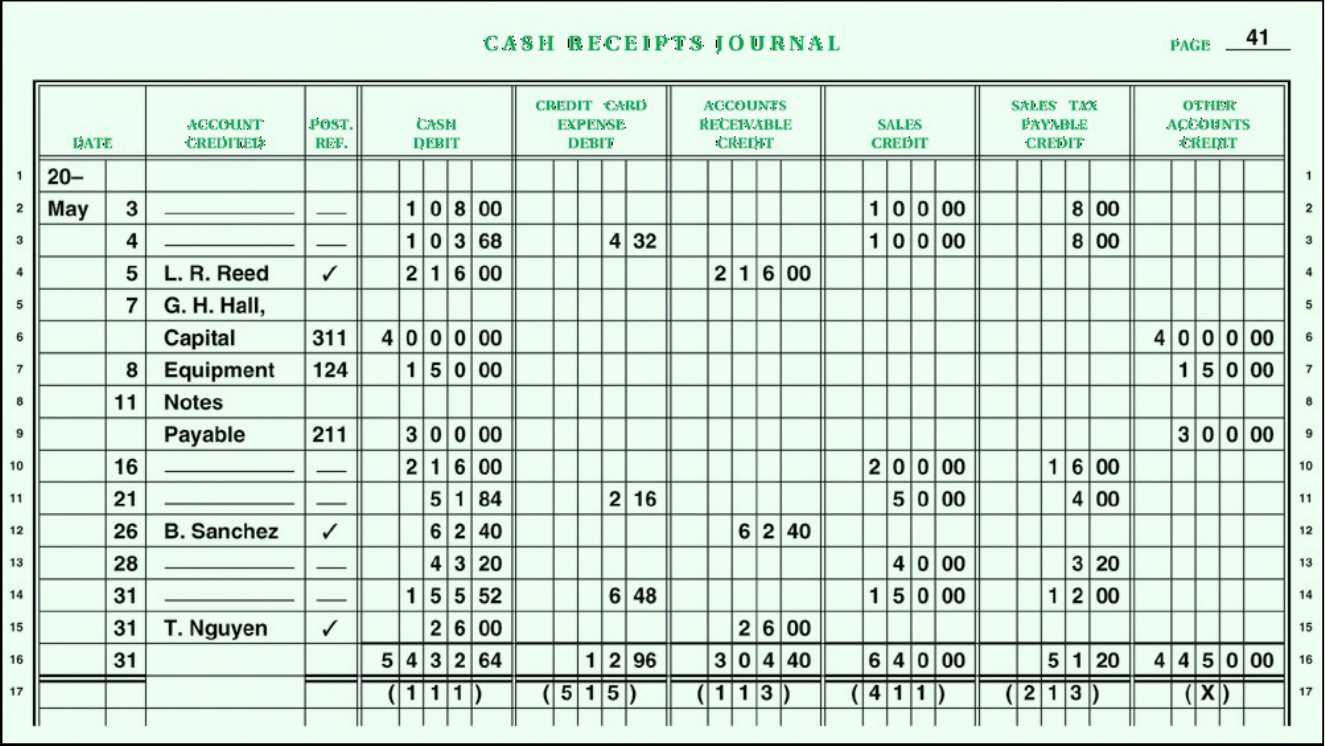

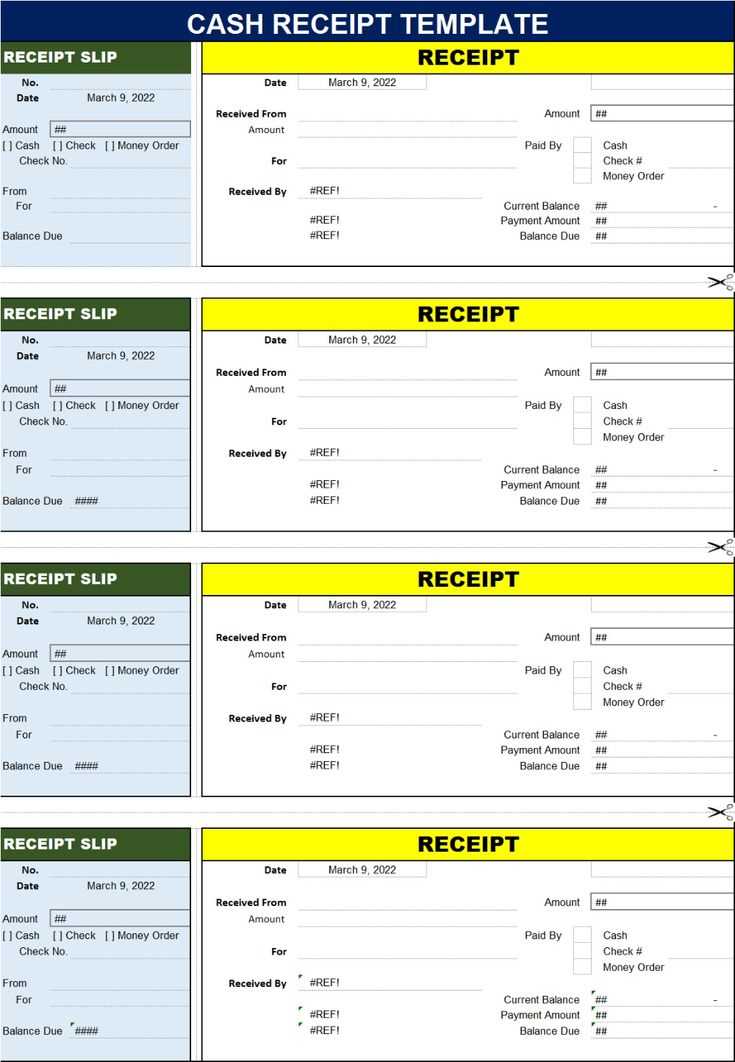

To streamline your accounting process, consider using a Cash Receipts Journal template in Excel. This tool helps you track all incoming cash transactions with clarity and precision, ensuring accurate financial records. With customizable fields, you can capture transaction dates, sources, amounts, and payment methods all in one place.

Excel’s flexibility makes it easy to adapt the template to your specific business needs. You can quickly add or remove columns, and use formulas to automatically calculate totals. This saves you time while maintaining consistency in your cash receipts log.

