Clear and Concise Receipt Structure

A well-organized cash receipt ensures transparency in transactions. Every receipt should include the following:

- Date and Time: The exact moment the transaction occurs.

- Receipt Number: A unique identifier for easy tracking.

- Payer Information: Name and contact details of the customer.

- Received By: The name of the cashier or business representative.

- Transaction Details: A breakdown of purchased items or services.

- Amount: Total sum received, including tax and discounts.

- Payment Method: Cash, card, or any other accepted payment method.

- Company Information: Name, address, and contact details of the business.

Step-by-Step Guide for Creating a Cash Receipt

1. Use a Standard Format

Keep the layout simple and structured. Use a template with clearly marked fields to ensure consistency.

2. Enter Transaction Details Accurately

Record each item or service separately, including unit price, quantity, and subtotal. Avoid rounding errors.

3. Indicate Taxes and Discounts

Specify applicable taxes and any discounts applied. This prevents confusion and ensures compliance with regulations.

4. Confirm Payment and Provide a Copy

Once payment is received, mark the receipt as “Paid” and hand a copy to the customer. Keep a duplicate for records.

Following these steps guarantees a professional and legally compliant cash receipt that simplifies bookkeeping and enhances customer trust.

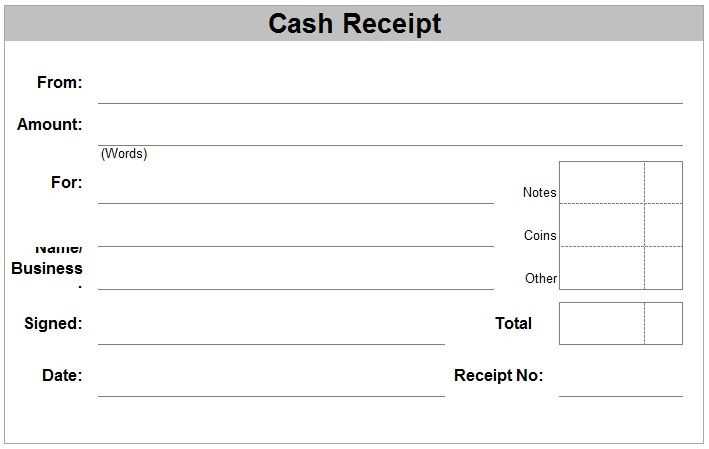

