Designing cash register receipts that are clear, functional, and visually appealing requires attention to detail. Focus on keeping essential information, such as the store name, transaction details, and payment method, easy to find and understand. An organized layout will not only help customers but also reduce errors during future transactions.

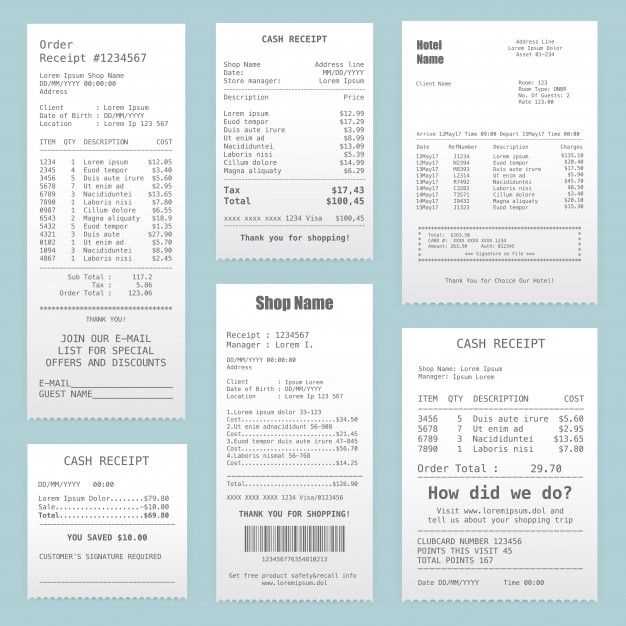

Template Structure should prioritize readability. Use a clean font and ensure that transaction details like item descriptions, prices, taxes, and totals are properly aligned. Providing a quick summary of the purchase helps the customer verify the details instantly. A well-structured template avoids clutter and confusion.

Legal and Business Requirements vary by region, so tailor your receipts accordingly. Include required tax information, business identification numbers, or any other mandated details. Staying compliant ensures your business avoids potential legal challenges, while also offering transparency to your customers.

Consider customization options to reflect your business brand. Custom logos, colors, and a unique message on receipts can create a lasting impression. Templates should be adaptable to accommodate updates like seasonal promotions or new products without complicating the design.

Here are the corrected lines, maintaining meaning and reducing word repetition:

Keep phrases clear and concise to ensure readability. If you need to display an address or store name, make sure it is distinct and easy to locate on the receipt. Avoid redundancy by removing repeated references to the same details. For example, instead of repeating “Thank you for your purchase” several times, try including it once and using a different phrase for follow-up messages.

For tax and total amounts, avoid unnecessary wording. Display the total directly followed by the tax breakdown to help customers easily review their transaction. Limit the use of “subtotal” and “tax” to a single instance, where clarity is most needed.

Additionally, ensure itemized details are spaced out and organized for quick review. Group related items together and minimize filler words like “per unit” unless absolutely necessary. This keeps the focus on the core information: product, price, quantity, and total.

By simplifying sentence structure and removing excess repetition, you make the receipt both efficient and easy to follow. A cleaner format aids in faster scanning and reduces customer confusion.

- Cash Register Receipt Templates: Practical Guide

Start by selecting a template that fits your business needs. If your transactions are simple, go for a basic design that includes the essential details. For more complex operations, opt for templates that can accommodate additional fields, such as product descriptions or discounts.

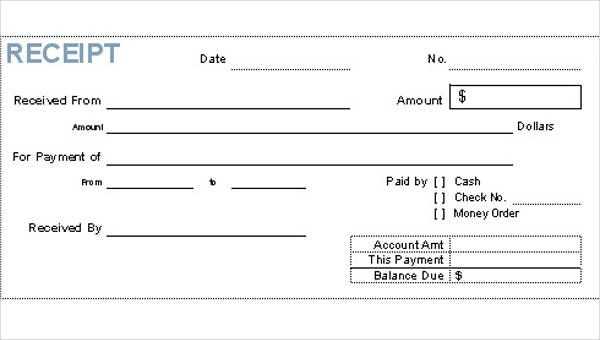

Make sure the receipt includes these key elements:

- Store Name & Contact Info: Include your store’s name, address, phone number, and website if applicable.

- Transaction Date & Time: Clearly list the date and time of the transaction for record-keeping purposes.

- Items & Prices: List each item, its quantity, unit price, and the total for each line. This ensures transparency.

- Taxes: Show taxes separately so customers can easily see how much tax is being charged.

- Total Amount: The final total, including taxes and discounts, should be clearly highlighted.

- Payment Method: Indicate the payment method used (cash, card, etc.).

Choose a layout that’s easy to read. Clear typography and a simple structure help avoid confusion. Avoid overloading the receipt with unnecessary information.

Make sure to test your template. Ensure it prints clearly and fits the size of your register’s paper roll. A template that doesn’t align properly will look unprofessional and cause issues when the receipt is printed.

If your business has specific needs, such as loyalty programs or gift cards, consider adding custom fields to your template to reflect those transactions accurately.

Lastly, consider the environmental impact. Opt for a digital receipt option when possible, or use eco-friendly paper for physical receipts.

