To simplify the process of documenting cash transactions, a cash receipt template DOC can be incredibly useful. This template helps create a clear and professional record of payments, ensuring transparency for both parties involved. A well-structured receipt will detail the amount received, the date, and the purpose of the transaction, making it easier to track finances and avoid misunderstandings.

Using a cash receipt template DOC provides a consistent format for issuing receipts every time a payment is made. Customize the document to include relevant fields such as the payer’s name, the amount, and the method of payment. This not only improves organization but also saves time, as you don’t need to create a new receipt from scratch each time.

If you’re looking for a practical way to generate these receipts, search for a downloadable DOC template that suits your needs. Many free templates are available online, and they can be easily modified to fit the specific details of any cash transaction. This simple tool is an easy solution for small businesses, freelancers, or anyone who handles cash payments regularly.

Here is the revised version without word repetition while maintaining the meaning:

To create a clear and accurate cash receipt, ensure the following key components are included:

- Receipt Number: Assign a unique identifier for reference.

- Date: Indicate the transaction date.

- Received From: Specify the payer’s name or company.

- Amount: Clearly state the amount paid, including the currency.

- Payment Method: Include details such as cash, check, or card.

- Received By: State the name or position of the individual accepting the payment.

- Purpose of Payment: Briefly explain the reason for the transaction, such as for goods or services.

- Signature: If applicable, both parties should sign to confirm the transaction.

Ensure the receipt is legible, accurately formatted, and free from unnecessary repetition. Use a simple layout that makes it easy to track payments. Regularly update templates to align with any changes in your accounting practices or legal requirements.

