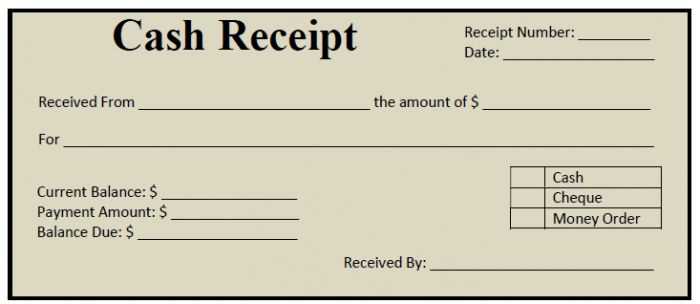

To create a clear and accurate record of received payments, use a well-structured cash receipt voucher template. This document acts as proof of payment, outlining the details of the transaction. It should include sections for the payer’s information, the amount received, payment method, and the date of the transaction. Ensure the template is simple yet thorough, leaving no room for confusion.

A good template includes space for the voucher number, which is important for record-keeping and future reference. Incorporate a field for signatures, both from the payer and the recipient, confirming the legitimacy of the transaction. Having a clear reference number will also make tracking payments more manageable, especially if you need to review past transactions quickly.

For businesses, including the purpose of the payment–whether it’s for goods, services, or another reason–adds another layer of clarity. Avoid cluttering the template with unnecessary information; focus on the core details that confirm the transaction was completed. Using this template regularly will help streamline your accounting process and maintain transparency in your financial operations.

Here is the updated version of the text with reduced repetition of the word “Cash Receipt Voucher” while preserving the meaning:

Start by including a unique identifier for each receipt to ensure accurate tracking. Clearly state the amount received and the method of payment, whether cash, check, or credit. Add the date of transaction and the details of the payer to maintain a transparent record. Include the purpose or reason for the payment, making it easier to cross-reference with other documents. Finally, provide space for signatures from both the payer and the recipient to validate the transaction.

