To streamline your understanding of Walmart’s cash receipt process, start by familiarizing yourself with the key components of the template. This will help ensure accuracy when documenting each transaction.

The first step is to verify the date and time on the receipt. This is critical for tracking the purchase and reconciling it later. Double-check that the transaction date matches the corresponding entry in the system to avoid discrepancies.

Next, review the total amount and payment method listed. Ensure that the payment type (e.g., cash, card, or mobile payment) is correctly noted and matches the recorded transaction method. If applicable, note any additional charges, such as taxes or discounts, which should be clearly outlined in the template.

Pay special attention to the itemized list of products and their prices. Each item should be clearly separated with quantities and unit prices indicated. Any promotional or loyalty discounts must be reflected, ensuring the final total is accurate and transparent.

Finally, verify the receipt’s reference number or unique identifier. This ensures the document is traceable in Walmart’s system, helping to resolve potential issues quickly. Store this receipt securely for future reference or auditing purposes.

Here are the corrected lines:

When processing cash receipts for Walmart, ensure you include all necessary transaction details. Each line must clearly state the transaction type, date, and the corresponding payment amount. Be specific with the payment method, whether it’s cash, credit, or another method. Avoid generic terms like “payment received”–instead, specify the amount and reference number, if applicable.

Key Adjustments

Update line items that include unclear payment method descriptions. Replace vague phrases like “payment method” with specific identifiers, such as “credit card” or “cash” followed by the exact amount. Include transaction IDs for easier tracking.

Example Format

Ensure the format aligns with Walmart’s receipt template. For example, the corrected line should read: “Paid via Visa ending in 1234: $50.00” instead of simply “Payment received: $50.00”. This gives full transparency and makes the receipt more accurate.

- Cash Receipt Walkthrough Template of Walmart

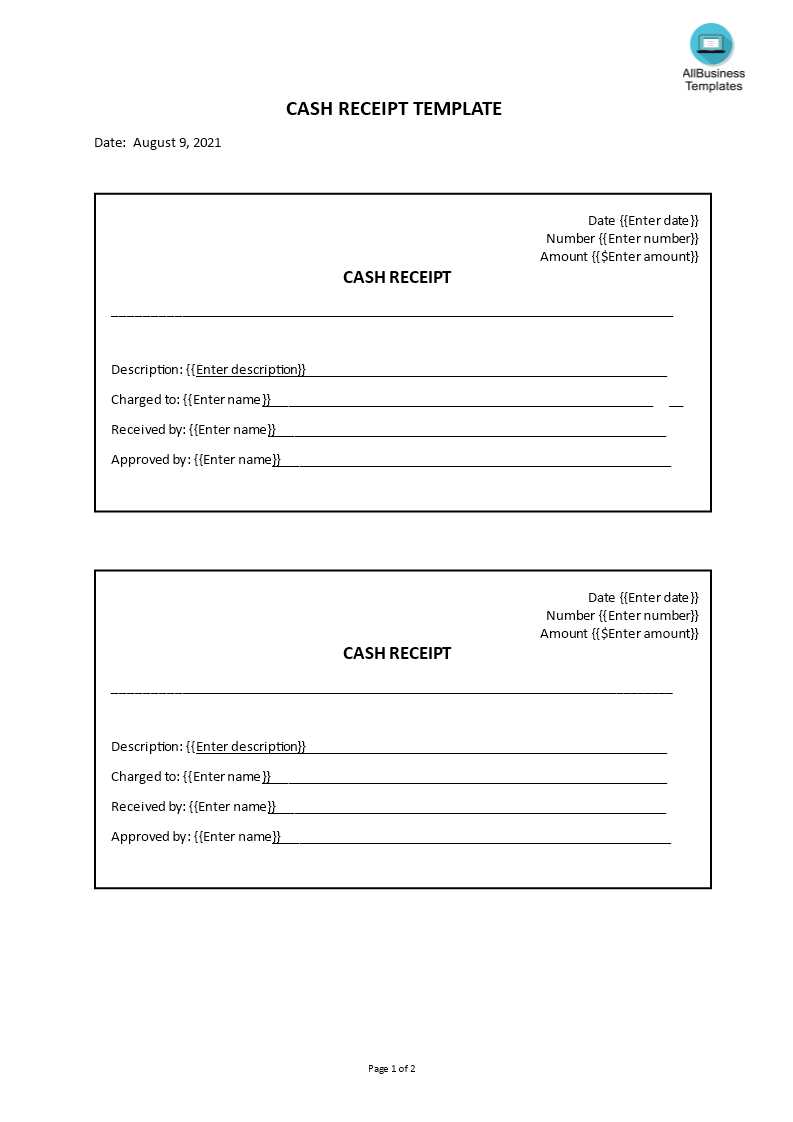

To streamline the cash receipt process at Walmart, start by clearly outlining the sections within the template. Make sure it includes: Transaction ID, Date of Transaction, Cashier ID, and Itemized Purchase Details. Include separate fields for the total amount, taxes, and applicable discounts. This transparency ensures both accuracy and easy tracking.

Template Breakdown

Each section should be easy to read and understand. For example, start with the “Transaction ID” at the top, followed by the date. This provides immediate context for the receipt. The next section should detail the “Itemized Purchase” with columns for product name, quantity, unit price, and subtotal. Always include a row at the end for total cost calculation, which aggregates the subtotals. Use a separate line for tax and discounts, allowing customers to view adjustments clearly.

Consistency and Accuracy

Ensure all fields are formatted consistently. For example, the date should always appear in the same format (e.g., MM/DD/YYYY), and item prices should be listed in a uniform currency format. Clear labeling will help avoid any confusion and ensure smooth record-keeping for both customers and employees.

