For smooth financial transactions, always create a reliable cash receipt template. A clear and organized receipt helps both the payer and receiver keep accurate records. It should include essential details like the date, amount received, and the name of the payer, ensuring transparency and avoiding potential disputes.

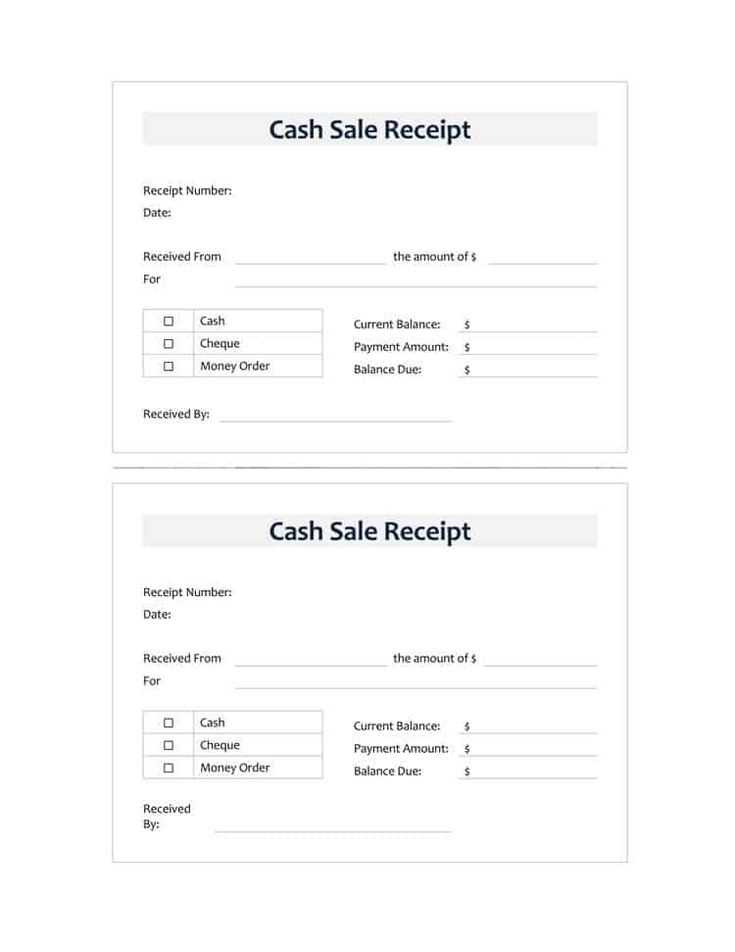

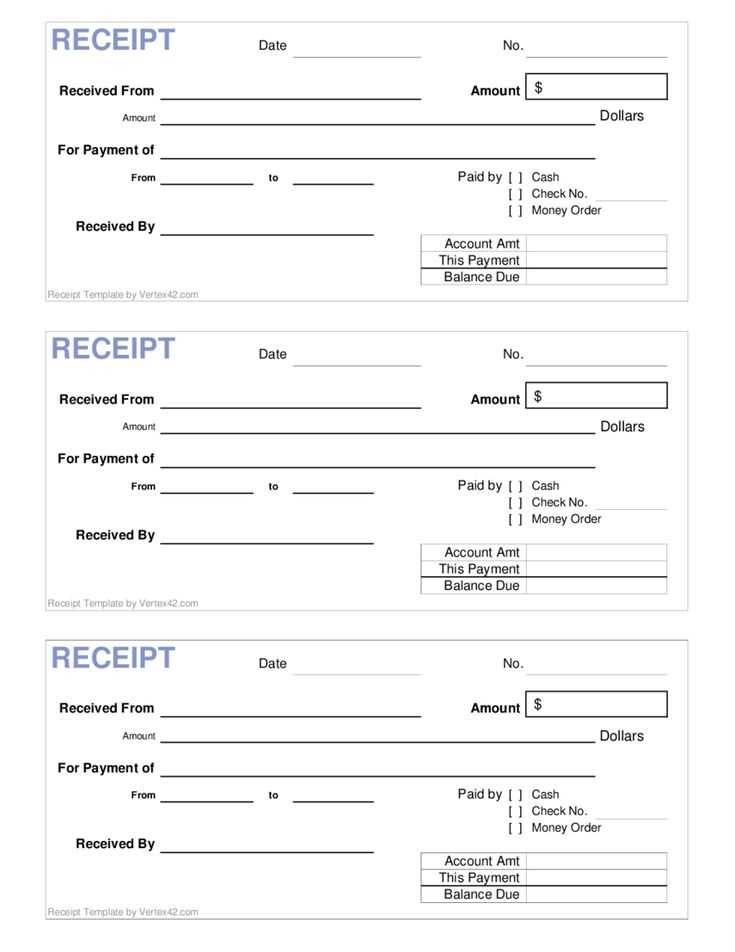

Include a unique receipt number for tracking purposes, making it easier to reference past transactions. List the method of payment clearly–whether it’s cash, check, or any other form. If applicable, mention the reason for the payment, such as a service provided or product purchased.

When designing the template, prioritize clarity. Use sections with bold headings for quick identification of key information. The receipt should be concise but detailed enough to meet any legal or financial requirements. Customize it based on the nature of your business or personal needs.

Save your template in a digital format to easily replicate it for future transactions. This way, you won’t have to start from scratch every time. Having a consistent format also strengthens your professional appearance and builds trust with clients or partners.

