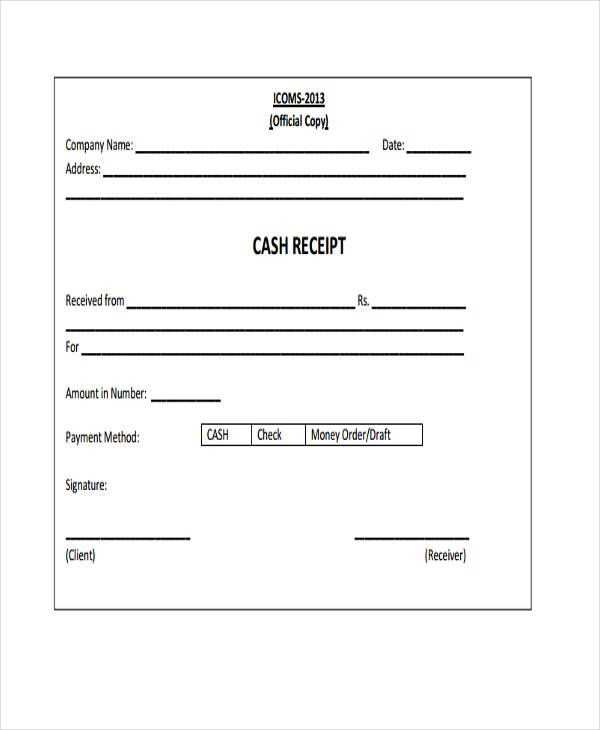

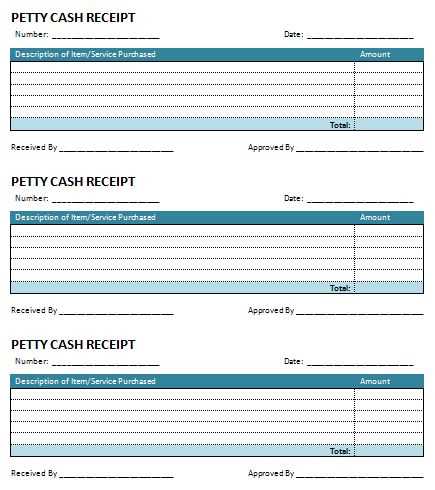

If you’re managing payments, a cash receipt template in Open Office can simplify your record-keeping. This template will help you efficiently document each transaction, ensuring you have a clear, accurate record of all cash received. The layout is straightforward, making it quick to fill in with relevant details such as date, amount, payer information, and the purpose of the payment.

Start by downloading a customizable template, or create your own by adjusting the fields to suit your needs. It’s a smart idea to include sections for both the payer’s details and a brief description of the transaction. Using Open Office allows for easy modifications, so you can always update the template as your requirements change.

To ensure clarity and consistency in your records, consider adding simple formulas for automatic calculations, like the total amount received, especially if you’re handling multiple transactions in a day. By using this template regularly, you’ll keep your financial documentation organized and accessible for future reference.

Here is the revised plan with improved formatting:

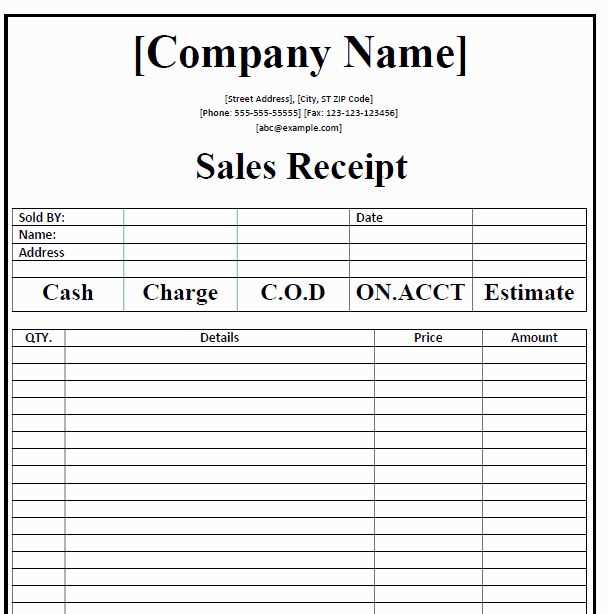

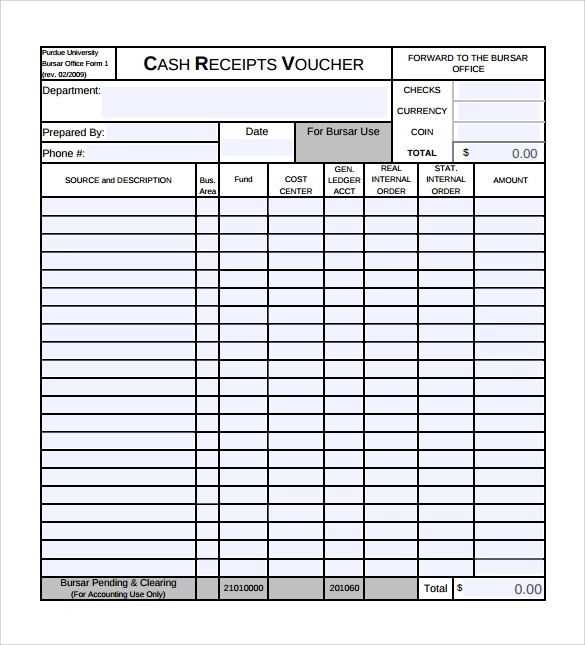

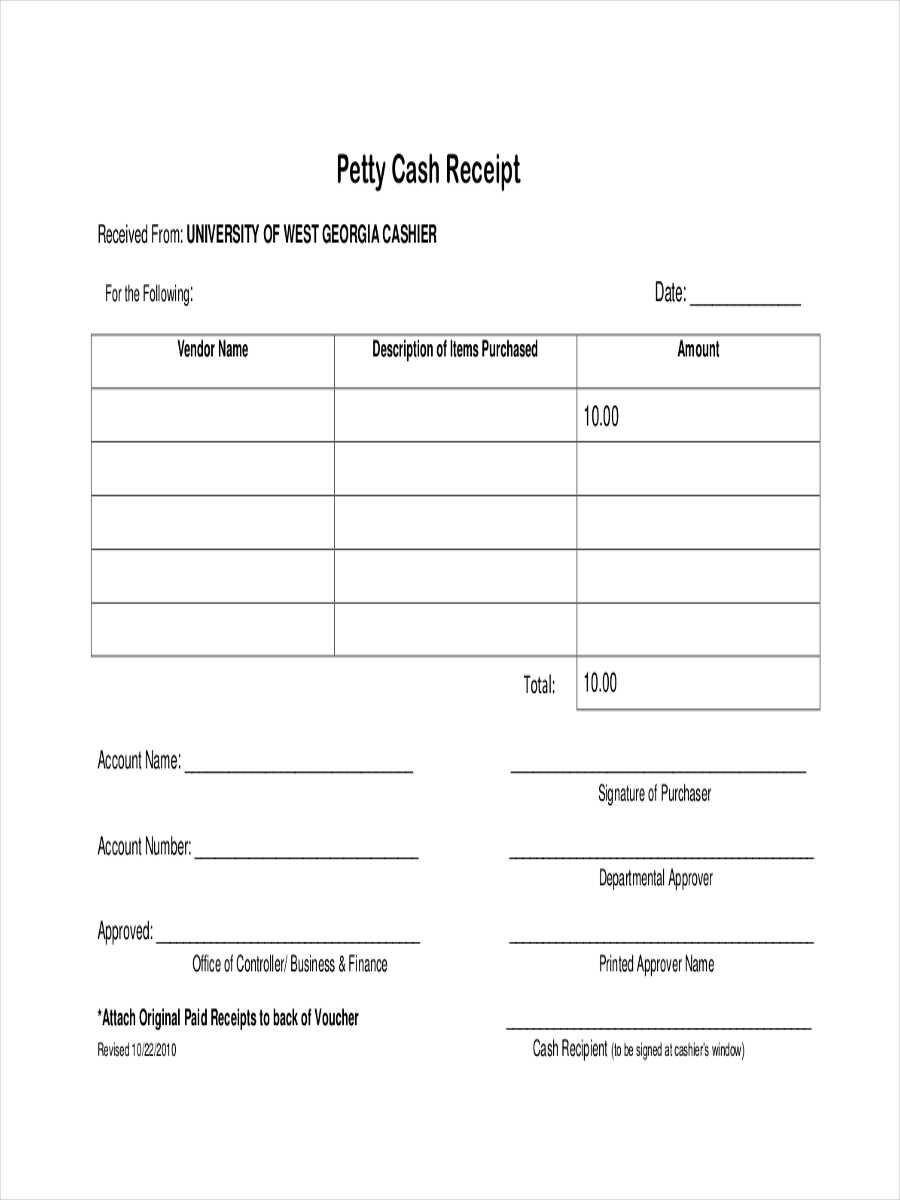

Ensure that the template is structured to provide clarity and ease of use. Begin with a simple header that includes the business name, date, and a receipt number. This helps with organization and future reference. Make sure the itemized list of goods or services is clear, with columns for quantity, description, price, and total amount. Double-check that tax calculations are correct, and include a clear line for the total amount due, including tax and discounts if applicable.

