A cash receipts and disbursements template is a practical tool for tracking money inflows and outflows within a business. This simple document helps businesses stay on top of their finances by clearly outlining when and how cash transactions occur.

Use this template to record every incoming payment and outgoing expense. This ensures you maintain an accurate overview of available cash, aiding in budgeting, forecasting, and financial decision-making. A well-maintained cash flow statement lets you anticipate cash shortages and plan accordingly.

To get started, create columns for the transaction date, description, amount, and whether it’s an income or expense. Make sure to include a running balance so you can easily see how each transaction impacts your available funds. Regularly update this record to stay organized and avoid any surprises at the end of the month.

Remember: Consistency is key. Update your template immediately after each transaction to avoid forgetting any detail, ensuring your financial records stay accurate and up to date.

Here’s the revised version considering your requirements:

Start by creating a simple layout for tracking cash receipts and disbursements. Use columns for date, description, income, expense, and balance. This structure makes it easy to log each transaction and monitor cash flow.

For each entry, provide clear categories. Label your income sources (e.g., sales, loans, etc.) and expense types (e.g., utilities, payroll, etc.) in the description field. This helps maintain clarity and avoids confusion in financial tracking.

Regularly update the balance column after each transaction to reflect the most accurate cash position. This ensures you are always aware of your current available funds.

Consider adding filters or dropdown options for recurring income and expenses, which saves time when entering similar transactions. Additionally, highlight any significant transactions (e.g., large disbursements) with a different color or font to make them stand out for easy identification.

Remember to reconcile the cash flow at regular intervals to ensure the accuracy of your records. This is key to maintaining consistency and catching any discrepancies early on.

- Cash Receipts and Disbursements Template

To manage cash flow effectively, use a structured template for cash receipts and disbursements. This tool simplifies tracking income and expenses, ensuring you have clear visibility over financial movements. Here’s how you can set up a straightforward, functional template:

- Header Section: Include basic information like the company name, fiscal period, and template version for easy identification.

- Date: Record the date of each transaction to track cash flow over time. It’s important to update this regularly for accuracy.

