Managing cash flows efficiently is a key factor in maintaining the financial health of any business. The Cash Receipts and Disbursements Excel Template BizSmart offers a straightforward and reliable way to track both incoming and outgoing cash transactions. With this template, you can instantly record all your business transactions in an organized format, ensuring that your financial records are up to date and accessible.

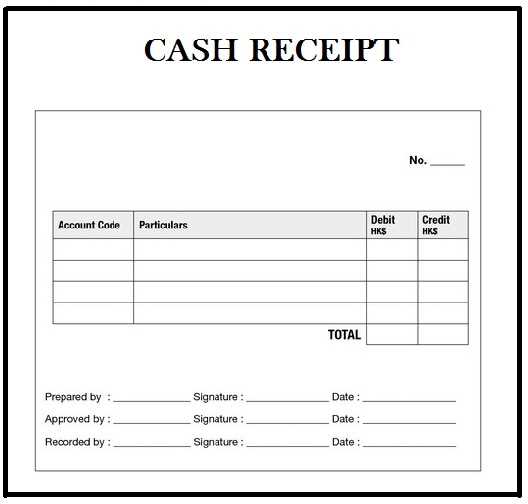

The template features separate columns for detailed descriptions of each receipt and disbursement, allowing you to track the source or destination of funds. You can easily customize it to match your unique business needs, providing a clear overview of your cash flow situation without the need for complex software.

By using this template, you can instantly identify cash shortages or surpluses, which helps in making quick decisions on budgeting or planning. It’s an excellent tool for businesses that want to keep things simple but effective, ensuring that no transaction goes unnoticed. Additionally, with automatic totals for receipts and disbursements, your financial summaries are just a click away, saving you time and effort.

Here’s the revised version:

For an accurate and reliable cash receipts and disbursements tracking system, consider the following tips when using the BizSmart Excel template:

- Data entry consistency: Ensure that each transaction is entered correctly in the designated columns. This includes the date, description, and amounts for receipts and disbursements.

- Use drop-down lists: Utilize Excel’s data validation feature to create drop-down lists for categories. This will help reduce input errors and standardize your records.

- Real-time balance calculation: Make use of the template’s balance column to automatically update the cash balance with each new entry. This ensures you always have an up-to-date view of your cash flow.

- Separate personal and business transactions: Keep your personal transactions separate from your business ones to maintain clarity and avoid confusion in your financial records.

- Regular reconciliation: Reconcile your receipts and disbursements with bank statements on a regular basis to ensure accuracy and spot any discrepancies early.

By following these steps, you’ll maintain a more organized and accurate cash flow record using the BizSmart template. Regular updates and attention to detail will keep your financial tracking on track.

- Cash Receipts and Disbursements Excel Template Bizsmart

Bizsmart’s Cash Receipts and Disbursements Excel template simplifies tracking of incoming and outgoing cash flows for any business. By using this template, you get a clear view of financial transactions without the hassle of complicated accounting software. The spreadsheet includes separate columns for cash receipts and disbursements, making it easy to monitor daily financial activity.