- Cash Receipt Template Doc Guide

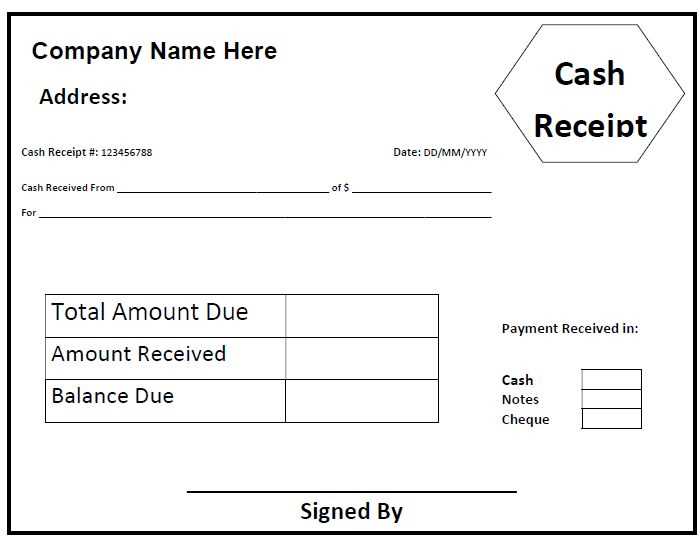

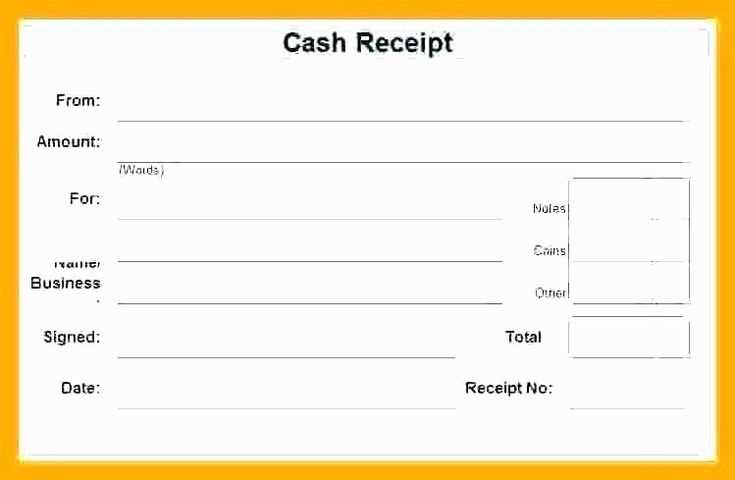

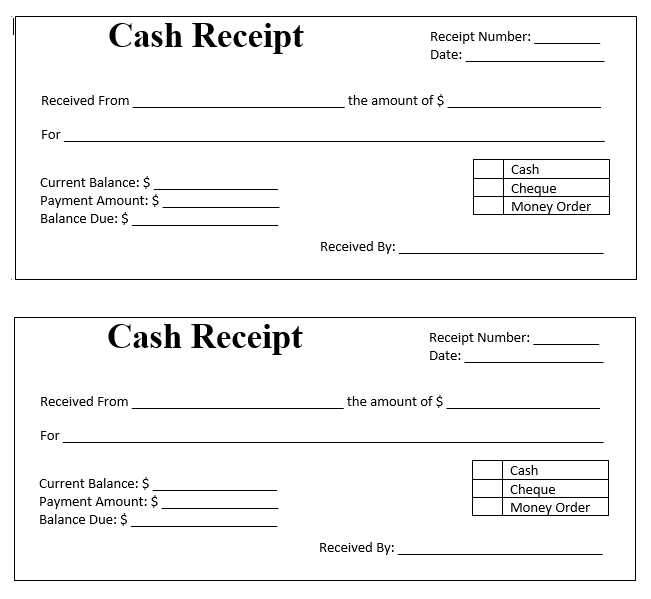

To create a clear and functional cash receipt, use a template designed to capture the most critical details in a concise format. A cash receipt document should include the payer’s information, the amount received, the payment method, and the date of the transaction. It is essential to ensure that the template is customizable for different transaction types while keeping the layout simple and professional.

Key Sections to Include

Start with the title of the document, such as “Cash Receipt” or “Receipt of Payment”. Under this, include the following fields:

- Receipt Number – A unique identifier for the transaction.

- Payer’s Name – The individual or entity making the payment.

- Payment Method – Specify whether the payment is made by cash, cheque, or card.

- Amount Received – The total sum received, often broken down into the principal amount and any taxes, fees, or discounts.

- Date – Date when the payment was made.

- Signature – Space for the recipient’s signature as proof of acknowledgment.

Formatting Tips

For a professional appearance, keep the template layout clean. Use lines or boxes to clearly separate sections, and ensure that the text is legible with appropriate spacing between fields. If needed, add a brief note at the bottom for terms or conditions relevant to the transaction. Remember, clarity and accuracy are key to preventing disputes and ensuring that both parties have a record of the transaction.

To create a simple receipt template in DOC format, follow these steps:

1. Open Microsoft Word or any compatible word processor that supports DOC format.

2. Set up the page layout. Choose a standard letter size (8.5 x 11 inches) and ensure the margins are set to 1 inch on all sides.

3. Insert the header. Include the business name, address, phone number, and email. This will serve as your company’s identifier on each receipt.

4. Add a title. Label the document “Receipt” in bold, large font at the top of the page to clearly identify the document type.

5. Create a table for the receipt details. The table should include the following columns: Date, Description, Quantity, Unit Price, and Total. These columns will help organize the transaction information.

| Date | Description | Quantity | Unit Price | Total |

|---|---|---|---|---|

| MM/DD/YYYY | Item Description | 1 | $10.00 | $10.00 |

6. Include a section for payment information. List the total amount paid, any taxes, and the payment method (e.g., cash, credit card).

7. Add a footer with additional information. This can include the return policy, website, or social media handles.

8. Save the file in DOC format. Go to “File,” select “Save As,” and choose DOC as the file type. This ensures the template can be easily reused for future receipts.

For cash payments, include a “Cash Received” section to specify the exact amount given by the customer. If any change is involved, add a “Change” field to clarify the amount returned.

For card payments, incorporate a “Payment Type” section where you can note whether the card is credit or debit. Additionally, add a “Transaction ID” for tracking and reference purposes.

For check payments, include a “Check Number” field and a “Bank Name” section. This ensures you capture all necessary details in case of follow-ups or issues.

For online payments, provide fields to indicate the “Payment Provider” (e.g., PayPal, Venmo) and “Transaction Reference.” This helps track the payment source and resolve any discrepancies quickly.

For mobile payments, create sections for the “Payment Method” (e.g., Apple Pay, Google Pay) and “Transaction ID” for easy tracking of mobile payment transactions.

Customizing your receipt template with these specific fields will help streamline your record-keeping and ensure accuracy for every payment type.

Include the following fields in your receipt template to capture all relevant transaction details:

Date and Time

Always add the date and time of the transaction. This helps track purchases and confirms when the exchange took place. Make sure the format is clear and easy to read, like “MM/DD/YYYY” and “HH:MM AM/PM”.

Transaction ID

Provide a unique transaction ID for each receipt. This allows customers or businesses to reference specific transactions, making tracking and follow-up simpler.

Buyer’s Information

Include the buyer’s name and contact details if applicable. This is helpful for returns, warranties, or any customer service follow-up.

