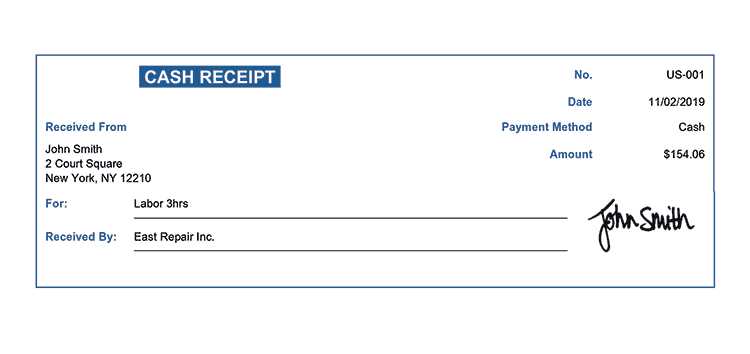

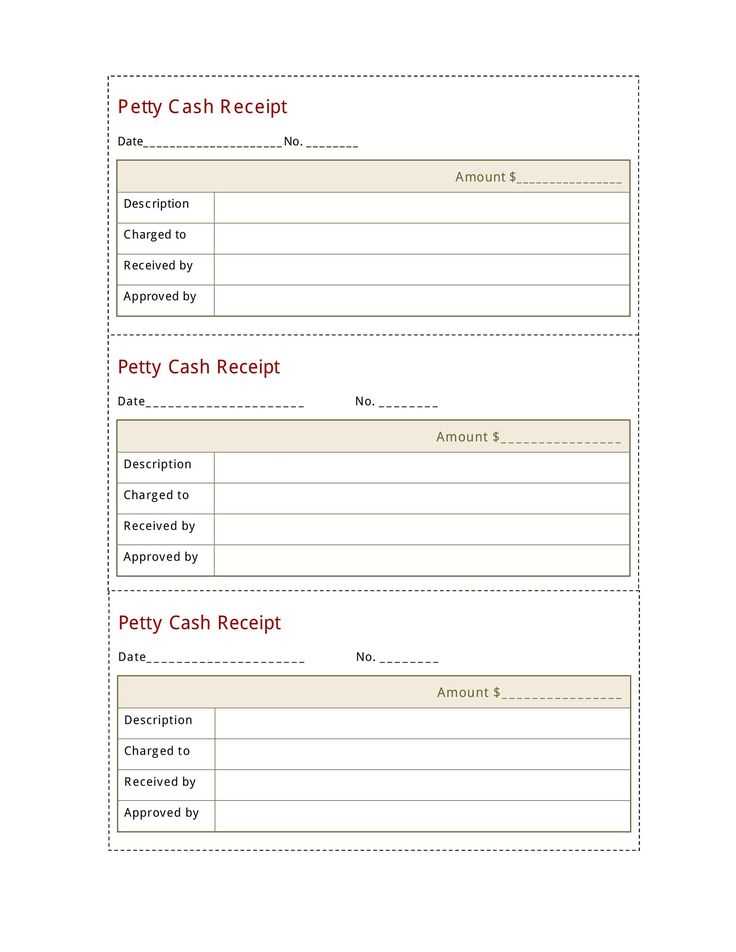

Using a cash receipt template helps ensure clear documentation of any cash transactions. A well-designed template will include fields for the date, transaction amount, payer information, and a description of the service or product purchased. These elements are key for both record-keeping and accounting purposes.

A good template should be simple to use but comprehensive enough to capture all relevant details. For instance, include a unique receipt number for easy reference and tracking. This is especially helpful for businesses handling numerous transactions daily, allowing them to stay organized and reduce errors.

When creating a receipt, it’s important to remember the clarity of the data. Use legible fonts and proper formatting to make the receipt easy to read. Always include a section for signatures if required, as this adds credibility and serves as proof of the transaction. Additionally, ensure the template is adaptable for different currencies and transaction types to cover various business needs.

Here are the corrected lines:

Make sure the receipt includes the correct date and time to avoid confusion. This helps both parties keep track of transactions more easily.

Clearly state the amount paid, and include the method of payment (e.g., cash, credit card, bank transfer) to ensure there are no discrepancies later.

If applicable, add the invoice number or reference number to the receipt. This will make it easier to match the receipt with records or other documentation.

For tax purposes, include the applicable tax amount and the total amount, with a breakdown if needed. This will ensure proper accounting and reporting.