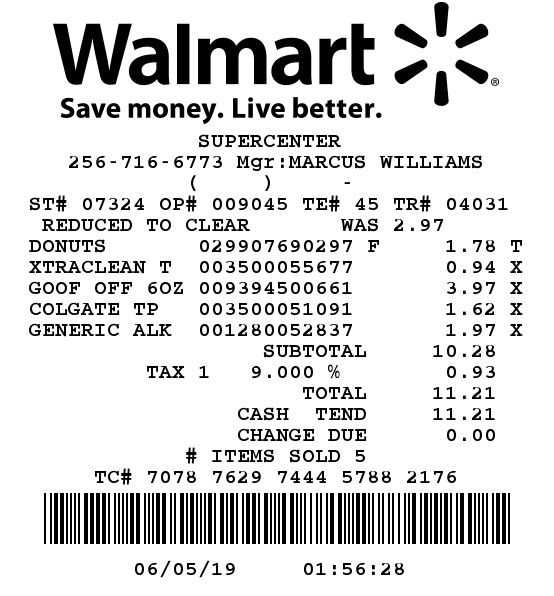

Walmart receipts include specific sections that provide important details about your purchase. These are designed to be user-friendly and to quickly convey key information. Let’s break down the primary sections you will find on a typical Walmart receipt.

Store Information: At the top of the receipt, you’ll see the store’s name, address, and phone number. This section helps identify the specific location where the purchase was made, which can be useful for returns or inquiries.

Date and Time: Directly under the store information, the date and time of your purchase are displayed. This timestamp is helpful for tracking purchases, returns, and any promotional offers that might apply to specific days or times.

Transaction Details: Below the date, you’ll find the transaction number, which is unique to each purchase. This number is essential for customer service or if you need to reference the transaction later. You may also notice payment method details in this section, such as whether the purchase was made with a credit card, debit card, or cash.

Itemized List: This is one of the most important sections. It shows each item you purchased, along with its price, quantity, and any applicable discounts. Keep an eye on this part of the receipt to ensure all items and prices are correct. Walmart also lists any coupons or promotions applied here.

Tax Information: After the itemized list, the receipt will display the tax amount added to your purchase. This section breaks down the state, local, and federal taxes separately so you can see exactly how much you paid in tax.

Total: At the bottom of the receipt, you’ll find the total amount due, including all taxes, discounts, and fees. This is the final amount you’ve paid for your items, and it’s what you’ll need to compare to your payment method details to ensure everything matches.

Return Policy: Some receipts include a note about Walmart’s return policy. This section helps you understand the time frame and conditions under which you can return or exchange items. Keep this part of the receipt for reference in case you need to make a return.

By familiarizing yourself with these sections, you can easily manage your purchases and track your spending at Walmart. Each section serves a specific purpose, providing a transparent breakdown of your transaction.

To efficiently manage your daily transactions with Walmart, begin by entering transaction details into the receipt template immediately after each purchase. This helps track expenses, ensure accuracy, and avoid errors.

- Start with the date and time of the transaction. This allows for easy reference when reviewing records.

- Next, input the total amount paid. This includes all items purchased, taxes, and any discounts applied. Ensure this matches the total printed on your receipt.

- Record payment methods–whether cash, card, or any other form. This ensures clarity on how the transaction was completed.

- Itemize purchased products with their descriptions and individual prices. This provides an overview of what was bought and its cost, useful for inventory or budgeting purposes.

- Include any coupons or promotions applied to the transaction. This gives you insight into savings and discounts.

- Check if there are loyalty points or rewards linked to the transaction. Add this information to maintain an accurate account of your program status.

Regularly update your template to avoid missing any transactions, and refer to it when preparing financial reports or reviewing spending patterns.

If the receipt from Walmart is unclear or contains errors, follow these steps to address the issue quickly. First, double-check the receipt for mischarges. Sometimes, items may be listed incorrectly or at the wrong price. If this happens, compare the receipt with the price tags on the items or check the price through the Walmart app.

If you can’t find the issue, contact Walmart customer service for clarification. They can review the transaction and correct any discrepancies. Be ready to provide the date and time of purchase, the store location, and any item details to make the process faster.

In cases where the receipt is faded or hard to read, ask the store to reprint it. Walmart stores can generate a duplicate receipt, which is often available even if you didn’t opt for a digital receipt. To avoid this in the future, try opting for an email receipt, which is easier to store and retrieve.

If the receipt includes an unexpected discount or promotional offer, ensure that it has been applied correctly. Sometimes, coupons or promotions are automatically processed, but errors can occur. Contact customer service if you believe the discount wasn’t applied or wasn’t applied fully.

For returns, check if the receipt mentions the return policy clearly. If it’s hard to understand, the store staff can help verify the terms. If you’ve misplaced the physical receipt, the digital version can often be used for returns if you’ve provided your email address at checkout.

Use a simple and clear approach to document each cash receipt process at Walmart. Begin by listing the date and time of the transaction, along with the employee handling it. This gives clarity on the specific shift or period in question.

Next, include a breakdown of the items purchased, itemized with their prices. It helps ensure transparency and accuracy in tracking sales data. Double-check the quantity and pricing to avoid discrepancies.

Include the payment method used, whether it’s cash, credit, or another method. Record the exact amount paid and any change provided if cash was used. This allows for easy reconciliation with your cash register at the end of the shift.

Don’t forget to add a section for taxes and any discounts applied. Keep it simple but clear, noting the tax rate and how discounts impact the total cost. This provides a straightforward audit trail for tax purposes.

Finally, include a signature or electronic confirmation from the cashier, ensuring that the receipt has been reviewed and verified. This adds accountability and helps with any potential future queries related to the transaction.