Use a cash receipt template for smooth and clear documentation of payments in New Zealand. A well-organized template helps to provide your clients with a reliable proof of payment while also keeping your records in order. You can customize it to suit your specific business needs, whether it’s for small transactions or larger sums.

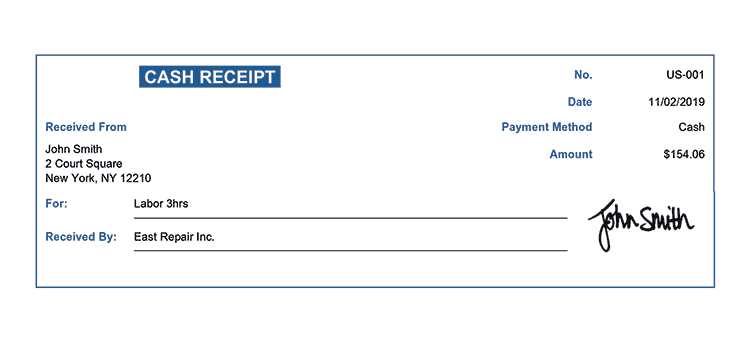

When creating your cash receipt, ensure it includes details such as the date, amount received, and the payer’s name. This information helps avoid any confusion or misunderstandings in the future. Include a unique receipt number for easy tracking and reference. It’s also a good idea to specify the method of payment, whether it’s cash, EFTPOS, or another method.

Having a ready-to-use template in your toolkit streamlines daily operations and prevents errors when issuing receipts. It’s especially useful for businesses that deal with frequent cash transactions. By using a template, you ensure consistency and professionalism in your financial documentation, which can help improve trust with your clients.

Here is the edited version with repeated words removed:

Make sure to keep the receipt concise and clear. Include the date, amount received, and the payment method. For better record keeping, add the payer’s details and a brief description of the transaction. Ensure all fields are filled out accurately to avoid confusion later.

Key Elements to Include

Clearly state the transaction date, the total amount paid, and any reference numbers. A short description of the goods or services provided will help maintain clarity. Double-check that both the payer’s name and payment method are listed correctly. This helps with easy tracking and verification when needed.

Final Tips

Always proofread the receipt before issuing it to prevent any errors. Keep copies for your own records in case of future reference. A clear and professional receipt can simplify accounting and build trust with clients.

- Cash Receipt Template NZ

A well-structured cash receipt template is a must for businesses in New Zealand to accurately track cash transactions. This template provides a clear format that includes the date of the transaction, the amount received, the purpose of the payment, and the payer’s details. It ensures both parties involved have a record for reference, reducing confusion and potential disputes.

