Use a cash receipt template to simplify the process of recording payments received in cash. By having a clear and organized document, you ensure all relevant details are captured, providing both the payer and payee with a transparent record. These templates are particularly useful for small businesses, freelancers, or any situation where cash transactions occur regularly.

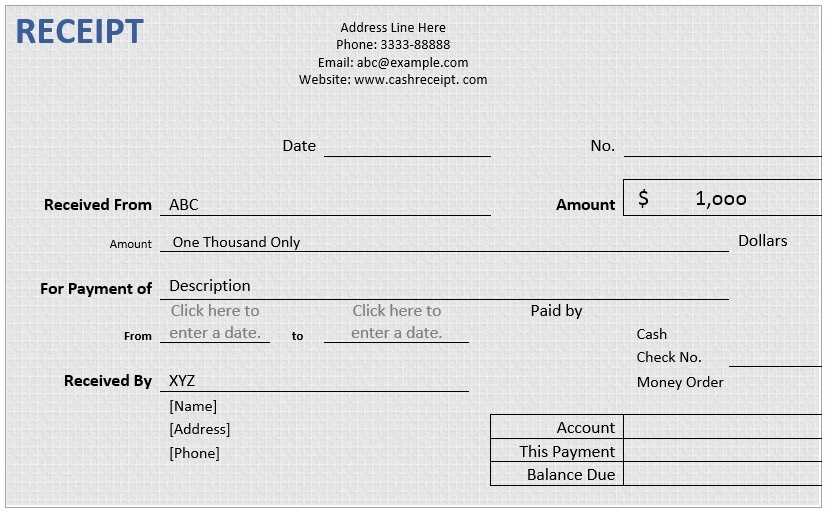

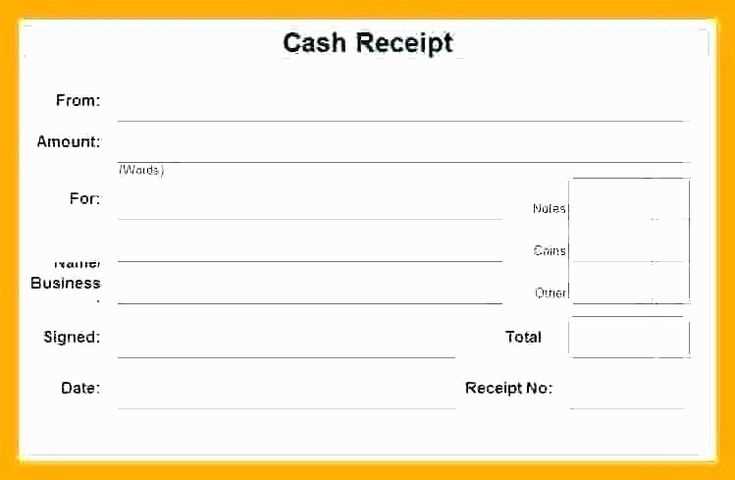

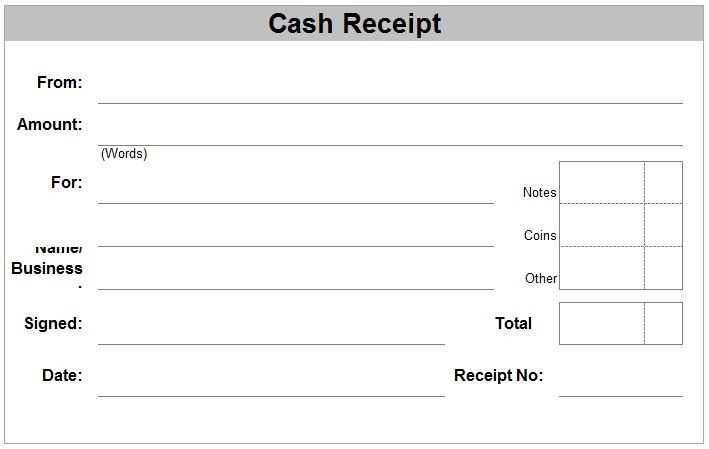

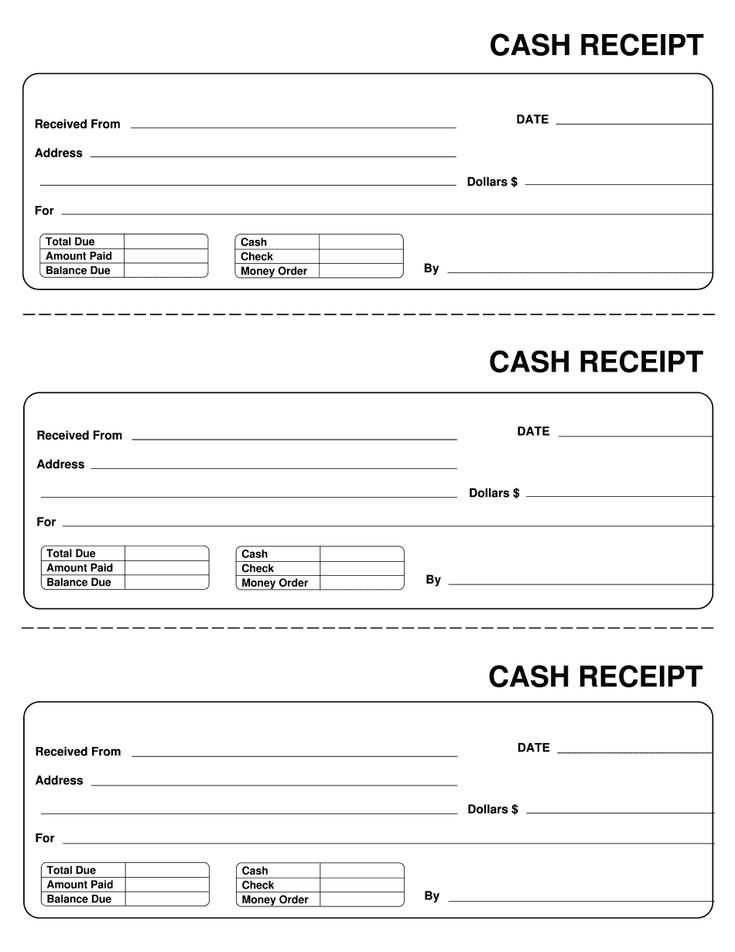

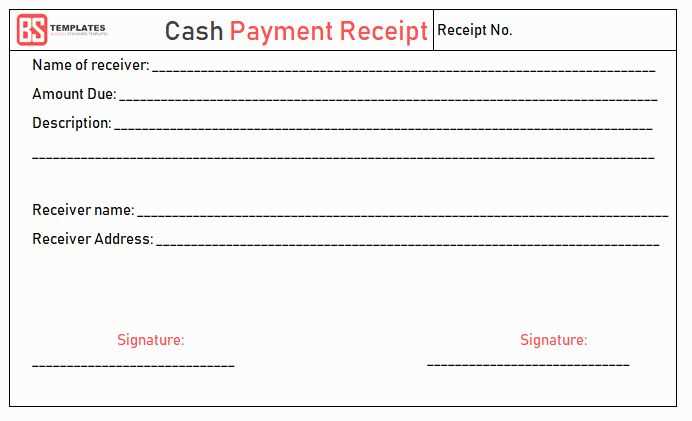

Ensure that your template includes key information such as the date of the transaction, the amount received, the purpose of the payment, and the signature of the recipient. A well-structured document helps avoid misunderstandings and provides proof of payment when needed. The format should be straightforward, with clearly labeled sections for each required detail.

By using a standardized cash receipt template, you reduce the risk of errors and maintain a consistent record of cash flow. A good template can save time, eliminate confusion, and keep your financial records organized for future reference. Always keep a copy of the receipt for your own records, and provide one to the payer for their assurance.

