For businesses in South Africa, using a reliable cash receipt template in Excel simplifies financial record-keeping. This template is designed to accurately document all transactions, making it easy to track payments received. Whether you’re dealing with cash, bank deposits, or card payments, the template provides an organized way to store all transaction details.

Start by filling in basic details such as the date of the transaction, the amount received, and the payer’s name. Additionally, specify the payment method to avoid confusion later. This template also helps you record the purpose of the payment, which can be helpful during tax filing or financial reporting.

Consider customising the template to suit your business needs. You may want to add columns for specific items sold or services rendered. This way, you can break down your receipts by category, providing more granular insight into your business’s financial health.

Here is the corrected version:

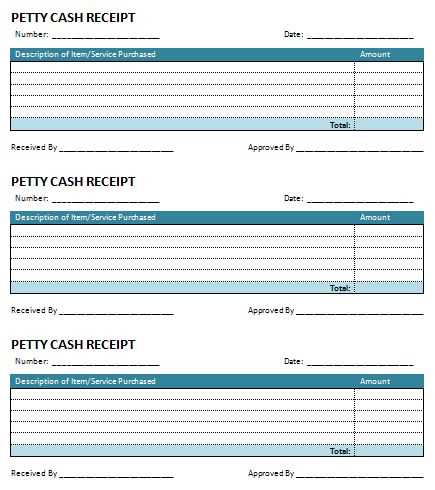

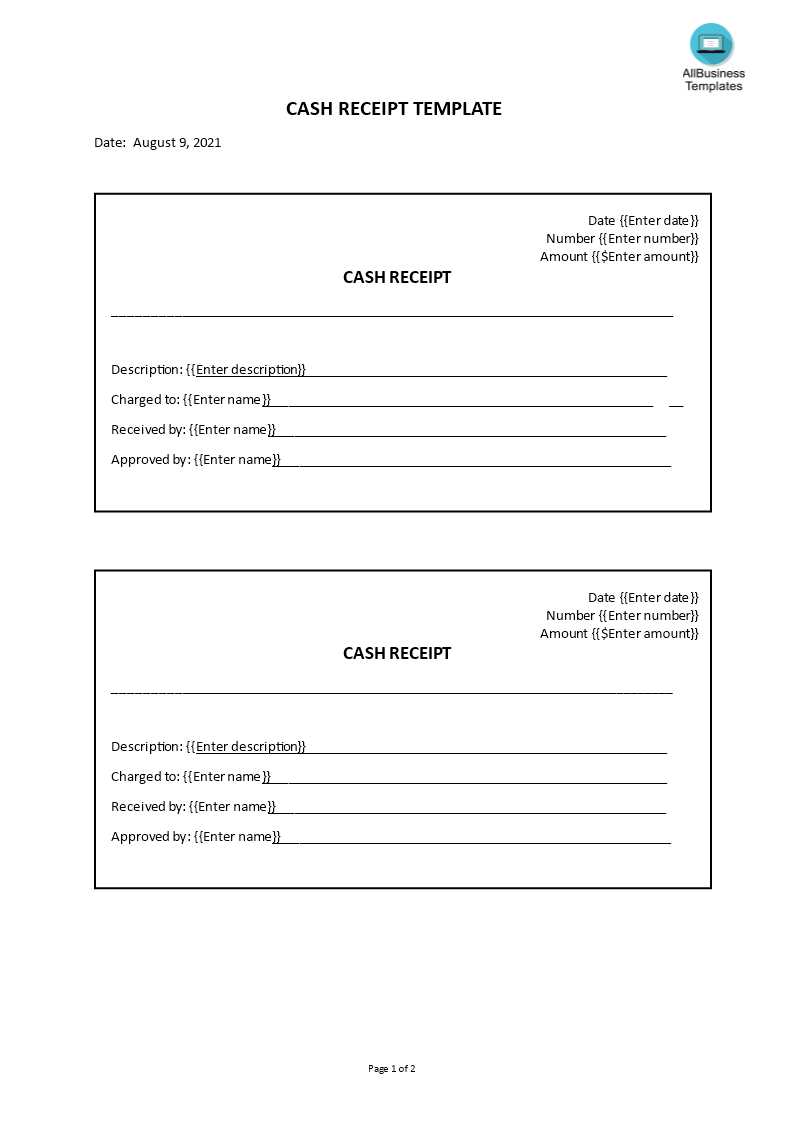

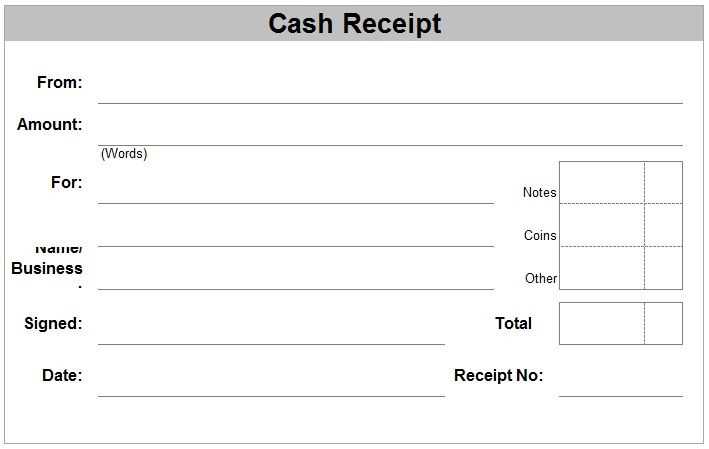

To create a cash receipt template for South Africa, ensure your design includes essential fields like transaction date, payer details, amount received, and payment method. Make sure that the document complies with local tax regulations, including a space for VAT or tax numbers if applicable. Include a unique receipt number for tracking and an area for both the payer and receiver’s signatures. Organize the layout to highlight important details clearly. For consistency, use standard font sizes and avoid unnecessary decorations. A simple, well-structured table format can help maintain clarity and readability.

