To manage cash transactions smoothly, using a cash receipt record template can significantly streamline your accounting. A well-structured template helps ensure that all payments are documented accurately, reducing the risk of errors and discrepancies in financial records.

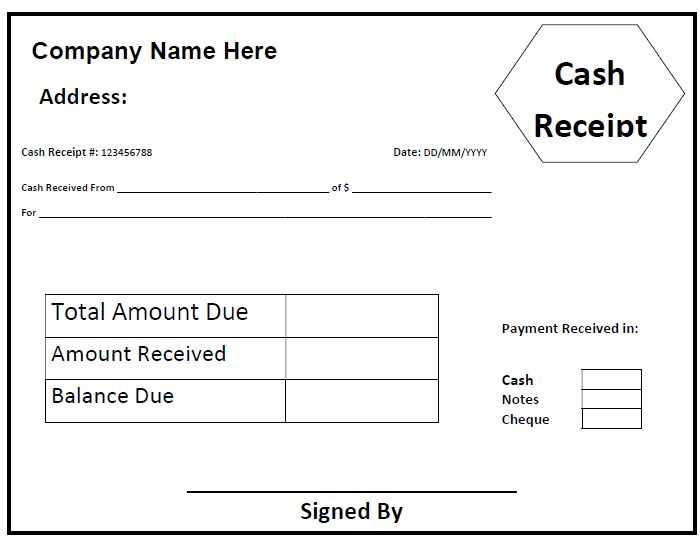

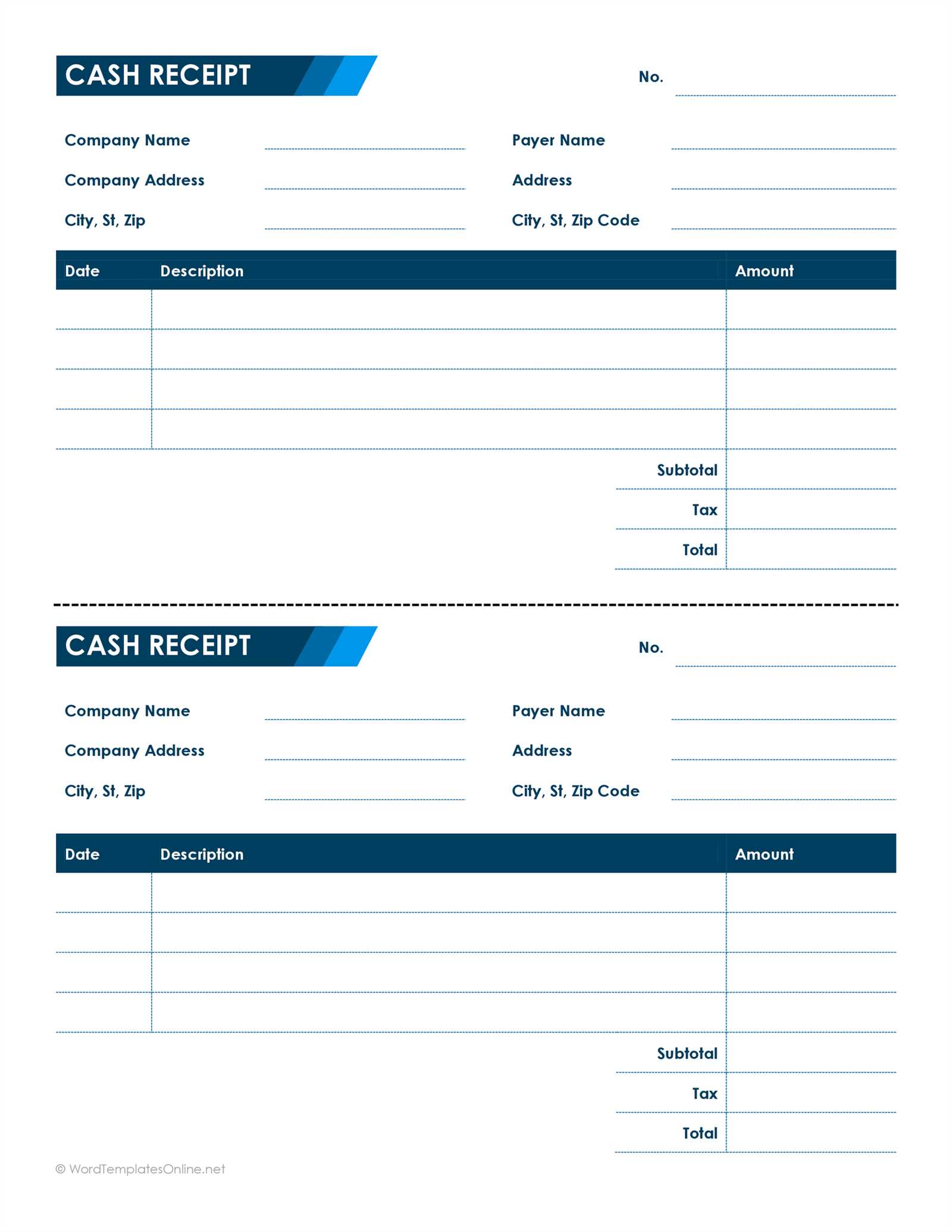

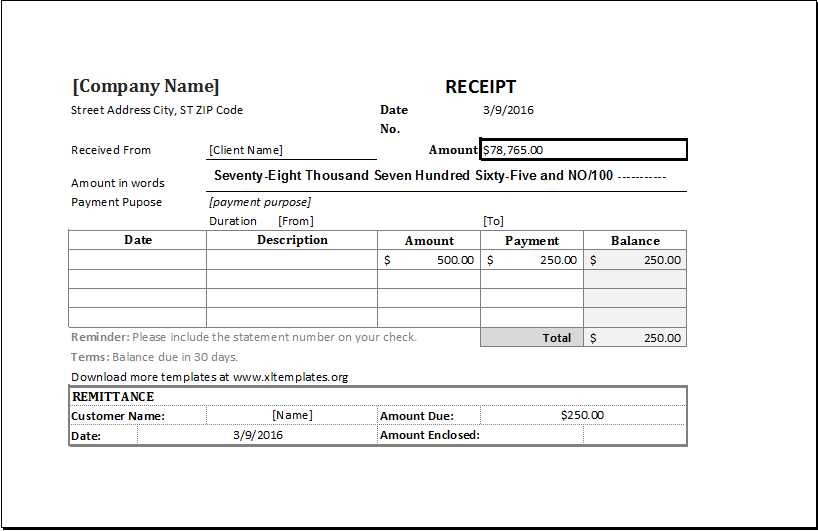

Start by including key details such as the date, payer’s name, payment amount, and the purpose of the