To access the necessary manual books for cash receipt templates, start by choosing the right format for your needs. Many downloadable resources offer easy-to-use templates, making it simple to document all transactions. Here’s how you can get started:

Steps for Downloading Cash Receipt Templates

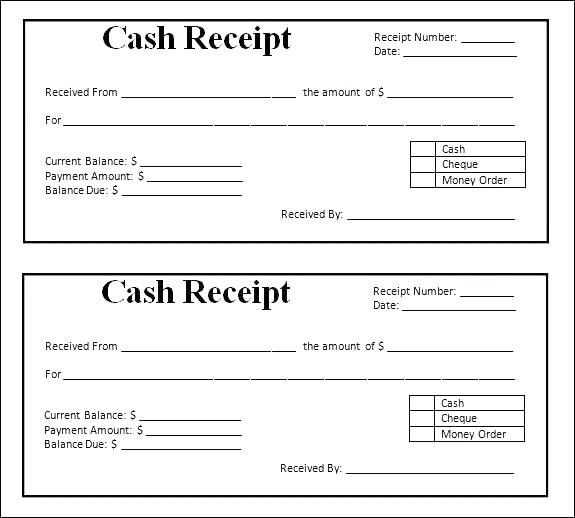

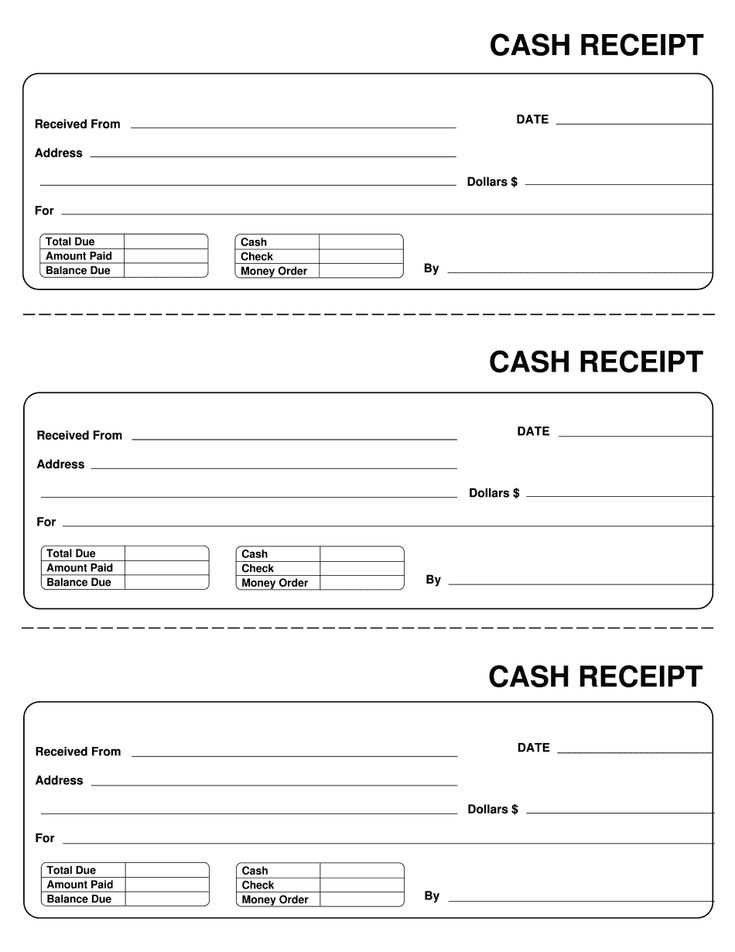

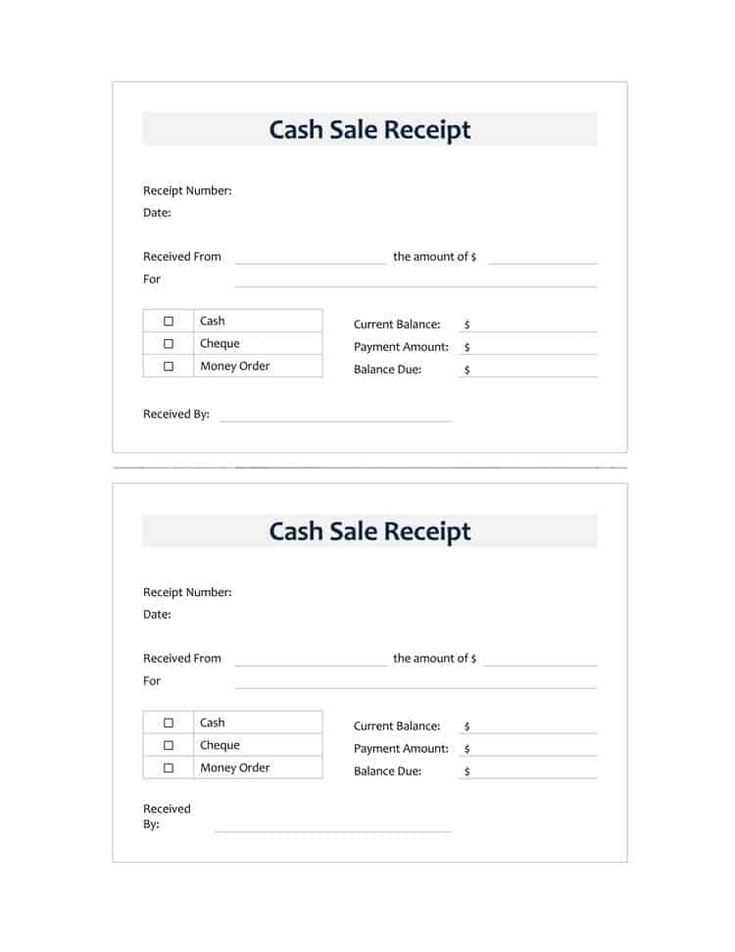

- Choose the template that fits your business: Templates are available in different formats such as PDF, Word, or Excel. Make sure to select the one that aligns with your preferred documentation method.