The template also offers the advantage of clear financial analysis through built-in features like sorting and filtering. This lets you review specific entries over a defined period, providing insights into cash flow and payment trends without manually sorting data.

Here’s a detailed HTML plan for an informational article on the topic “Cash Receipts Journal Template Excel” with three practical, narrow-focused headings: htmlEditCash Receipts Journal Template Excel

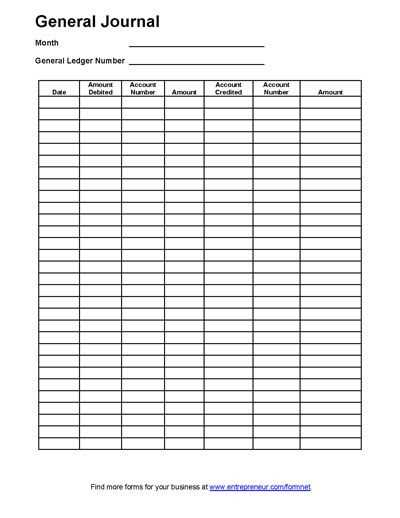

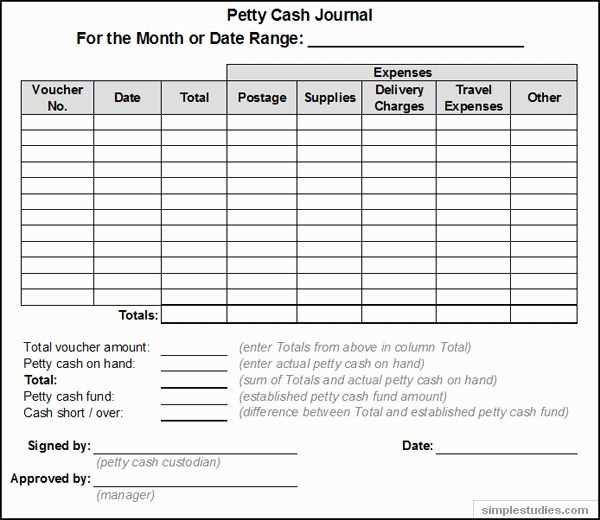

Start with a clear and structured template. A well-organized cash receipts journal in Excel should cover all key transaction details. Begin by setting up columns for Date, Receipt Number, Customer Name, Amount, and Account to Credit. This ensures easy tracking of incoming payments.