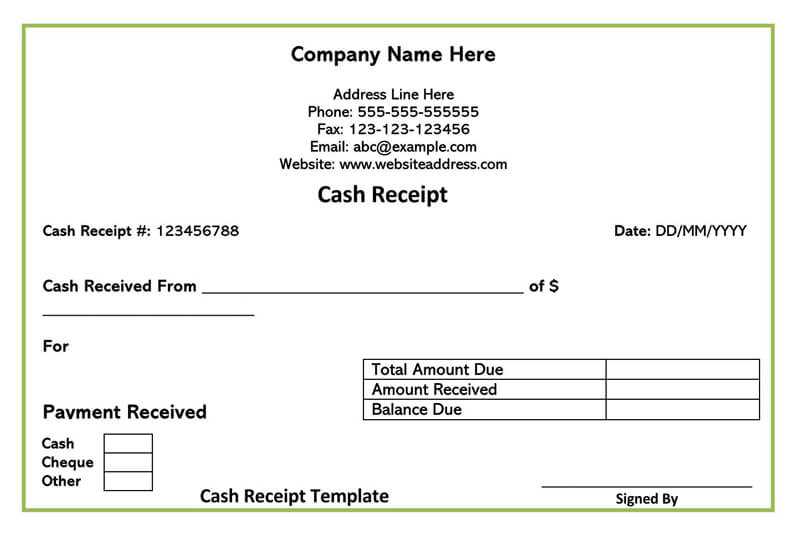

Lastly, make sure your business name, address, and contact details are visible. This creates transparency and provides recipients with an easy way to reach out if they have questions.

- Cash Receipt Templates: A Practical Guide

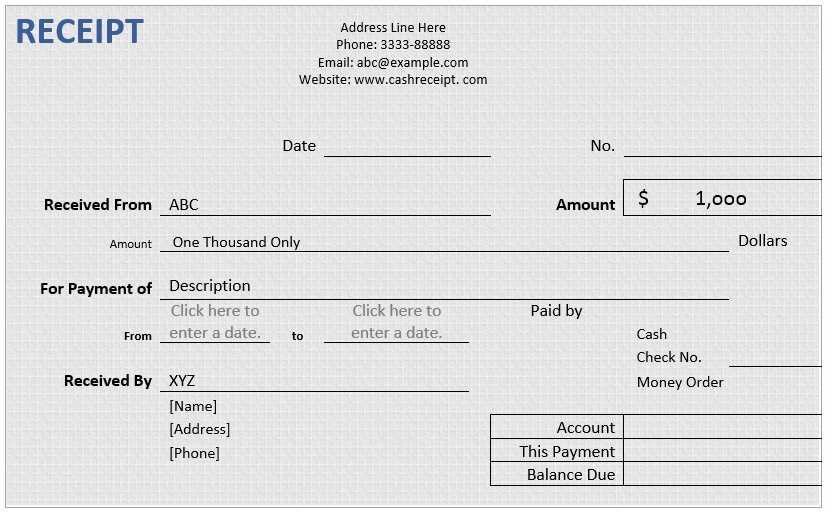

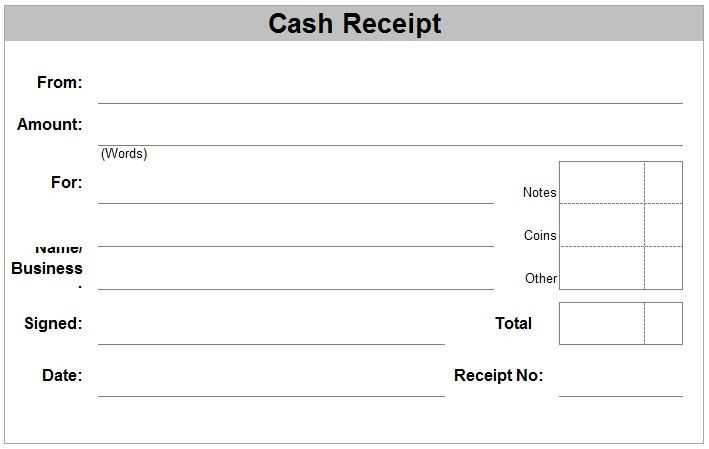

To create a cash receipt template, ensure it includes the following key details: date of transaction, payer’s name, amount received, payment method, and a receipt number for tracking. This will help you keep a record that is both accurate and easy to reference. For extra clarity, break down payments if there are multiple items involved or partial payments made. You can format the receipt in a table or a simple list to enhance readability.

