Got it! If you need help with any technical topics, whether it’s in Finnish or English, feel free to ask. How can I assist you today?

It looks like you prefer writing articles in Finnish with specific HTML formatting. Do you have a specific topic in mind for an article or any content you need help with today? Let me know how I can assist!

- Cash Receipt Template in Australia: Practical Guide

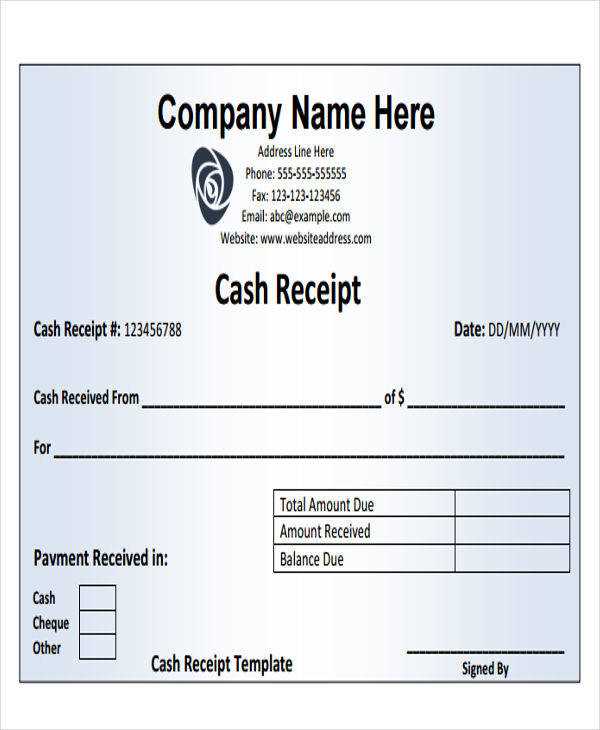

When creating a cash receipt template in Australia, make sure it includes all the necessary details for both the payer and payee. This helps in maintaining transparency and serves as proof of payment.

The template should include the following fields:

- Receipt Number: A unique identifier for each transaction.

- Date: The date the payment was received.

- Amount: The total amount of cash received, including the currency (AUD).

- Payee Name: The name of the business or individual receiving the payment.

- Payer Name: The name of the person or business making the payment.

- Description of Payment: A brief description of the purpose of the payment.

- Payment Method: Specify that the payment was made in cash.

- Signature: Both parties’ signatures to confirm the transaction.

It is also helpful to use a template that is easy to modify and ensures the legibility of all the necessary details. By keeping the information clear and organized, both parties can quickly reference the receipt when needed. Additionally, it is advisable to keep a digital record for your records, especially if you process payments regularly.

To create a simple receipt template for your small business in Australia, ensure it includes key details required by law. First, make sure to include your business name, address, and Australian Business Number (ABN). These elements identify your business and ensure compliance with Australian tax regulations.

Key Information to Include

Your receipt should clearly list the following components:

- Receipt Number: A unique identifier for each transaction.

- Date of Transaction: The exact date when the purchase or service was completed.

- Buyer Details: Include the buyer’s name and contact information if necessary, especially for large transactions.

- Description of Goods/Services: Provide a detailed breakdown of what was purchased, including quantities and unit prices.

- GST Information: For GST-registered businesses, show the amount of GST included in the total price.

- Total Amount Paid: The final amount paid, including GST if applicable.

Formatting Tips

Ensure your receipt is easy to read by using a clean layout. Include your logo if possible for a professional touch. Provide clear itemized lists for products or services and leave space for the total at the bottom. Make your receipt printer-friendly for convenience. If using an electronic format, consider offering a PDF version for customers.

Receipts in Australia must contain specific details to comply with legal and tax requirements. Here’s what you need to include:

- Business Name and Contact Details: The business name should be clearly stated, along with relevant contact details such as address or phone number.

- Australian Business Number (ABN): Businesses must include their ABN for tax identification purposes.

- Date of Transaction: Include the exact date the transaction took place.

- Item Description: Provide a brief description of the goods or services sold, including quantities and prices.

- Total Amount Paid: The total amount paid should be clearly indicated, with any applicable taxes (like GST) included or listed separately.

- Payment Method: Specify how the payment was made, whether it was by cash, card, or other methods.

- GST Information (if applicable): If GST is included, it must be itemized and clearly stated.

- Receipt Number: A unique number for tracking the transaction should be included to help with record-keeping and verification.

Including all of these details ensures that receipts comply with Australian law and are clear for both customers and businesses.

Using digital templates for cash receipts allows for faster, more accurate documentation of transactions. Start by selecting a template designed for your business type, such as an invoice template or a receipt template, ensuring it contains necessary fields like the transaction amount, date, and payment method.

Customize the Template

Tailor the template to reflect your branding by adding your business logo and contact details. This not only ensures consistency in your receipts but also maintains a professional appearance for customers. Customize fields to accommodate specific needs, such as discount codes or tax calculations.

Automate Data Entry

Many digital receipt templates integrate with accounting software, which reduces the chances of errors from manual data entry. By automating data entry, the system will pre-fill customer details, transaction amounts, and other variables, saving time and reducing the potential for mistakes.

| Field | Purpose |

|---|---|

| Transaction Amount | Shows the total amount paid by the customer |

| Date | Indicates when the transaction took place |

| Payment Method | Specifies the method used, such as cash or credit |

| Customer Information | Includes name and contact details, if required |

Integrating digital templates into your workflow minimizes errors and speeds up the entire transaction process, from creating receipts to managing financial records.

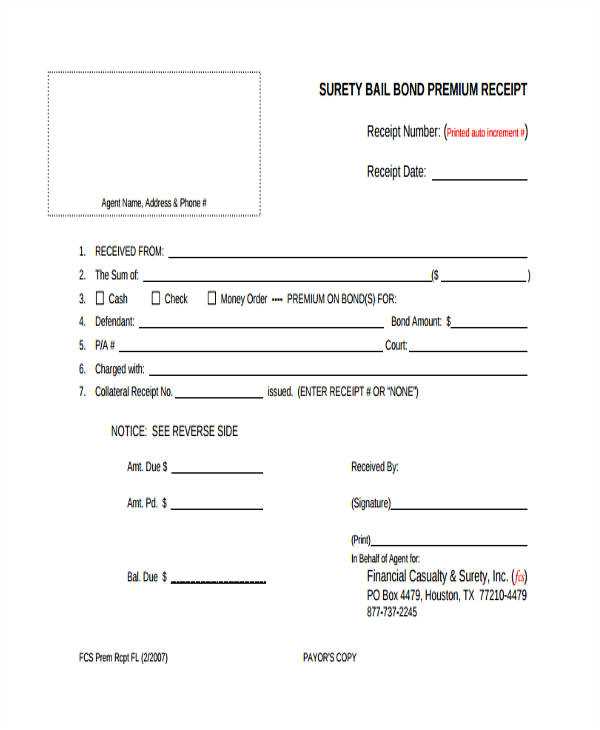

Ensure your cash receipt template includes a clear payment method section. Specify whether the payment was made in cash, by credit card, cheque, or other methods. This adds clarity and allows both parties to track the transaction history accurately.

Include a receipt number or code for easy reference. This unique identifier helps both the payer and the issuer locate the receipt in records. It also prevents any confusion or disputes regarding the transaction details in the future.

For businesses, display your ABN (Australian Business Number) clearly on the receipt. This confirms your legitimacy as a registered business and helps meet legal requirements. Additionally, ensure the payer’s information, such as their name and contact details, is correctly recorded for verification purposes.