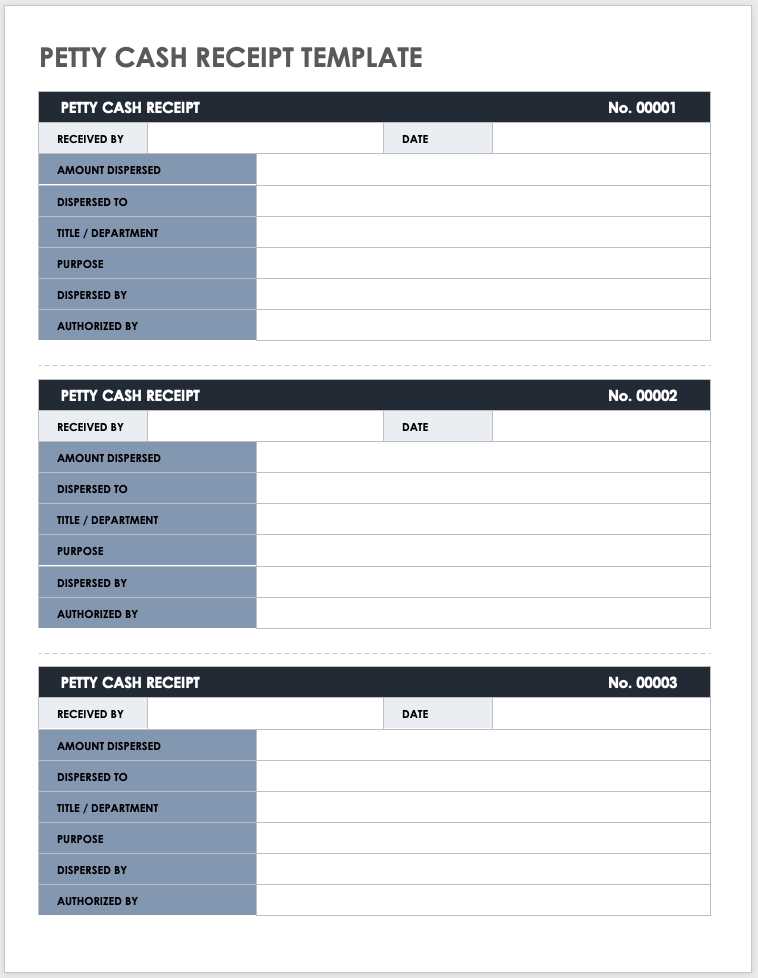

1. Organizing Receipt Information

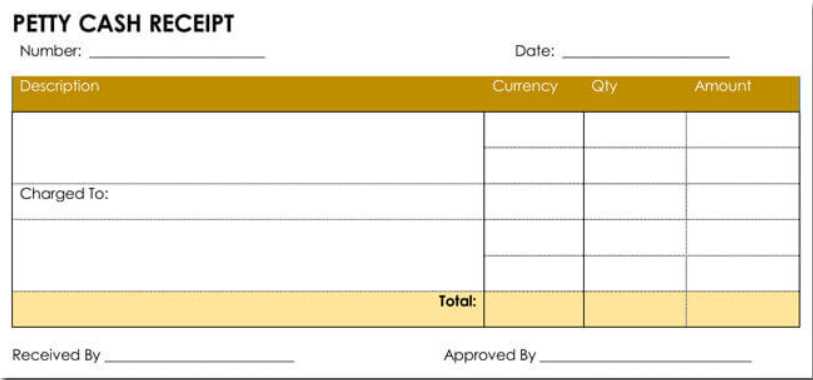

Arrange your journal to capture every receipt with accuracy. Each row should represent a single receipt, and it’s helpful to label each column for easy identification. For example, start by including fields like Date (for when the receipt was processed), Receipt Number (unique identification for each transaction), and Customer Name (to match payments to accounts). This method reduces errors and speeds up data entry.