Here’s the corrected version:

Ensure all fields are filled out clearly and accurately. Start with the date of receipt at the top, followed by the buyer’s and seller’s details. These should include full names, addresses, and contact information. In the payment section, specify the amount received and the payment method used. Clearly mark whether the transaction was made in cash, by check, or via another method.

Details to Include

Provide a detailed description of the items or services for which the payment was made. This will prevent any confusion later on. If possible, list individual prices, quantities, and any applicable taxes or fees. Add any discounts if they were applied to the total amount due.

Additional Notes

Leave space for any special instructions or comments related to the transaction. If a receipt is issued for a deposit, clarify that in the notes section. Always include a unique receipt number for reference.

Finally, make sure to sign the receipt and provide a copy to the buyer. This helps ensure both parties have proof of the transaction for record-keeping.

- Cash Receipt Template Documents

When creating a cash receipt template, focus on clarity and accuracy. A well-structured document helps both parties verify payment details. Make sure to include key elements such as the date of transaction, the payer’s name, the amount received, the payment method, and a unique receipt number for record-keeping.

Key Sections of a Cash Receipt Template

Each receipt should have the following sections:

- Date: The exact date the payment was received.

- Payer’s Name: The full name or company name of the individual or entity making the payment.

- Amount Received: The total amount paid, preferably in both numerical and written form.

- Payment Method: Specify how the payment was made, whether in cash, check, or electronic transfer.

- Receipt Number: Assign a unique identifier to each receipt for easy reference.

- Description: A brief note on what the payment covers, such as goods or services provided.

Design Tips for Your Template

For ease of use, organize the template into clearly defined sections. Use bold headers for each category to make the document easy to scan. If the receipt is digital, consider adding fields that allow for automatic population of details like date and amount.

Begin by designing the structure of your receipt. Start with a clear header, including your business name, logo, and contact information. This makes it easy for customers to identify the source of the receipt. Position this information at the top, ensuring it’s easy to read.

Next, add a unique receipt number. This helps keep records organized and allows you to track transactions. You can implement a numbering system, such as starting from 001 and incrementing for each new receipt.

Include the date of the transaction. This can be done by automatically inserting the current date or leaving space for manual input. It’s helpful for both you and your customer to track the time of purchase.

List the products or services purchased, along with their quantities and prices. Ensure each item is clearly labeled with the total amount next to it. Include any applicable taxes or discounts to give a full breakdown of the transaction.

Provide a subtotal, followed by tax and the final total. This gives transparency and helps customers verify the details of the transaction easily.

Lastly, leave space for any additional notes or terms, such as refund policies or thank you messages. A receipt that conveys helpful information leaves a lasting positive impression on your customers.

To truly tailor cash receipt templates for your business, start by focusing on the fields that matter most for your transactions. These include customer details, items or services provided, payment method, and the total amount. Removing unnecessary fields or adding specific ones related to your industry can streamline the process and make receipts clearer.

Incorporating Branding Elements

Integrating your business logo, color scheme, and font style into your receipt template gives it a professional touch. This not only enhances the appearance but also strengthens brand recognition. Consider placing your logo at the top, followed by a clear breakdown of the transaction to keep it organized and easy to read.

Adjusting for Local Legal Requirements

Depending on your location, local regulations may require certain information to be present on cash receipts. Check if your template needs adjustments to include tax IDs, VAT numbers, or specific terms and conditions for compliance. Make sure to incorporate these elements without cluttering the document, keeping it simple yet professional.

Regularly reviewing and adjusting your template can save time, improve customer experience, and ensure that your receipts meet both internal standards and legal requirements.

A well-structured receipt template ensures clarity and helps maintain accurate records. To create a functional and professional receipt, focus on these key elements:

- Business Information: Include the name, address, phone number, and email of the business or seller. This provides a clear point of contact for the buyer.

- Receipt Number: Assign a unique receipt number for easy reference. This helps both parties track and organize transactions.

- Transaction Date: Always include the exact date of the transaction. This is crucial for bookkeeping and customer verification.

- Buyer Details: If applicable, include the buyer’s name and contact details. This may not be necessary for all transactions, but it’s helpful for record-keeping.

