Follow this structured approach to streamline the cash receipt process for WAL. This template offers clarity in documenting each step, ensuring all details are captured accurately and consistently.

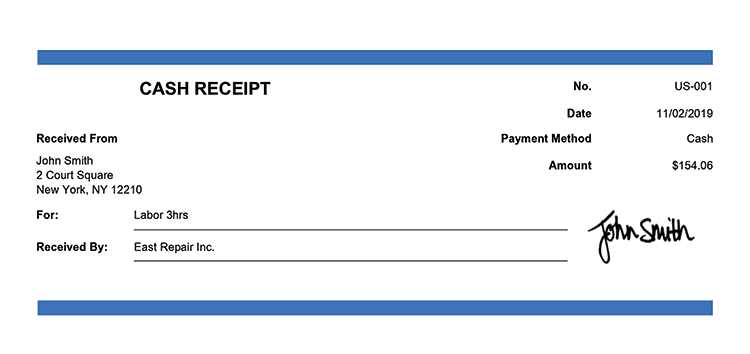

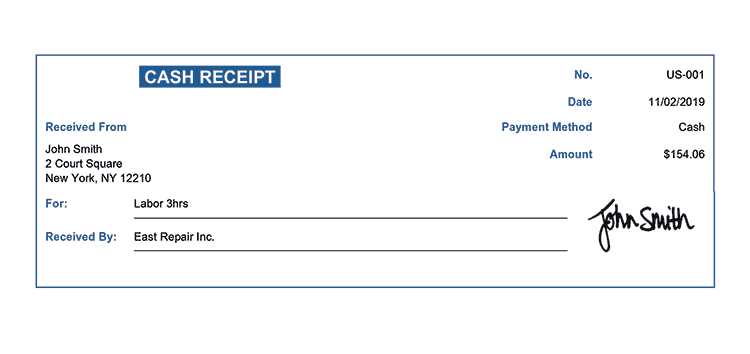

Start by recording the date of the transaction and the amount received. Make sure to include the method of payment, whether it’s cash, credit card, or another form. For each entry, provide a brief description to clarify the purpose of the transaction.

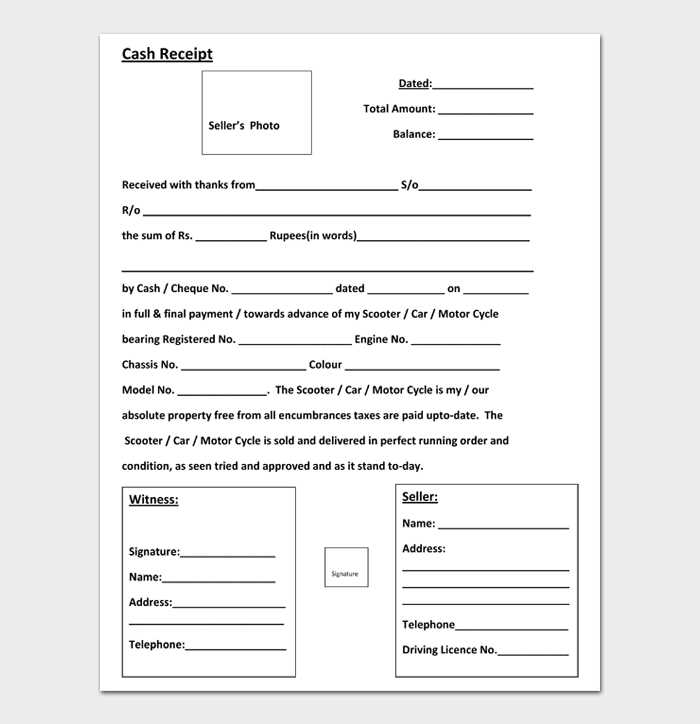

Ensure the receipt also includes the payer’s details, such as the name and contact information if available. This allows for easy verification of the transaction later. Conclude by noting any applicable taxes or deductions associated with the payment.

Use this template as a reference to maintain accurate financial records, ensuring each step is clearly outlined and easy to follow.

Cash Receipt Walkthrough Template of WAL

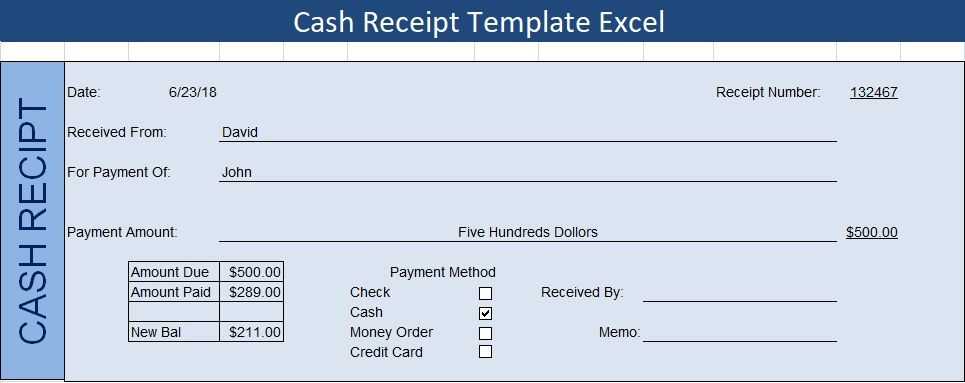

Begin by verifying the transaction details for accuracy. Confirm the date, amount, and payer information are correctly entered in the template. The next step involves matching the cash receipt against your accounting records to ensure consistency. Ensure each entry is categorized properly according to your financial system’s structure.

