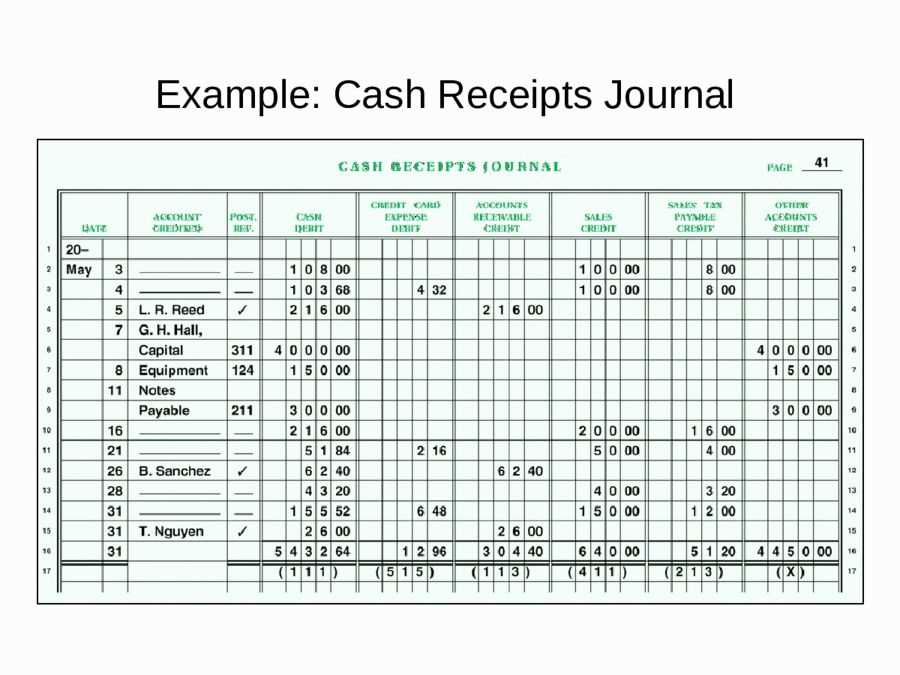

A cash receipts journal template simplifies the process of tracking incoming payments for your business. By organizing cash transactions efficiently, it helps ensure accurate records and timely financial reporting. This template allows you to categorize receipts, making it easier to track revenue, reconcile accounts, and maintain transparency in your financial records.

When using a cash receipts journal template, focus on including key fields such as date, source of payment, amount received, and account credited. This will give you a clear snapshot of where the money is coming from and how it affects your general ledger. Ensure that each transaction is logged as soon as it’s received to prevent discrepancies later on.

The template’s layout should be simple, allowing for easy updates and adjustments. Regularly reviewing your cash receipts journal helps you spot errors early, maintain smooth cash flow, and stay on top of your business finances. Make sure to store it securely, whether digitally or on paper, to maintain an accurate record of all cash transactions.

Here’s the revised version according to the requirements:

To ensure accuracy in the Cash Receipts Journal template, focus on organizing transaction details clearly. Start with columns for the date, customer name, receipt number, and amount received. Make sure the amount is entered in both the debit and credit columns. Add specific categories for payment types, such as cash, check, or bank transfer, to simplify classification and reconciliation.

Next, include a reference column to link each transaction to supporting documents, like invoices or receipts. This helps maintain a clear audit trail. If your system uses accounts or departments, make a column to assign each receipt to the corresponding account or cost center. This step ensures transactions are correctly categorized in your accounting records.

For consistency, use a standard format for entry, such as entering dates in MM/DD/YYYY and amounts in whole numbers or two decimal places. Double-check that the sum of all receipts matches the total balance at the end of each period to avoid discrepancies.

Finally, consider including a section for notes or comments, where you can add relevant details for any special transactions. This can be especially useful for transactions requiring further review or explanation.

- Cash Receipts Journal Template

A Cash Receipts Journal Template helps track all incoming payments to a business, ensuring transparency and accurate accounting. Use this template to record cash transactions, credit payments, and any other forms of revenue received by the business.

Key Elements of a Cash Receipts Journal

Each entry in the journal should include the following details: the date of the receipt, the payer’s name, the amount received, the payment method, the account credited, and any relevant notes for future reference. By maintaining these records consistently, you ensure smooth reconciliation of the accounts.

How to Create Your Own Cash Receipts Journal Template

Design your template with columns for each key element mentioned above. Excel or Google Sheets works well for this purpose as it allows easy modification and automatic calculations. Use separate columns for the date, payer, amount, payment method, account credited, and a reference field for notes or additional details. Organizing the information in this manner will help you track payments and reconcile them quickly at the end of the period.

