To manage cash transactions smoothly, use a reliable cash receipts journal template. This tool helps track incoming cash, ensuring accurate and timely recording of financial activities. It eliminates confusion and minimizes the risk of errors, making bookkeeping simpler and more transparent.

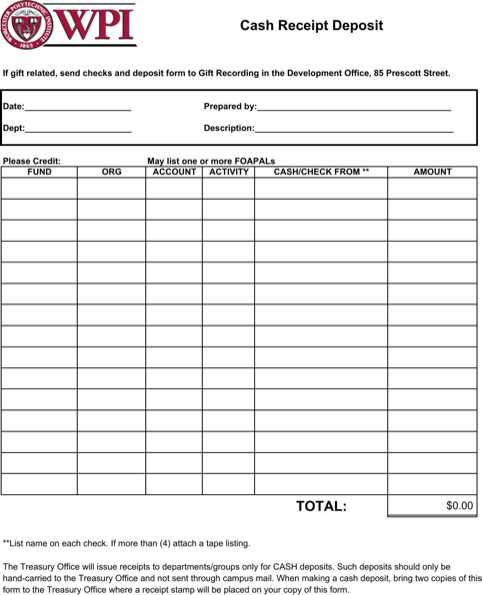

When creating a template, include key sections such as the date of transaction, customer name, invoice or receipt number, payment amount, and the account credited. This structure ensures that each receipt is accounted for and classified correctly in your financial records.

For improved organization, consider categorizing cash receipts based on their nature–whether sales, loan repayments, or other transactions. This will allow for better financial analysis and help reconcile your books with bank statements.

Here is the corrected text:

Ensure that each transaction entry in the cash receipts journal includes the following details: the date of the transaction, the source or payer, the amount received, the account credited, and a brief description of the reason for the receipt. Double-check that all amounts are correctly recorded and matched to the corresponding accounts. Regularly reconcile the journal with bank statements to verify accuracy and consistency. Use clear, standardized categories for each entry to streamline reporting and auditing processes. This will help maintain clarity and prevent errors in financial records.

- Cash Receipts Journal Document Template

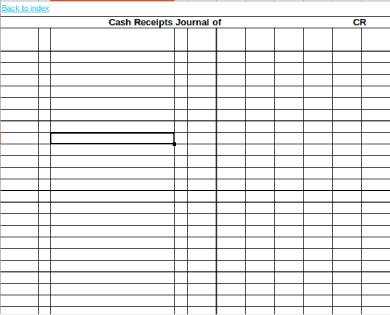

A cash receipts journal is a critical record for tracking all incoming payments. To create an efficient template, focus on key sections that capture essential transaction details. Use columns for the date of the receipt, customer name, payment method (e.g., cash, check, or electronic transfer), invoice number (if applicable), amount received, and any additional notes.

Design Considerations: Ensure there is space for transaction totals at the bottom of the journal. This helps in summarizing daily or weekly receipts, making it easier to reconcile records with bank deposits. It’s also helpful to include a reference number for each transaction for future tracking.

Use a consistent format: Align your columns for easy scanning. Group similar payments together and consider color coding for specific types of transactions, such as cash versus checks. This not only makes the template more organized but also improves the speed of data entry.

Template Features: Your document should include sections for the transaction date, payer details, amount, and the payment method. Make sure there’s space for additional notes, which can be useful for providing context (e.g., partial payment or returned check). This structure will keep your cash receipt records clear and accurate.

Begin by setting up a table that includes key columns for accurate tracking. At a minimum, you should include:

- Date of receipt

- Source of payment

- Amount received

- Payment method (cash, check, electronic transfer, etc.)

- Account credited

- Reference number (e.g., receipt number, check number)

Ensure that each transaction is recorded in chronological order. This will make it easier to reconcile receipts at the end of a period.

Next, create a summary section at the bottom of the journal to track total receipts by day, week, or month. This can be done using simple formulas in spreadsheet software or by adding totals manually if using a paper-based format.