How the Template Works

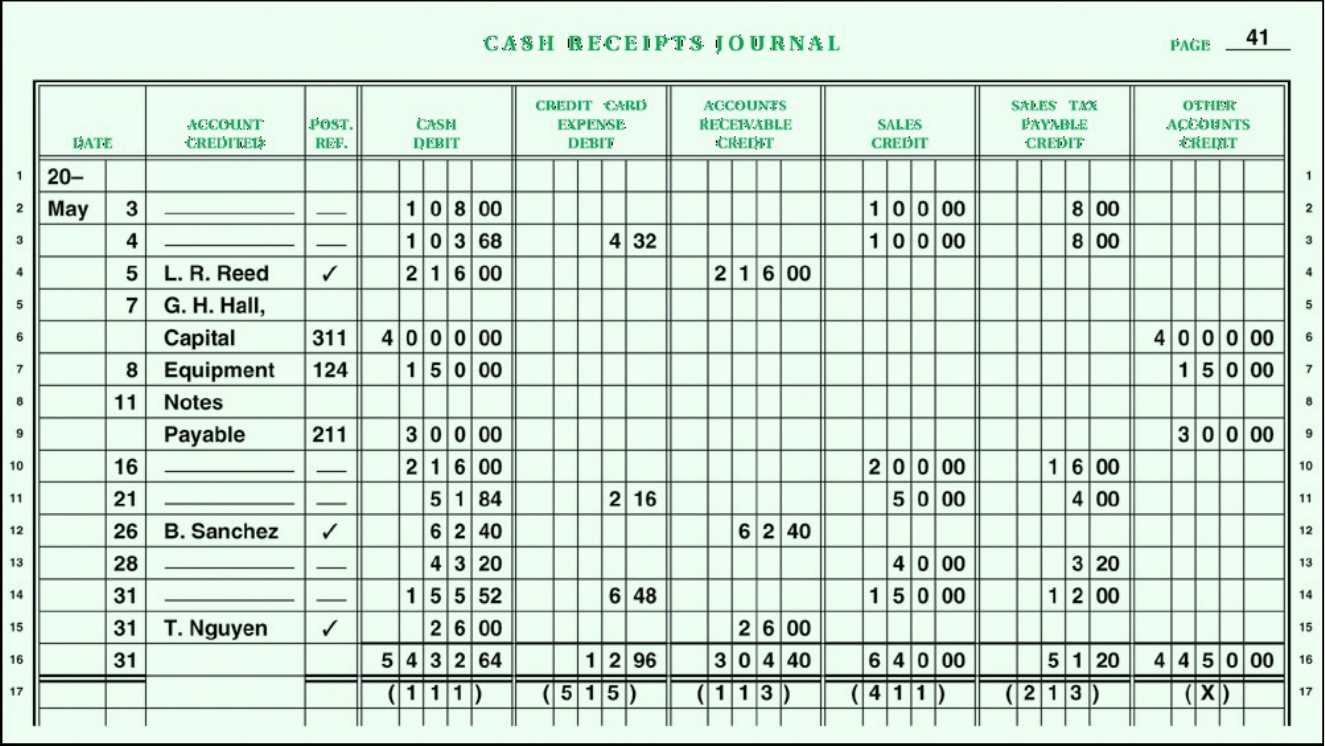

The template is divided into two main sections: receipts and disbursements. Cash receipts include payments from customers, loans, or any other income sources, while disbursements cover all outgoing payments like expenses or purchases. It automatically calculates the net cash flow for each day, allowing you to see whether the business is operating with a surplus or deficit.

Key Features

- Easy-to-use layout for tracking daily transactions

- Automatic calculation of net cash flow

- Option to customize categories for receipts and disbursements

- Monthly and yearly summaries for better financial overview

- Clear visual presentation of cash balance

This template helps reduce errors often caused by manual bookkeeping. It is perfect for small businesses or startups looking for a straightforward way to manage cash flow without investing in expensive accounting software.

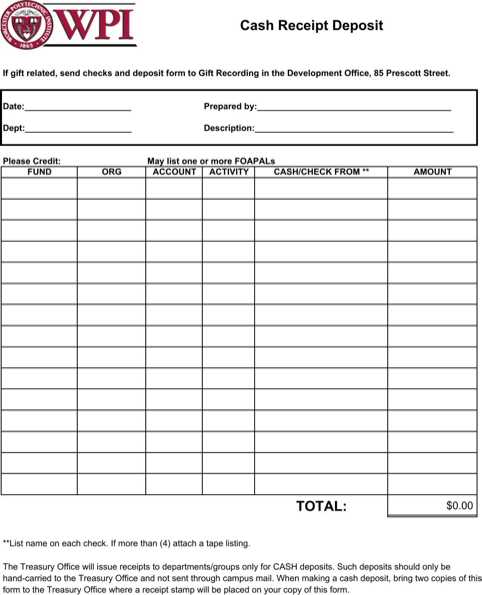

To set up the Bizsmart cash tracking template, begin by downloading the template from the official website or the platform where it’s available. Once you have the template, open it in Excel and review the structure. You’ll find separate sections for cash receipts, disbursements, and a summary of your cash flow.

Start by entering your opening balance in the designated field. This will set the baseline for all transactions you input later. Make sure to accurately categorize all cash receipts and disbursements into their respective sections. For receipts, list any incoming cash such as sales, loans, or other income. For disbursements, include payments for expenses like salaries, supplies, or rent.

The template automatically updates the cash balance based on your entries, so ensure you input data consistently and correctly. If needed, adjust the date format and currency settings to match your local preferences. Check the formulas to confirm that they are working as expected, especially the ones calculating the net cash flow and closing balance.

For easier tracking, you can color-code or highlight significant entries. This will help you quickly identify high-value transactions or specific categories you want to focus on. Be sure to double-check your entries regularly to avoid discrepancies, especially if you’re manually adding new rows or changing formulas.

Once you’ve populated the template with the initial data, continue updating it regularly to maintain an accurate record of your cash position. This template will give you a clear overview of your cash flow and help with budgeting and financial planning.

Organizing disbursements in the Bizsmart template involves structuring outgoing payments to maintain clear records and ensure financial transparency. Begin by categorizing each disbursement to avoid confusion. The template allows you to assign specific expense types, such as rent, utilities, or office supplies, to each transaction. This approach not only helps track where the money goes but also streamlines budgeting and forecasting processes.