transaction. This creates a clear, traceable record that can be easily referenced for future audits or reporting. Ensure that every entry is precise and consistent for better tracking.

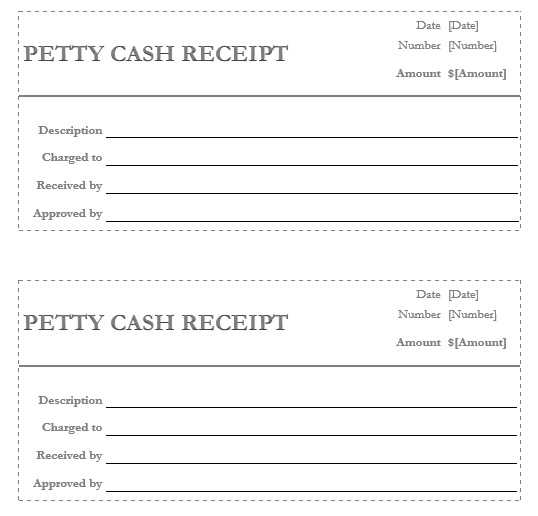

Don’t forget to provide space for signatures or initials, which adds an extra layer of verification. By doing so, you confirm the transaction’s authenticity and prevent potential fraud or misunderstandings. Keep the template simple, organized, and easy to update as needed.