- Cash Receipt Template Overview

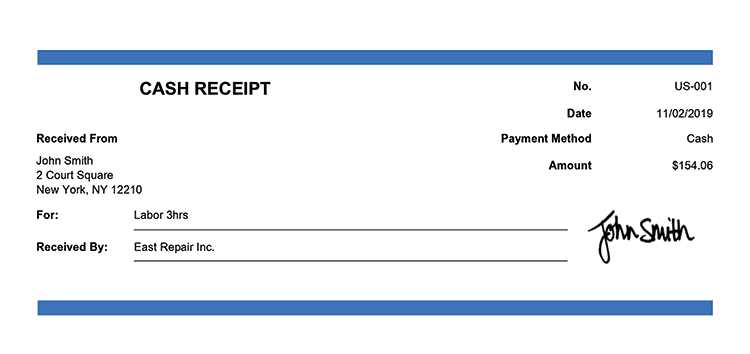

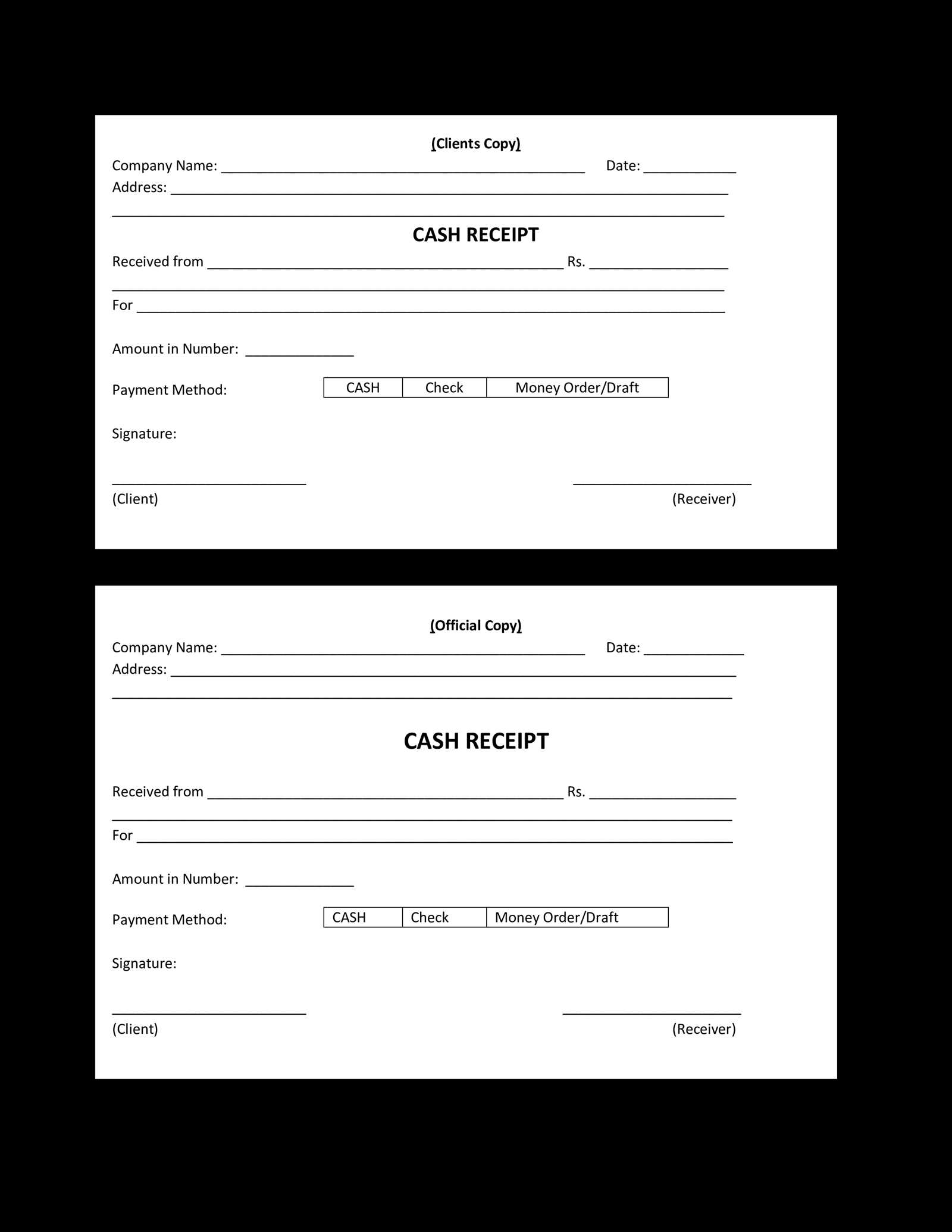

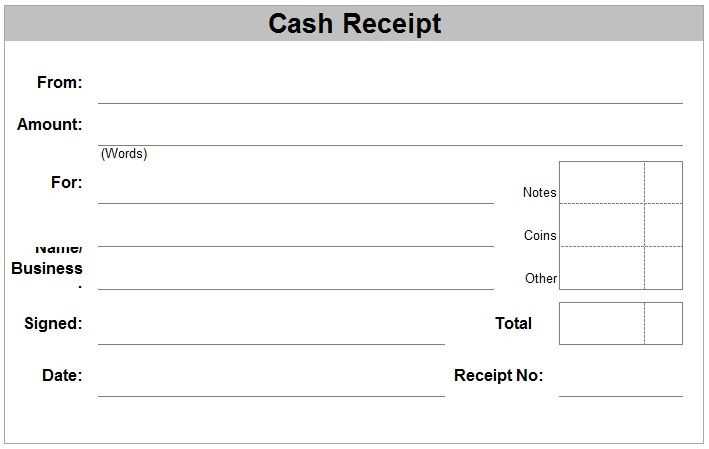

A cash receipt template is a practical tool for documenting cash transactions between a buyer and a seller. It ensures both parties have a record of the payment made, which is helpful for tracking finances and maintaining transparency. The template typically includes fields for the date, amount received, payer’s name, payment method, and the purpose of the transaction. This clear format helps avoid confusion and ensures that all important transaction details are recorded accurately.

To create an effective cash receipt template, focus on including essential details such as a unique receipt number for easy reference, and the signature of the person receiving the payment. This way, the document serves as proof for both parties involved. Having a standardized template allows for quicker processing of cash transactions and reduces the chance of errors or omissions. It’s advisable to use consistent formats across receipts to maintain uniformity in your financial records.

Begin by collecting the necessary details. A basic receipt includes the transaction date, the items or services purchased, and the total amount paid. It is important to clearly display these elements to ensure both parties are on the same page.

Step-by-Step Breakdown

- Transaction Date: Include the exact date when the payment was made. This serves as a reference for future inquiries or returns.

- Item List: Provide a clear description of each item or service. Include quantities, prices, and any discounts applied.

- Total Amount: Calculate the total after adding taxes or discounts. Display this figure prominently at the bottom of the receipt.

- Payment Method: Specify whether the payment was made by cash, card, or other methods. This can help avoid confusion later.

Formatting Tips

- Keep the layout simple and neat. Use a clear font and sufficient spacing to make the receipt easy to read.

- If possible, include a logo or company name at the top for branding purposes.

- Ensure the total amount is bolded or highlighted so it stands out.

A cash receipt should include the following key elements for clarity and accuracy:

- Receipt Number: Assign a unique identification number to each receipt to keep transactions organized and easily traceable.

- Date of Transaction: Clearly state the date when the payment was made to avoid any confusion in financial records.

- Received From: Include the name or business of the person or entity making the payment to confirm the source of funds.

- Amount Paid: Specify the exact amount of money received, including the currency type (e.g., USD, EUR) to prevent errors.

