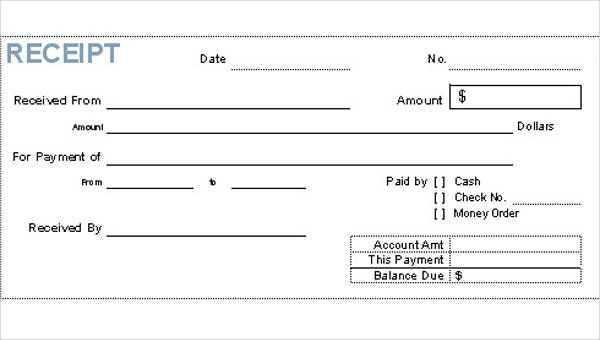

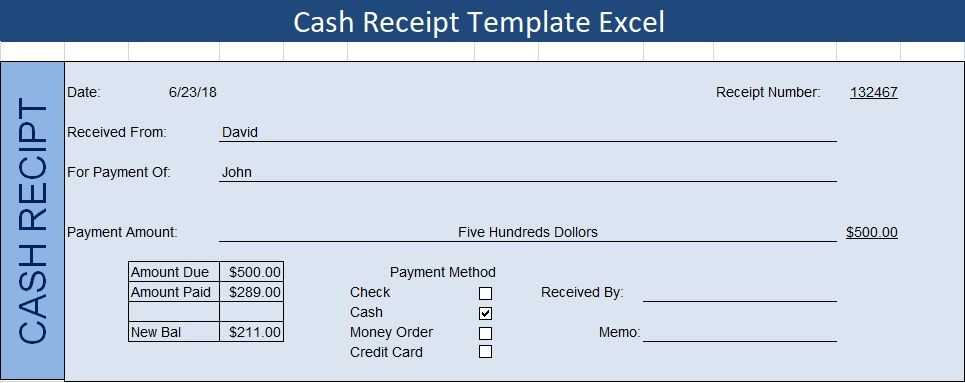

To create a clear and accurate cash receipt, start by including the transaction date, payment amount, and the name of the payer. Specify the method of payment, whether it’s cash, check, or credit, to avoid confusion. Ensure that the receipt contains a brief description of the goods or services provided.

Next, break down the amounts received. If applicable, itemize different components of the payment. For instance, if a partial payment is made for an invoice, detail each portion to show the balance due. This prevents future disputes or misunderstandings.

Ensure the receipt is signed by the authorized person. This not only adds credibility but also ensures accountability for the transaction. Include the signature of the recipient as well as the payer when possible, especially for higher-value transactions. Include a receipt number for easy reference.

Here’s the corrected version:

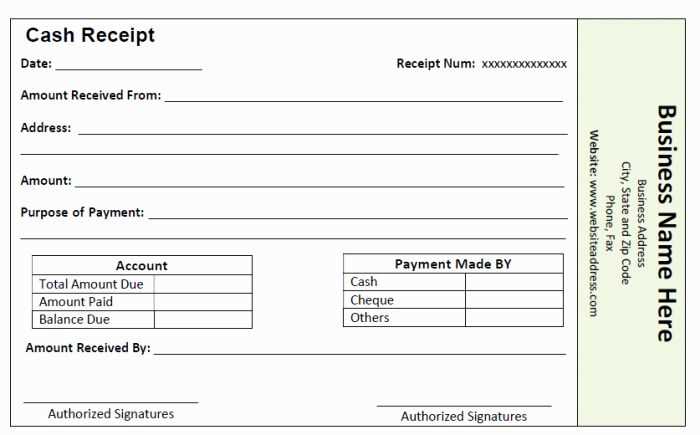

Start by ensuring the cash receipt template clearly lists all essential fields. Include the date, receipt number, payer’s details, payment method, and the amount. Use a clean layout that separates these fields to avoid clutter.

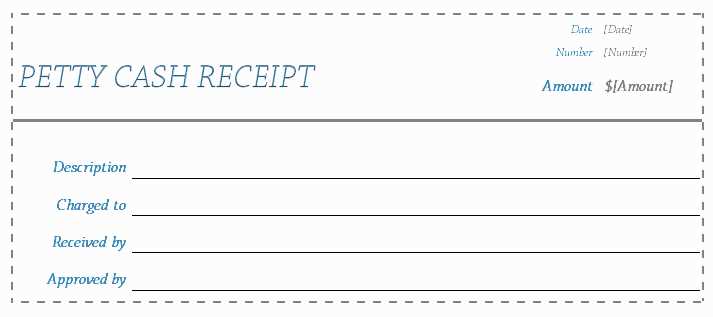

For the transaction description, be concise. Specify the purpose of the payment and reference any related invoices or receipts, if applicable. This provides clarity for both the payer and the receiver.