- Cash Receipt Template Excel South Africa

For creating a cash receipt template in Excel specifically for South Africa, it’s vital to include key elements tailored to local business practices. Begin with a clear header indicating “Cash Receipt” or “Receipt of Payment” to avoid confusion. Follow with the date, which should be formatted to the South African standard (DD/MM/YYYY), ensuring clarity for both parties.

Next, include fields for the payer’s details, such as name and contact information. It’s important to list the amount received in South African Rand (ZAR), and be sure to clearly specify whether the payment is for goods, services, or another purpose. Add a space for the method of payment (e.g., cash, EFT, credit card), as this will help clarify the transaction.

A section for a brief description or invoice number may also be helpful for tracking purposes, especially in the case of multiple payments. At the bottom, leave space for signatures from both the payer and the receiver. This provides an additional layer of documentation and accountability, which is common practice in South African transactions.

Lastly, ensure that the layout is neat and organized, making it easy for anyone to fill out the necessary fields. Use simple formulas to calculate totals if applicable, and consider adding a reference column for easier future tracking.

Adjust the existing template by first replacing the default information with your business name, address, and contact details. Create a column for the receipt number and use Excel’s auto-numbering feature to generate unique identifiers automatically for each new entry.

Next, modify the payment method section. Include options like cash, credit card, or bank transfer. You can use drop-down lists to simplify data entry and prevent errors. For better organization, format each row to automatically update the total amount based on the values entered in the quantity and unit price columns.

To add more flexibility, customize the date field to automatically display the current date using Excel’s TODAY function. This will save time and reduce errors when issuing receipts. Additionally, if you require VAT calculations, add a VAT column and set up a formula to calculate the tax based on the subtotal of each receipt.

Make sure to use conditional formatting to highlight important information, such as overdue payments or incomplete entries. This ensures that the data stands out for quick review. Lastly, create a separate summary sheet within the same workbook to track total sales, taxes, and payments received over a set period, using Excel’s SUM and SUMIF functions for easy analysis.

To ensure a well-organized and legally sound cash receipt, make sure to include the following features:

1. Transaction Details: Clearly specify the date, amount received, and the payment method (cash, card, etc.). Include any relevant reference numbers that link to the transaction for easy tracking.

2. Vendor Information: Include the name, address, and contact details of the business or individual issuing the receipt. This helps establish legitimacy and makes future inquiries smoother.

3. Recipient Information: Specify the name of the individual or business receiving the payment. This ensures there is no ambiguity in identifying the transaction parties.

4. Description of Goods or Services: Provide a clear breakdown of what was purchased or serviced. This may include the quantity, price per unit, and total cost, which can be essential for accounting purposes.

5. VAT Details: In South Africa, include the VAT (Value Added Tax) amount or percentage where applicable. This is especially important for businesses registered for VAT. Include the VAT number if necessary.

6. Signature Field: Adding a space for both parties to sign adds an element of security and mutual agreement to the transaction. It can be vital for resolving disputes later.

7. Unique Receipt Number: A distinct receipt number for each transaction can help track and reference receipts, especially when managing multiple payments over time.

8. Terms and Conditions: If applicable, include any relevant terms, return policies, or warranties related to the transaction. This sets clear expectations for both parties involved.

One common mistake is failing to double-check the details in the template. Ensure the date, amount, and description match the transaction precisely. Mistakes in these details can cause confusion and lead to errors in financial reporting.

Another mistake is using generic templates without customizing them to fit local requirements. South African businesses must include certain information like tax details or VAT numbers, which might not be present in basic templates.

- Not including clear payment terms, such as whether the payment is full or partial, can cause miscommunication between parties.

- Leaving out customer information like their name or contact details is another issue. Always include enough identifiers to ensure clarity on both sides.

Don’t overlook the importance of updating your template periodically. Financial regulations and tax laws may change, and using outdated templates can lead to compliance issues.

- Ensure that the payment method (cash, card, or bank transfer) is clearly stated in the template.

- Not saving backup copies of filled templates for future reference may cause trouble if you need to verify a transaction later.

Lastly, always review the template for errors before using it. A poorly formatted or inaccurate receipt can damage your professional reputation and lead to disputes.

To create a cash receipt template in Excel for South Africa, ensure that it includes all necessary details such as the date, receipt number, business name, buyer information, and a description of the goods or services provided. You can use simple formulas for calculations such as subtotal, VAT, and total amounts. Make sure to add a payment method section to indicate whether the payment was made via cash, bank transfer, or another method.

Key Components of a Cash Receipt

Each receipt should have the following columns:

- Receipt Number

- Issue Date

- Buyer Information (Name, Address, Contact)

- Item Description

- Quantity and Price

- Subtotal

- VAT (if applicable)

- Total Amount

- Payment Method

Excel Formatting Tips

Use cell formatting to make the template clean and easy to read. Use bold headers, align text properly, and apply borders to distinguish sections. Incorporating a drop-down list for the payment method can speed up data entry and minimize errors. Ensure the formulas for VAT calculation are correct, and verify that totals update automatically when data changes.