Organizing Payment Information

Include fields for payment method, such as cash, card, or online transfer. This section should clearly distinguish between the different options, allowing for quick verification. Add a line for any received amount, ensuring it’s easy to track the balance due. If there are any special payment terms, such as deposits or partial payments, make sure to clearly label and calculate them separately.

Enhancing Readability and Usability

Consider using bold for headings, totals, and important details to make them stand out. Using borders around sections like item details and totals will further help the reader focus on important information. Ensure that the font size is consistent and legible, especially for financial amounts. Finally, leave enough space between different sections to avoid clutter and ensure a professional, clean layout.

- Formatting the Cash Receipt for Clarity and Professionalism

Set a consistent font, such as Arial or Calibri, at a size of 10-12 pt to keep the receipt legible and clear.

Keep margins uniform and maintain consistent spacing between sections. This creates an organized structure and ensures ease of reading.

- Use bold text for important headings like “Date,” “Amount Paid,” and “Receipt Number” to highlight critical information.

- Separate sections with adequate spacing to avoid a cluttered appearance.

Highlight the payment amount by positioning it in a larger or bold font. Box it or place it in a distinct area so that it’s easy to locate.

Include your business name, logo, and contact details at the top. Keep the size of the contact information smaller to ensure it doesn’t overpower the receipt content.

- Double-check alignment and spacing to ensure a uniform presentation.

Consistency in formatting is key. Ensure all text is aligned properly and the layout looks balanced for a polished, professional receipt.

To ensure your cash receipt template is complete and compliant, include your company’s information along with tax details. Start by adding the company name, address, and contact information at the top of the receipt. This section should be clear and easily readable for both parties.

Company Name and Address

Place the company name prominently at the top of the receipt, followed by the business address. This is important for identification and communication purposes. Be sure to include the street address, city, state, and postal code to avoid confusion in case of correspondence.

Tax Information

Include tax details such as the tax identification number (TIN) or VAT number, depending on your location. This ensures the receipt meets tax regulations. You may also want to list the applicable tax rate or specify if any tax exemptions apply. If you issue receipts for both taxable and tax-exempt sales, make sure the relevant tax information is clearly indicated for each item or total.

To save your cash receipt template for future use in Open Office, go to the “File” menu and select “Save As.” Choose the location where you want to store the file, and in the “Save as type” dropdown, select “OpenDocument Text (.odt)” to keep it in the default format. If you need it in a different format, such as PDF or Microsoft Word, select the corresponding option from the dropdown. Click “Save” to store your file.

If you want to share or use the template across different devices, exporting it as a PDF can be useful. To do this, click “File” and choose “Export as PDF.” Adjust the settings according to your needs, then click “Export” to save it as a PDF file, which can be easily opened on any device.

For consistent use, consider creating a template file. Save it as an OpenOffice template by choosing “File” > “Templates” > “Save As Template.” This way, you can easily access it from the “File” > “New” > “Templates” menu whenever you need it, without altering the original file.

Ensure that all necessary details are included in the cash receipt template. Start with the date of the transaction, the name of the payer, and the amount paid. These basics will help maintain a clear and transparent record for both parties involved.

Consistency in Formatting

Use a uniform layout each time a cash receipt is issued. This includes using the same font, spacing, and arrangement of information. Consistent formatting makes the receipt easy to read and helps prevent confusion in the future when reviewing records.

Include a Payment Method

Always specify the method of payment, whether cash, check, or another form. This adds clarity and avoids misunderstandings. Including payment method details ensures that transactions are accurately recorded and auditable if needed.

Keep a copy of every receipt for both the business and the customer. This ensures there are no discrepancies, and it can serve as a proof of transaction in case of disputes.

Key Elements of a Cash Receipt Template

When creating a cash receipt template in Open Office, focus on these essential elements to ensure clarity and functionality:

Receipt Header

Include a prominent header with your business name, logo, and contact information. This ensures the receipt is easily identifiable and helps establish trust with clients.

Receipt Details

The template should contain fields for the transaction date, receipt number, and a detailed list of purchased items or services. This will help maintain clear records for both parties.

| Item | Description | Amount |

|---|---|---|

| Service/Item 1 | Details of the transaction | $50 |

| Service/Item 2 | Details of the transaction | $30 |

Include a section for tax calculations, discounts, and total amount. This ensures the receipt is fully transparent and easy to understand.

Payment Method

Clearly state how the payment was made (e.g., cash, card, bank transfer) to avoid confusion during any potential audits.