For accuracy, double-check the format of numeric entries. Align numbers to the right and ensure the decimal points are consistent. Additionally, include a section for any applicable tax breakdowns to avoid confusion.

If the receipt is part of a larger accounting system, add a field to indicate which account or department the funds are allocated to. This adds transparency to internal reporting and tracking.

Finally, provide a section for any additional notes or comments at the bottom. This can be helpful for adding further context or clarifying special instructions regarding the payment.

- Cash Receipt Walkthrough Template Example

To create a straightforward and reliable cash receipt, follow this simple template example. Each section should be filled out carefully to ensure accuracy and transparency.

1. Receipt Number: Assign a unique identifier for each cash receipt to avoid confusion and track payments. This can be a sequential number or a combination of date and time.

2. Date of Receipt: Specify the exact date the payment was made. This helps with financial record-keeping and ensures proper documentation for future reference.

3. Payer Information: Clearly indicate the name of the person or organization making the payment. Include contact details if necessary, such as an address or phone number, for future communication.

4. Amount Received: List the total amount of cash received. Be sure to double-check the amount to ensure accuracy. If there are multiple payments or partial payments, document each accordingly.

5. Payment Method: Indicate the method used for the payment (e.g., cash, check, bank transfer). If using multiple methods, detail each one.

6. Purpose of Payment: Provide a brief description of why the payment was made (e.g., invoice payment, donation, loan repayment). This keeps financial records clear and organized.

7. Signature: Both the payer and the receiver should sign the receipt, confirming that the transaction took place as recorded.

8. Additional Notes: Use this section for any extra details that may be relevant to the transaction, such as discounts applied or payment plan terms.

By following this template, you can ensure that your cash receipt is complete, clear, and ready for any necessary audits or future reference.

To create an effective cash receipt template, focus on the key elements that need to be included. This ensures clarity and prevents confusion. Follow these steps:

1. Header Section

Start with a clear and visible header at the top of your template. It should state “Cash Receipt” or “Receipt” to make it instantly recognizable. Below the title, add your business name, logo, and contact details like phone number or email.

2. Date and Receipt Number

Include spaces for the date of transaction and a unique receipt number. This helps with tracking and managing records. Use a number sequence for easy reference in the future.

3. Payment Details

- Amount Received: Leave space for the payment amount.

- Payment Method: Specify methods like cash, check, or credit card.

- Paid By: Include a field for the payer’s name or business name.

4. Description of Goods/Services

List the goods or services provided in exchange for payment. If needed, include a section for quantity, unit price, and total cost.

5. Footer Section

- Include a space for notes or additional information (e.g., special discounts or payment terms).

- Provide space for the signature of both the payer and the payee if necessary for verification.

Ensure the layout is clean and easy to follow. Keep the sections organized for quick reference and professional appearance. Once your template is set up, save it in a format that’s easy to edit and print, such as a Word or Excel document.

Include the following key fields in your receipt template to ensure clarity and provide all necessary details for both parties:

| Field | Description |

|---|---|

| Receipt Number | A unique identifier for each transaction, helping with tracking and future reference. |

| Date of Transaction | The exact date when the transaction took place, ensuring a clear record of the purchase. |

| Business Name and Contact Information | Include your business name, phone number, email, and physical address to make it easy for customers to contact you. |

| Customer Information (Optional) | For personalized services, include the customer’s name, address, or account number. |

| Itemized List of Products/Services | Clearly list each product or service purchased, including the quantity, price per item, and total cost for each. |

| Subtotal | The sum of all items before taxes and additional charges. |

| Taxes | Show applicable tax amounts and the corresponding rate to maintain transparency in pricing. |

| Discounts (if applicable) | If any discounts were applied, specify the amount deducted from the total price. |

| Total Amount Paid | The final amount the customer paid, including all taxes, discounts, and additional charges. |

| Payment Method | Specify how the payment was made–cash, card, or other methods. |

| Signature (Optional) | While not always required, a customer signature may be included as confirmation of payment and receipt of goods/services. |

Adapt the cash receipt template to match each payment method, ensuring all necessary details are captured accurately. Each payment method requires distinct fields to reflect the transaction process effectively.

Cash Payments

- Add a specific field for the amount paid in cash.

- Include space for the cashier’s signature to confirm the transaction.

- Ensure the template records any change given to the customer to avoid confusion later.

Credit and Debit Cards

- Include a section for the card type (Visa, MasterCard, etc.), along with the last four digits of the card number for identification.

