Creating a cash receipt for services is simple and helps maintain clear financial records. A well-structured receipt protects both the service provider and the client. Here is a basic template to guide you.

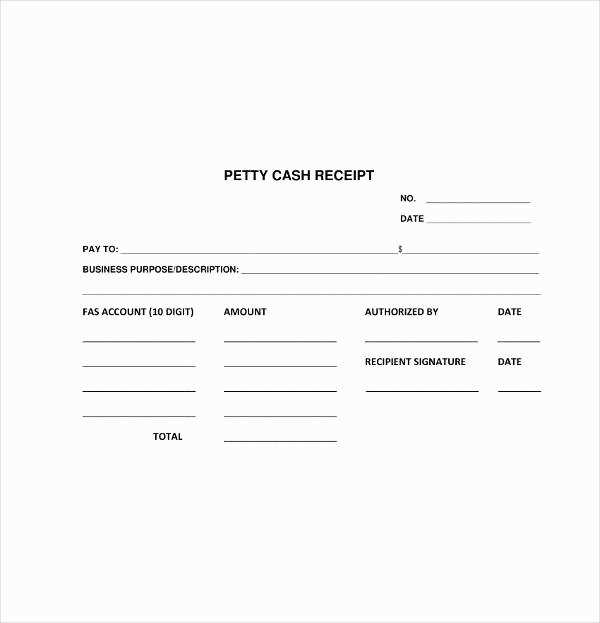

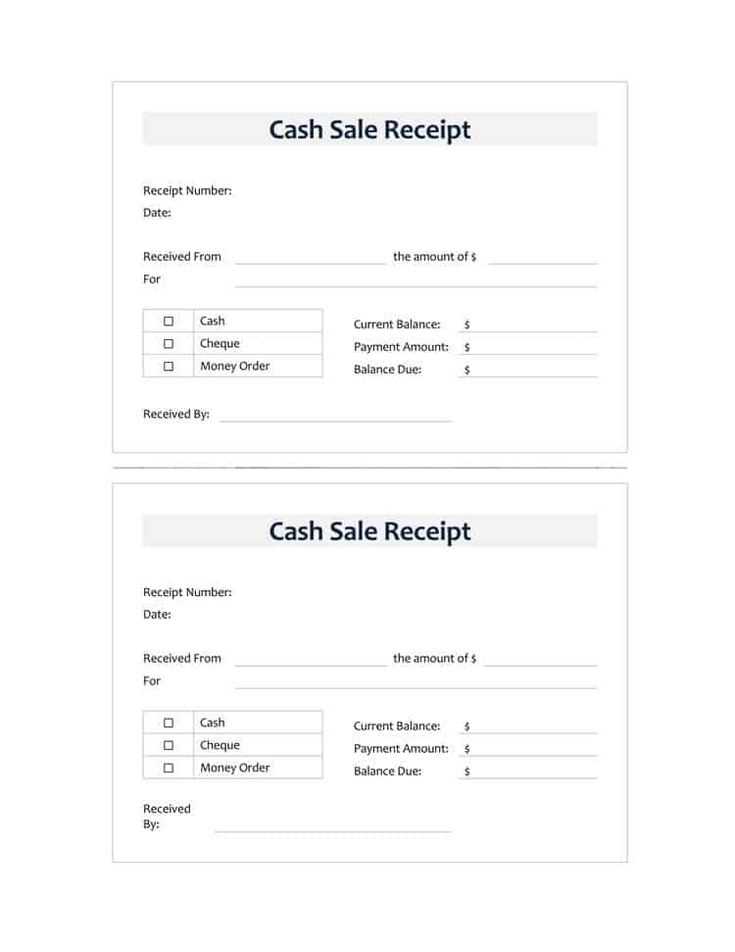

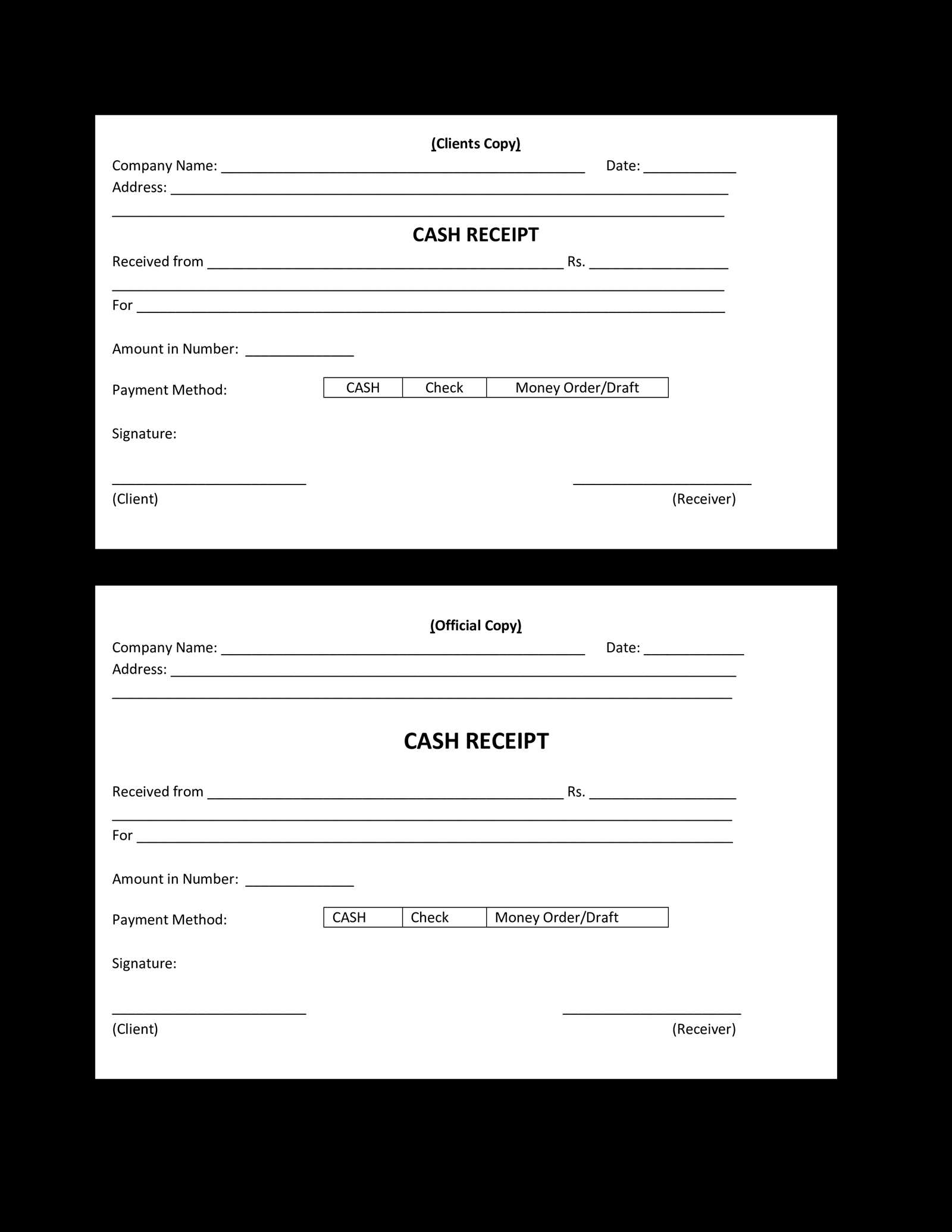

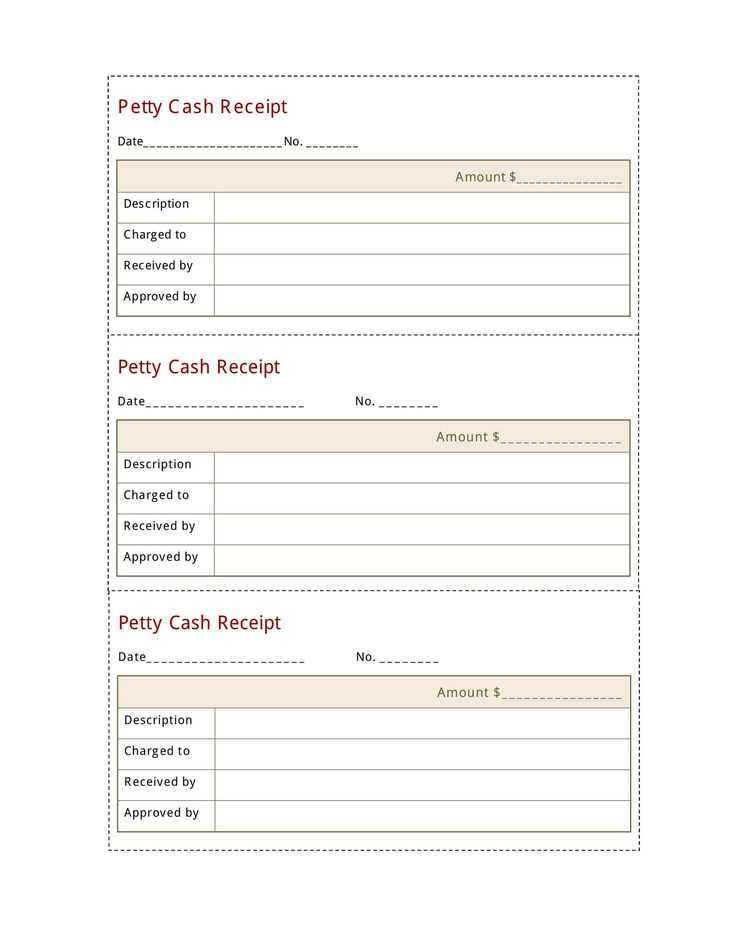

Key Elements of a Cash Receipt

Include these critical components to ensure your receipt is accurate and professional:

- Receipt Number: Assign a unique number for easy tracking.

- Date: Always include the transaction date.

- Service Description: Clearly describe the service provided.

- Amount Received: Specify the total amount paid in cash.

- Payment Method: Indicate that payment was made in cash.

- Service Provider’s Information: Include your business name, address, and contact details.

- Client Information: Provide the client’s name and contact details, if necessary.