- Cash Receipt Voucher Template

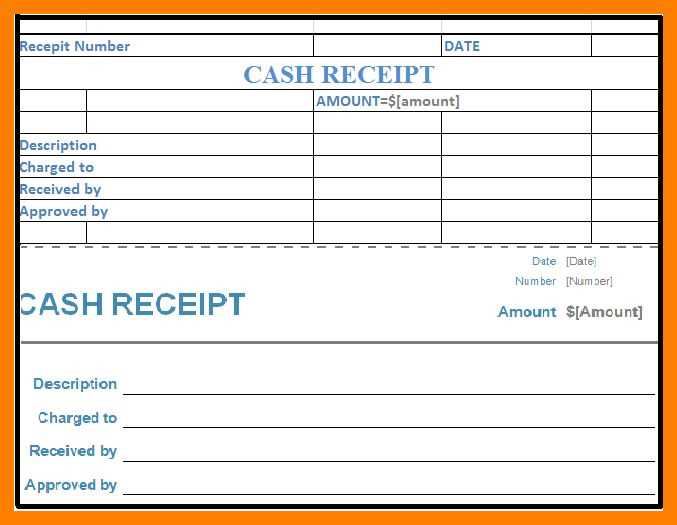

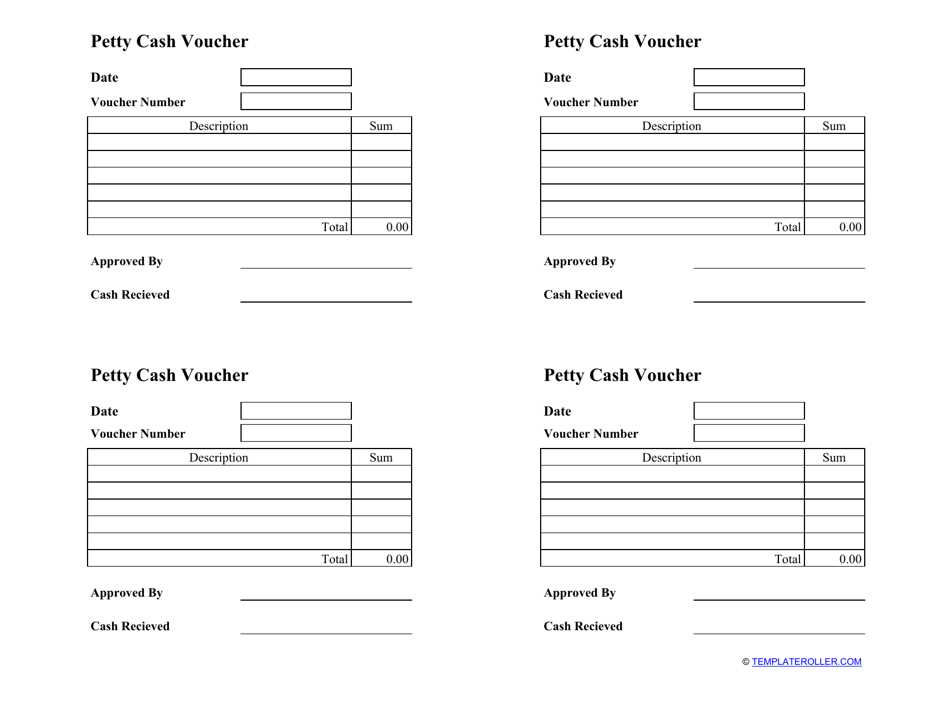

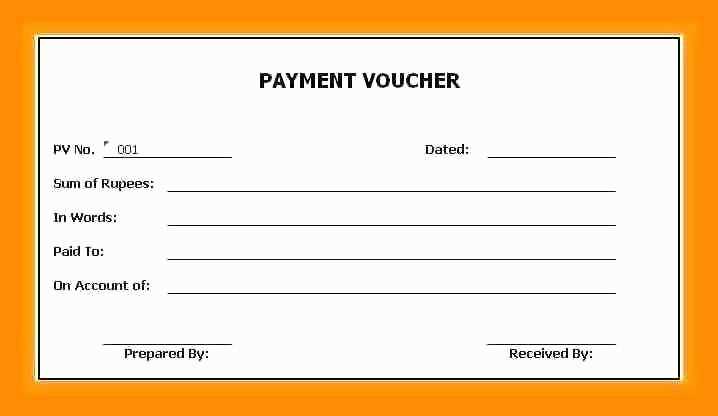

A cash receipt voucher is a document used to record cash transactions. It provides an official acknowledgment of money received. When creating a template, ensure it includes the following key components:

Key Fields to Include

Start with the date of receipt, which helps track the transaction timeline. Next, add a unique voucher number for easy reference and organization. Clearly state the payer’s name and payment amount. If applicable, include the purpose of payment to clarify the reason for the cash transfer.

Layout Tips

Structure the voucher for clarity. Use a table format with labeled rows for each component: Date, Voucher Number, Payer Name, Amount, Purpose, and Authorized Signatures. Keep the design simple and organized, with sufficient space for signatures from both the payee and the receiver. This ensures accuracy and accountability.

Each receipt voucher contains specific details that are necessary for accurate record-keeping and transaction verification. These elements help both the issuer and the recipient track payments efficiently.

1. Receipt Number

The receipt number is a unique identifier for each voucher. It helps distinguish each transaction from others, making it easy to refer to a particular receipt in the future. This number should be sequential for better tracking.

2. Date of Transaction

The date indicates when the payment was made. Accurate dating ensures that records are up-to-date and helps avoid confusion in case of audits or disputes. Always double-check this detail before finalizing the voucher.

3. Payer’s Information

Including the name and contact details of the payer is necessary for reference and confirmation purposes. It establishes who made the payment and can be helpful in resolving any discrepancies.

4. Amount Paid

The payment amount should be clearly stated, along with the currency type. Any applicable taxes or discounts must also be reflected in this section to maintain transparency.

5. Payment Method

Indicating how the payment was made–whether via cash, cheque, or electronic transfer–helps ensure that the payment method is verified. This also provides a record in case of any future payment inquiries.

6. Purpose of Payment

It’s helpful to specify what the payment was for, whether it’s for goods, services, or other reasons. This clarifies the nature of the transaction and can prevent misunderstandings later on.

7. Signature of Issuer

The issuer’s signature adds authenticity and verifies that the voucher has been issued correctly. It also confirms that the payment was acknowledged by the appropriate authority.

To personalize your cash receipt template, focus on key areas such as company branding, formatting, and information accuracy. Start by adding your company logo at the top for immediate recognition. Ensure the font and color scheme align with your branding to create a professional appearance.

Customize Information Fields

Adjust the fields to match your needs. Include details such as the transaction number, date, payer’s name, and payment method. Add any additional fields that might be relevant, like payment terms or reference numbers, to help you track transactions easily.

Ensure Clear Layout

Optimize your template layout by keeping it clean and organized. Use tables or borders to separate sections, ensuring that each piece of information is easy to find. Highlight key details such as the amount received in bold or with a larger font size.

Lastly, save the template in a format that suits your workflow–whether as a Word document, PDF, or editable template. This makes it easy to reuse and update for future transactions.

