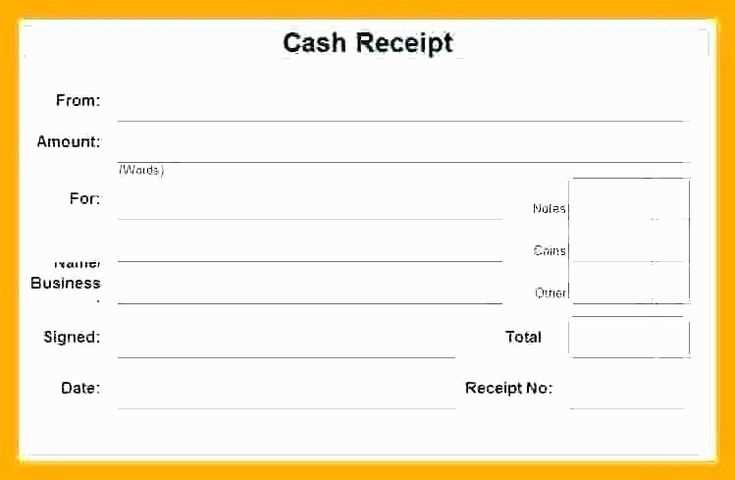

For creating a seamless and professional cash receipt for your website or business, it’s key to focus on clarity and functionality. A cash receipt template should contain the necessary fields, such as the amount paid, date, payer details, and a clear breakdown of the transaction. Ensure these elements are easy to read and logically arranged.

Start by including the payer’s name, address, and contact information in the top section, followed by the payment details like the transaction date, amount received, and method of payment. Make sure to include a unique receipt number for better tracking and organization.

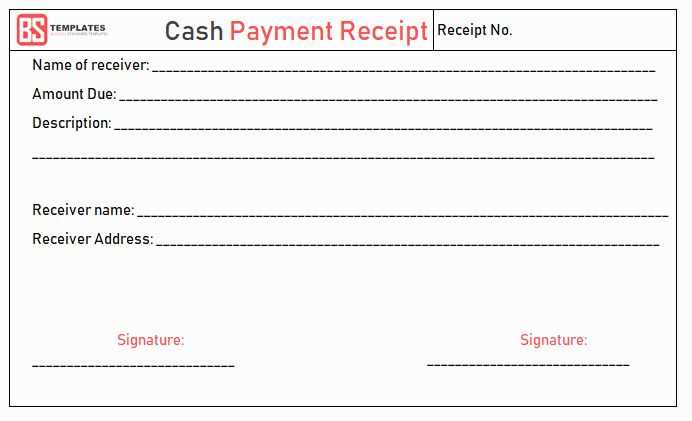

Additionally, include a section for both the payer’s and receiver’s signatures, confirming the completion of the transaction. Using a consistent design helps users understand the document’s structure and quickly locate important details, making it easier for both parties to keep records.

A well-designed template can also offer flexibility, allowing customization based on specific needs, whether for e-commerce transactions, service payments, or donations. With a straightforward format, both the sender and receiver will benefit from efficient transaction documentation.

Here are the corrected lines:

Ensure that all monetary values are formatted correctly. This includes placing the currency symbol before the amount, followed by the amount with no spaces. For example, use “$50” instead of “50$”.

Formatting Dates Properly

Use a consistent date format throughout the receipt. For example, “MM/DD/YYYY” should be used instead of any other date styles. This makes it easier for users to understand the receipt at a glance.

Including Clear Payment Methods

Clearly indicate the method of payment, such as “Paid by Credit Card” or “Cash Payment”. This eliminates any confusion regarding the payment type.

- Cash Receipt Template for Pages

A cash receipt template helps streamline transaction documentation for businesses and individuals. Use this template to ensure all necessary details are recorded, making the process efficient and error-free. Below is a simple format that includes key fields for tracking payments received in cash.

Key Elements to Include in the Template

Each cash receipt should include the following information:

- Date: When the payment was made.