Here is the revised text, where each word repeats no more than two to three times:

To maintain a clear and readable cash receipt record, avoid unnecessary repetition. Each entry should focus on the transaction details–such as amount, date, payer, and purpose–without overusing common terms. For example, instead of writing “payment received from John Doe on January 15th, payment received for services rendered,” simply note: “Received payment from John Doe, January 15th, for services.” This keeps the information precise and easily understandable.

Details to include:

In your template, list the payer’s name, the amount, the payment method, and the date clearly. Use consistent labels for these fields but do not repeat the same word unnecessarily. For example, avoid using “paid” multiple times in the same entry; once is enough to convey the transaction status. This maintains simplicity and clarity.

Final advice:

By keeping your entries concise and removing redundancies, you ensure the record is both functional and easy to follow. Always prioritize clarity over volume when designing your cash receipt record template.

- Cash Receipt Record Template

A well-structured cash receipt record helps maintain clear financial documentation. It ensures that every cash transaction is accurately recorded and provides an easy reference for reconciliation. Below is an example of a basic template designed for simplicity and usability.

| Date | Receipt Number | Received From | Amount | Payment Method | Description |

|---|---|---|---|---|---|

| 2025-02-10 | 00123 | John Doe | $500.00 | Cash | Payment for invoice #987 |

| 2025-02-11 | 00124 | Jane Smith | $200.00 | Check | Payment for consulting services |

Each transaction is captured with key details like the receipt number, payer’s name, amount, and method of payment. This ensures both clarity and accuracy when reviewing your cash receipts at a later time. You can easily adjust this template based on your specific business needs, adding additional columns as necessary, such as account codes or taxes, to track further details.

For best practices, always ensure that the receipt number is unique and that amounts are verified before being recorded. Store this information in an organized system for quick retrieval during audits or financial reporting.

Open a new Excel worksheet and set up the following columns: Date, Receipt Number, Payer, Amount, Payment Method, and Notes. These columns will help organize the receipt details. Format the “Amount” column as currency for easier tracking of values.

For the “Receipt Number” column, set up a sequential numbering system. You can do this by entering the first number, selecting the cell, and dragging the fill handle to auto-generate subsequent numbers.

In the “Payment Method” column, you can use drop-down lists for easy selection. Click on the column header, go to the “Data” tab, and select “Data Validation.” Choose “List” and input options like “Cash,” “Check,” and “Credit Card.” This ensures consistency in the data entry.

Add conditional formatting to highlight payment entries that are overdue or require special attention. Go to the “Home” tab, click on “Conditional Formatting,” and choose rules like “Cell Value” or “Text that Contains” for customization.

Finally, set up a simple total formula at the bottom of the “Amount” column. Use the SUM function to automatically calculate the total receipts entered in the sheet. This will make tracking your income effortless.

Every receipt record should contain specific fields that ensure clarity and accuracy. These fields provide crucial details for both the payer and the recipient, making it easier to track transactions. Below are the key elements to include in a receipt record:

| Field | Description |

|---|---|

| Date of Payment | Indicates the exact date the payment was made. This helps in organizing and cross-referencing transactions. |

| Receipt Number | A unique identifier for the receipt. It simplifies tracking and referencing specific transactions. |

| Amount Received | The total sum of money received. This should be clearly stated to avoid any ambiguity. |

| Payment Method | Specifies how the payment was made (e.g., cash, credit card, bank transfer). It adds context to the transaction record. |

| Payee Information | The name or business of the recipient of the payment. This is important for proper identification. |

| Payer Information | The name or business of the person making the payment. This field ensures accountability and transparency. |

| Description of Goods/Services | Details about what was paid for. This clarifies the purpose of the payment and can prevent misunderstandings. |

| Terms of Payment | Any conditions related to the payment, such as payment due dates or installments, should be outlined here. |

Including these fields ensures that both parties have the necessary information to track, verify, and reference a payment when needed.