Key Elements to Include

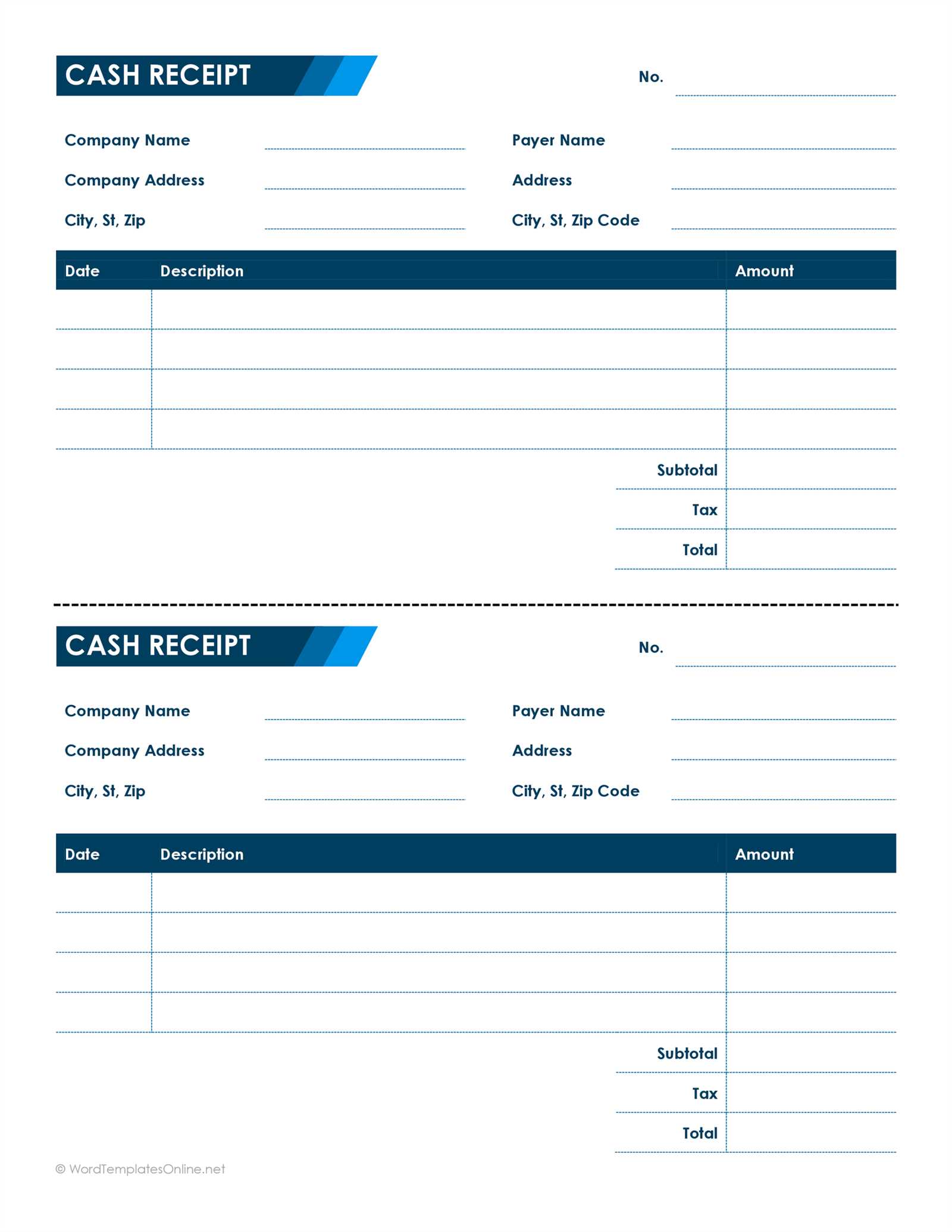

Ensure the following fields are present in your template for clarity and completeness:

- Receipt Number: A unique identifier for each transaction to easily reference past receipts.

- Date: The exact date the cash payment was received.

- Payer’s Name: Full name of the individual or business making the payment.

- Amount Received: Specify the exact amount of cash received, including the currency (NZD).

- Payment Purpose: Briefly describe the reason for the payment, whether it’s for goods, services, or a donation.

- Received By: Name of the person who received the payment on behalf of the business.

- Signature: Space for the payer’s and receiver’s signatures to confirm the transaction.

Practical Tips for Use

When issuing cash receipts, ensure all the information is filled out completely and accurately. This avoids errors and ensures the document is valid for both accounting and tax purposes. Regularly update your receipt book or template to reflect any changes in business operations. You can customize the template with your business logo and other branding elements, but always maintain the integrity of the essential data fields.

To create a custom cash receipt for your business in New Zealand, begin by ensuring it includes key details for both legal compliance and clear documentation. These details should include the transaction date, the seller’s and buyer’s contact information, and a unique receipt number for easy tracking. Below is a breakdown of what to include and how to structure your receipt.