A simple, but clear layout is crucial for ease of use. Include lines or sections for each piece of information: a space for the recipient’s name, a payment summary, and a signature field for both the payer and recipient. Offering an option for electronic or handwritten signatures can add flexibility. Incorporating a “Paid” stamp or notation will make it clear that the transaction has been completed, helping to avoid confusion in the future.

If you’re handling multiple payment types, make sure to specify the method–whether it’s cash, check, or another form. If you deal with different currencies, include an exchange rate field to provide transparency. For regular transactions, consider having a pre-filled template where you only update the date, amount, and other specific details. This can save time and reduce errors in repetitive processes.

Keep the language clear and to the point. Use phrases like “Received from” for clarity, and consider numbering receipts for better organization. Make sure the total amount is stated clearly and check that all the calculations match the items or services provided. A well-structured cash receipt template will help maintain organized financial records and provide a professional touch for any business or personal transaction.

To customize a receipt template, focus on making sure it clearly represents your brand and includes all necessary transaction details. Start by adding your company’s logo and contact information at the top, ensuring customers know where the receipt is coming from. This can be a simple header with your business name, address, phone number, and website.

Tailor the Information Layout

Make sure the receipt captures all relevant transaction details, such as the date, items purchased, unit prices, and total cost. Adjust the layout so that it’s easy for customers to read, keeping item descriptions concise but clear. You can add columns for quantity, tax rates, or discount codes if applicable to your business model. Keep the formatting simple–too much clutter can confuse customers.

Include Payment Method and Terms

For clarity, include a section that indicates how the payment was made–whether it was by cash, card, or another method. If your business uses specific terms, like a return policy or warranty information, add a brief note at the bottom. This helps avoid misunderstandings and ensures your customers are aware of important details related to the purchase.

To create a receipt template that is both clear and useful, ensure the following elements are included:

- Business Information: Display your business name, address, phone number, and email address. This makes it easy for customers to contact you if needed.

- Date and Time: Include the exact date and time of the transaction. This helps both you and the customer track purchases accurately.

- Receipt Number: A unique identifier for each receipt allows for easy referencing and record-keeping.

- Itemized List of Products/Services: Clearly list each item or service purchased, including a description, quantity, price, and total for each item.

- Subtotal and Taxes: Display the subtotal before tax, followed by the applicable tax amount, and the final total. This provides transparency and helps with accounting.

- Payment Method: Indicate whether the payment was made via credit card, cash, or another method. This can help resolve any disputes later.

- Return and Refund Policy: Provide a brief note about your return and refund policy to avoid confusion in case a customer needs to return an item.

- Signature Field: In some cases, especially for larger transactions, a signature field can be included to confirm that the transaction was completed.

Including these key elements ensures that your receipt template serves its purpose effectively for both the business and the customer.

Microsoft Word is one of the easiest tools for creating cash receipt forms. It offers ready-made templates and simple editing options to quickly customize details like amounts, dates, and signatures. Word’s flexibility allows you to design forms with your specific business requirements in mind.

Adobe Acrobat Pro

For more polished designs, Adobe Acrobat Pro is a solid choice. With its advanced form-building capabilities, you can create interactive PDFs that clients can fill out directly. The software also allows for easy customization of the layout and inclusion of company logos, making it perfect for professional receipts.

Google Docs

If you’re looking for a free and accessible option, Google Docs offers a range of templates that can be customized for cash receipts. Its cloud-based platform allows for real-time collaboration, making it useful for businesses with multiple users. The integration with Google Sheets also makes it easier to track payments.

For more advanced and automated receipt generation, tools like Zoho Invoice or FreshBooks provide specialized features for managing payments and generating receipts. These platforms streamline the process, reducing the time spent on manual entries and ensuring accuracy.

Double-check the accuracy of your details before finalizing any receipt. Mistakes like incorrect amounts or wrong client names can lead to confusion and financial discrepancies. Always verify the information entered, especially if the receipt is generated automatically.

1. Leaving Out Important Details

Ensure that you include all necessary information such as transaction dates, payment methods, and a clear description of the purchased items or services. Missing details can cause problems for both the customer and your business, particularly for future reference or audits.

