Creating a cash receipts and payments journal template is a practical way to manage cash flow effectively. By organizing your receipts and payments in a clear format, you can easily track all cash-related transactions and maintain accurate records for accounting purposes. This template helps streamline bookkeeping and ensures you have a straightforward way to monitor financial inflows and outflows.

A good template should include key fields like the date, transaction description, receipt or payment amount, and the balance. These fields provide a quick overview of cash movements, making it easier to spot discrepancies or trends. Ensure the template is simple but detailed enough to capture all necessary information for your records.

To make your journal template more useful, consider adding categories for each transaction type–such as sales, purchases, or loans. This extra level of organization will help you analyze cash flow and quickly generate reports when needed. A well-structured template will save time and reduce the chances of errors when updating your records.

Finally, always review your journal periodically. Regular updates help keep your finances in check and can alert you to any unexpected changes in cash flow that may need attention. A cash receipts and payments journal is not just a tool–it’s a key component of good financial management.

Here are the corrected lines with minimal repetition of words:

Adjust your journal template to eliminate redundancy and improve clarity. Focus on listing only relevant transactions without repeating terms like “receipt” or “payment.” Streamline descriptions to enhance readability. For example:

Before:

“Cash receipt of $500 was received as payment for services rendered in cash.”

After:

“Received $500 in cash for services rendered.”

This revision removes unnecessary repetition and keeps the focus on the key elements: the amount, the payment method, and the service provided. Always aim to simplify the language and cut down on words that don’t add value. When listing transactions, focus on the core information that needs to be recorded for clarity and quick reference.

By reducing redundancy in the template, you make it easier for anyone reviewing the journal to quickly understand the transactions. Keep your descriptions concise, highlighting only the most relevant details.

