Download a ready-to-use cash receipt template PDF to simplify tracking your transactions. With this template, you can quickly document cash payments, ensuring both clarity and accountability for your financial records.

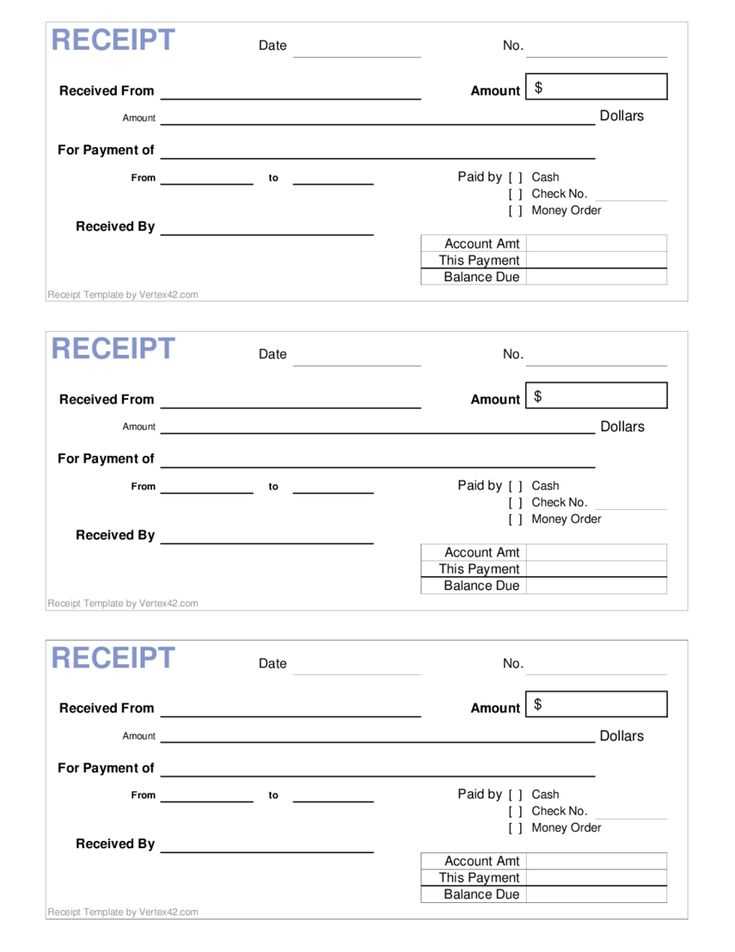

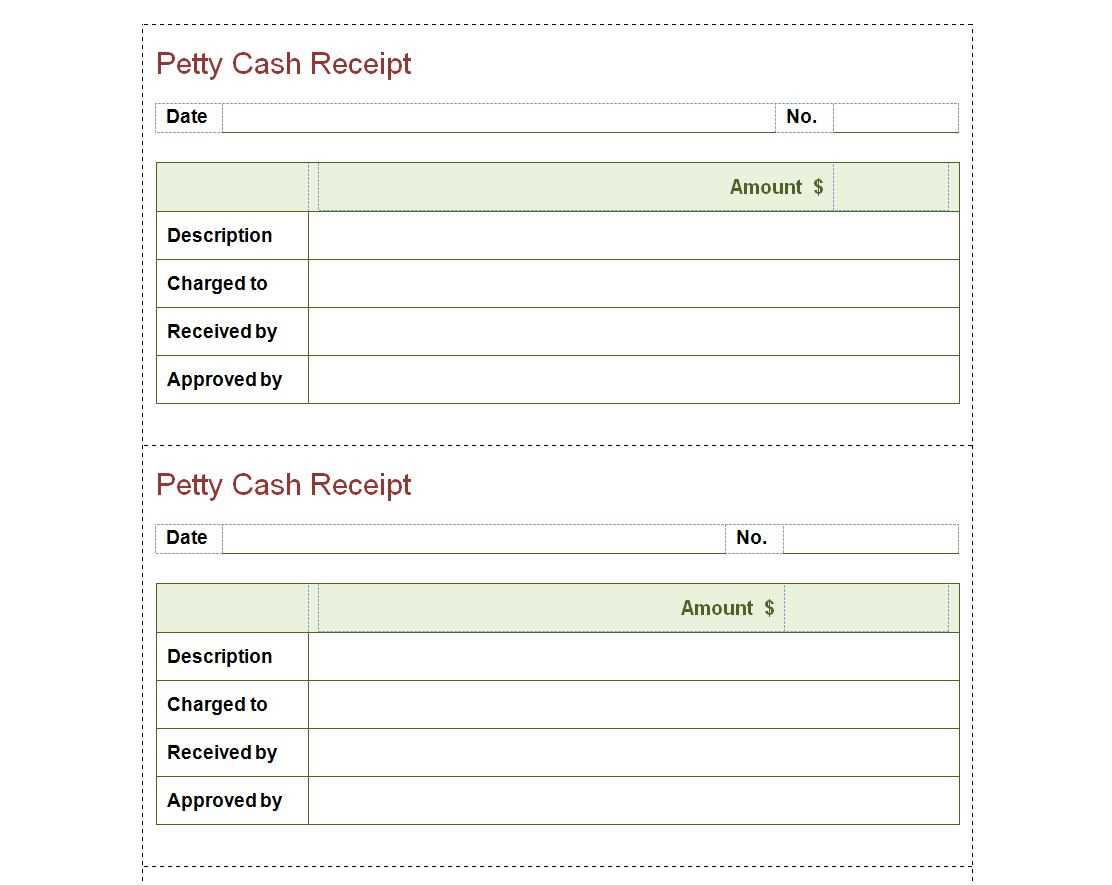

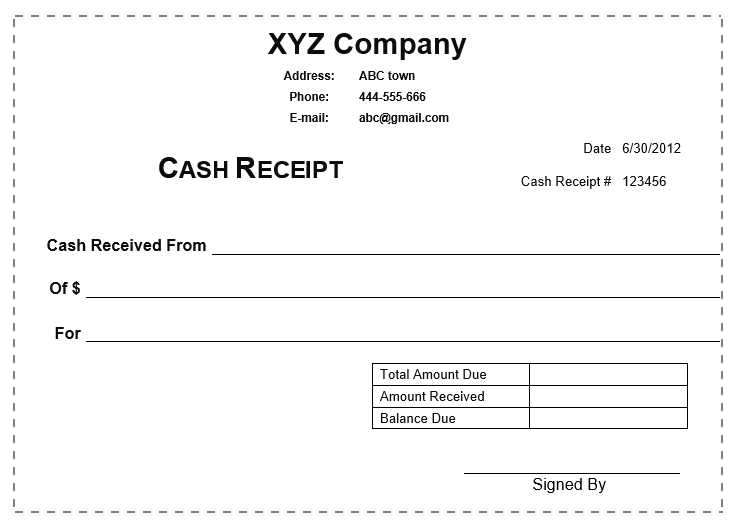

