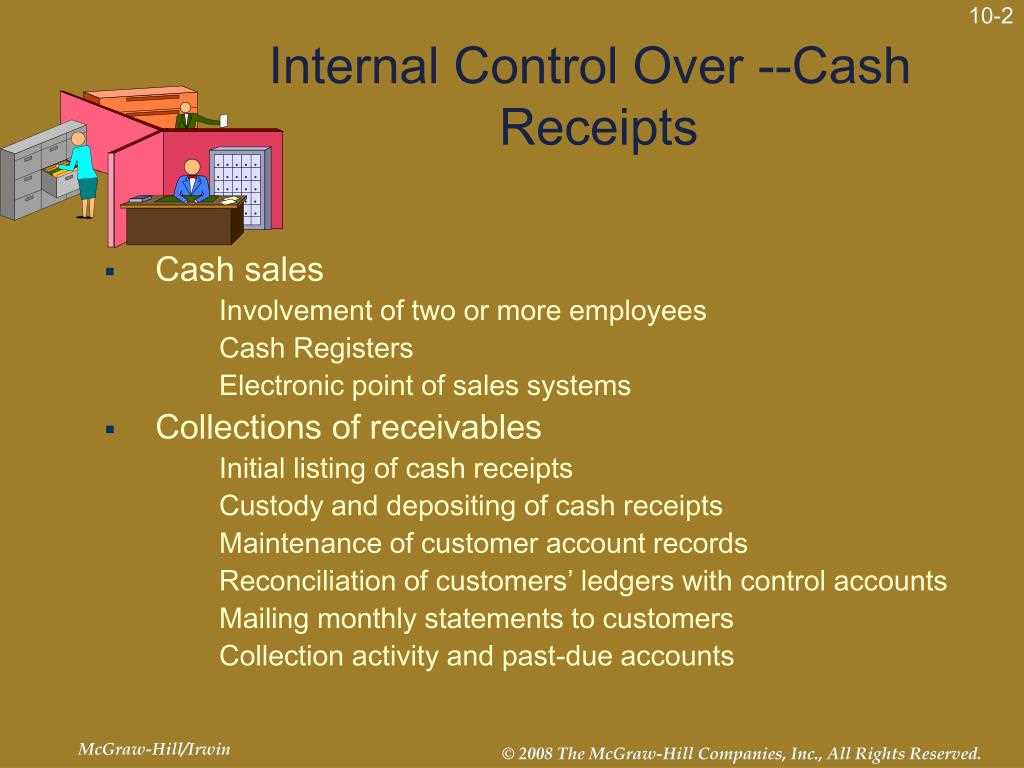

To ensure proper management of cash receipts, establish a clear and simple internal control template that defines each process step. This template must include guidelines for handling cash at every stage–from receipt to deposit–along with defined roles and responsibilities. Make sure all employees involved in cash transactions are trained on these protocols to maintain consistency and accuracy.

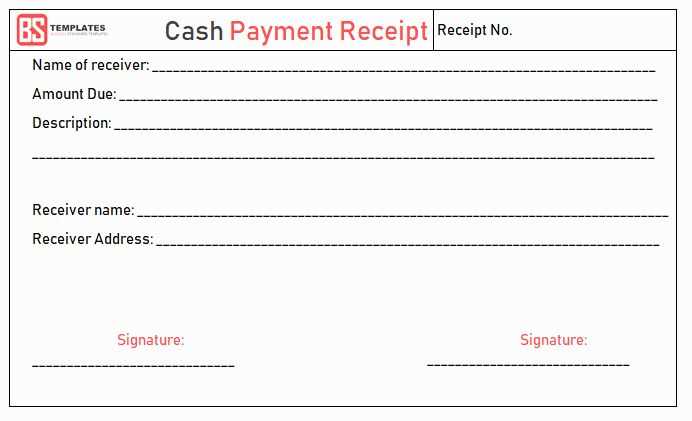

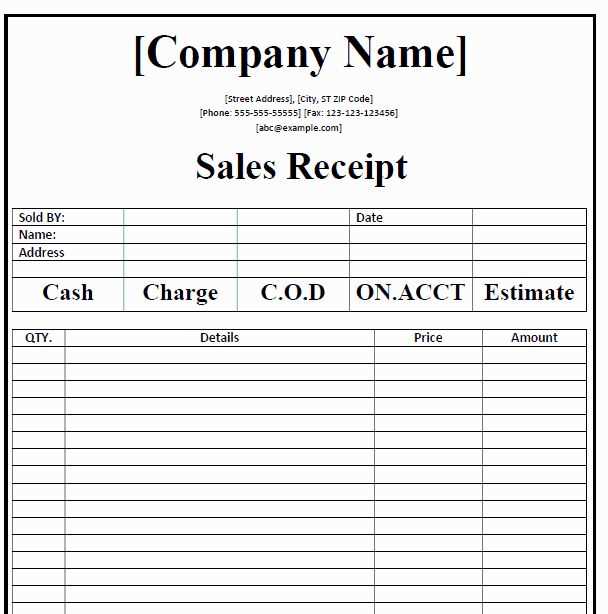

First, document the process of receiving cash. Each receipt should be recorded immediately with appropriate details, such as the amount and source. Use numbered receipts or logs to track all transactions. Next, separate duties between individuals handling the cash and those responsible for recording and depositing it. This separation helps prevent fraud and errors.

