To create a clear and professional cash receipt, ensure it includes key details like the amount received, the date, the purpose, and the names of both parties involved. A well-structured template can streamline this process, making transactions easier to document and track.

First, specify the amount of cash received in both numeric and written forms. This avoids any confusion and serves as a clear record. Use a consistent format for easy readability, and ensure the numbers are clearly legible.

Next, include the transaction date. This detail is vital for accurate record-keeping and future reference. Make sure to write the date in a standard format to avoid any misunderstandings. If applicable, add the time of the transaction.

Document the reason for the payment, whether it’s for goods or services rendered. Briefly describe the nature of the exchange, such as a product purchase, service fee, or loan repayment. This helps both parties understand the context of the payment.

Lastly, include the names of the payer and the recipient. Clearly state who made the payment and who received it, including their full names and contact details if necessary. This adds transparency and can prevent any future disputes.

With these elements in place, a cash receipt becomes a reliable document for both parties, providing clarity and protection in case of any issues down the line.

Here’s the revised version:

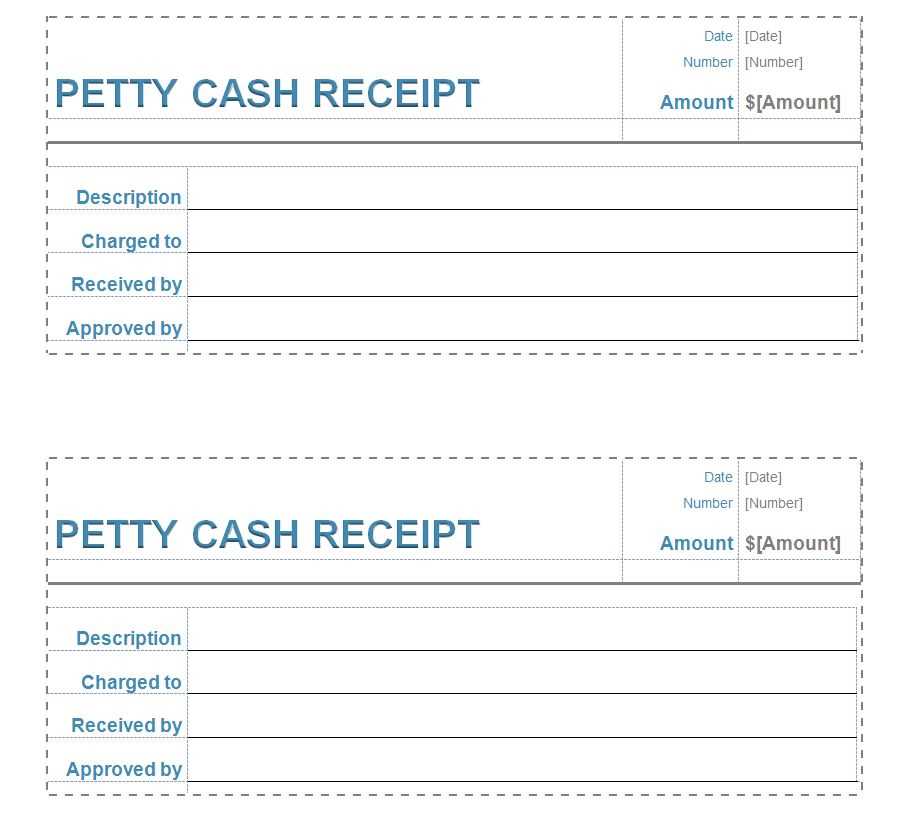

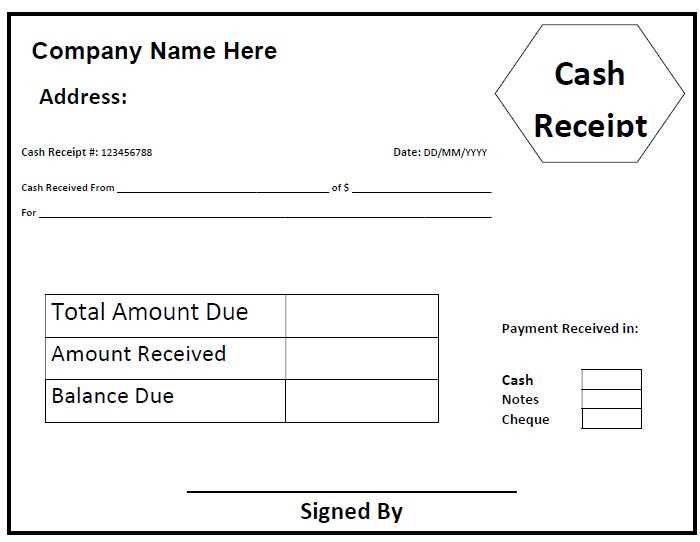

For a clear and concise receipt, include the following key details: the date of the transaction, the name and contact information of the payer, a description of the transaction or items purchased, the amount paid, and the method of payment. Ensure each section is properly aligned for easy readability.

Always provide a unique receipt number to avoid confusion in the future. This can be a simple sequential number or a more complex identifier, depending on your needs. Keep your formatting consistent throughout your receipts.