Key Elements of a Cash Receipt

Here’s a list of the necessary elements for your custom receipt:

| Item | Description |

|---|---|

| Receipt Number | A unique identifier for the transaction. |

| Transaction Date | The exact date the payment was made. |

| Seller’s Details | Name, address, and contact information of your business. |

| Buyer’s Details | Name and contact information of the buyer (optional for smaller transactions). |

| Amount Paid | The total sum of money received. |

| Payment Method | Specify whether the payment was made in cash, card, or another method. |

| Item Description | A brief description of the goods or services provided. |

| GST (if applicable) | Indicate if GST was included in the payment and its amount. |

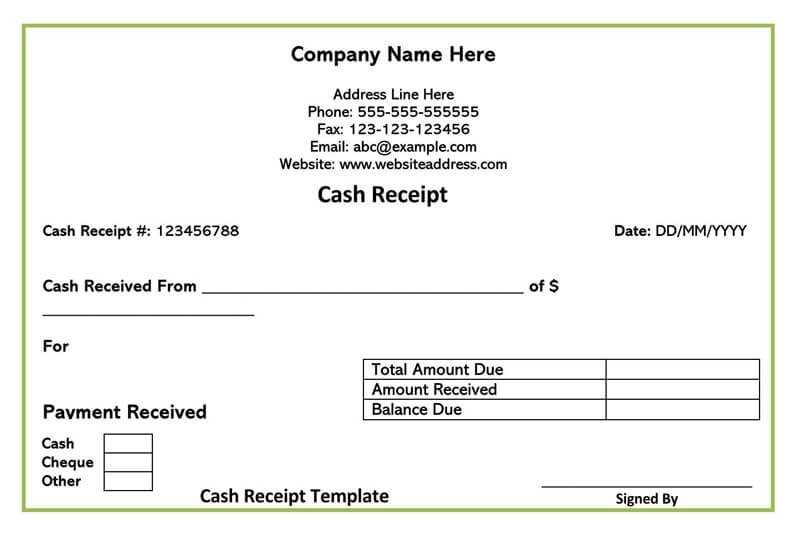

Customizing Your Receipt Template

Design your receipt template with your branding elements like your company logo and color scheme to maintain a professional appearance. Use a word processor or receipt software to create a layout that is easy to read and ensures that all required details are clearly presented. Make sure the receipt can be printed on standard paper sizes (e.g., A4) or formatted for digital sending.

For those who need to issue receipts regularly, consider using invoicing software that offers custom templates. Many tools allow you to input your business details once, and then automatically generate receipts based on customer purchases. This can save you time and reduce human error.

Include the date of the transaction at the top of the receipt. This ensures both parties can track when the exchange occurred. Specify the unique receipt or transaction number to avoid confusion in case of refunds or disputes. Clearly state the seller’s business name, address, and contact details for transparency.

List the items or services purchased with detailed descriptions. Include the unit price, quantity, and total for each item. This helps the buyer verify their purchase. Apply the applicable taxes separately to the total amount to maintain clarity. The subtotal should reflect the total before taxes, while the final amount includes taxes.

Provide payment details, such as the payment method (credit card, cash, bank transfer). If the transaction was completed through card payment, include the last four digits of the card number for reference. Include a space for any additional notes or terms of the sale, like return policies or warranty information.

End the receipt with a thank-you note or statement of appreciation to leave a positive impression and encourage future business.

In New Zealand, receipts must meet specific tax requirements for both businesses and individuals to ensure accurate record-keeping for GST (Goods and Services Tax) purposes. A valid receipt must clearly list the business’s name, the date of the transaction, and a description of the goods or services provided. Additionally, if the transaction is subject to GST, the receipt should include the GST amount charged and the total amount paid, including GST.

Key Tax Information for Receipts

Receipts must contain a unique transaction number, which serves as a reference for both parties involved. This allows the transaction to be tracked for tax filing purposes. For businesses registered for GST, receipts need to specify whether GST is included in the price and provide the GST rate (typically 15%) on the transaction. This helps businesses claim back the GST they have paid on business expenses, as per New Zealand’s tax laws.

Documenting Taxable Transactions

When providing receipts for taxable goods or services, businesses must ensure that the tax rate is clearly stated, and the total amount reflects the correct GST-inclusive price. Receipts should also be kept for a minimum of seven years, as required by New Zealand tax law, to support tax returns and any potential audits. Regularly reviewing these receipts helps ensure compliance with the country’s tax system.