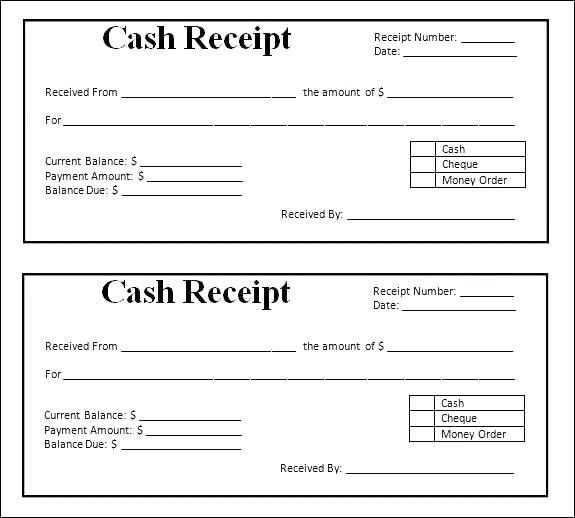

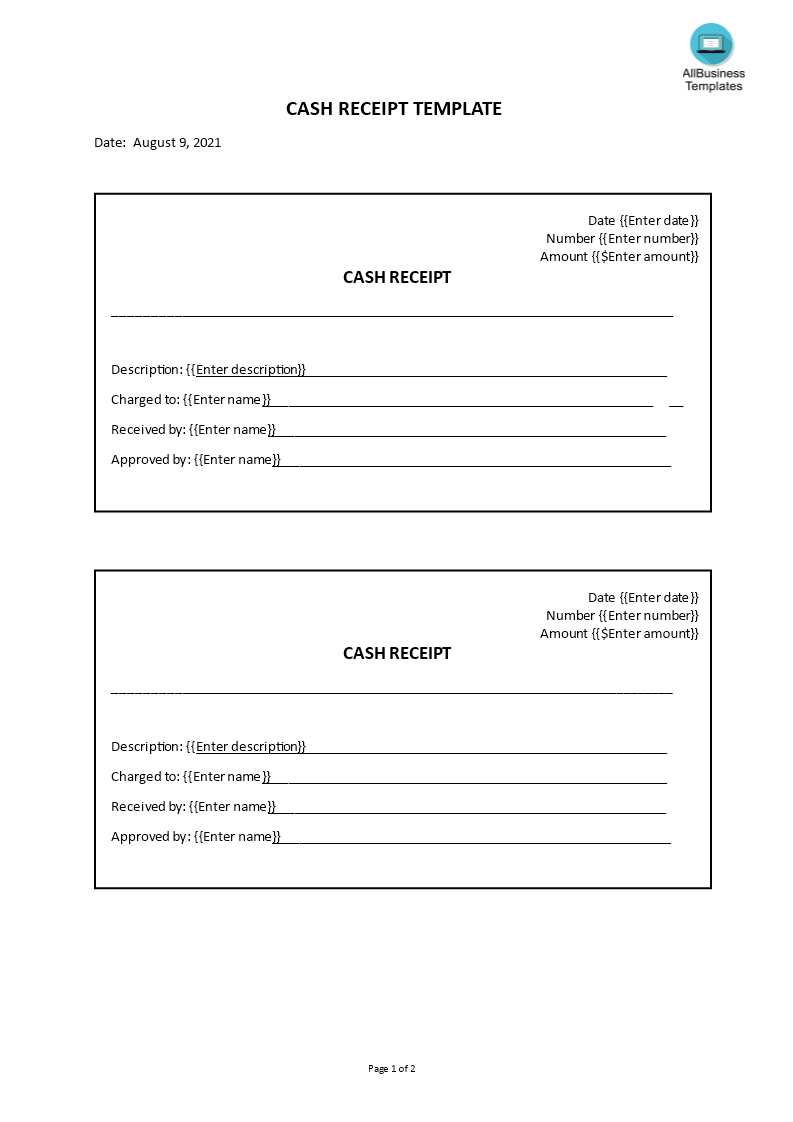

Customize the template by filling in fields such as date, payer, amount, and purpose. These details provide a clear breakdown of the transaction, making it easy to reference later. The template’s simple format helps eliminate confusion and ensures accuracy when recording payments.

Using a cash receipt template PDF can save you time and reduce the chances of errors, especially when handling multiple transactions. Whether for personal use or small business purposes, it provides a straightforward way to keep financial records organized and up-to-date.