Consider including a thank you message or note at the bottom to leave a positive impression with the payer. It adds a personal touch without taking up much space.

If you’re using digital receipts, make sure the file format is easily accessible, like PDF or image files, and ensure it’s readable on mobile devices.

- Cash Received Receipt Template Guide

When creating a cash received receipt, ensure all critical information is clearly visible. Include the date of the transaction, the amount of cash received, and the reason for the payment. Specify the recipient’s name and any reference numbers that apply to the transaction.

Keep the format simple and easy to read. Use a clear title like “Cash Received” at the top of the receipt. Below, list the details in a structured way. Include sections for the payer’s name, the amount paid, the payment method (if relevant), and any notes that may apply to the transaction. Adding a receipt number can be helpful for record-keeping.

To avoid confusion, ensure the amount in words matches the numerical value. This helps prevent any potential discrepancies in interpreting the receipt. Consider adding a line for signatures, especially if both parties need confirmation of the payment.

If the receipt is for a business transaction, include the company name, address, and tax identification number. This adds professionalism and clarity. A footer with terms such as “Thank you for your payment” or other relevant notes can also enhance the receipt’s overall look.

To create a receipt template that aligns with your business, focus on including key elements that customers need for tracking their purchases. Tailor the design to reflect your brand identity while ensuring all necessary information is clear and accessible.

1. Personalize with Your Business Information

- Include your business name, logo, and contact details (address, phone, email).

- Ensure the business name is prominently displayed to reinforce your branding.

- Add a unique receipt number for each transaction to keep records organized.

2. Include Transaction Details

- Provide the date and time of the transaction to give context to the purchase.

- List the items or services purchased along with their quantities and prices.

- Include applicable taxes and discounts to ensure transparency in pricing.

3. Add Payment Information

- Clearly state the method of payment used, whether it’s cash, card, or another option.

- Include any relevant transaction IDs or references for online payments.

4. Incorporate Custom Features

- If needed, add a section for return or exchange policies, providing customers with clear instructions.

- Consider adding a space for loyalty rewards or promotional codes if relevant to your business.

5. Keep the Layout Simple and Clean

- Avoid overcrowding the receipt with unnecessary information.

- Use clear, legible fonts and ensure adequate spacing between different sections.

- Ensure the template is printer-friendly with a well-organized format.

Include the date of the transaction to clearly mark when the payment was made. This is crucial for both parties to track financial records accurately.

Specify the amount received, ensuring it matches the payment made. Use clear numbers and, if applicable, specify the currency.

Clearly identify the payer’s name. This helps confirm who made the payment, especially when dealing with multiple transactions.

Indicate the method of payment, whether it’s cash, check, or another form. This provides a transparent record of how the funds were received.

List the purpose or description of the payment. This gives context to the receipt and helps in categorizing transactions later.

Provide a unique receipt number. This creates an easy reference point for both the payer and recipient in case of inquiries or future disputes.

Include the recipient’s name or business name. This ensures both parties know who received the payment and can be useful for tax or auditing purposes.

Ensure the receipt is clear and legible. Avoid small fonts or cramped layouts that make it difficult for recipients to read key information, such as the amount or transaction details.

Incorrect or missing dates can lead to confusion. Always include the transaction date, as this serves as a record for both parties and may be necessary for accounting or tax purposes.

Another mistake is omitting or incorrectly listing payment methods. Clearly specify whether the payment was made in cash, by card, or through any other method. This prevents discrepancies in transaction tracking.

Failing to include relevant transaction details is a common error. Ensure you list all purchased items, their quantities, and prices accurately. Missing or incorrect itemization can cause misunderstandings or disputes later.

Incorrect or incomplete customer details can cause issues, especially if the receipt is used for returns or warranties. Always double-check the customer’s name and contact information if required.

Ensure the receipt includes clear and correct tax details. This includes the tax rate applied and the total tax amount, which is crucial for both record-keeping and verification of the total transaction value.

Double-check for typos and calculation errors. Small mistakes, like rounding or incorrect totals, can cause confusion and reduce the reliability of the receipt.

Here is a simple example of a well-structured receipt table:

| Item | Quantity | Price | Total |

|---|---|---|---|

| Product A | 2 | $10.00 | $20.00 |

| Product B | 1 | $15.00 | $15.00 |

| Subtotal | $35.00 | ||

| Tax (10%) | $3.50 | ||

| Total | $38.50 | ||

Avoid these common mistakes to ensure the receipt is both professional and useful for both you and your customer.

A clear and professional cash receipt template should provide a straightforward summary of a transaction. Use this template to record the date, the name of the payer, the amount received, and the purpose of the payment. Make sure all fields are easily readable, and the format is simple to follow.

Important Fields to Include

Include the date of the transaction, payer’s name, amount received (in both numbers and words), and payment method (cash, check, credit card, etc.). Ensure that the purpose of the payment is described clearly to avoid any ambiguity in the future. This will serve as an important reference for both parties.

Formatting Tips

Use bullet points or numbered lists for clarity. Place the most crucial information, such as the amount received, in bold to highlight it. Keep the receipt free of unnecessary text to maintain focus on the essential details. If possible, offer a separate section for additional notes that may be helpful for either party.