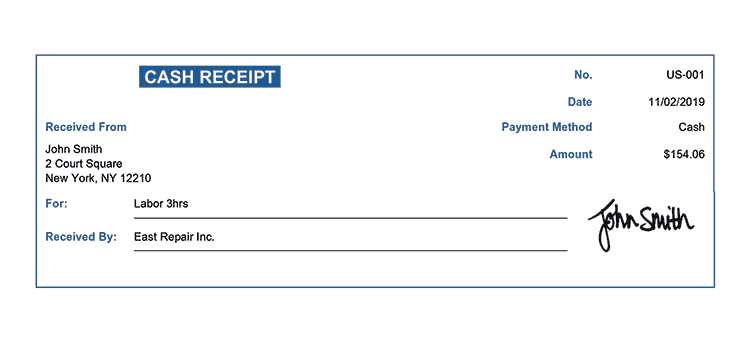

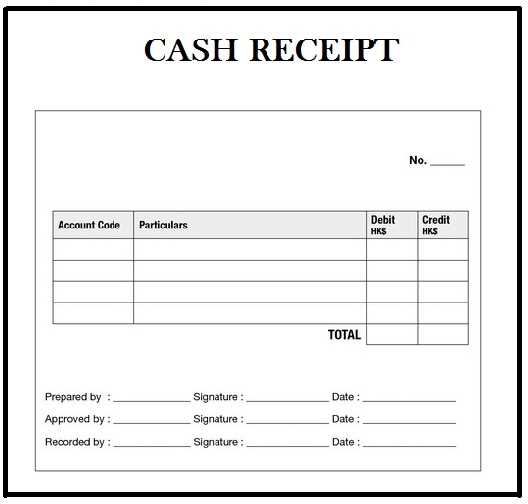

- Verify the template content: Check that all the required fields are included, such as the payer’s name, amount, date, and any relevant descriptions of the transaction.

- Download the template: Once you’ve selected the template, simply click the download button. Ensure that the file format is compatible with your device for easy editing or printing.

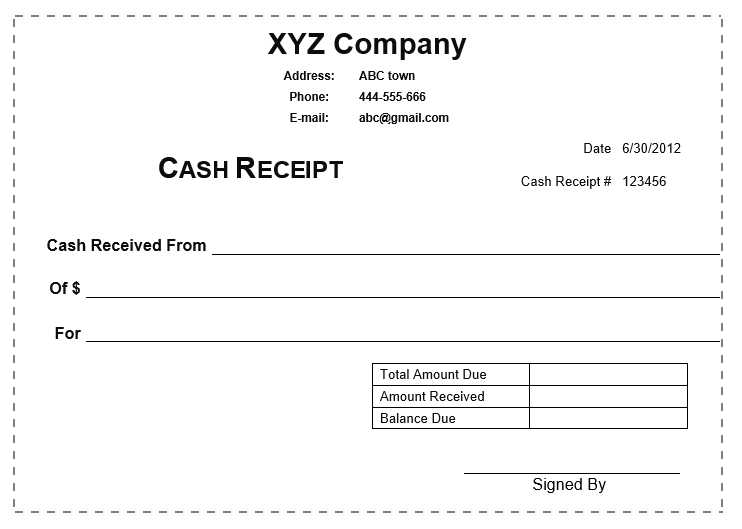

- Customize if needed: Some templates allow you to edit text or add your company’s logo. Customize the template to fit your specific requirements before using it in transactions.

Advantages of Using Cash Receipt Templates

- Time-saving: Pre-made templates help save time on formatting, allowing you to focus on the core aspects of transactions.

- Consistency: Using the same format ensures that all receipts are uniform, reducing confusion and making it easier to track payments.

- Accuracy: The structure of the templates minimizes the chances of errors in recording transaction details.

- Professionalism: Having a well-organized receipt template helps maintain a professional image for your business.

Where to Find Cash Receipt Templates for Download

These templates are available on various online platforms, including accounting websites, business forums, and template directories. You can also find free and paid options, depending on the level of customization and features you require.

Things to Keep in Mind

- Check the compatibility of the template with your software tools.

- Ensure the template adheres to any legal or business-specific requirements for cash receipts in your area.

- Look for templates that allow you to add custom fields for specific transaction details.

Ensuring Accuracy in Payment Receipt Entries

Common Errors in Using Payment Receipt Templates and How to Resolve Them

Integrating Payment Receipt Templates with Accounting Systems

Double-check payment amounts, especially decimals. Incorrect figures can cause discrepancies when reconciling accounts. Always verify the received amount against the payment method (cash, credit, etc.) and ensure the total is entered correctly.

Common Errors in Using Payment Receipt Templates

One common mistake is using incorrect date formats. Always match the date format with the system’s settings or local standards. Another issue is inconsistent customer information. Ensure names and addresses match the records to avoid confusion or mistakes in your financial reports.

Integrating Payment Receipt Templates with Accounting Systems

Integrating receipt templates with accounting software streamlines data entry and minimizes errors. Make sure your template allows for automatic data transfer, reducing manual entry. Configure the software to automatically update the general ledger and other relevant accounts after a payment is recorded.