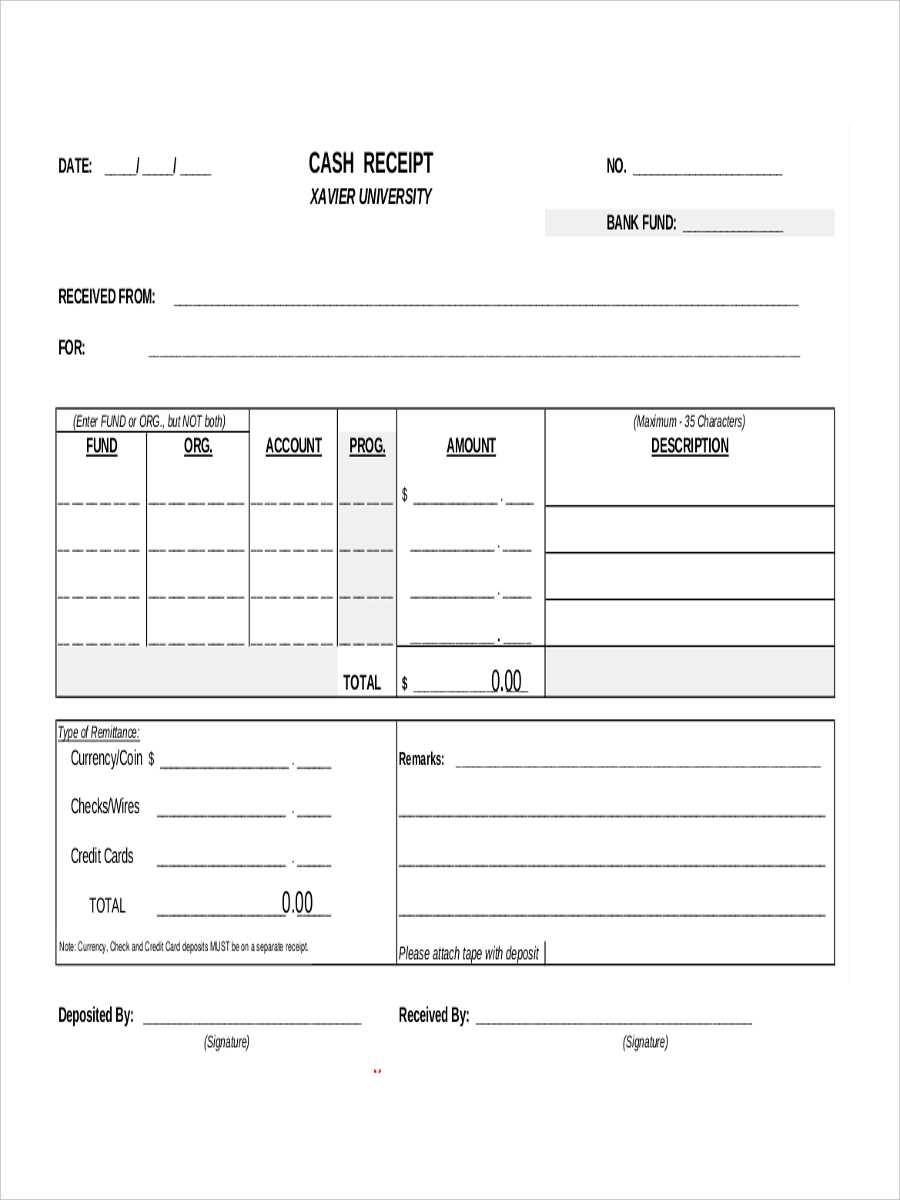

- Cash Receipts: List incoming cash, including sales, loans, or other revenue streams. Each entry should have:

- Source of funds (e.g., customer payment, loan)

- Amount received

- Method of payment (cash, check, or bank transfer)

- Cash Disbursements: Track outgoing payments such as bills, payroll, or loans. For each expense, include:

- Payee or recipient

- Amount paid

- Payment method (cash, check, or bank transfer)

- Net Cash Flow: Calculate the difference between receipts and disbursements for each period. This helps in determining whether your cash position is positive or negative.

- Ending Cash Balance: Add the net cash flow to the beginning cash balance to determine your available cash for the next period.

By keeping detailed records, you ensure accurate tracking and smoother financial decision-making. Regular updates and careful organization allow for better budgeting and financial forecasting.