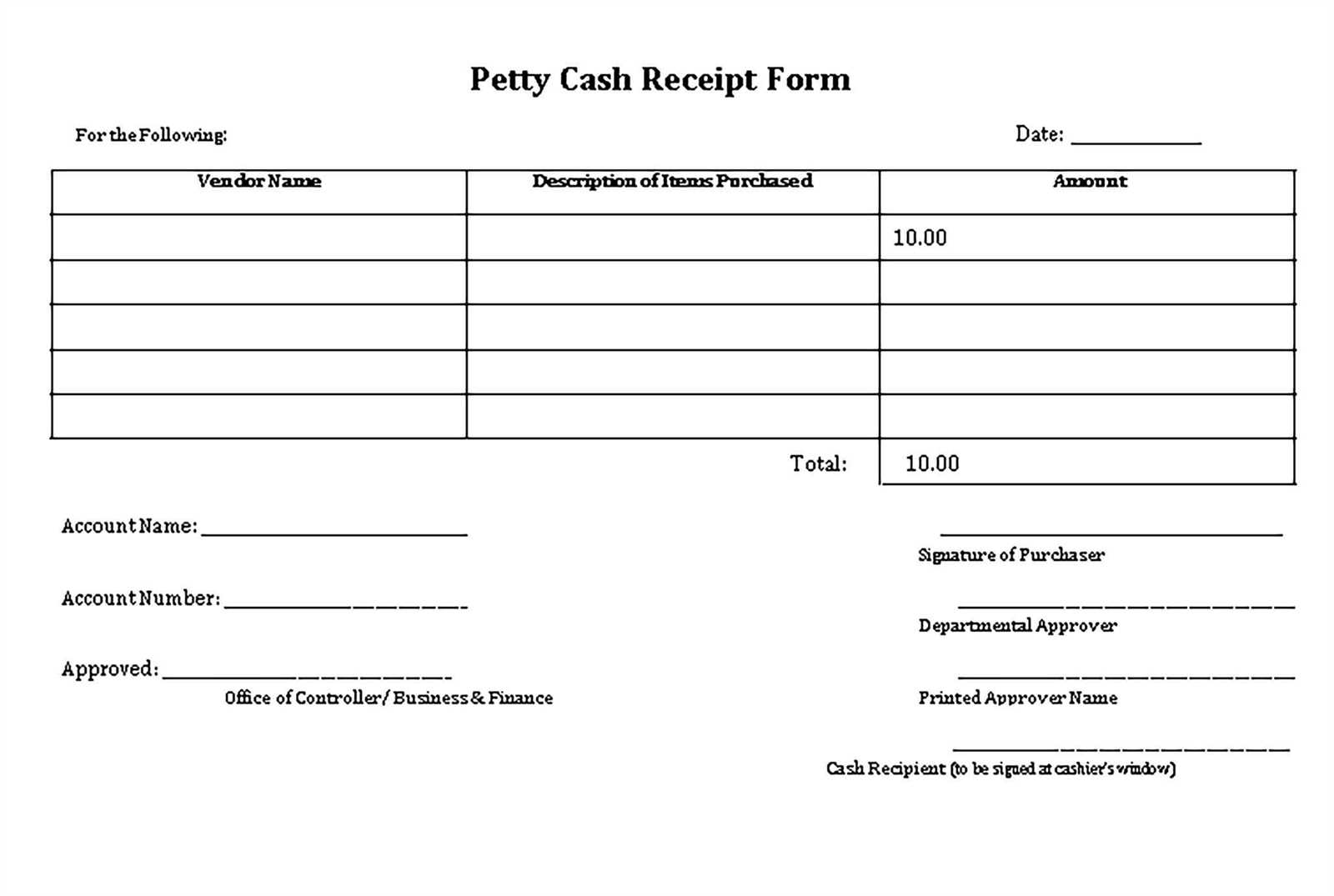

Track each payment by noting the exact amount and method of payment. Record the date, time, and any reference number related to the transaction. For cash payments, mark the amount clearly and keep track of change if any. For checks, include the check number and bank details.

Identify the source of each payment. This could be a customer, client, or another entity. Include the source’s name or business name, and consider adding a contact number or email for future reference.