- Itemized List: Clearly list the items or services purchased, including quantity, price, and any applicable taxes. This breakdown prevents confusion and aids in returns or refunds.

- Payment Method: Specify how the payment was made (e.g., cash, credit card, bank transfer). This clarifies the transaction for both parties.

- Total Amount: Indicate the total amount paid, including all taxes and additional fees. Make sure the number is clear and easy to read.

Optional Elements:

- Discounts or Coupons: If any discounts or promotions were applied, list them separately to show the original price vs. the discounted amount.

- Sales Tax Information: Clearly break down the sales tax if applicable, listing the rate and total tax amount.

- Notes or Terms: If needed, add any special notes regarding the transaction, such as return policies or warranty information.

Including these elements ensures your receipt is complete and transparent, promoting trust between the seller and buyer.

Digital templates make creating cash receipt documents faster and more consistent. They help eliminate the risk of manual errors and reduce the time spent formatting each document. Templates can be reused, which saves time and effort, and they allow for easy storage and retrieval of records. However, they come with a few disadvantages.

| Pros | Cons |

|---|---|

| Faster document creation | Limited customization options |

| Reduced human error | Requires access to compatible software |

| Easy to store and retrieve documents | Technical issues may disrupt workflow |

Despite the limitations, digital templates can be highly efficient, particularly when consistency and speed are important. They might not fit every situation, but for routine tasks, they offer a great solution. Always assess your needs to determine whether digital templates provide the right balance of convenience and flexibility for your business.

Receipts must contain accurate and clear information to meet legal requirements. Ensure they reflect the date, transaction amount, payment method, and details of the goods or services exchanged. Inaccurate receipts can lead to disputes or legal penalties.

Accuracy and Transparency

Each receipt should clearly show the correct total amount, including taxes if applicable. Mistakes or omissions can cause confusion and may result in fines from tax authorities. It’s also necessary to ensure that both the business and customer details are correct to avoid legal claims later on.

Record Keeping

Businesses are required to keep receipts for a specific period. Depending on your jurisdiction, this period may range from a few years to a decade. Failing to retain these records can complicate audits or legal disputes. Store both paper and electronic receipts securely to comply with applicable tax regulations.

Link your receipt templates directly to your accounting software. Ensure compatibility by selecting a template format that integrates easily with your system, such as CSV, Excel, or PDF. Many accounting platforms, like QuickBooks or Xero, allow you to import templates with preset fields that auto-fill accounting details like transaction amounts, tax calculations, and client information.

Next, automate template population by mapping necessary fields. For instance, set up automatic inputs for invoice numbers, payment methods, or client names. This reduces manual data entry, minimizes errors, and ensures consistency across all receipts.

To keep your templates accurate and up-to-date, integrate them with your accounting system’s reporting tools. By linking receipt data to sales reports, balance sheets, or tax summaries, you can create a seamless flow of information that reflects every transaction automatically.

If your system supports it, consider adding custom fields tailored to your specific accounting needs, like discounts or shipping costs. Customize your template layout to match the reporting style of your business. This not only streamlines operations but also improves the clarity of your financial data.

Regularly back up your templates and accounting data. Cloud-based systems often provide automated backups, but it’s always a good practice to verify this feature is enabled to avoid any disruptions in your accounting process.

Ensure clarity by organizing each cash receipt with a clearly defined structure. Begin with the date and time of the transaction, followed by the details of both parties involved. This helps in easy identification of the transaction details later.

- Include the name of the payer and recipient.

- Specify the payment method used (cash, check, credit card, etc.).

- State the total amount received and the breakdown, if applicable (taxes, discounts, etc.).

- Provide a unique reference or receipt number to distinguish each receipt.

- Ensure space for both signatures, confirming the transaction was completed.

For a clean, professional look, keep the formatting simple and readable. Use a clear font, and avoid unnecessary colors or complex layouts. This helps keep the focus on the transaction details.

Lastly, store and back up the receipts digitally or in physical form for future reference, ensuring proper organization for tax purposes or any dispute resolution.