To set up a cash receipts journal, begin by creating columns for each necessary detail. Include columns for the date, description, reference number, account to be credited, and amount received. This format helps you track each transaction efficiently. Keep the journal updated with every incoming payment to maintain accuracy.

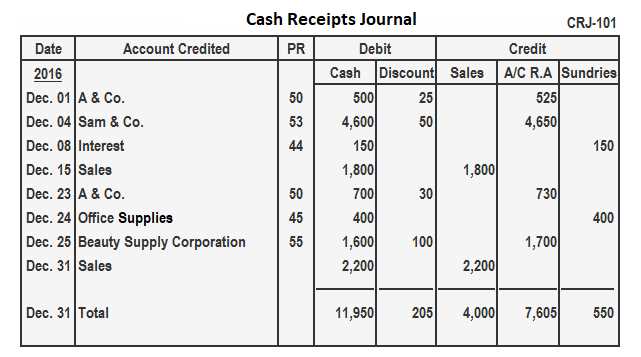

Next, establish categories based on your business needs. If you handle various payment types (e.g., sales, loan repayments, or refunds), create separate columns for each type to streamline the recording process. This structure ensures quick reference and reduces the likelihood of errors.

Each entry should include a brief description of the transaction and any relevant identifiers, such as invoice numbers or customer names. If possible, use a numbering system for references to make tracking simpler.

Lastly, balance your journal regularly by reconciling the recorded amounts with your bank deposits. This step prevents discrepancies and keeps your records accurate. By following this setup, you’ll ensure that your cash receipts journal serves as a reliable financial tool for tracking incoming payments.

The cash receipts journal should capture key information about incoming payments. Below are the most critical columns to include:

Date: Record the date each payment is received. This helps track the timing of cash flow and provides a clear payment history.

Customer Name/ID: Include the name or customer ID to identify the source of the payment. This ensures proper crediting to the correct accounts.

Invoice Number: If the payment corresponds to a specific invoice, include its number. This provides a direct link to the transaction and helps with tracking unpaid amounts.

Amount Received: Record the exact amount received. This allows for easy verification of the payment and reconciles with the accounting records.

Payment Method: Specify how the payment was made (e.g., cash, check, credit card). This helps categorize the payment type and facilitates reconciliation with bank statements.

Account Credited: Indicate the account that is being credited with the payment. This ensures the funds are properly allocated in the accounting system.

Reference or Check Number: If applicable, include any reference or check number associated with the payment. This helps in tracing payments if any issues arise.

Including these key columns ensures a well-organized and transparent cash receipts journal, aiding in accurate financial reporting and easy reconciliation of accounts.

Step-by-Step Guide to Recording Transactions in the Cash Journal

Begin by organizing your cash receipts. This involves identifying the source and amount of each transaction.

- Record the Date: Always start by writing the date of the transaction in the designated column. This helps maintain a chronological order of all receipts.

- Identify the Source: List the person or company from whom the payment was received. This could be customers, clients, or other payees.

- Enter the Amount: Write the exact amount of cash received. If it’s a partial payment, note the remaining balance elsewhere for future reference.

- Classify the Receipt: Specify the type of transaction, such as sales revenue, loan payments, or other sources. This ensures proper classification for accounting purposes.

- Record Payment Method: Indicate how the payment was made, such as by cash, check, or electronic transfer. This provides clarity in case of any discrepancies.

- Note Any Discounts or Adjustments: If the transaction involves a discount or adjustment, make sure to subtract this from the original amount received.

- Update the Running Total: After entering the transaction, update the cash balance. This ensures your journal reflects an accurate cash position at all times.

Regularly review the journal to confirm accuracy and consistency. This habit minimizes errors and ensures reliable financial reporting.

Debits and credits play a key role in tracking cash receipts. In a cash receipts journal, every transaction involves both a debit and a credit entry, which helps maintain the balance of your accounts.

Debits

When cash is received, the cash account is debited. This increases the cash balance, reflecting the incoming funds. Debiting the cash account ensures that the company’s books are updated with the new cash inflow, accurately reflecting the company’s financial position.

Credits

Simultaneously, a corresponding credit is made to another account. For example, if the cash receipt is from a customer paying off an invoice, the accounts receivable is credited. This reduces the outstanding balance owed by the customer, showing that they’ve made a payment. Credits decrease the balance of the account they are applied to, ensuring that all records are balanced.