Itemized List

List the items or services purchased, including quantity, description, and price per item. Ensure the total is clearly marked and includes any applicable taxes or discounts.

Payment Method

Indicate the payment method used, such as credit card, cash, or electronic payment. This confirms the transaction’s financial process and can be useful for future reference.

Merchant Details

Include the name, address, and contact information of the business or seller. This establishes legitimacy and provides a point of contact for any questions or issues.

To ensure legal compliance, include specific details in your cash receipt template. Always record the full name and address of the payer, along with the exact amount of cash received. Include the date and a description of the transaction to avoid misunderstandings. If applicable, note any taxes applied to the transaction.

Include Proper Documentation

Ensure that both parties involved in the transaction sign the receipt. This adds authenticity and serves as proof of payment. Retain a copy of the receipt for your records, as it may be required for auditing or tax purposes. If the receipt involves a significant amount, it’s advisable to keep additional documentation supporting the transaction, such as invoices or contracts.

Comply with Local Tax Laws

Make sure to adhere to local tax regulations when issuing cash receipts. This includes applying the correct tax rate and reflecting it on the receipt, where necessary. Businesses must file taxes accurately, and receipts can serve as evidence in case of an audit. For international transactions, include the appropriate currency exchange rates and indicate the currency used.

Make your receipts easy to read and understand by following these key formatting guidelines:

- Use Clear Fonts: Choose legible, simple fonts like Arial or Times New Roman. Avoid decorative fonts that can confuse the reader.

- Organize Information in Sections: Group related items together, such as business details, transaction details, and payment summary. This will help the reader quickly find important information.

- Use Bold and Italics Sparingly: Use bold for headers or key information, like the total amount, and italics for optional information like payment methods.

- Provide a Clean Layout: Ensure there is enough space between each section. Avoid clutter by limiting the number of words on each line and aligning text properly.

- Use a Consistent Date Format: Stick to one format, such as DD/MM/YYYY or MM/DD/YYYY, and use it throughout your receipts.

- Include Clear Itemization: For purchases, list each item with a description, quantity, unit price, and total cost. This makes it easy for customers to verify the transaction.

- Highlight the Total Amount: The total should stand out, either by using bold text or a larger font size to ensure it’s noticed immediately.

- Provide Contact Information: Include your company name, phone number, and email address at the top or bottom of the receipt for easy customer reference.

- Ensure Alignment: Align text neatly for a professional appearance. Consistent left, center, or right alignment can improve the overall readability.

- Include a Thank You Note: Adding a short note of appreciation at the bottom can leave a positive impression on the customer.

Additional Tips for Clarity

- Limit Colors: Stick to one or two colors to keep the design professional. Too many colors can make the receipt hard to read.

- Use Simple Borders or Lines: Light lines can be used to separate sections, but avoid heavy borders that can distract from the content.

Do not overlook mandatory fields: Missing essential information like the transaction date, item descriptions, or the total amount can create confusion. Always double-check that all required fields are properly filled in before issuing a receipt.

Incorrectly formatted amounts: Ensure that monetary values are accurate and consistently formatted. For example, always use the correct currency symbol and decimal places. A common mistake is to omit the decimal point or include an extra digit.

Skipping tax details: If tax is applicable, make sure to clearly separate the tax amount from the subtotal and indicate the tax rate. Failure to do so may lead to discrepancies in financial records.

Using unclear item descriptions: Provide precise and comprehensive descriptions for each item or service. Avoid vague terms that leave room for interpretation. This helps both parties understand the details of the transaction without confusion.

Incorrect receipt numbering: Always follow a consistent numbering sequence. Gaps in the numbering or duplicate numbers can create issues with record-keeping and tracking transactions.

Inconsistent branding or design: Maintain consistency in your receipt’s design. A poorly aligned logo or inconsistent font style can make receipts look unprofessional. Ensure your template matches your business’s branding standards.

Failure to include contact information: Always include your business name, address, phone number, and email. This information is crucial for customers who need to reach out regarding their purchase.

Create a clear and concise receipt template to avoid confusion. Structure it to include the following sections:

Recipient Information

Ensure the recipient’s name and contact details are clearly stated. This allows both parties to keep track of the transaction and contact each other if needed. Always check for accuracy before finalizing the document.

Transaction Details

List the date, amount, and description of the transaction. Specify whether the payment was made in cash or via another method. Including payment terms, if applicable, helps clarify expectations and reduces misunderstandings.

Signature Area

Provide space for both the payer and payee to sign, confirming the accuracy of the information. This adds a layer of formality and accountability to the receipt.