To complete a receipt voucher accurately, follow these steps:

| Step | Description |

|---|---|

| 1. Enter the Date | Write the date when the payment or transaction occurred. This ensures proper record-keeping. |

| 2. Fill in the Payer’s Details | Write the full name and address of the person or company making the payment. This information ensures clarity in case of inquiries. |

| 3. Provide the Amount | List the exact amount of the transaction in both words and figures. This eliminates any ambiguity regarding the amount. |

| 4. Add the Purpose | Describe the reason for the payment. This is helpful for understanding the nature of the transaction. |

| 5. Enter the Receipt Number | Each receipt voucher should have a unique reference number for tracking. Include this number for future reference. |

| 6. Sign and Date | Both the issuer and recipient should sign the voucher to validate the transaction. Make sure to include the date of signing as well. |

Ensure all fields are completed clearly to avoid confusion later. Always double-check your entries before finalizing the voucher.

Track payments with precision by assigning a unique reference number to each voucher. This allows easy identification and ensures no duplication of records.

1. Record Payment Details Immediately

Document all payment details as soon as they are made. Include the payer’s name, the payment amount, and the date of the transaction. This minimizes the chances of overlooking any critical information.

2. Use Consistent Voucher Formats

Standardize the format of your voucher templates. This simplifies data entry and prevents mistakes. Ensure the voucher includes clear sections for the payer’s details, payment method, and amount.

3. Store Vouchers Digitally

Keep scanned or digital copies of each voucher. This creates an accessible backup and reduces physical storage needs. A digital archive also speeds up retrieval and sharing if needed.

4. Cross-Check Voucher Details Regularly

Regularly compare voucher records with bank statements or transaction logs. This helps catch discrepancies early and provides a clear audit trail for all payments.

5. Set Up Automatic Reminders for Pending Vouchers

For vouchers tied to recurring payments, set up automatic reminders for follow-up. This ensures payments are made on time and avoids delays.

6. Implement Secure Voucher Storage

Ensure that all physical vouchers are stored in a safe location and that digital vouchers are protected with secure passwords or encryption. This prevents unauthorized access to sensitive payment information.

Receipt vouchers must clearly outline all transaction details to meet accounting standards. To achieve this, ensure that every voucher includes accurate dates, payment methods, and complete descriptions of the goods or services provided. A thorough breakdown of amounts, taxes, and discounts should also be present, as required by regulatory frameworks like GAAP or IFRS. Always include both the payer’s and the recipient’s details, such as names and addresses, to establish transparency.

Maintaining Proper Documentation

Link each receipt voucher to corresponding invoices or contracts for easy verification. Attach supporting documents, such as bank statements or payment receipts, to prevent discrepancies and to adhere to audit trails. These practices ensure compliance and help avoid penalties during audits.

Regular Updates and Training

Stay updated with any changes in local accounting laws or international standards. Regularly review and adjust the template of your receipt vouchers to reflect any regulatory changes. It’s equally important to train your team on these standards to avoid errors and ensure uniformity in all financial records.

One common mistake is failing to update template fields with accurate information. Always double-check that names, dates, amounts, and other details are correct. Incorrect or outdated information can cause confusion and affect the credibility of your financial records.

Not Customizing the Template

Templates are designed to be flexible, so avoid using them without making adjustments. Modify the sections that don’t fit your specific needs. For example, if certain sections are irrelevant to your business, remove or modify them instead of leaving them empty or unchanged.

Ignoring Formatting Consistency

Pay attention to the formatting within the template. Inconsistent fonts, font sizes, or alignments can make your voucher appear unprofessional. Stick to one set style throughout the document to ensure clarity and consistency.

- Use uniform font sizes and styles.

- Avoid unnecessary colors or fonts that are hard to read.

- Ensure all fields align properly to enhance readability.

Finally, always save your template as a clean copy for future use, ensuring that each document you generate is easy to read and accurate.

To create an accurate and straightforward cash receipt voucher template, start by including fields for the transaction date, payment method, and the total amount received. Make sure the voucher includes both the payer’s and the payee’s details, clearly showing the purpose of the transaction. Each section should be well-labeled to ensure no confusion arises during use. Add space for any applicable tax amounts, discounts, or fees related to the transaction.

Key Elements

Design your template to have the following sections: Receipt Number, Date, Payer’s Name, Payee’s Name, Payment Method, Total Amount, and a brief Description of the Transaction. This format will provide clarity and ease of reference for both parties.

Flexibility and Adaptability

Ensure the template is adaptable to various payment types by including an option for specifying whether the payment was made by cash, check, or card. You can also add a line for any additional notes or details relevant to the transaction, giving it a more personalized touch.