2. Adding Payment Types and Accounts

Include a column to specify the payment type, such as cash, check, or online transfer. This helps separate different payment methods. Additionally, having an Account to Credit column allows users to specify which account is being affected by the receipt, ensuring accurate financial reporting.

3. Managing Totals and Balances

At the bottom of your template, add a row that automatically calculates the total of all amounts in the Amount column. This can be done with a simple Excel SUM function. Ensuring totals are updated in real-time helps keep track of your financials efficiently. You can also add a running balance column that adjusts after each new receipt entry, offering an ongoing snapshot of the account status.

| Date | Receipt Number | Customer Name | Amount | Payment Type | Account to Credit |

|---|---|---|---|---|---|

| 02/12/2025 | 001 | John Doe | $500 | Cash | Cash Sales |

| 02/12/2025 | 002 | Jane Smith | $300 | Check | Accounts Receivable |

| 02/12/2025 | 003 | ABC Corp | $1500 | Online Transfer | Sales Revenue |

Setting Up a Basic Cash Receipts Journal in Excel

To create a functional cash receipts journal in Excel, begin by setting up the essential columns. These should include Date, Receipt Number, Customer Name, Payment Method, Amount Received, and Account Debited. These fields will track all incoming cash transactions efficiently.

- Date: Enter the date each payment is received.

- Receipt Number: Assign a unique receipt number to each transaction for easy reference.

- Customer Name: Include the name of the customer or payer.

- Payment Method: Specify whether the payment was made by cash, check, or electronic transfer.

- Amount Received: Record the exact amount of money received.

- Account Debited: Note which account the payment will be applied to.

Next, set up a running total of the amounts received. You can use Excel’s SUM function to automatically update the total each time a new entry is added.

For added organization, apply cell formatting to make it easier to read. Highlight columns, use borders, and format currency fields to ensure consistency and clarity.

Consider using filters or conditional formatting to quickly view payments from specific customers or time periods. This will help with sorting and data retrieval, especially if your journal becomes large over time.

Lastly, save your journal regularly and back it up to avoid losing any data.

Customizing Your Template for Business Needs

Adjust your cash receipts journal template to reflect the unique aspects of your business. Focus on the key transactions that matter most, such as customer payments, deposits, or sales. Add columns to track payment methods like cash, credit, or checks. This will help you stay organized and ensure accurate record-keeping.

Adding Specific Columns for Your Transactions

Consider adding columns for discounts, refunds, or special fees that apply to your business. For example, if you run a retail operation, a column for sales tax could be helpful. Tailoring the template to your needs reduces errors and increases clarity when reviewing financial data.

Color Coding and Filters

Use color coding to differentiate between types of transactions or payment statuses. For instance, you can color-code completed payments in green, pending ones in yellow, and overdue payments in red. Filters help you quickly access specific data, saving you time when reconciling records.

Automating Calculations and Reporting in Excel

Use Excel’s built-in functions like SUM, AVERAGE, and IF to streamline your calculations. These functions can help you automatically calculate totals, averages, and conditional values in your cash receipts journal. For example, you can set up formulas to sum up daily receipts or apply conditional formatting to highlight receipts that meet certain criteria.

Leverage Excel’s Data Validation to limit data entry errors. This tool helps ensure that only the correct type of data is entered, reducing the chances of mistakes in your journal. You can also create drop-down lists for categories such as payment methods or transaction types, making it easier to maintain consistency.

Pivot tables allow you to summarize and analyze data efficiently. By grouping data in pivot tables, you can quickly generate reports that break down the cash receipts by different parameters like date, amount, or customer. This approach saves time compared to manually sorting and calculating data.

For regular reports, create templates that pull data from your main journal and generate monthly or quarterly summaries automatically. You can use Excel’s Power Query tool to connect to your data source, automate data extraction, and refresh reports without needing manual input each time.

With these techniques, you’ll save time, reduce errors, and gain better insights from your cash receipts journal. Excel’s automation features help turn manual tasks into streamlined processes, providing you with accurate and up-to-date financial reports quickly.