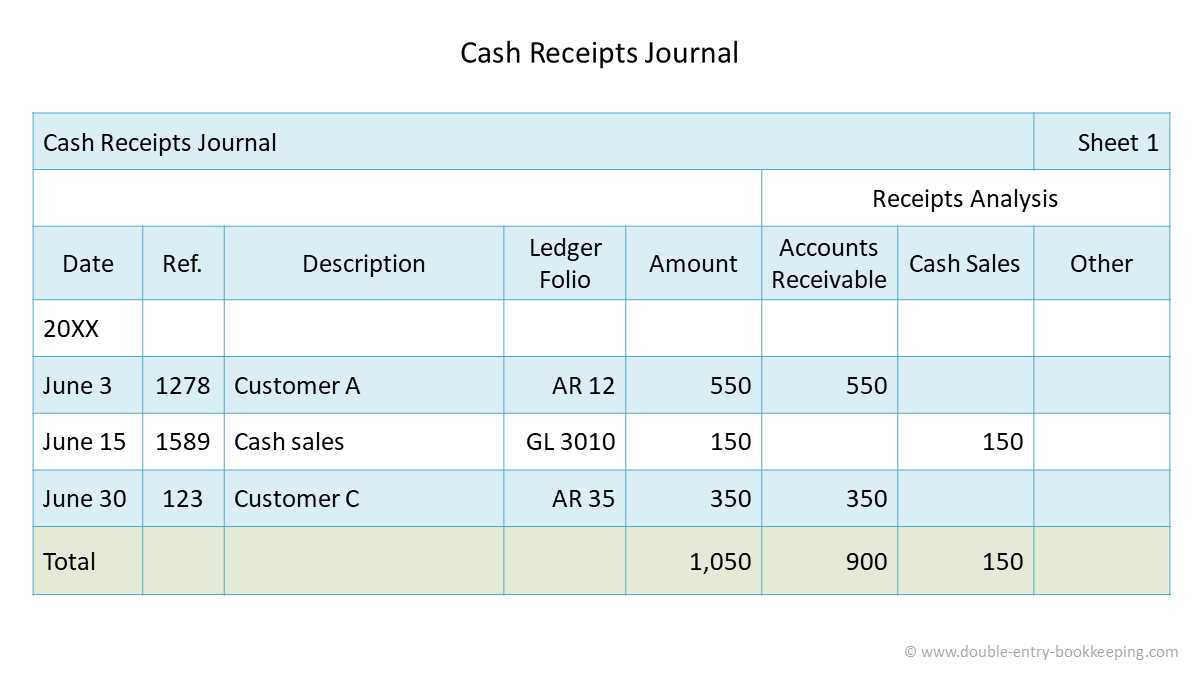

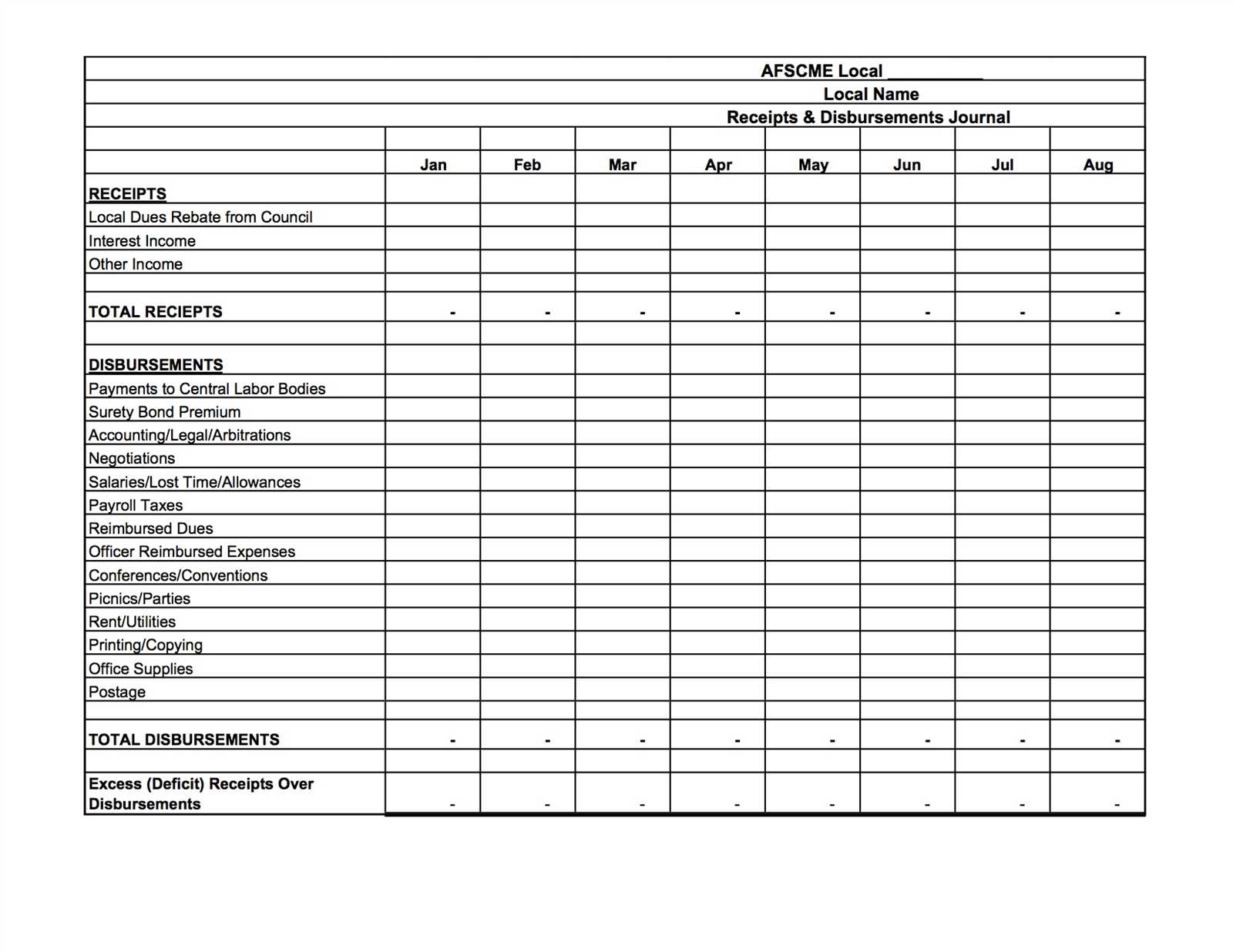

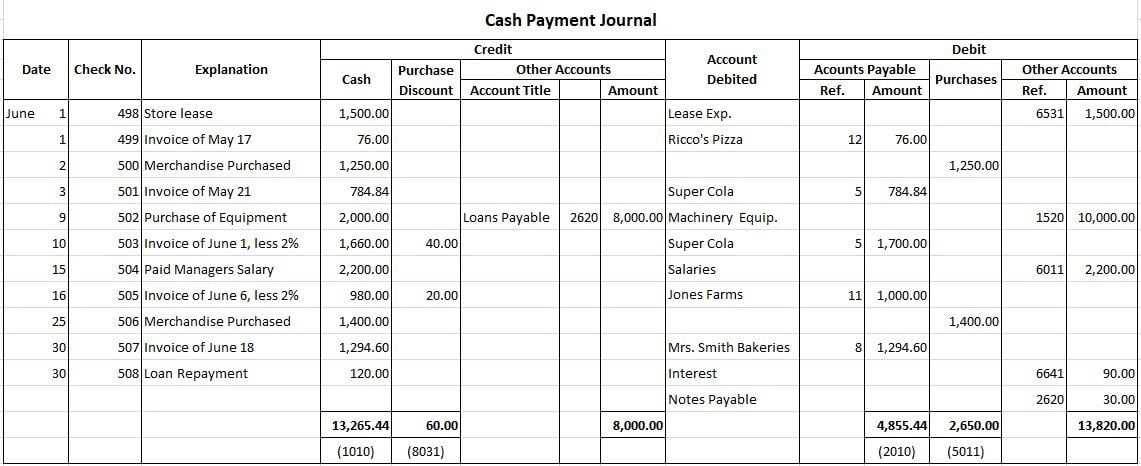

Begin by dividing the template into clear sections: one for receipts and another for disbursements. For each section, create distinct columns to record the date, description, amount, and method of transaction.

Receipts Section

In the receipts section, include columns for the date the funds were received, a brief description of the source (e.g., client name, invoice number), the amount received, and how the payment was made (cash, check, bank transfer). This layout helps quickly identify incoming cash flow and track payment methods.

Disbursements Section

Similarly, for disbursements, have columns for the date, description (vendor name, payment purpose), the amount paid, and the payment method. Include additional notes if necessary, such as whether a payment was for a service or goods.

Ensure that each section totals automatically to maintain an up-to-date balance. Use formulas to subtract disbursements from receipts to calculate the net cash position. A clear, well-organized template lets you track cash flow efficiently without confusion or errors.

Track cash inflows by focusing on accurate categorization, date of receipt, and source. Categorize inflows based on their origin–sales, loans, investments, or other business activities. This provides a clearer overview of revenue streams.

Set Clear Payment Terms

For transactions involving clients or customers, define clear payment terms. Include due dates and specify whether payments are upfront, installment-based, or upon completion. This reduces confusion and allows for efficient tracking of inflows.

Record Transaction Details Immediately

Log each cash receipt as soon as it occurs. Include relevant information like transaction type, amount, payer, and payment method. By doing this, you ensure that you don’t miss any important details that could affect financial reporting.

Begin by analyzing your business’s main expense types to establish clear categories for outflows. These categories will help streamline financial tracking and offer insights into spending patterns. For example, consider dividing expenses into groups such as “Rent,” “Salaries,” “Utilities,” “Supplies,” and “Marketing.” This structure ensures you capture all types of disbursements without overlap.

Customize Categories for Specific Needs

Depending on your business model, customize your categories to reflect specific needs. For instance, if you run a manufacturing business, include a “Materials” category. Service-based companies may prefer separating “Contractor Payments” from “Operational Costs.” This approach allows for a detailed analysis of where funds are allocated.