Here’s the corrected version:

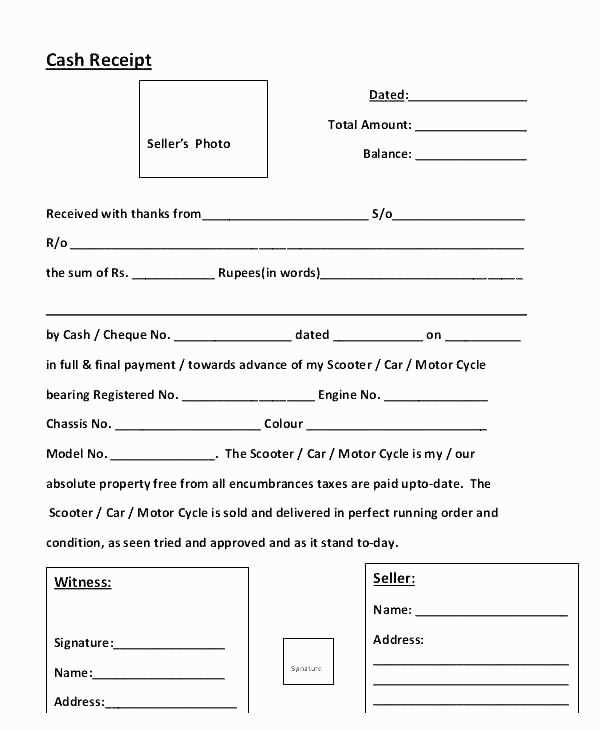

Ensure the receipt template includes the buyer’s full name, address, and contact details. Specify the date of the transaction clearly, along with a unique transaction number for easy reference. Describe the items or services purchased in detail, including quantities and unit prices, followed by the total amount. Double-check that the payment method is clearly stated, whether cash, check, or card. If applicable, include tax information and the total amount paid. For legal compliance, make sure the template has a footer stating that the receipt serves as proof of the transaction.

- Cash Receipt Template PDF Guide

To create a cash receipt, use a simple template to record each transaction clearly. This ensures accuracy and provides a record for both the payer and recipient.

Here are the key steps to include in your template:

- Date: Always mark the date of the transaction.

- Amount Received: Specify the exact amount paid.

- Payment Method: Indicate whether the payment was in cash, check, or another form.

- Recipient Information: Include the name or business name of the person receiving payment.

- Purpose of Payment: Add a brief description of what the payment is for, such as a service or product purchase.

- Signature: Both parties should sign the receipt to confirm the transaction.

For convenience, search for pre-made PDF templates available online. These templates are editable and can be tailored to suit specific business needs. Always ensure that your template complies with local legal requirements.

After completing the receipt, make sure to store it securely for future reference and possible audits.

To download a cash receipt template in PDF format, visit a reliable website offering templates. Many platforms provide free options, and you can find various designs to suit your needs.

Look for a section labeled “Download” or “Templates,” then select the desired template style. After that, click on the “Download” button. The PDF will automatically start downloading to your device.

If you’re using a specific template site, ensure it offers the template in PDF. Some platforms also let you customize the receipt before downloading, allowing you to add details like company name, payment amount, and date.

After downloading, open the PDF file with any standard PDF viewer to fill in the details or print it directly.

Choose a design that matches your brand. Include your logo and brand colors to create a professional, cohesive appearance. You can add these elements by adjusting the template layout or incorporating custom fields in your receipt software. Make sure the font is easy to read and appropriately sized for clarity.

Modify the information displayed. Add or remove fields like customer details, order numbers, or discounts depending on your business needs. Customize the date format, tax rates, and payment method sections to suit local requirements or industry standards.

Ensure the receipt is organized. Structure the content logically–group the purchase details, taxes, and totals clearly to avoid confusion. A well-organized receipt helps customers understand their purchase quickly and reduces follow-up questions.

Offer additional features for convenience. Include a return policy, customer service contact, or a thank you note. This adds value without cluttering the receipt, creating a friendly experience for your customers.

Finally, test your customized receipt before using it in your daily transactions. Verify that all fields are correctly formatted and that the layout works across different devices or printers.