- Cash Receipts and Payments Journal Template

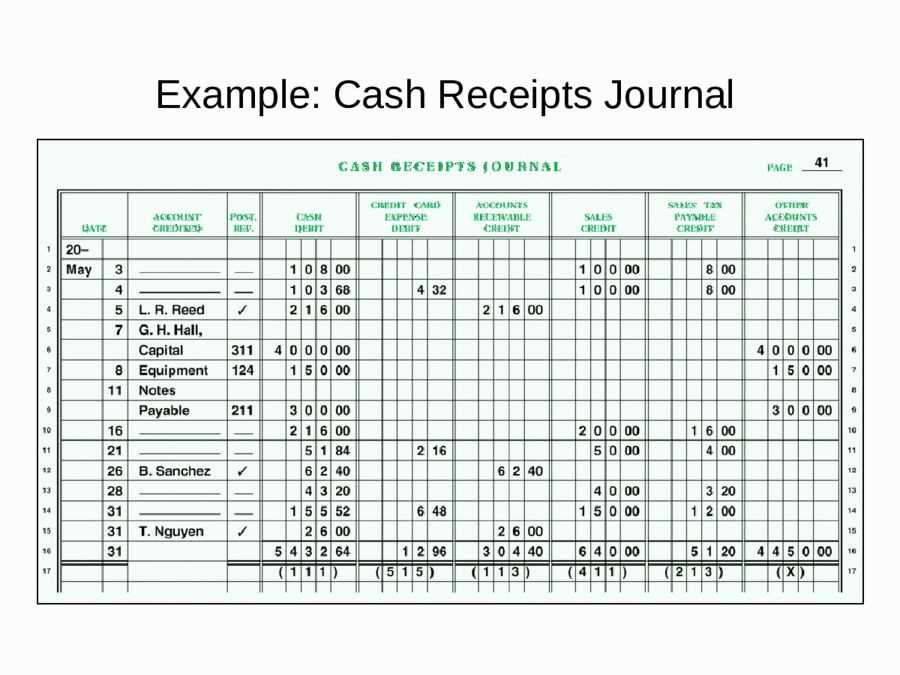

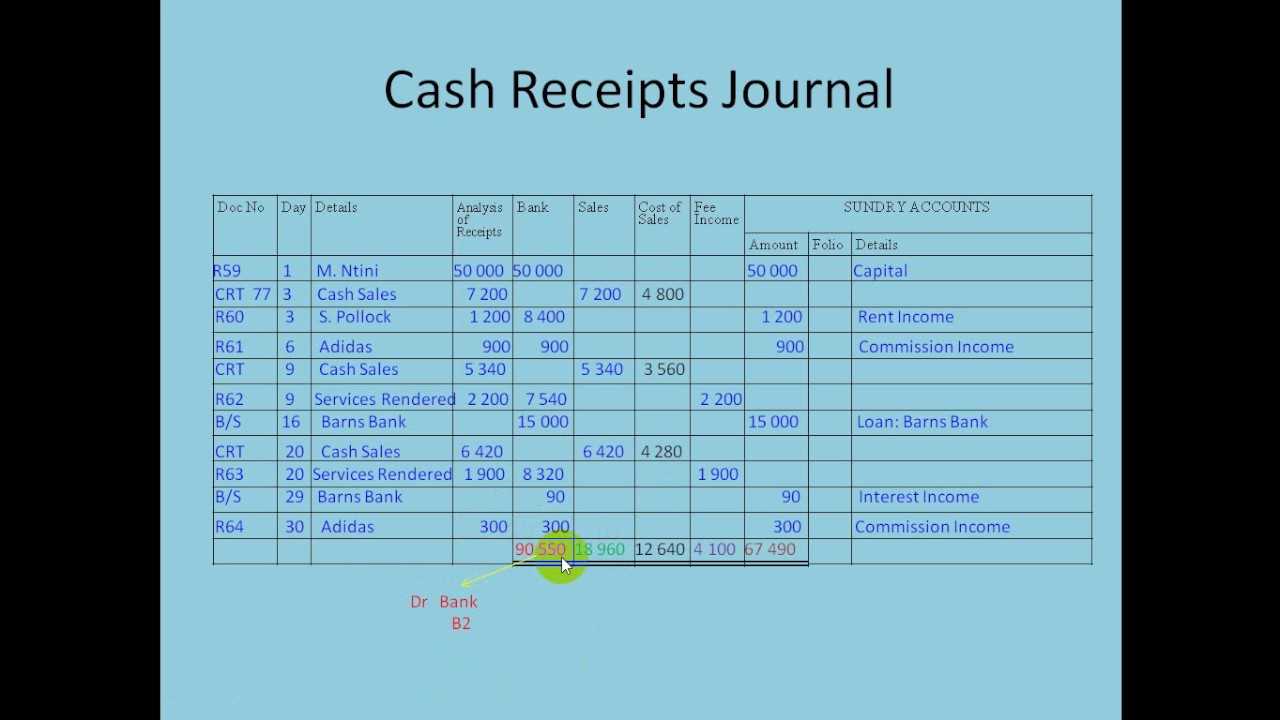

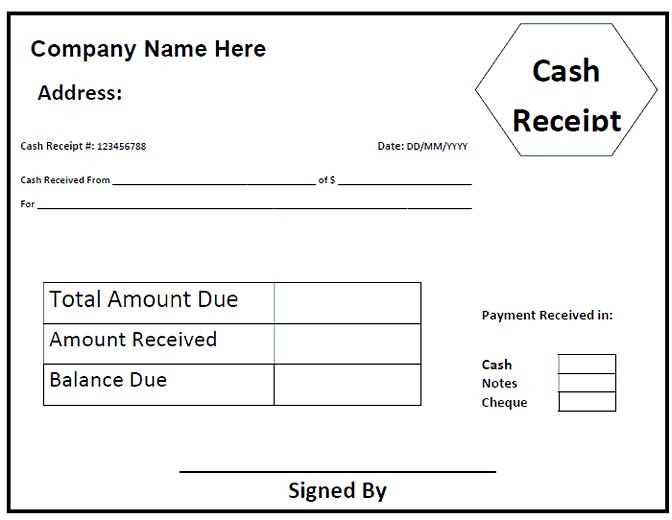

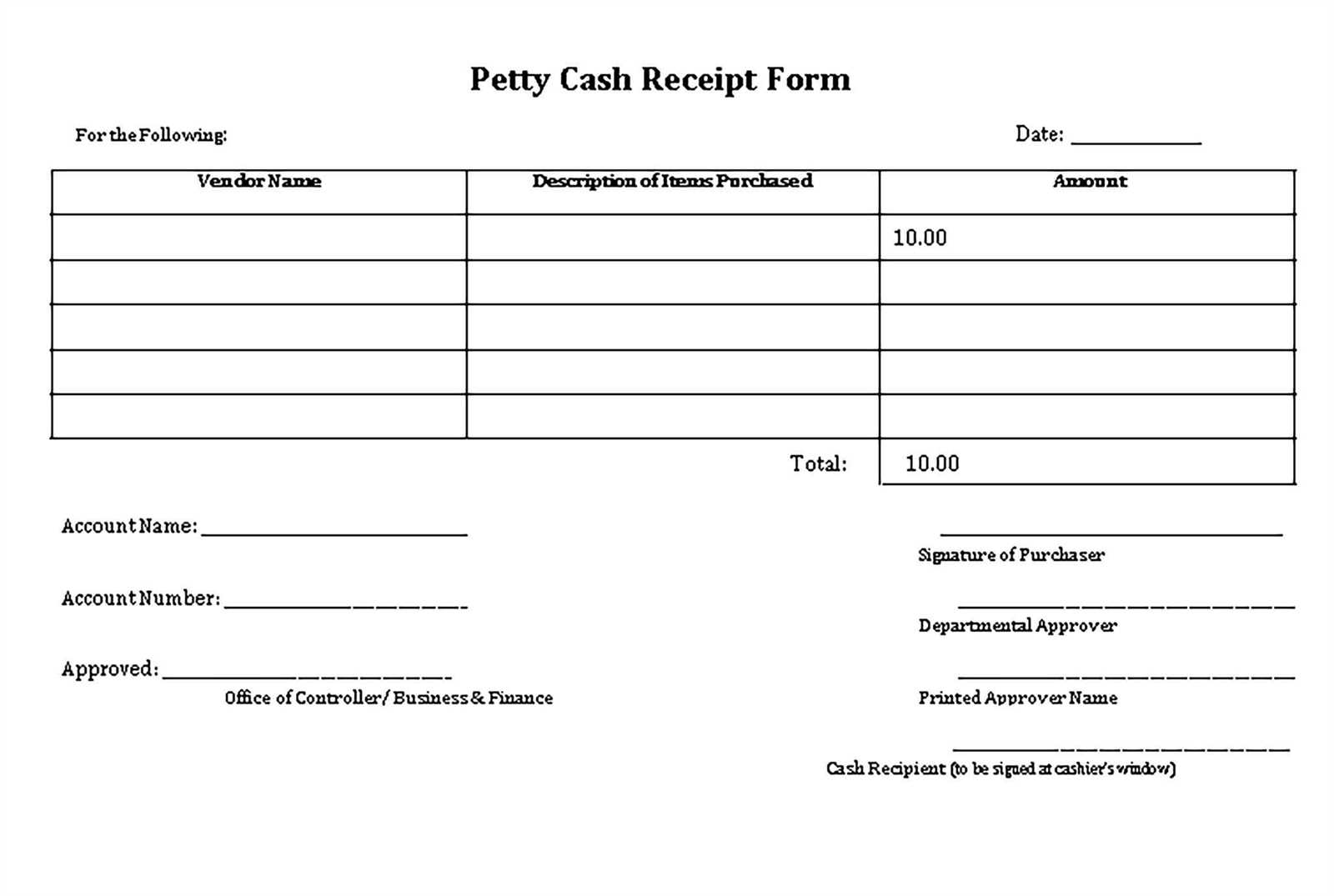

To simplify financial tracking, a well-structured Cash Receipts and Payments Journal template is a must. This template allows businesses to monitor cash inflows and outflows, ensuring accurate financial reporting and avoiding discrepancies. Organize your entries by date, receipt number, description, account, and amount for clarity and consistency.

