A cash receipts journal template in Excel can simplify your record-keeping process. This tool helps track all incoming payments, whether from customers, loans, or other sources. The structure of an Excel template provides clarity by breaking down payment details such as date, source, amount, and payment method.

Setting up a template involves organizing columns for essential information like payment date, payer, amount, and account to be credited. You can easily filter and sort data to gain quick insights into your finances. The ability to customize your columns and add notes ensures that the template fits your business needs without excess complexity.

Tracking payments efficiently is crucial for maintaining accurate cash flow records. Excel’s built-in functions, such as SUM and conditional formatting, can help you automatically calculate totals and highlight overdue payments. The template also allows you to generate financial reports that will assist in audits and tax preparation.

Consider including drop-down menus for payment sources and methods to speed up data entry and minimize errors. Creating a separate section for bank deposits and reconciling transactions is also a good practice. This template can be adjusted to suit any size business or organization, ensuring you never miss a payment detail again.

Cash Receipts Journal Excel Template

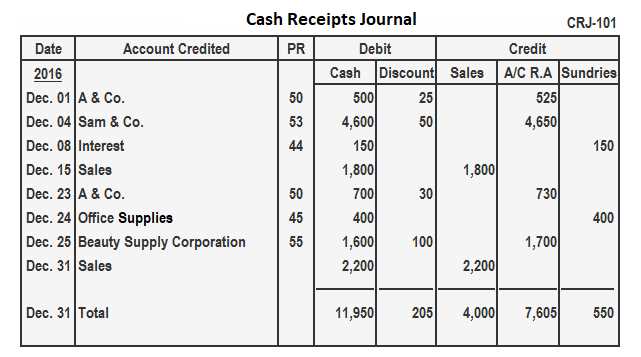

A cash receipts journal Excel template is a simple tool to track and manage incoming payments. It helps organize transactions in an easy-to-use format, ensuring clear records for accounting purposes. By setting up columns for date, receipt number, payer details, amount, and payment method, this template gives you an accurate picture of cash flow.

Key Features of a Cash Receipts Journal Template

- Date: Record the date of each transaction to track cash flow over time.

- Receipt Number: Assign unique numbers to each entry for easy reference and auditing.

- Payer Information: Include details like payer name and contact information to identify sources.

- Amount: Track the exact amount received, ensuring all funds are accounted for.

- Payment Method: Specify the method of payment (cash, cheque, bank transfer) for transparency.

How to Use the Template

- Start by entering the date and receipt number for each payment.

- Update payer information to maintain a clear record of who made the payment.

- For each payment, input the amount received and specify the payment method.

- Review the total at the bottom of the template to ensure all payments are recorded correctly.

- Use the journal to easily reconcile cash receipts with your bank statements or financial reports.

Setting Up a Cash Receipts Journal in Excel

Open a new Excel worksheet and create headers for each column. Common columns include “Date,” “Description,” “Account,” “Cash Receipts,” and “Balance.” You can customize these headers based on your business’s needs.

Column Configuration

For the “Date” column, use the date format (e.g., MM/DD/YYYY) for easy tracking. In the “Description” column, list the reason for the cash receipt. For the “Account” column, include the appropriate account or customer name.

Formulas and Calculations

To track balances automatically, use formulas. In the “Balance” column, input a simple formula to add the current cash receipt to the previous balance. For example, if the first row is row 2, the formula in cell E2 will be =D2. In subsequent rows, the formula should be =E2+D3, where E2 is the previous balance, and D3 is the current cash receipt. Adjust the cell references for your specific setup.

Tracking and Categorizing Transactions

Accurate transaction tracking begins with clearly defined categories. Use separate columns in your Excel template to classify income, expenses, and other relevant transaction types. This allows for quick sorting and filtering based on category. A consistent approach ensures that you can easily identify trends and discrepancies. Apply predefined categories like “Sales”, “Refunds”, or “Payments Received” to streamline data entry.

For consistency, use drop-down lists to minimize data entry errors. Excel’s data validation feature lets you create a list of transaction categories that can be selected from a menu. This saves time and helps avoid inconsistencies that might occur with manual entry.

To get a clear overview, group similar transactions together. For example, list all customer payments in a “Receipts” section and all vendor payments in an “Expenses” section. This organization simplifies reporting and ensures that every entry can be linked back to its specific purpose.

Don’t forget to mark the date and amount for each transaction. This will make it easier to track payments and generate accurate financial reports. Using Excel’s built-in date functions can automatically calculate totals for different categories over time, providing a snapshot of your financial health.

Generating Reports and Analyzing Data

To create reports from your cash receipts journal template, focus on summarizing key data like dates, payment types, and amounts. Use Excel’s built-in functions such as SUM, COUNTIF, and PivotTables to group and calculate data efficiently. PivotTables are particularly useful for segmenting your data by categories like customer, payment method, or date range.

Start by filtering the journal for specific time periods or transaction types to pinpoint trends or outliers. For example, use the filter function to isolate payments made via credit card or payments received within a certain month. This makes it easier to track cash flow and detect anomalies.

Once your data is organized, you can apply Excel’s charting features to visualize key insights. Create bar charts to compare payment types, or line graphs to visualize cash flow over time. These visualizations will help you quickly spot trends and identify periods of high or low receipt activity.

Finally, utilize conditional formatting to highlight important data points, such as unusually large transactions or late payments. This can help bring attention to potential issues that need further investigation.