Regularly update your journal to reflect each new cash receipt and verify that the totals match the amounts deposited into your business bank account.

For better organization, consider separating cash receipts from other types of income or payments, and make sure to follow a consistent format across entries. This consistency helps prevent errors and discrepancies over time.

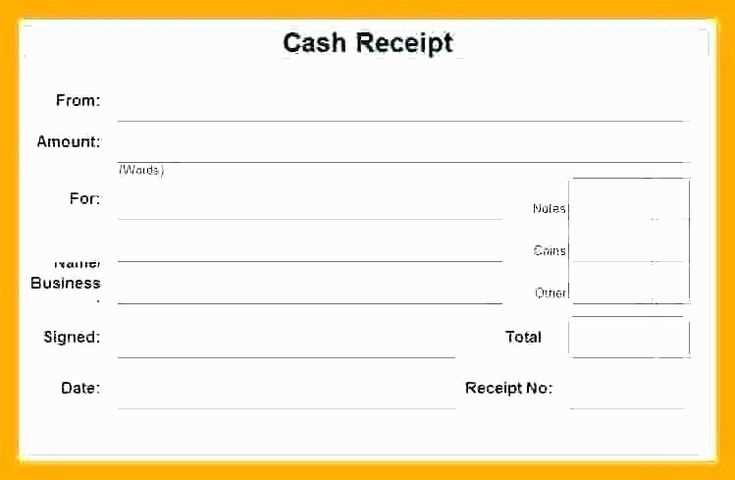

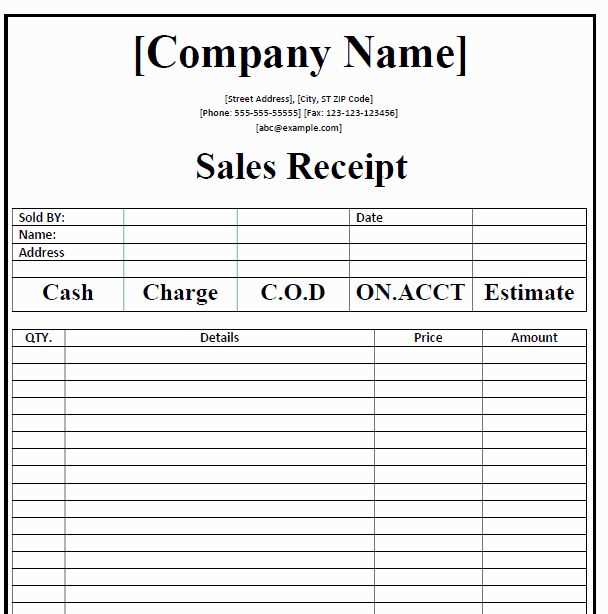

Include the following details to make your receipt clear and professional:

- Date of Transaction: Always specify the date when the payment was made. This helps track the timing of the transaction.

- Receipt Number: Assign a unique identifier to each receipt for reference and organization.

- Seller’s Information: Clearly display the seller’s name, business name, address, and contact details.

- Buyer’s Information: Include the buyer’s name and, if relevant, contact details. This is especially useful for invoices and large transactions.

- Description of Items/Services: Provide a brief description of the products or services purchased, including quantity, price per item, and total cost.

- Payment Method: Indicate whether the payment was made by cash, card, cheque, or another method. This provides clarity on how the transaction was completed.

- Total Amount: Clearly state the total amount paid, including taxes, discounts, or additional fees.

- Signature (Optional): For added security or formality, include a space for signatures from both the buyer and seller.

Additional Tips

- Ensure all details are legible and accurate to avoid confusion.

- If applicable, include any terms or conditions regarding returns or exchanges.

Tailor your cash receipts journal template by adjusting the columns to fit the financial tracking needs of your business. Focus on specific details such as customer name, transaction date, payment method, and invoice number. If you deal with multiple currencies, add a column for currency type and exchange rate.

Include Relevant Payment Categories

Incorporate categories that align with your business operations, such as cash, credit card, or checks. This allows for easier reconciliation and tracking of how each payment type impacts your finances. For businesses that offer discounts or refunds, add sections to record those adjustments separately.