Steps to Organize Disbursements

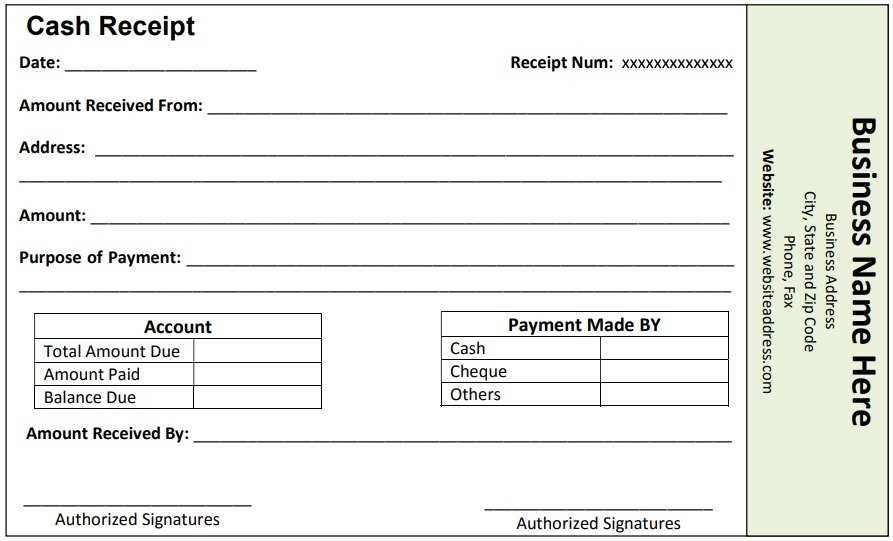

Start by entering the disbursement date and amount. Then, select an appropriate expense category from the dropdown menu in the template. You can create custom categories if necessary. Record the payment method, whether it’s via bank transfer, cheque, or cash, and include relevant notes or reference numbers to identify the transaction. This data will make it easier to reconcile accounts and track your spending over time.

Example Disbursement Table

| Date | Amount | Category | Payment Method | Reference | Notes |

|---|---|---|---|---|---|

| 01/25/2025 | $500 | Office Supplies | Bank Transfer | INV12345 | Purchased printer cartridges |

| 01/28/2025 | $1,200 | Rent | Cheque | JAN2025 | January office rent |

For a more detailed analysis, you can add additional columns to the template, such as ‘Vendor Name’ or ‘Due Date’, depending on your needs. Regularly reviewing these entries will ensure better control over business cash flow and help identify potential savings or areas where spending can be reduced.

To tailor cash flow tracking in Bizsmart, adjust the default categories based on your business needs. This ensures your financial data is organized in a way that aligns with your specific operations.

1. Access Category Settings

Start by opening the template and locating the “Categories” section. Click on the settings or “Edit” option to begin customization. Here, you can modify existing categories or create new ones that reflect your income and expenses more accurately.

2. Modify or Add Categories

When editing, ensure each category is descriptive and relevant to your business transactions. For example, instead of using a generic “Miscellaneous” category, create specific labels like “Sales Revenue,” “Marketing Expenses,” or “Supplier Payments.” This makes tracking and reporting more precise.

Bizsmart allows for multiple levels of categorization. Utilize sub-categories to break down larger groups into more manageable data points. For instance, under “Operating Expenses,” add “Salaries,” “Utilities,” and “Supplies” as sub-categories.

Be mindful of how the categories align with your reporting requirements. If you need detailed insight into certain areas, like project costs or department-specific spending, create categories that reflect those nuances.

To streamline your workflow in Bizsmart, take advantage of formulas that automate data entry. Using Excel functions like SUM, IF, and VLOOKUP, you can automatically populate fields based on the data entered elsewhere in the sheet. This reduces manual input errors and saves significant time.

SUM Formula for Auto Calculations

Start by using the SUM function to automatically calculate totals. For example, if you’re tracking cash receipts, you can sum up the amounts in a specific column using =SUM(B2:B10). This will update the total whenever the data in those cells changes, ensuring your calculations are always accurate.

VLOOKUP for Data Retrieval

If you need to pull specific data from another section of your workbook, use VLOOKUP. For instance, to pull customer details based on a given customer ID, use =VLOOKUP(A2, CustomerData!A:B, 2, FALSE). This retrieves data from the “CustomerData” sheet automatically without needing to search manually.

By setting up these formulas in your Bizsmart template, you eliminate repetitive tasks and improve data accuracy. This will allow you to focus more on analysis and decision-making, rather than data entry.