- Leave a spot for the transaction authorization code or approval number, verifying the payment was processed.

- Allow room to record the transaction date and time for accurate bookkeeping.

Online Payments

- Provide fields for payment reference numbers, transaction IDs, or confirmation codes to verify the authenticity of the payment.

- Include a link or instructions for accessing the online payment platform’s receipt if applicable.

Checks

- Leave space to record the check number, bank name, and routing number for easy tracking.

- Make sure the template can capture the date the check was issued and the amount written on it.

Gift Cards and Vouchers

- Ensure there is room for the gift card or voucher number, as well as the amount used.

- Provide a space for recording the balance remaining on the card if it’s not a full payment.

Cluttered layout can confuse customers. Keep the receipt organized with clear sections for purchase details, taxes, and payment methods. Use space effectively and avoid unnecessary elements that distract from the key information.

- Small Fonts – Using small font sizes may make it hard for customers to read the details. Always use a legible size for important information like total amounts and transaction dates.

- Missing Transaction Details – Ensure all necessary details, like item descriptions, prices, taxes, and total amounts, are included. Omitting any of these can lead to misunderstandings or disputes.

- Unclear Tax Breakdown – A lack of transparency in tax calculations can raise concerns. Clearly separate taxes from the item price and indicate the rate applied to each charge.

- Unreadable Logos or Branding – Poor-quality printing or overly complicated designs can make your branding illegible. Make sure your logo and contact information are visible and clear.

- Unorganized Itemized List – Present the list of items in a logical order, grouping similar items together. This makes the receipt easier to follow and more professional.

- Not Including Refund or Return Policies – If applicable, include your store’s return or refund policy in a legible and accessible place. This helps reduce confusion if the customer needs to address issues with the purchase.

To implement a cash receipt template in accounting systems, begin by ensuring the system supports customizable templates for receipts. The template should capture key transaction details, such as date, amount received, payer’s information, and method of payment. Ensure all fields are clearly defined and necessary for the transaction’s accuracy.

Step 1: Design the Template Structure

Organize the template to display transaction information logically. Include sections for the payer’s name, receipt number, date, and total amount. Add specific fields for payment details, including payment method (cash, check, credit card, etc.) and any applicable tax breakdowns. These elements will make the receipt clear and legally compliant.

Step 2: Automate Data Entry

Link the template to the system’s core accounting software to auto-fill fields based on transaction entries. This reduces manual input, minimizing errors and improving efficiency. Ensure the template integrates seamlessly with the ledger to record the transaction in real-time.

Once the template is set up, test it using sample transactions to verify that all fields populate correctly and that the receipt is generated in the desired format. Regularly review and update the template as needed to stay aligned with accounting standards and regulatory requirements.

Store cash receipts in a safe, organized manner to avoid loss or damage. Use a dedicated folder or binder for physical receipts, and ensure they are kept in a dry, secure place away from direct sunlight or moisture. For digital receipts, create a system to organize files by date, vendor, and type of transaction. Use cloud storage for easy access and backup.

Label each receipt with relevant details such as the date, amount, and vendor name. This will make retrieval easier if needed for auditing or returns. Avoid cramming multiple receipts into one envelope or file–this can cause physical wear and tear and make tracking difficult.

For digital receipts, regularly back up files to ensure they are not lost in case of hardware failure. If using an expense tracking software, make sure receipts are uploaded in a timely manner and categorized correctly. This will help maintain accurate financial records and simplify tax filing.

Periodically review your storage system to remove outdated receipts and free up space for new ones. For physical receipts, consider scanning or photographing them to keep a digital backup, especially for receipts that may fade over time.

Cash Receipt Walkthrough Template Example

When creating a cash receipt walkthrough template, focus on clarity and ease of understanding. Begin with the date of receipt and specify the amount received. Include sections for both the payer’s details and the purpose of the payment. This ensures transparency and accuracy in tracking all financial transactions.

It is recommended to break down the template into clear sections. For instance, the first section can detail the payer’s name, address, and contact information. The next section should cover payment details such as method (e.g., cash, check, credit card) and transaction ID. This helps avoid confusion later in the process.

| Field | Details |

|---|---|

| Date | Enter the date of receipt |

| Payer Name | Include the full name of the payer |

| Payment Method | Specify whether it’s cash, check, or electronic transfer |

| Amount | State the total amount received |

| Purpose | Describe the reason for the payment |

| Transaction ID | Include any unique reference or transaction ID number |

Conclude the template with a clear acknowledgment statement, noting that the receipt was issued to confirm payment. Keeping this information organized ensures smooth processing and future reference when needed.