Next, input the payment method and reference number, ensuring all supporting documentation, such as bank deposit slips or invoices, is attached for verification. It’s crucial that every field is populated to maintain clarity and prevent discrepancies in future audits.

Once the receipt is recorded, double-check for any discrepancies between the amounts listed in the template and actual received funds. In case of a mismatch, immediately follow up with the payer or review the accounting entries to locate the error.

To wrap up, ensure that the receipt is stored in the proper ledger or filing system according to your organization’s protocol. This ensures quick access in case of future inquiries or audits. Always back up the data electronically to safeguard against potential loss of physical records.

Step-by-Step Guide to Cash Receipt Template Setup

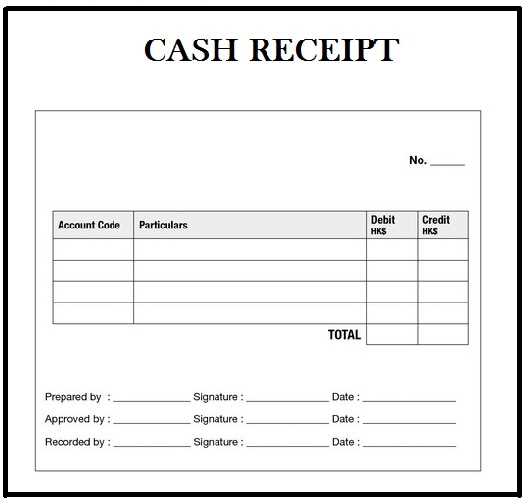

To set up a cash receipt template, begin by identifying the necessary fields for the document. Include sections for the date, amount received, payment method, and payer details. Make sure to leave space for item descriptions or services if applicable. This ensures all key transaction details are clearly noted.

Design and Structure

Organize the template by creating clear sections. Use a table or grid layout to divide the data into readable parts. The header should have the company name and contact information, followed by transaction details such as receipt number and payer details. Position the payment details in a separate row for clarity.

Customization and Finalization

Customize the template by adding your company logo, payment terms, or specific notes to personalize it. Once everything is arranged, save the template in an easily accessible format like PDF or DOCX. Ensure that the template is ready for use in multiple scenarios by keeping it simple yet adaptable.

How to Ensure Accurate Data Entry for Transactions

Verify each transaction’s details before entering them into the system. Double-check the amount, date, and relevant references. Utilize drop-down menus or auto-fill options to reduce human error when selecting categories or account numbers.

Keep clear guidelines for data formats, especially for dates, phone numbers, and addresses. This ensures consistency across entries and prevents invalid or incomplete data from being recorded.

Implement real-time validation to alert users of any discrepancies, such as mismatched totals or missing information. This helps prevent errors before they can affect the final record.

Limit manual data entry by integrating automated systems where possible. For instance, using scanners or automated receipt capture tools can drastically reduce input mistakes.

Train staff regularly on the importance of accurate data entry and the specific requirements for your system. Offer refresher courses to keep everyone updated on any changes to protocols.

Maintain a thorough review process by having multiple team members cross-check the entered data. A second pair of eyes can catch mistakes that may have been overlooked initially.

Best Practices for Documenting and Storing Cash Receipts

Use a consistent format for documenting cash receipts. Ensure that each receipt includes the date, transaction details, and the amount received. This basic structure makes it easier to reference later.

Store receipts in a secure, organized system. Consider using both physical and digital methods. For physical receipts, use a filing system with labeled folders, and store them in a locked location. For digital receipts, create a cloud-based storage solution or encrypted file management system. Always back up digital files regularly.

Key steps to follow:

- Scan physical receipts to create digital copies and store them in organized folders.

- Ensure receipts are backed up to multiple locations (cloud storage and an external hard drive).

- Use a simple naming convention for files, such as the date and transaction type, for easy retrieval.

- Regularly audit your storage system to ensure all receipts are documented and securely stored.

Implement access controls to protect sensitive data. Limit access to authorized personnel only and regularly review permissions to maintain security.

Key considerations:

- Ensure employees responsible for storing receipts understand the process and security protocols.

- Develop a clear policy on document retention and deletion based on company needs and legal requirements.

Review and update your system periodically. As your business grows, adjust your documentation process and storage solutions to stay organized and compliant with regulations.