If there are recurring payments, assign a unique identifier to each source. This helps streamline record-keeping and reduces the chance of errors over time.

For online payments, include the transaction ID or confirmation number. This will allow you to easily track and reconcile payments through your payment processor.

Lastly, categorize payments based on the type of service or product provided. This helps with budgeting and financial planning, ensuring you can see which areas generate the most revenue.

Ensure the date is always accurate. Incorrect or missing dates can cause confusion and may lead to issues in financial tracking. Double-check the day and month before finalizing the receipt.

- Missing Payment Information: Always include the full details of the transaction, such as payment method (cash, card, check) and the amount paid. Missing this information can create discrepancies later on.

- Inaccurate or Unclear Item Descriptions: Avoid vague descriptions. Each item or service listed should have a clear and concise name, along with the quantity and price. This helps avoid confusion for both parties.

- Not Including Taxes or Discounts: Clearly itemize any taxes, discounts, or additional charges applied. Failing to do this can lead to misunderstanding about the total amount owed or paid.

- Forgetting to Include Contact Information: Make sure to list your business or personal contact information, including an address, phone number, or email. This provides a point of contact for any potential follow-up.

- Using Outdated Templates: If you are using an old or non-customized template, it might not include recent legal requirements or new fields. Always ensure your template is up-to-date with local regulations.

- Not Storing Copies: Keep a record of every receipt issued. Having both digital and physical copies can prevent issues if a dispute arises or you need to reference the transaction in the future.

Set a schedule to update your cash receipt record at least once a week. Consistent updates prevent errors from piling up and help maintain accuracy in your financial data.

Review all entries to ensure completeness. Double-check each transaction for the correct amount, date, and source. If necessary, cross-reference with receipts and other supporting documents.

Implement a quick verification process. After every transaction, immediately enter the details into your record. This minimizes the chance of forgetting or misplacing important information.

Use automated tools or software where possible. Many accounting systems allow you to integrate receipts and bank transactions directly, reducing manual data entry and the risk of mistakes.

Conduct periodic audits of your records. At least once a month, review your cash receipt logs for inconsistencies or discrepancies. This helps identify issues early and ensures your books remain accurate.

Back up your records regularly. Store your data in both physical and digital formats to protect against loss. If you use a software system, make use of its backup options.

Stay disciplined about consistency. Whether it’s daily, weekly, or monthly updates, make it a habit that you stick to. This routine keeps your records organized and up to date.

Organize receipt records by category: sales, refunds, expenses, and taxes. This makes it easier to identify discrepancies during audits. For each receipt, ensure that the date, amount, and vendor details are clearly documented.

Regularly cross-check receipts against bank statements and accounting software. This helps detect any missing or duplicate transactions that could raise concerns during audits.

Store receipts securely, either digitally or physically, depending on the audit requirements. Digital records should be backed up and accessible in a format that is easy to review, such as PDFs or spreadsheet files.

Review receipts periodically to ensure compliance with internal accounting standards. Ensure that all receipts include the necessary details, like tax numbers, product descriptions, and payment methods.

Keep track of receipt totals by using automated tools or spreadsheet templates. Regularly compare these totals against your financial reports to spot any inconsistencies early.

When preparing for an audit, gather all receipt records from the period in question. Organize them in chronological order and group them according to transaction type. This will speed up the auditing process and reduce the chance of errors.

Consider implementing a receipt approval system to ensure that all records are verified before being filed. This adds an extra layer of accountability and minimizes the risk of overlooked discrepancies.

To create a clear and organized cash receipt record, follow these steps:

- List the date of the transaction for accurate tracking.

- Include the source of the payment, such as customer or payment method.

- Record the amount received, ensuring that it matches the payment.

- Note the purpose of the payment, whether it’s for goods, services, or other transactions.

- Provide any additional details, such as invoice numbers or reference codes, for further clarity.

- Ensure all entries are legible and concise, making it easy to understand the context of each receipt.

Keep the template simple and ensure it covers the necessary details. This will improve accuracy and make record-keeping easier over time.