- Payment Method: Indicate how the payment was made, whether it was by cash, check, or credit card.

- Description of Transaction: Provide a brief explanation of the goods or services paid for to ensure transparency.

- Signature: Both the payer and the recipient should sign the receipt to verify the authenticity of the transaction.

By including these elements, you create a transparent record that can be easily referenced for future use or auditing.

Focus on including your business logo and name prominently at the top of the receipt. This creates a clear, professional brand identity. Choose a clean, readable font for the text, ensuring it is easy to read at a glance.

Incorporate transaction-specific details like the date, time, and payment method, so customers can quickly verify their purchase. If applicable, add the transaction ID or order number for easy tracking. You can also include a customer reference number for a more personalized touch.

Design the itemized list in a way that’s easy to follow, with clear labels for the product name, quantity, price, and any applicable taxes or discounts. Ensure the totals are displayed prominently, so customers can easily understand the final amount due.

Include payment terms and refund policies. Keep this section brief but clear, outlining how customers can resolve issues if necessary. Adding a return policy link or a brief note can prevent confusion down the line.

Lastly, don’t forget to make room for contact information like your website, customer service number, or email. A quick way for customers to reach you will build trust and transparency.

Double-check the details before finalizing any record. Verify the figures, dates, and descriptions to prevent errors that might cause confusion later. Use clear and consistent formatting to make the data easier to read and cross-check.

Incorporate clear labels and categories for each entry. This allows for quicker validation and ensures that nothing is overlooked. Always confirm the source of the data to guarantee its correctness.

Store records digitally, where feasible. This minimizes human error and facilitates quick searches or corrections if needed. Keep backups in case of any data loss or corruption.

| Record Type | Action | Verification Method |

|---|---|---|

| Invoice | Check payment amount | Compare with bank statement |

| Receipt | Confirm date and amount | Review the transaction log |

| Payments | Verify recipient details | Consult payment records |

Establish a routine for record reviews. Set periodic intervals to ensure no discrepancies have occurred, especially if your records are paper-based. Use a checklist for consistency and to reduce chances of oversight.

Always double-check the spelling of the customer’s name. A small typo can cause confusion and affect future transactions. Accuracy is key.

Ensure the date of the transaction is clearly visible and correct. Incorrect dates can lead to misunderstandings and accounting discrepancies.

Include a detailed description of the product or service provided. Vague terms like “miscellaneous” or “other items” don’t provide enough clarity for both the business and the customer.

Double-check the amount paid. If a mistake is made, it can cause disputes, delays, and unhappy customers.

Verify that tax rates are applied properly and in accordance with local regulations. Missing or incorrect tax details can create problems during audits.

Avoid using receipts that are too generic or lack any specific information about the transaction. Each receipt should be unique to the specific purchase to ensure proper tracking.

Use a consistent method for categorizing receipts to ensure smooth tracking and storage. Start by grouping them by type of expense, such as office supplies, travel, or meals. Keep digital copies of all receipts for easy access and reference. Utilize receipt-scanning apps or simple photo storage on your phone for easy digitalization.

Storing Receipts Physically

For paper receipts, use an organized filing system. Keep receipts in labeled folders based on categories. Use a filing cabinet with individual compartments to separate and easily locate receipts when needed.

Digital Storage and Backup

Digitize paper receipts immediately after receiving them. Use cloud storage for backup, ensuring the data is protected and easily accessible. Consider storing both the receipt image and any related transaction information in a folder for future reference.

Review receipts regularly to avoid missing any for tax purposes or audits. Set a schedule, such as once a month, to categorize and store all receipts, both physical and digital. By maintaining a regular routine, tracking becomes less time-consuming and more reliable.

Ensure you include clear sections in your cash receipt template for both the payer and recipient information. Start by creating spaces for the payer’s name, address, and contact details. The recipient’s information should be aligned below, capturing the business or individual’s name, address, and phone number.

Provide a dedicated field for the date of the transaction and the unique receipt number. These elements help track transactions efficiently. Following this, list the items or services provided, along with their prices, and include a subtotal section for easy calculation of the total amount due.

At the bottom, leave space for any applicable taxes or discounts. These should be calculated separately to avoid confusion. Finally, provide space for payment details, specifying the method of payment, such as cash, credit, or check.

Ensure the template is simple, with adequate spacing between sections to prevent clutter. Use readable fonts and keep the design minimal to emphasize clarity and usability.