Incorporate regular reconciliation procedures. At set intervals, compare the recorded cash receipts against bank deposits and financial reports. This practice ensures that discrepancies are identified early and corrective actions are taken. Regularly update your template to reflect any changes in policies, staffing, or business needs to keep controls current and robust.

Here’s the updated version:

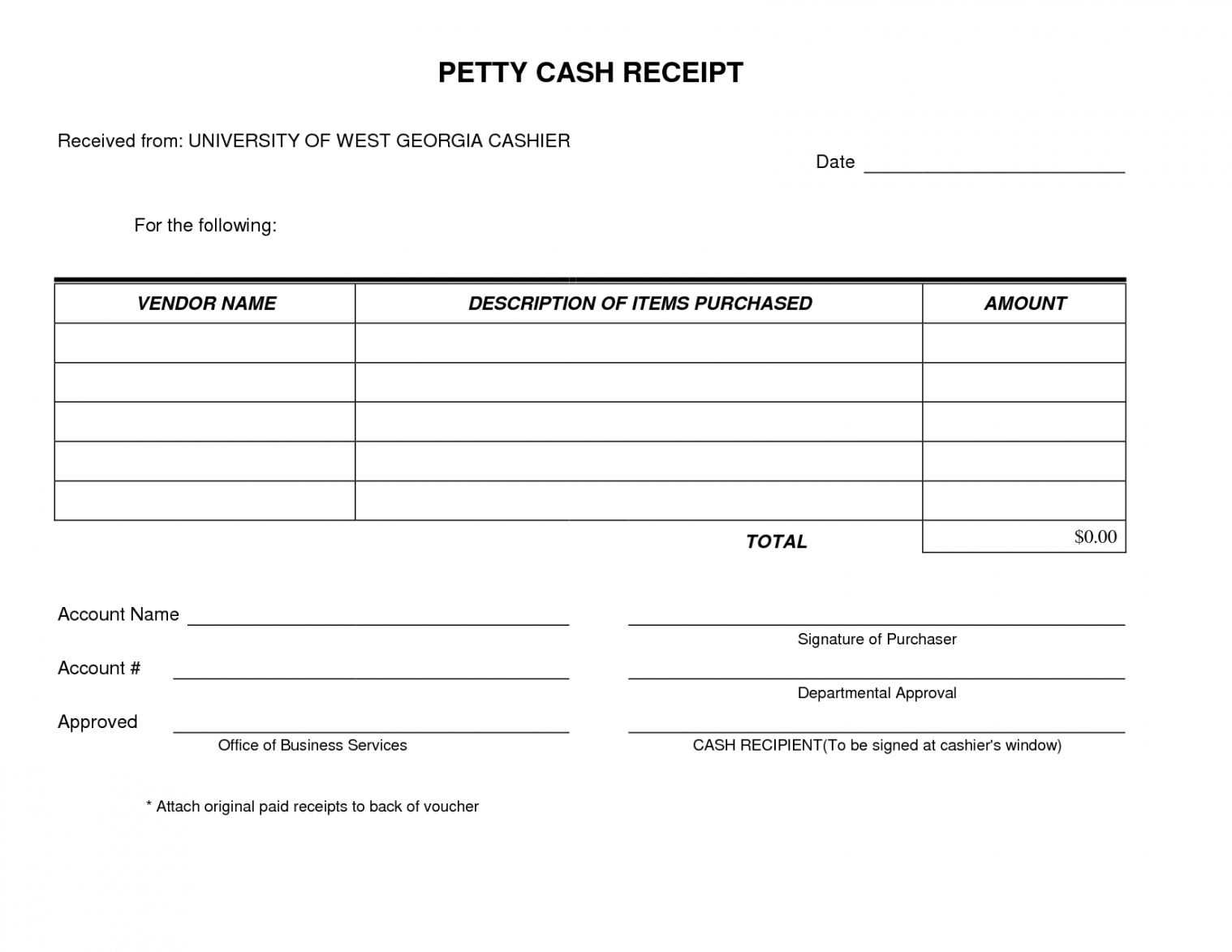

Update your internal control procedures by ensuring every cash receipt is tracked immediately upon receipt. Assign a unique reference number to each transaction and record the date, amount, and payer’s details. This will help maintain an accurate log of all incoming payments.