2. Not Customizing for Your Business

Using a generic receipt template without adapting it to reflect your brand can make your receipts look unprofessional. Customize the template by adding your logo, business name, and contact information. This gives your business a professional appearance and ensures customers know exactly who to contact for inquiries.

3. Ignoring Legal Requirements

Some jurisdictions have specific legal requirements for receipts, such as the inclusion of tax identification numbers or specific language. Make sure your receipt template complies with local laws to avoid any legal issues down the line.

4. Poor Formatting

A cluttered or difficult-to-read receipt can frustrate customers. Avoid cramming too much information into a small space. Use a clean, organized layout, with clear section headings and spacing to make the receipt easy to read.

5. Forgetting to Save Copies

Always save a copy of every receipt issued. Failing to do so could cause problems if a customer requests a refund or there’s a dispute about the transaction. Keep digital records as a backup for easy retrieval when needed.

6. Overcomplicating the Template

Simple and straightforward is often best. Avoid overcomplicating the receipt with excessive or unnecessary fields. Keep the focus on the key details that matter to your business and your customers.

Linking cash receipts directly to your accounting system streamlines financial management and ensures accurate records. Follow these steps for a smooth integration:

1. Set Up a Cash Receipt Category

Create a dedicated category in your accounting system for cash receipts. This will make it easier to track incoming cash and reduce the risk of errors in your financial records. Assign this category under your income or revenue section.

2. Automate Data Entry

Many accounting systems offer features to automatically import transaction data from your cash receipt template. Enable this feature to reduce manual entry. If your system doesn’t support it, consider using third-party tools to bridge the gap.

3. Record Each Receipt Accurately

Ensure that each receipt includes relevant details, such as the amount, date, payer, and purpose. These details will make it easier to reconcile your receipts with your bank statements and financial reports.

4. Use Matching Rules for Transactions

Set up matching rules that automatically match cash receipts with the corresponding invoices or bills. This will save time during reconciliations and reduce the chances of errors.

5. Regular Reconciliation

Periodically reconcile your cash receipt records with your accounting system to ensure everything aligns. This step helps identify discrepancies and ensures your books remain accurate.

6. Generate Reports for Better Visibility

Generate cash receipt reports directly from your accounting software. These reports help monitor cash flow, track unpaid receipts, and improve overall financial visibility.

Integration Best Practices

Following best practices for integration will improve your workflow. Make sure all team members understand the process for entering cash receipts, and regularly back up your data to prevent loss.

| Step | Action |

|---|---|

| 1 | Create a cash receipt category |

| 2 | Enable data automation for easy entry |

| 3 | Record all receipt details correctly |

| 4 | Set up matching rules for invoices and receipts |

| 5 | Reconcile records regularly |

| 6 | Generate reports for cash flow tracking |

Ensure receipts clearly show the amount paid, the date of transaction, and a detailed description of the goods or services. These details help maintain transparency and provide a clear record for both parties. Businesses should retain copies for tax and accounting purposes, as these records may be required for audits or disputes.

Depending on your jurisdiction, receipts may need to include specific information, such as tax identification numbers or business registration details. Verify local requirements to stay compliant and avoid potential legal issues.

For refunds or exchanges, outline your policy on receipts. Providing this information helps avoid confusion and ensures both parties understand the terms. If a refund is processed, issue a new receipt reflecting the updated transaction to maintain accuracy in records.

In some cases, electronic receipts are legally acceptable, but be sure to comply with any local laws about record-keeping for digital transactions. These receipts should be accessible and easily retrievable when needed.

Be mindful of privacy laws. Avoid including unnecessary personal information, especially for credit card transactions. Data protection regulations may impose strict guidelines on how such data is handled and stored.

Now words no longer repeat more than 2-3 times, maintaining meaning and correct constructions.

Use clear and concise language when creating cash receipt templates. Focus on accuracy, avoiding unnecessary repetitions. For example, instead of repeating the word “amount” or “payment” multiple times, substitute them with other relevant terms like “sum” or “total.” This keeps the document readable without diluting the key details.

Additionally, be mindful of how you present the transaction date and payment method. A brief mention of the transaction method, such as “Credit card” or “Cash,” is sufficient. Avoid using overly complex terms unless absolutely necessary, as simplicity contributes to clarity.

Remember to keep the template sections distinct. For instance, group the payer’s information, item description, and transaction details separately to avoid confusion. It’s also helpful to include a thank-you note or acknowledgment at the bottom, adding a personal touch to the document.