Begin with your business name, logo, and contact information at the top. This ensures your receipt is immediately recognizable and helps your customers reach out if needed. Use a clean, legible font for all text to maintain readability.

Next, include a unique receipt number. This helps with record-keeping and tracking. Position it prominently so it’s easy to locate. Right after, add the date of the transaction, clearly displayed.

Underneath, list the items or services purchased. For each entry, include the following details:

- Item name or description

- Quantity

- Unit price

- Total price for the item

If applicable, include a line showing the subtotal. This makes the calculation process transparent for both you and the customer.

Don’t forget to show the tax rate and the total amount paid. Make the tax amount clear, either as a percentage or a specific value. The final total should be highlighted, making it easy for customers to see their overall expenditure.

Provide payment method information, such as credit card, cash, or bank transfer. For digital payments, include the payment processor name or transaction reference number.

Finish with any return or warranty policies your business offers, but keep this brief and straightforward. This reinforces trust and provides the customer with additional useful information.

Use clear spacing between each section to avoid clutter and make the receipt user-friendly. Consistent alignment and a structured layout create a professional and easy-to-read document.

Accounting software in New Zealand allows businesses to tailor cash receipt templates to suit their specific needs. Customizing these templates can simplify record-keeping and ensure compliance with local regulations. Many platforms offer straightforward tools for adjusting layout, adding or removing fields, and integrating company branding.

Adjusting Template Layout

Start by modifying the template layout to match your preferred format. Most accounting software lets you change the arrangement of key sections such as the date, payment method, and amounts. This flexibility ensures that the receipt aligns with your business’s processes and customer expectations.

Incorporating Company Branding

Customizing templates also includes the option to add logos, adjust colors, and select fonts. Integrating your company’s branding helps maintain a professional image, reinforcing recognition in every transaction. Ensure all contact information and terms are clearly visible for consistency and transparency.

Use a dedicated folder for storing paper receipts. This makes it easier to organize and retrieve them when needed. Divide receipts into categories such as groceries, utilities, or business expenses for better tracking. It’s also helpful to label each folder with the month and year to keep everything in order.

For digital receipts, take clear photos or scan them and store them in a cloud service. This prevents loss and allows access from multiple devices. Use a folder system on the cloud, mirroring your paper organization method, to keep your digital receipts just as tidy.

Track all receipts regularly, especially for tax or warranty purposes. Set a schedule to go through receipts at the end of each month, ensuring you’re not accumulating piles of paper. This will also help you spot errors or discrepancies early.

Consider using a receipt management app. Many apps allow you to take pictures of receipts and automatically categorize them. Some even link directly to accounting software for easier expense tracking. This will save time and reduce the risk of losing important documents.

If you’re self-employed or managing business expenses, maintain a separate system for business receipts. This makes it much easier to file taxes and track deductions. Ensure you’re keeping all relevant receipts for the required retention period, which is typically seven years in New Zealand.

Finally, review your receipts yearly before tax season. This will help you ensure that you have everything you need and prevent any last-minute scrambling. Dispose of receipts that no longer serve a purpose but make sure to shred sensitive ones to avoid identity theft.

Cash Receipt Template NZ

When creating a cash receipt in New Zealand, ensure the following key elements are included for clear documentation and compliance:

- Date: Always add the date of the transaction at the top of the receipt for record-keeping purposes.

- Receipt Number: Assign a unique number to each receipt to maintain an organized system of records.

- Payee Information: Include the name and contact details of the person or business receiving the payment.

- Payer Information: List the details of the individual or business making the payment. This helps verify the transaction.

- Amount Paid: Clearly state the total amount paid, including the currency (NZD), and break down any taxes or additional charges.

- Method of Payment: Specify the payment method (e.g., cash, bank transfer, credit card) for transparency.

- Description of Goods/Services: Provide a brief description of what was paid for, whether it’s a product, service, or other transaction.

- Signatures: Obtain the signatures of both the payer and the payee to validate the transaction.

Using a template with these elements ensures your receipts are clear, organized, and legally compliant with New Zealand’s accounting requirements.