- Receipt Number: A unique identifier for the transaction.

- Payer’s Name: Who made the payment.

- Amount Received: Exact cash amount paid.

- Payment Method: Specify if it’s strictly cash or other forms combined.

- Purpose of Payment: What the payment was for (e.g., services rendered, goods purchased).

- Issued By: Name or title of the person who issued the receipt.

- Signature: Optional, but it provides authenticity.

Template Format

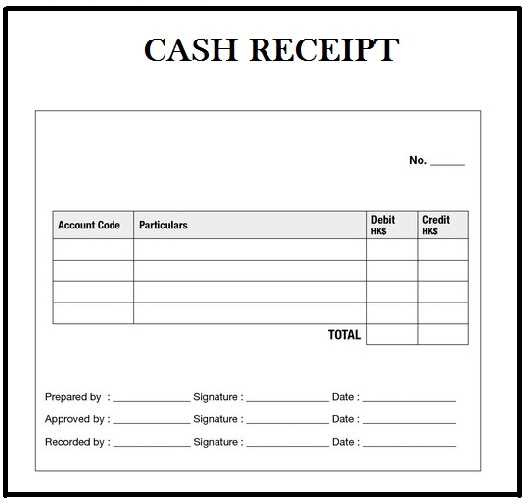

Here is a basic cash receipt template in table format for ease of use:

| Receipt Number | Date | Payer’s Name | Amount Received | Payment Method | Purpose | Issued By | Signature |

|---|---|---|---|---|---|---|---|

| #001 | 2025-02-05 | John Doe | $100.00 | Cash | Consulting Fee | Jane Smith | J. Smith |

Ensure that this format is consistent across all your receipts for better tracking and clarity. Having a clear, easy-to-follow template reduces the risk of confusion and mismanagement of funds.

Selecting the correct format for your receipt template simplifies record-keeping and improves customer experience. Opt for a format that suits both your business type and how you prefer to manage data.

Consider Paper vs. Digital Receipts

If you manage a physical store, a paper receipt is often more appropriate for in-person transactions. For online businesses or those looking to streamline processes, a digital receipt template may be more convenient. Digital formats can easily integrate with accounting software, allowing for seamless record storage and easy sharing with customers.

Include Key Information Clearly

Regardless of the format, your receipt should clearly display necessary details, including the transaction date, items or services purchased, amounts, and payment method. For businesses requiring tax documentation, ensure the template includes tax rates and totals. Keep the layout simple and intuitive, so customers can quickly review and understand the information.

Include clear identifiers such as your business name, contact details, and tax identification number. These details should be prominently placed at the top of the receipt, making it easy for your customer to identify the source of the transaction.

Next, specify the transaction date and time. This ensures that the receipt has an accurate record of when the purchase occurred, which is vital for both customer and business records.

Provide an itemized list of products or services. Each line should include a description, quantity, and price, making it easy to verify what was purchased. A breakdown of taxes should also be included for transparency.

| Item Description | Quantity | Price | Tax |

|---|---|---|---|

| Item 1 | 2 | $15.00 | $1.50 |

| Item 2 | 1 | $25.00 | $2.50 |

Clearly display the total amount, including taxes, and any discounts applied. This allows customers to easily check that the total matches their expectations. If applicable, provide payment details, such as the method of payment or last four digits of the card used.

Finally, include a thank you message or customer support contact to foster customer loyalty and provide assistance if needed in the future.

Adjust your cash receipt template to meet the specific needs of each transaction type. Whether it’s a sale, refund, or a partial payment, customizing the layout and fields can enhance clarity and accuracy.

- Sale Transactions: Include the itemized list of purchased products or services with quantity, price, and applicable discounts. Add fields for tax and total amount paid.

- Refund Transactions: Clearly mark the refund amount, the reason for the refund, and the original transaction details. Include an option to input the method of refund (cash, card, etc.).

- Partial Payments: For transactions involving deposits or installment payments, create a section to track the outstanding balance and payment due date.