Both debits and credits maintain the accounting equation (Assets = Liabilities + Equity), ensuring that each cash receipt is properly recorded in both the cash and corresponding accounts.

Ensure you are recording all transactions, including small payments, as these can easily be overlooked in busy periods. A common mistake is skipping over minor receipts that can lead to discrepancies in financial records.

1. Inaccurate Date Entry

Always verify the date of each transaction. Misdated entries can cause confusion, especially when reconciling records with bank statements or reports. This mistake can lead to errors in cash flow analysis or missing reports.

2. Forgetting to Include All Payment Sources

- Include all forms of payments like cash, checks, bank transfers, and credit card payments.

- Leaving out any payment type, such as digital transfers, can result in incomplete records and financial gaps.

3. Failing to Categorize Receipts Correctly

Each payment should be linked to the correct account or category. Failing to classify receipts properly can complicate future financial analysis, leading to inaccurate reports and potential mistakes in tax filing.

4. Not Updating the Template Regularly

Templates should reflect the latest accounting methods and business needs. Neglecting updates may lead to errors or outdated practices being carried forward, especially when new receipt categories or rules come into play.

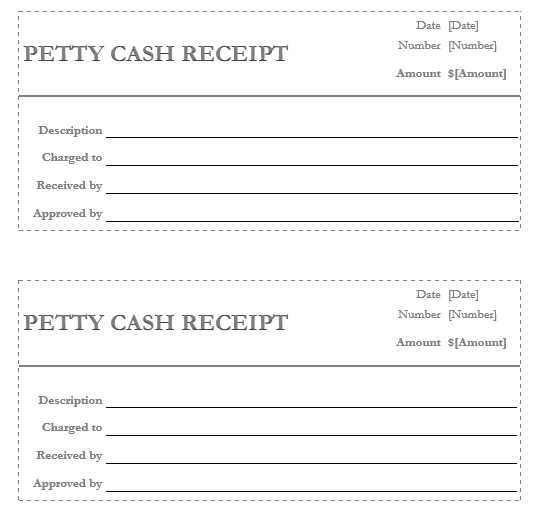

5. Overlooking the Need for Backup Documentation

Attach supporting documents, such as invoices or receipts, for each transaction recorded in the template. This practice ensures accuracy and serves as proof in case of audits or disputes.

6. Lack of Review and Verification

Make it a habit to review the cash receipts journal periodically. A second pair of eyes or regular self-checks can catch errors before they escalate into larger problems.

Adjust the template to suit your business operations by aligning categories with your income and expense types. Begin by reviewing the standard fields in a cash receipts journal, such as date, receipt number, amount received, and payer. Add or remove columns as needed based on the specifics of your transactions.

For example, if you manage different revenue streams, include separate columns for each income source, like product sales, services, and miscellaneous income. This separation allows you to track cash inflows more precisely.

Include a section for discounts or adjustments if your business offers those. If your company deals with multiple currencies, add a currency column and specify the exchange rate used for conversion. Adjust the payment method column to capture specifics like cash, credit card, or bank transfer.

Lastly, create a summary row that totals the receipts for each day, week, or month. This will give you a quick overview of the cash flow and simplify reconciliations.

| Date | Receipt Number | Payer | Amount Received | Payment Method | Income Source | Currency | Discount/Adjustment |

|---|---|---|---|---|---|---|---|

| 02/10/2025 | 001 | John Doe | $200 | Credit Card | Product Sales | USD | $0 |

| 02/10/2025 | 002 | Jane Smith | $500 | Cash | Service Fees | USD | $20 |

| Total | $700 | ||||||

Regularly update and refine your template as business needs change. This customization process ensures better tracking, transparency, and easier financial management for your business.

Meaning is preserved while minimizing word repetition.

Use clear headings and consistent formats to organize your journal. Group similar transactions together and ensure all columns are properly labeled for easy reference. This structure simplifies data entry and helps avoid redundancy.

When entering cash receipts, categorize each entry based on its source. Include relevant details such as the payment method, date, and amount. This provides a concise overview without unnecessary repetition of terms or details.

Ensure the totals at the bottom of your journal are updated regularly. This not only helps in tracking cash flow but also prevents confusion by maintaining accurate records. Cross-check these totals with your bank statements for consistency.

To keep your journal clear, avoid overloading it with excessive descriptions. Stick to the key information needed for accurate tracking and reporting. This reduces clutter and enhances usability.