Integrate Automatic Calculations

Ensure your template includes automatic total calculations, such as summing up the receipts for the day or week. This reduces manual errors and saves time. Customize formulas based on your accounting software or reporting preferences to improve accuracy in financial reporting.

To maintain a clear overview of your cash flow, start by documenting all cash transactions as they occur. This practice will help you monitor your financial situation regularly and prevent errors in record-keeping.

- Record every cash inflow and outflow in chronological order.

- Include the date, amount, and description for each transaction to ensure accuracy.

- Group transactions by category (e.g., sales, expenses, investments) for easier tracking and reporting.

Regularly review your entries. Monthly or quarterly reviews help identify trends in cash movement, allowing you to adjust your budgeting and spending practices accordingly. Organize receipts, invoices, and other supporting documents alongside the journal for easy reference.

- Keep a dedicated space in the journal for reconciling totals with your bank statements.

- Use a spreadsheet or accounting software to visualize cash flow data for better decision-making.

By consistently tracking and organizing your cash flow, you’ll gain greater control over your finances, reduce errors, and improve financial planning.

1. Missing Key Information: Ensure all necessary details are included, such as the date, item description, quantity, price, and tax. Omitting any of these could lead to confusion or errors in future record-keeping or audits.

2. Inaccurate Totals: Double-check calculations before finalizing the receipt. Small mistakes in adding up totals or applying discounts can result in discrepancies that affect the accuracy of financial records.

3. Using Outdated Templates: Regularly update your receipt template to reflect any changes in tax rates or company policies. An outdated template can lead to incorrect entries, potentially resulting in compliance issues.

4. Unclear Formatting: Avoid cluttered layouts. A clean, easy-to-read receipt reduces the chances of misinterpretation. Use clear section headings and consistent spacing to organize the details effectively.

5. Incorrect Payment Methods: Be sure to accurately represent the payment method on the receipt. Whether it’s cash, credit, or debit, listing the wrong method can create confusion or misunderstandings between you and the customer.

6. Forgetting to Include Terms or Conditions: If there are any specific terms related to the sale (e.g., return policy), make sure they are clearly stated. Failing to include these can lead to disputes later on.

Double-check every entry before finalizing. It’s a simple step that prevents costly mistakes. Accuracy in documenting cash receipts requires careful attention to detail from the outset. If data is entered incorrectly, it creates discrepancies that affect reporting and decision-making.

Key Steps for Accuracy

Follow these steps to ensure accurate data entry:

| Step | Action | Benefit |

|---|---|---|

| 1 | Cross-check receipt numbers and amounts | Prevents discrepancies in financial records |

| 2 | Use a standardized template for data entry | Minimizes errors and increases consistency |

| 3 | Verify entries with supporting documents | Ensures that records align with actual transactions |

| 4 | Utilize automated tools for calculations | Reduces human error and speeds up the process |

Common Pitfalls to Avoid

Watch out for these common mistakes:

- Overlooking small discrepancies in amounts.

- Neglecting to reconcile records with bank statements regularly.

- Failing to update records in real-time, leading to outdated information.

By paying attention to these details, you ensure that all financial data is accurate, timely, and reliable for future reference. Implementing these practices will lead to a well-maintained cash receipts journal.

To effectively structure a cash receipts journal, utilize clear headings and categories for every transaction. Ensure columns reflect necessary details like date, amount, and description. Maintain an organized format for easy reference and tracking.

Here’s a simple table template for your reference:

| Date | Receipt Number | Received From | Amount | Description |

|---|---|---|---|---|

| MM/DD/YYYY | R12345 | John Doe | $100.00 | Payment for services rendered |

| MM/DD/YYYY | R12346 | ABC Corp. | $250.00 | Payment for product sale |

Ensure all information is accurately recorded. A clean, easy-to-read format will prevent errors and facilitate reconciliation. Periodically review entries for discrepancies and consistency in the recorded amounts.