Implement a dual verification process where two employees review and confirm cash receipt entries. This step will reduce the risk of errors or fraudulent activities. Periodically cross-check the records against bank deposits to verify accuracy.

Keep physical and electronic copies of receipts in separate, secure locations. Maintain an up-to-date log of who has access to both systems and ensure that only authorized personnel can modify or approve entries. Regular audits should be scheduled to assess the integrity of the cash receipt system.

Lastly, integrate a standardized reporting format for cash receipts, ensuring all information is clearly categorized and easily accessible for reviews and audits. Standardization prevents misinterpretation of data and helps streamline the reconciliation process.

- Cash Receipts Internal Control Template

Establish clear segregation of duties by assigning different individuals to handle cash receipts, record transactions, and reconcile accounts. This prevents unauthorized access and reduces the risk of fraud.

Implement a system for issuing and tracking receipts. Each transaction should have a corresponding receipt number, which helps maintain accountability and makes it easier to trace any discrepancies or errors.

Set up a process for daily reconciliation of cash receipts with recorded amounts. This includes comparing the total receipts with the amounts logged in the accounting system. Any discrepancies should be flagged and investigated immediately.

Use a secure deposit method for cash handling. Cash should be deposited into the company account at regular intervals, minimizing the amount of physical cash on-site. Keep records of each deposit, noting the date, amount, and individual responsible.

Ensure that access to the cash register and accounting system is restricted to authorized personnel only. Implement password protection and regular audits of access logs to monitor user activity.

Set guidelines for managing customer payments, including the process for issuing refunds and handling returned items. Establish clear procedures for documenting these transactions to prevent misuse.

Perform regular internal audits of cash receipt operations to assess compliance with policies and identify areas for improvement. These audits should be conducted by personnel who are independent of the cash handling process.

Establishing Proper Authorization for Transactions

Ensure that every transaction is authorized by a designated individual with the proper authority. This prevents unauthorized access to company funds and protects against fraudulent activities. Set clear boundaries by assigning specific roles and responsibilities to each employee involved in financial processes.

Clear Definition of Authority Levels

Establish well-defined approval levels for each type of transaction. For example, smaller transactions can be approved by lower-level staff, while larger amounts require authorization from higher management. Ensure that employees understand their limits and the process for escalating requests when needed.

Authorization Process Documentation

Document the entire authorization process to create transparency and accountability. Use written policies and procedures to outline who can authorize specific transactions, what information is needed for approval, and how approvals are recorded. This will help identify weaknesses or potential risks in the system.

Setting Up Segregation of Duties in Handling

Separate responsibilities to prevent fraud and errors by clearly defining roles in cash receipt processing. Assign distinct tasks for handling cash, recording transactions, and reconciling accounts. This separation minimizes the risk of any single employee manipulating the process.

Key Areas to Separate

Focus on the following key areas when establishing segregation of duties:

- Receiving Cash: One person should handle the receipt of cash, ensuring they are not involved in the recording process.

- Recording Transactions: A separate individual must record the cash transactions to maintain a clear audit trail.

- Reconciling Accounts: Assign a third individual to reconcile cash receipts with records to verify accuracy.

Monitoring and Enforcement

Regularly monitor and review processes to ensure compliance with segregation procedures. Conduct surprise audits to catch potential issues early and make adjustments as necessary to uphold control integrity.

| Task | Assigned Individual | Purpose |

|---|---|---|

| Cash Receipt Handling | Employee A | Receive and verify cash |

| Transaction Recording | Employee B | Record the cash receipt in accounting software |

| Account Reconciliation | Employee C | Verify accuracy of cash records and physical cash |

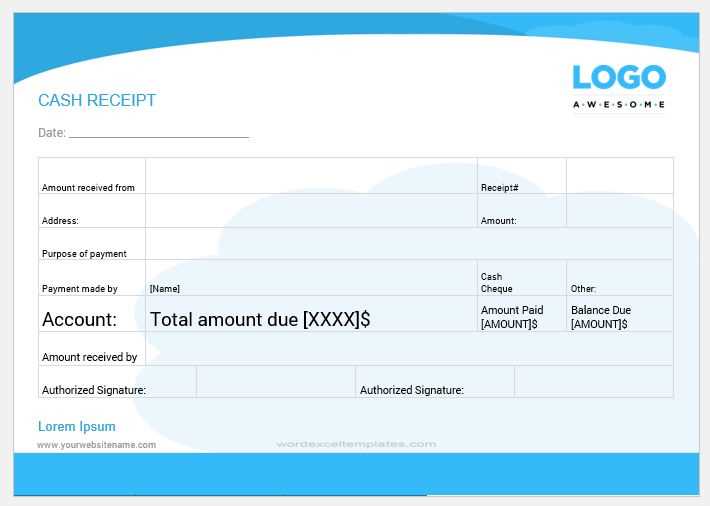

Accurately documenting and recording receipts requires a clear and consistent process. Each receipt should be logged immediately upon receipt, ensuring all relevant details are captured. Include the date, amount, and method of payment. Additionally, reference any associated invoices or transaction numbers to avoid discrepancies. Use a reliable system to store these records, whether digital or physical, and ensure they are easily accessible for future audits.