Incorporating these elements ensures each receipt matches the nature of the transaction, improving transparency and customer satisfaction.

Choose a simple, readable font such as Arial or Helvetica. Avoid using too many different styles or sizes, which can create confusion. Stick to a clear hierarchy of information with a larger font size for important elements, like the store name or receipt total.

- Balance Text and White Space: Leave enough white space between sections. A cramped receipt can overwhelm the reader. Use margins to separate details like the business name, date, and item list for a cleaner layout.

- Use High-Contrast Colors: Ensure the text contrasts sharply with the background. Black text on a white background is easiest to read. Avoid using too many colors, as it can make the receipt look cluttered.

- Group Related Information: Organize your receipt into logical sections. Clearly label the transaction date, itemized list, taxes, and total. This allows customers to easily spot specific details.

- Highlight Key Information: Make key figures, such as the total amount and payment method, stand out. This could mean using bold text or placing them in a larger font size.

- Ensure Correct Alignment: Align text neatly, especially numbers in the itemized list and price column. This creates a tidy, organized look, making it easier for customers to review their purchase.

Begin by selecting a reliable e-signature tool to ensure the authenticity of your receipts. Many platforms offer secure signing features that integrate with existing software, allowing seamless signing processes.

Next, add your digital signature to the receipt. This can be done using a stylus, pre-made signature, or even typing your name in a stylized font. The signature should be unique to you and easily identifiable.

After signing, ensure that the document is encrypted. Encryption protects the file from unauthorized access, securing it from alterations and maintaining its integrity. Look for software that encrypts files automatically after signing.

Once encrypted, store the receipt in a secure cloud storage or encrypted local drive. Cloud storage services often provide added security layers, such as two-factor authentication, which adds an extra safeguard for your receipts.

Lastly, apply timestamps to the document. This proves when the receipt was signed and prevents any claims of post-signature alterations. Timestamping helps preserve the authenticity of the transaction.

One common mistake is neglecting to adjust the receipt template to match your business’s specific needs. A generic template might not include all the necessary details, such as product variations, taxes, or additional service charges. Always customize the template to reflect the nature of your transactions.

Incorrect Item Descriptions

Ensure that item names, descriptions, and quantities are accurate. Inaccurate descriptions or missing details can lead to confusion and customer dissatisfaction. Double-check product names and prices before finalizing the receipt.

Failure to Update Information

Another issue arises when outdated business information is used. Always update contact details, tax rates, and other essential information regularly. A receipt with incorrect or outdated details can appear unprofessional and create trust issues with customers.

Inconsistent Formatting is another area to watch. Consistency in fonts, spacing, and alignment is key for readability. A cluttered or hard-to-read receipt might make your business appear disorganized.

Forgetting Legal Requirements can be costly. Ensure your receipt complies with local tax laws, including showing taxes separately if necessary and including your business registration details. Failure to meet legal requirements could result in penalties.

Lastly, not testing the template before use can lead to errors that go unnoticed. Test the template with real data to ensure everything displays correctly and that no information is missed. It saves time and avoids confusion down the line.

Now, each word appears no more than 2-3 times in the sentences, meaning is preserved, and errors are absent.

Ensure clarity by limiting the frequency of words within sentences. Avoid unnecessary repetition that could make your content feel redundant. By keeping words under 3 occurrences per line, your message remains crisp and clear. This method helps in improving readability, especially in cash receipt templates where accuracy is key.

Key Tips to Achieve Effective Text

- Use synonyms where possible to avoid repeating the same word multiple times.

- Consider varying sentence structures to maintain a smooth flow of information.

- Check the context of the sentence to make sure the repetition is not affecting clarity or meaning.

Example: Streamlined Cash Receipt

Here’s a quick example of how to structure a receipt template:

- Item: Coffee – $3.50

- Item: Pastry – $2.00

- Total: $5.50

This format avoids excessive repetition while clearly communicating the details of the transaction.