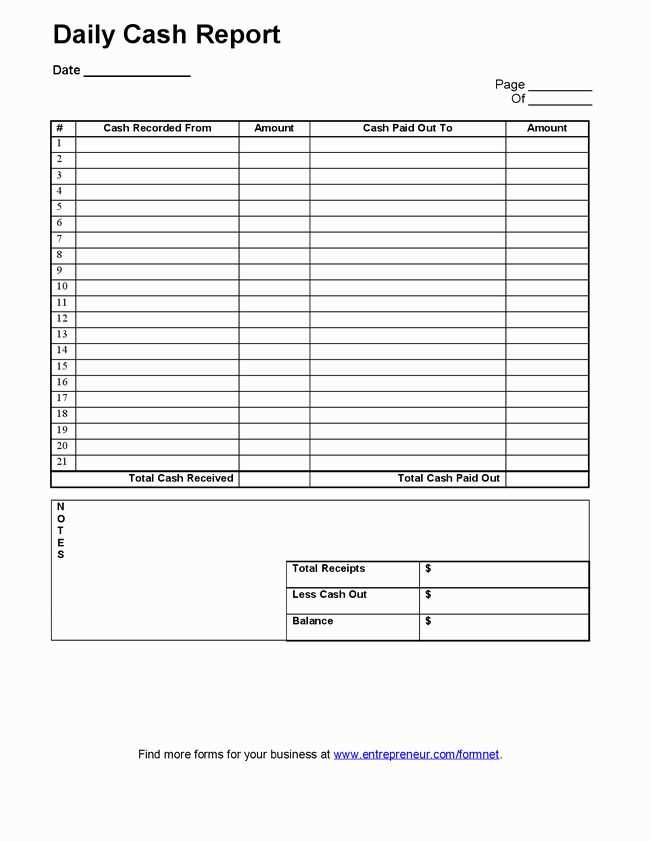

Use the Cash Receipts and Disbursements template to track cash inflows and outflows in a structured manner. With regular updates, you can quickly identify fluctuations in your cash flow and pinpoint any patterns or anomalies that require attention.

Tracking Cash Inflows and Outflows

The template allows you to categorize each cash receipt and disbursement, helping you visualize which areas contribute the most or least to your financial situation. Create separate columns for different income streams and expenses, allowing for easy comparison. This step enables you to monitor the consistency of cash inflows and to spot any irregularities in expenses or revenue generation.

Identifying Trends and Predicting Cash Needs

By entering data regularly, you can generate trends over time. For instance, a sudden drop in cash receipts might indicate a reduction in sales or an issue with accounts receivable. Conversely, a spike in disbursements could point to unexpected costs or inefficiencies. With this insight, you can predict when cash flow will be tight, making it easier to plan for necessary adjustments or financing options.

Integrating Bizsmart with your accounting software streamlines financial reporting and ensures accuracy. By syncing cash receipts and disbursements data directly with your accounting system, you reduce manual data entry errors and speed up reconciliation processes. To get started, make sure both systems support compatible file formats, like CSV or API integrations. This allows you to import financial transactions seamlessly without needing to duplicate information.

Once integrated, you’ll gain real-time access to detailed reports that reflect both cash flows and financial health. You can create custom reports to track specific transactions or analyze trends across multiple periods. This level of automation not only saves time but also provides insights that may have been harder to track manually. Some accounting platforms also allow for automatic categorization of entries based on predefined rules, further improving reporting efficiency.

To ensure smooth integration, test the connection between Bizsmart and the accounting software with a small batch of data before syncing larger sets. This helps identify any issues with data transfer or formatting, allowing you to make adjustments early. Consider setting up automated workflows to trigger updates at regular intervals, ensuring your accounting records stay current without requiring constant monitoring.

Lastly, integrating Bizsmart with accounting software also simplifies year-end audits. The ability to pull comprehensive financial reports directly from both systems gives you confidence in the accuracy of your records and makes audit preparation more efficient.

Use this simple Excel template to track cash receipts and disbursements effectively. It helps you stay organized and monitor your cash flow without hassle.

- Start with a clear separation between income and expenses. Create distinct columns for “Cash Receipts” and “Cash Disbursements”. This provides clarity when reviewing your data.

- Regularly update the template to reflect all incoming and outgoing transactions. Ensure each entry is detailed, including date, amount, and transaction type.

- Utilize formulas like SUM to automatically calculate totals for each category. This reduces manual calculation errors and saves time.

- Set up a running balance column to track the current cash position after each transaction. This helps identify trends in cash flow, such as periods of high expenses or income.

- Use color coding to highlight important transactions or discrepancies. For example, use green for receipts and red for disbursements. This instantly draws attention to key data points.

- Consider adding a notes section to explain unusual or large transactions. This will help you keep track of one-time expenses or irregular receipts.

Regularly review your cash flow to ensure you’re staying on top of financial management. This template offers a clear view of your inflows and outflows, making it easy to adjust your budget or plans accordingly.