Reconcile receipts with bank deposits regularly. Ensure that every recorded receipt matches the corresponding bank statement. If discrepancies arise, investigate immediately to identify the cause. This practice helps maintain the accuracy of financial records and reduces the risk of errors or fraud.

When dealing with electronic receipts, ensure that all documents are scanned or saved in a format that is legible and tamper-proof. Maintain a backup system to prevent loss of important data. Consistent tracking and thorough documentation create a transparent and verifiable financial record, making it easier to monitor cash flow and detect any issues early on.

Performing daily reconciliations is critical for maintaining accurate financial records. This process ensures that cash receipts match the bank deposits and transaction logs, helping identify discrepancies early on. Here’s how you can implement a reliable reconciliation procedure:

Set Clear Daily Reconciliation Steps

- Start by collecting all cash receipts documentation, including sales receipts, bank deposit slips, and cash register reports.

- Compare these records against daily bank account statements or electronic transaction reports to ensure they align.

- Any discrepancies between recorded receipts and actual deposits should be documented immediately for investigation.

Assign Accountability for the Process

- Designate a specific person or team to handle the daily reconciliation process to avoid confusion.

- Ensure the assigned personnel understand the importance of timely and accurate reconciliations to prevent errors from accumulating.

- Implement a system of checks and balances, such as having a supervisor review the reconciliations periodically.

By sticking to these steps, you ensure that cash handling remains transparent and discrepancies are addressed quickly, reducing the risk of errors or fraud.

Monitoring and Reporting Suspicious Activities

Establish a clear process for monitoring transactions and activities that might signal fraudulent or suspicious behavior. Identify red flags, such as discrepancies in cash handling, large or frequent transactions outside of normal patterns, and irregular accounting entries. This will ensure a proactive approach to potential issues.

Key Indicators to Watch

- Unusual cash deposits or withdrawals, particularly in amounts that don’t align with regular business transactions.

- Unexplained adjustments to receipts, such as sudden changes in transaction amounts or missing details.

- Employees who frequently bypass normal procedures or demonstrate inconsistent reporting practices.

- Excessive refunds or voided transactions with no valid explanation.

Steps for Reporting Suspicious Activities

- Document the specific behavior or transactions that raised concerns. Include dates, amounts, and employee details.

- Report the findings to the internal control team or designated personnel responsible for investigating financial anomalies.

- Ensure that the process for reporting is confidential, protecting whistleblowers from retaliation.

- Follow up on any suspicious findings to ensure they are properly addressed and resolved.

Provide staff with detailed training on internal control procedures by breaking down each task involved in cash receipt handling. Focus on areas like verifying amounts, recording transactions, and safeguarding cash. Make sure they understand how each action impacts the integrity of the financial process.

Use interactive training methods like hands-on demonstrations or simulations of common situations, such as discrepancies between receipts and deposits. This practice will help staff become more comfortable handling issues in real-time.

Offer clear guidelines on reporting irregularities, and stress the importance of following procedures even in routine tasks. Reinforce accountability by assigning specific duties and tracking performance regularly to identify areas for improvement.

Conduct refresher courses periodically to keep everyone updated on any changes to procedures or policies. Encourage staff to ask questions and provide feedback to ensure that the training remains relevant and effective.

Internal Control Checklist for Cash Receipts

Implement clear procedures for handling cash receipts to ensure accuracy and minimize risk. Begin by assigning a specific individual or team to oversee cash receipt activities. This role should involve verifying the amounts received, maintaining logs, and monitoring compliance with internal policies.

Documentation and Reporting

Maintain detailed documentation for all cash receipts, including the method of receipt (e.g., cash, check, electronic transfer) and the purpose of the transaction. Each receipt should be recorded with a unique reference number for tracking. Establish a procedure for reconciling these receipts with bank statements regularly to identify discrepancies early.

Segregation of Duties

Separate duties related to cash receipt processing. The person receiving payments should not also be responsible for recording or reconciling the transactions. This reduces the likelihood of errors or fraudulent activities going unnoticed.

Implement an independent review of cash receipts and reconcile them with accounting records. Regularly review both the transaction logs and the reconciliations for discrepancies, ensuring that any discrepancies are addressed immediately.