Each cash receipt template includes key fields that ensure proper documentation of the transaction. These fields allow for clear tracking and verification of payments. Below are the essential components to include:

| Field | Description |

|---|---|

| Date of Transaction | Specifies the exact date the payment was received. This helps in organizing records chronologically. |

| Receipt Number | A unique identifier for each receipt. It avoids confusion between multiple transactions. |

| Payer Information | Details such as the name and contact information of the person or entity making the payment. |

| Amount Received | The total value of the cash payment. This field should be clearly visible to avoid any misinterpretation. |

| Payment Method | Indicates how the payment was made, whether by cash, check, or other methods. |

| Purpose of Payment | A brief description or reference to what the payment is for, helping both parties understand the context. |

| Receiver’s Signature | Verification from the party receiving the payment, confirming the transaction’s authenticity. |

By ensuring these fields are present and accurate, the cash receipt serves as a reliable proof of transaction for both the payer and the receiver.

To include tax and discounts, calculate them separately and add the values to the receipt. Begin by determining the tax rate based on the local laws and product category. Multiply the subtotal by the tax rate to find the total tax amount. Add this tax amount to the subtotal to get the total price after tax.

Next, for discounts, subtract any percentage or fixed amount from the subtotal before tax. Ensure you clearly label the discount on the receipt, showing the original price, discount applied, and final amount after the discount. If the discount is conditional (e.g., based on total purchase), make the criteria visible.

Ensure the receipt clearly lists both the tax and the discount amounts, along with the final amount the customer is expected to pay. This transparency builds trust and helps avoid any confusion later on.

Verify the cash receipt template aligns with local tax regulations to avoid legal complications. Ensure that it includes necessary details such as the buyer’s and seller’s information, transaction date, and the correct item descriptions.

- Include your business registration number if required by law.

- Adhere to any specific rules regarding taxes or VAT, showing the tax amounts separately when applicable.

- Ensure that the template complies with consumer protection laws, including providing clear terms of the transaction.

- Review local financial regulations regularly to ensure the template remains compliant with any legal updates.

Implementing these steps reduces the risk of errors and ensures your receipts hold up in the event of an audit or dispute. Double-check with a legal professional to confirm compliance with jurisdiction-specific rules.

Integrating digital signatures into cash receipt templates increases security and confirms authenticity. Digital signatures, based on public key infrastructure (PKI), create a unique encrypted mark, ensuring the receipt cannot be tampered with once signed. This method helps prevent fraud, especially when handling high-value transactions.

To add a digital signature, ensure that your receipt template supports electronic signing, either via PDF software or dedicated signing platforms. Many solutions offer a simple process, where the signer can insert a signature that verifies the transaction. Choose a signature service that complies with local regulations regarding electronic signatures for maximum validity.

Digital signatures also streamline record-keeping by automatically storing verified signed copies. This reduces paper usage, enhances organization, and provides easy access to past transactions when needed for audits or customer verification. Consider using timestamping to add an extra layer of credibility, confirming the exact moment the receipt was finalized.

For businesses that need to comply with legal requirements, adopting digital signatures offers a more reliable and scalable solution compared to traditional handwritten ones. Ensure the digital signing service you choose meets your region’s compliance standards, such as the eIDAS regulation in the EU or the ESIGN Act in the U.S.

Use a cash receipt template in PDF format for smooth, accurate record-keeping. Customize the fields to match your needs, such as adding the transaction date, recipient, and payment details. Ensure clear labeling for each section to avoid confusion. Adjust the layout to fit your business requirements, and consider including both itemized lists for purchases and total amounts. If needed, add a signature section for confirmation.

Keep the receipt brief and to the point. Avoid overloading the document with unnecessary details. The goal is clarity and simplicity, ensuring both parties can quickly reference important information. Save the template in a secure location, and consider keeping backups in case of future audits.

For consistency, save your completed receipts in PDF format to prevent unauthorized changes. This file format is widely accessible, making it easy for recipients to view or print. Also, consider using electronic signing options for added convenience and speed.