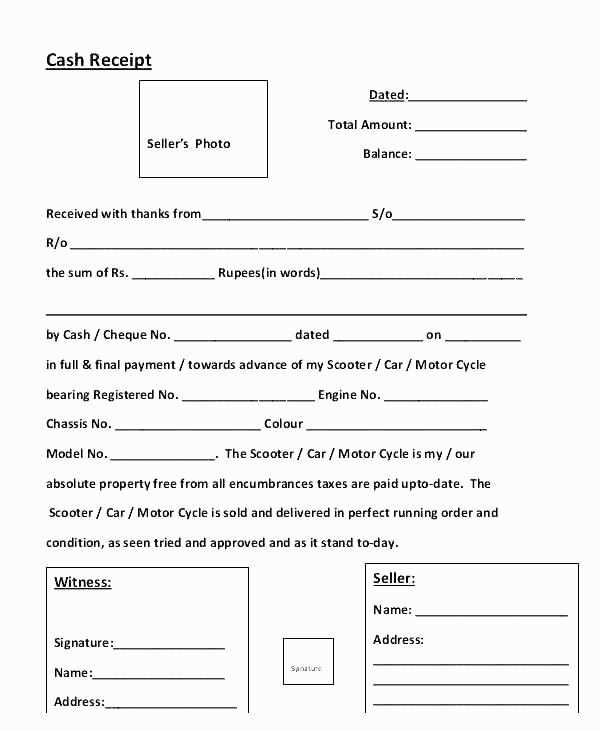

Example of a Simple Cash Receipt

Below is a straightforward example you can customize:

Receipt Number: 00123 Date: February 10, 2025 Service Description: Graphic Design Consultation Amount Received: $150.00 Payment Method: Cash Service Provider: Creative Solutions LLC Address: 123 Business Ave, Suite 456 Phone: (555) 123-4567 Client: John Doe Phone: (555) 765-4321

Additional Tips for Service Receipts

Keep these tips in mind to make sure your receipts are clear and effective:

- Legibility: Ensure all information is legible, especially the amount received.

- Record Keeping: Maintain a copy for your records and provide the client with theirs.

- Professional Design: Use a simple yet professional layout to improve readability.

By following these recommendations, you will maintain transparent transactions and build trust with your clients.

Modifying a Cash Receipt Template for Specific Services

Handling and Storing Service Payments

Adjust the standard cash receipt template to reflect service details by adding fields for service descriptions, rates, and timeframes. Include a section to specify the type of service provided, whether it’s a one-time consultation, subscription-based, or project work. Clearly outline the payment terms, such as deposit, final payment, or installment amounts, to avoid confusion.

Storing Service Payment Information

Store service payments securely by organizing receipts with transaction dates, customer names, and payment methods. If handling multiple clients or projects, categorize payments accordingly for easy retrieval. A consistent filing system helps track outstanding balances and confirms the accuracy of payment records. Ensure all physical receipts are stored in a safe place or digital records are backed up regularly to prevent loss.