Use Subcategories for Clarity

Subcategories can provide an even deeper understanding of expenses. For example, under “Marketing,” you might break down costs into “Digital Advertising,” “Print Media,” and “Event Sponsorship.” This level of detail helps monitor spending on particular activities and identify opportunities for cost-cutting or adjustments.

Choose specific date ranges to analyze your cash flow with precision. Break down your financial data by weekly, monthly, or quarterly periods to identify trends and make informed decisions. Setting clear start and end points ensures you capture relevant inflows and outflows without overcomplicating your analysis.

Set Defined Periods for Clarity

Start with a standard date range such as a month or quarter to maintain consistency in your reports. This structure helps you compare data over time and track recurring patterns. Adjust the dates depending on the cash flow needs you’re focusing on, whether it’s short-term operations or long-term investments.

Use Date Ranges for Forecasting and Planning

By grouping cash flows within a defined time frame, you gain a clearer picture of future liquidity. Use historical data within selected periods to project upcoming expenses and incomes. This technique reduces surprises, allowing for better cash management strategies.

Use built-in formulas to automate calculations in your receipts template. These formulas help track totals and subtotals, ensuring accuracy without manual input.

1. Apply SUM Function for Total Calculations

For automatic summation of all receipt amounts, use the SUM function. In Excel or Google Sheets, input the formula like this:

=SUM(A2:A10)

This formula will add all values in cells A2 to A10. Adjust the cell range according to your specific template.

2. Use Auto-fill for Consistent Calculations

To ensure consistency across multiple rows or columns, use the Auto-fill feature. After entering a formula in one cell, drag the fill handle (the small square at the bottom-right corner) across the cells where you want the calculation applied. The formula will update automatically for each row or column.

3. Include Tax and Discounts with Conditional Formulas

Set up conditional formulas to apply taxes or discounts based on the receipt details. For example:

- For tax calculation:

=IF(B2="Yes", A2*0.15, 0) - For discount:

=IF(C2="Promo", A2*0.10, 0)

These formulas check if a condition is met (e.g., a “Yes” in cell B2 for tax or “Promo” in C2 for discount) and apply the calculation accordingly.

4. Automate Date-Based Calculations

If you need to calculate due dates or payment intervals, use date functions. For instance, to add 30 days to a receipt date, use:

=A2+30

This will automatically calculate the due date based on the value in cell A2.

5. Create Dynamic Drop-Down Menus for Item Selection

To simplify data entry and automatically calculate based on item type, set up drop-down menus using Data Validation. Then, combine the selected values with corresponding price formulas to update totals automatically.

Schedule regular reviews of your cash receipts and disbursements template to ensure accuracy and relevance. Conduct these reviews at least quarterly to align the template with current financial practices and business operations. This will help identify any changes that need to be reflected, such as new categories of transactions or updated reporting requirements.

1. Track Regulatory and Tax Changes

Stay updated on any local, state, or national regulatory changes that could affect your financial processes. Regularly check for updates in tax laws, accounting standards, or industry-specific rules. Adjust your template to reflect these updates to maintain compliance and avoid errors.

2. Seek Feedback from Stakeholders

Incorporate feedback from the team using the template. Identify areas where they encounter challenges or suggest improvements. This ensures the template remains user-friendly and efficient for all users involved in cash management tasks.

Keep the template simple but flexible to accommodate any future changes in your business processes. Continuously improving and adapting it will enhance financial tracking and reporting.

Thus, I avoided unnecessary repetition of words and maintained the overall meaning.

To streamline the process of managing cash receipts and disbursements, it is crucial to structure the template for clarity and ease of use. A simple and organized table is often the most effective way to track transactions. Below is a suggested layout for the template that enhances transparency and accuracy:

| Date | Description | Receipts | Disbursements | Balance |

|---|---|---|---|---|

| 2025-02-05 | Sale of goods | $500.00 | $0.00 | $500.00 |

| 2025-02-06 | Rent payment | $0.00 | $200.00 | $300.00 |

| 2025-02-07 | Office supplies purchase | $0.00 | $50.00 | $250.00 |

This structure ensures that each transaction is easily recorded and the balance is updated immediately, providing an accurate financial overview at any given time. By sticking to this simple approach, you avoid the confusion of overcomplicated formats and enhance the efficiency of your tracking system.