Structure of the Journal

The template should have columns for each critical element:

- Date: Record the exact date of the transaction.

- Transaction Description: Provide a brief description of the receipt or payment.

- Account: Specify the account involved in the transaction (e.g., bank, cash register).

- Amount: List the exact amount received or paid.

- Balance: Keep a running balance after each transaction to track cash flow.

Recommendations for Use

For accurate reporting, enter each transaction immediately. This helps avoid missing any critical details and reduces the chance of errors. If possible, use the template in conjunction with accounting software to automate balance calculations.

Regularly reconcile your journal with your bank statements to ensure your records match actual cash flow. This practice enhances transparency and provides a clearer financial picture.

Begin by opening a new Excel workbook. Create column headers for the following categories: Date, Receipt Number, Description, Amount Received, Account (or Payee), and Method of Payment (Cash, Check, Bank Transfer, etc.). These columns will help you organize incoming funds systematically.

Next, set up the rows for data entry. In each row, record the date the cash was received, a unique receipt number, a short description of the transaction, the total amount, the account or customer from whom the payment was received, and the payment method.

Use Excel’s built-in formatting tools to make sure the amounts are displayed correctly (set the ‘Amount Received’ column to currency format). You can also apply conditional formatting to highlight overdue or large payments for better visibility.

To ensure accurate totals, create a sum formula at the bottom of the ‘Amount Received’ column. This will automatically update every time new data is entered.

If you’re dealing with different types of payments, consider adding additional columns for each method (e.g., Cash, Credit, Bank Transfer) so you can track the sources separately.

Lastly, save the file regularly and back it up to avoid losing any data. You can also password-protect the Excel file to ensure security and prevent unauthorized access.

To ensure clarity and consistency in your cash receipts and payments journal, structure your columns with precision. Start with separate sections for “Date,” “Description,” and “Amount” for both payments and receipts. The “Date” column should record the exact transaction date, making it easier to track the flow of cash. “Description” serves to explain the transaction, whether it’s a purchase, sale, or other financial activity.

For the “Amount” columns, create distinct entries for “Payments” and “Receipts.” This division simplifies tracking and minimizes the risk of errors. Ensure each entry is accurately placed under the correct column to maintain proper bookkeeping.

For clarity, consider additional columns for “Payment Method” or “Receipt Method,” specifying whether the transaction was made via cash, check, or electronic transfer. This level of detail helps you quickly verify the method of payment and receipt, streamlining audits or future reconciliations.

Keep the structure uniform throughout the journal to avoid confusion. By using these columns, you’ll establish a straightforward system for documenting cash flow, making record-keeping more intuitive and reliable.

To track your daily cash flow, use a simple journal template that captures both cash receipts and payments. This template allows you to quickly record transactions as they occur, helping you stay on top of your financial situation without missing key details. The format should include columns for the date, description of the transaction, cash inflow, cash outflow, and balance. Each entry should be clear and concise to ensure easy tracking.

Record All Transactions Immediately

As soon as a cash transaction occurs, log it in your journal. Delaying entries can lead to confusion or errors. For receipts, note the source of the income and the amount. For payments, specify the expense and its purpose. Consistently tracking these details will give you a more accurate view of your cash flow over time.

Maintain a Running Balance

The journal template should include a running balance that automatically updates after each transaction. This balance helps you spot any discrepancies quickly and ensures you’re aware of your current cash position at all times. If your template doesn’t include an auto-calculation feature, manually update the balance after each entry.

By reviewing your journal regularly, you can identify trends in your daily cash flow and make more informed decisions about your finances. A consistent tracking method helps you avoid surprises and maintain control over your cash management process.

