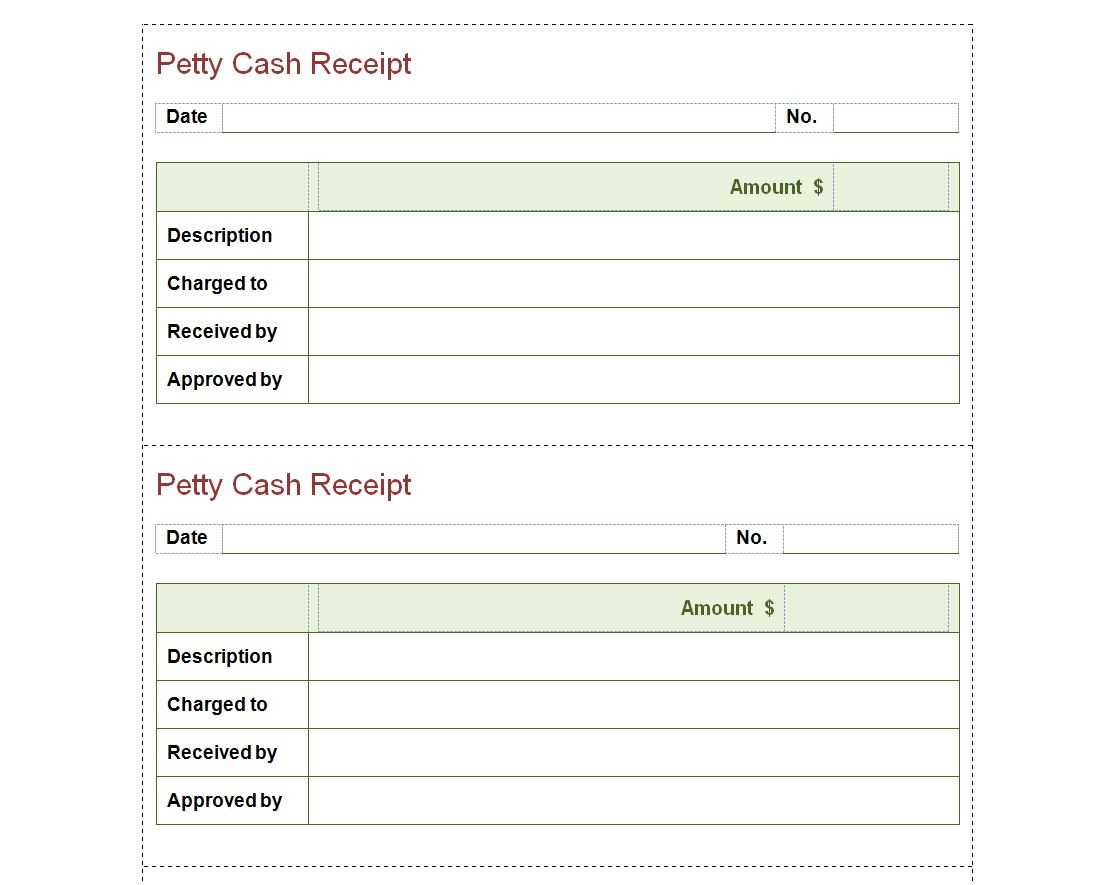

The cash receipt log should include key details that ensure accurate tracking and proper documentation. Each entry should have a unique identifier for easy reference. This can be a receipt number or a sequential transaction ID.

Record the date and time of the transaction to maintain an organized and clear timeline. Include the name or identifier of the customer or payer, as this helps to cross-check records in case of discrepancies.

Next, specify the amount of cash received. Be sure to indicate the payment method, whether it’s cash, check, or another form of payment. If applicable, record the purpose or description of the transaction for clarity.

Lastly, ensure the log captures the name or signature of the person receiving the payment. This step provides accountability and minimizes errors in the future. Make sure these entries are easily legible and organized in chronological order to streamline any audits or reviews.

Ensure all transactions are recorded immediately. Delays can lead to mistakes or omissions. As soon as a transaction is made, write it down or input it into your system.

Double-check each entry. Take the time to verify amounts, dates, and any additional details before finalizing the entry. This reduces the likelihood of errors slipping through.

Maintain consistency in formatting. Use a standardized template for all entries to make reviewing and reconciling the log easier. Consistency helps identify discrepancies faster.

Reconcile your log regularly with bank statements or receipts. A weekly or monthly reconciliation process helps catch any mistakes early, preventing issues from compounding.

Use clear and concise descriptions for each entry. Avoid vague terms or abbreviations that may be confusing later. This ensures that each entry is easily understood when reviewed.

Secure your log to prevent unauthorized access. Whether it’s a physical or digital log, make sure it’s protected by appropriate security measures to avoid tampering.

Involve multiple people in the verification process. Having someone else review your log periodically adds an extra layer of scrutiny, helping identify potential errors or inconsistencies.

Regularly back up your data. If you’re using digital logs, ensure that copies are stored in secure locations. Regular backups protect against data loss due to technical failures.

Train all relevant personnel. Make sure everyone involved in recording transactions understands the process and follows the same procedures for accuracy.

Stay organized. Group related entries together, and keep your log well-structured. An organized log makes it easier to spot mistakes and reduces confusion during reviews.

Organizing and Using a Cash Receipt Log Template

Maintain clear and accurate records by using a structured template for your cash receipts. Ensure the following details are included to capture essential transaction data:

- Date: Record the exact date of the transaction.

- Receipt Number: Assign a unique number to each receipt for easy reference and tracking.

- Amount: Clearly state the amount received, ensuring no discrepancies.

- Payment Method: Specify whether the payment was made in cash, check, or another form.

- Payer’s Name: Include the name of the person or business making the payment.

- Purpose of Payment: Note the reason for the payment, such as service or product purchased.

- Authorized Signatory: Have an authorized individual sign the receipt to confirm the transaction.

How to Use the Template

- Fill in each section clearly and accurately as payments are received.

- Review entries regularly for accuracy and completeness.

- Store completed logs securely for reference during audits or for tax purposes.