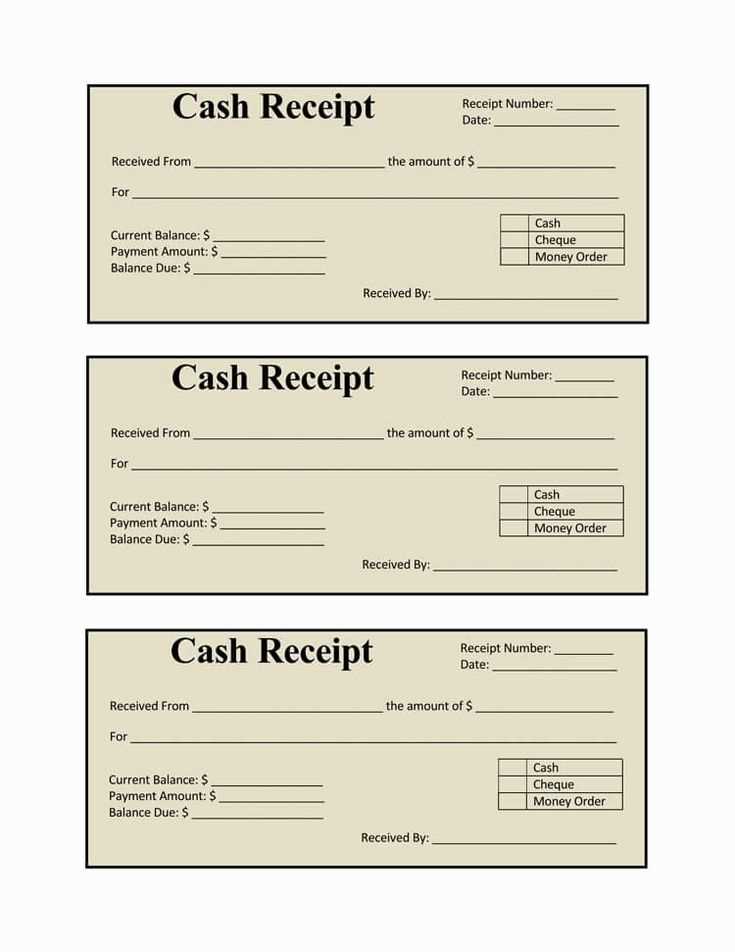

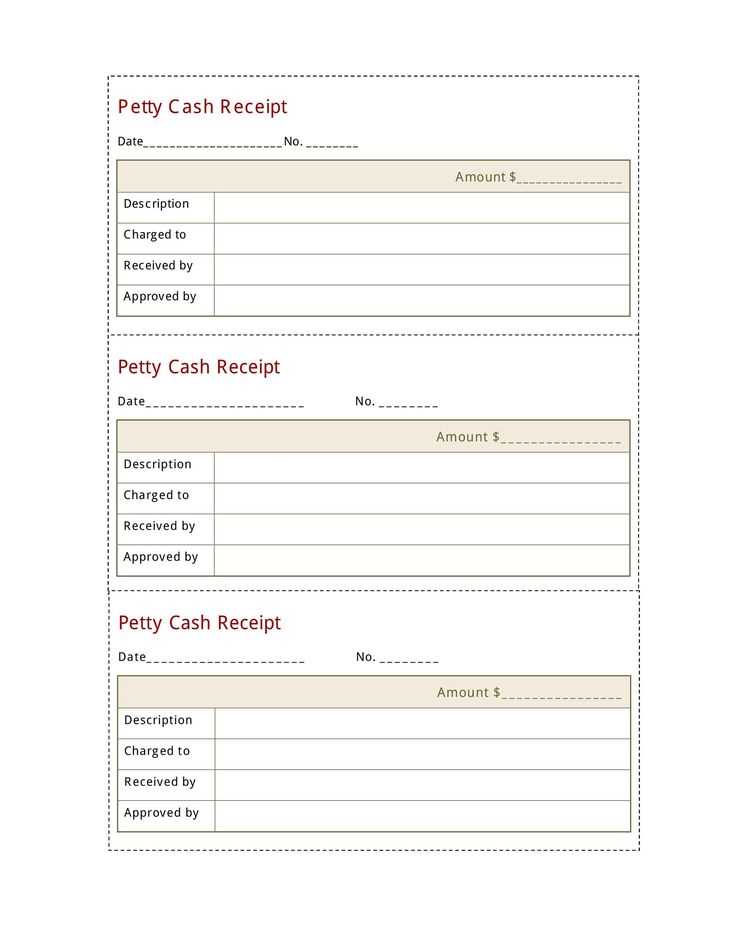

Cash Receipt Walkthrough Template

Key Elements of a Cash Receipt Template

Structuring Payment Details for Clarity

Formatting Tips for Readable Receipts

Common Errors in Creating Cash Receipts

Legal and Accounting Aspects of Cash Receipts

Customizing a Receipt Template for Your Business

Include the date, receipt number, and payer details at the top to establish a clear reference for transactions. Ensure the amount is both numerically and verbally represented to prevent misinterpretation.

Use distinct sections for itemized details, payment method, and applicable taxes. Align figures consistently, keeping spacing uniform for easy readability. Break long numbers with commas for better clarity.

Choose a legible font and maintain sufficient contrast between text and background. Avoid excessive styling that may obscure critical information.

Common mistakes include missing signatures for cash payments, unclear descriptions, and inconsistent numbering. Regularly audit receipt records to catch discrepancies early.

Ensure compliance with tax regulations by including necessary legal disclaimers. Store copies digitally and physically to maintain proper financial records.

Customize templates by adding a business logo, adjusting layout to fit specific needs, and incorporating QR codes for quick verification. Adapt designs to align with branding while keeping all essential details intact.