To streamline cash flow tracking, divide transactions into clear categories such as “Cash Receipts” and “Cash Payments.” This helps in organizing and understanding financial activities without confusion. Add further distinctions by considering categories like “Sales Revenue,” “Loan Payments,” or “Operating Expenses.” By doing so, you create a structured journal that allows for better financial insights and reporting.

When building your template, make sure each category has its own row, making it easy to track and analyze each transaction type separately. For instance, create separate columns for “Date,” “Transaction Description,” “Amount,” and “Account,” under each category. This will ensure that all related transactions are consistently recorded and easily traceable.

| Transaction Date | Transaction Description | Amount | Account |

|---|---|---|---|

| 02/07/2025 | Sales Revenue | $500.00 | Cash |

| 02/07/2025 | Loan Repayment | $200.00 | Bank |

| 02/07/2025 | Utility Payment | $50.00 | Cash |

Ensure that each category is easy to access and manage. Categorizing your transactions by type not only simplifies your journal but also aids in generating accurate financial reports. By keeping everything organized, you avoid confusion during audits and ensure you have a clear record for decision-making.

Adapt the cash receipts and payments journal template to reflect the specific needs of your business by modifying key categories and sections. Start by aligning the structure with your financial reporting practices. This may involve adjusting the columns to match the types of transactions your business processes, such as adding separate fields for credit card payments or categorizing payments by project codes.

Modify the Date and Reference Columns

Ensure the date format matches your regional preference, such as day/month/year or month/day/year. Adding a reference number column helps in tracking each entry and cross-referencing with invoices or receipts, enhancing record-keeping accuracy.

Tailor the Payment and Receipt Categories

Customize the payment and receipt categories according to the types of transactions your business handles. For instance, if your business deals with a variety of vendors, include categories for vendor payments, while clients’ payments can have separate columns. This enables quick identification and organization of your cash flow sources.

To reconcile cash journals with bank statements, compare each transaction in your journal to the corresponding entry in your bank statement. Ensure that both match in amount, date, and description. If discrepancies occur, investigate by reviewing receipts, deposits, or bank charges.

Steps to Reconcile

- Start by reviewing the opening balance in both the cash journal and bank statement.

- Go through each transaction, checking for differences in amounts or missing entries. If a deposit appears in the bank statement but not in the cash journal, make a note of it.

- Match payments recorded in the journal to the withdrawals in the bank statement. Pay attention to timing differences, such as checks that haven’t been cashed yet.

- Identify any fees, interest, or adjustments noted on the bank statement. Ensure these are accounted for in your cash journal.

- After matching the entries, calculate the adjusted balances for both the bank and cash journals.

Handling Discrepancies

- If a transaction doesn’t match, double-check your records for errors in recording, missing transactions, or delayed bank processing.

- Look out for transactions entered in one record but not the other, such as deposits or payments not yet processed by the bank.

- Reconcile the difference by adjusting the journal or contacting the bank for clarification on any unrecognized transactions.

Once you’ve compared all entries and resolved discrepancies, your cash journal and bank statement should match. If they don’t, continue reviewing each record until you find the cause of the difference.

Cash Receipts and Payments Journal Template

Organize cash transactions with a streamlined approach using a simple journal template. This method ensures accurate tracking of receipts and payments, simplifying record-keeping and reporting tasks.

Structure of a Cash Journal

- Date: Enter the date of each transaction.

- Receipt Number: Assign a unique number for each cash receipt to ensure clarity and reference ability.

- Description: Provide a brief explanation of the transaction.

- Account Code: Link the transaction to a specific account code for consistency in categorization.

- Debit: Record the amount received under the debit column.

- Credit: Enter any outgoing payments in the credit column.

- Balance: Update the running balance after each transaction.

How to Use the Template Effectively

- Track all cash transactions–both receipts and payments–systematically.

- Ensure the journal is updated regularly to prevent confusion and errors in financial reporting.

- Periodically review the entries to ensure accuracy and resolve any discrepancies promptly.

- Use the running balance to monitor cash flow and assess financial stability.