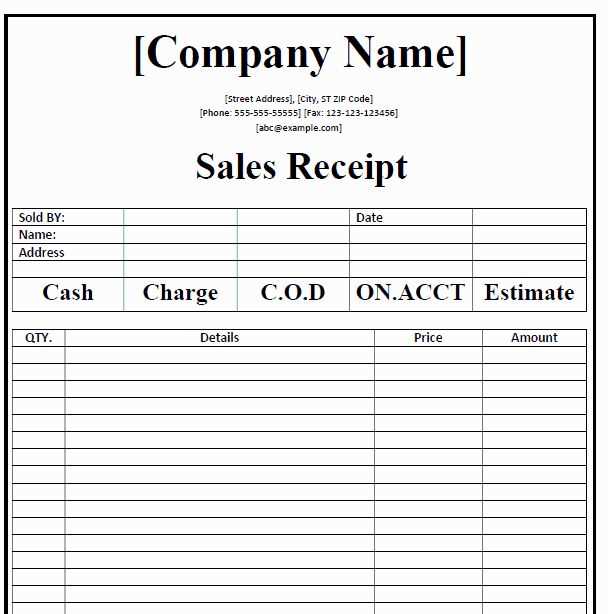

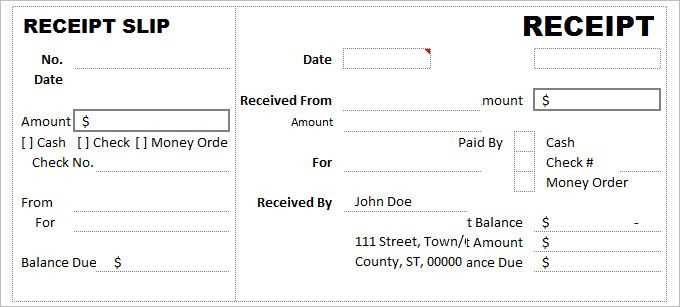

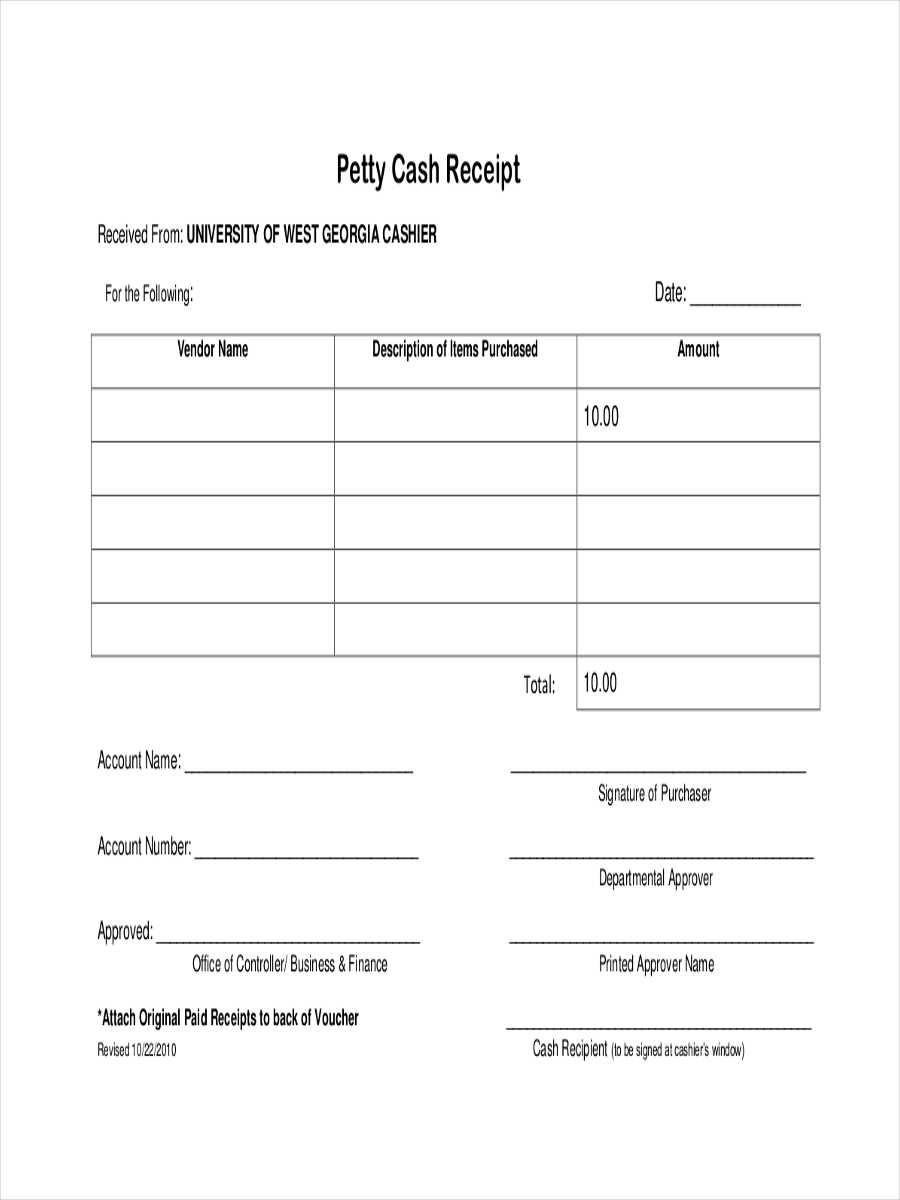

Designing a custom receipt template starts with deciding what information you need to include. Most receipts show the transaction details such as the date, items purchased, price, and taxes. However, some businesses might require additional fields like customer info, loyalty points, or promotional codes. Here’s how to structure your template efficiently:

1. Define the Necessary Fields

Before you create the design, list all the elements that need to appear on your receipts. Common fields include:

- Business name and address

- Transaction number

- Date and time of purchase

- Items or services purchased

- Price, taxes, and total amount

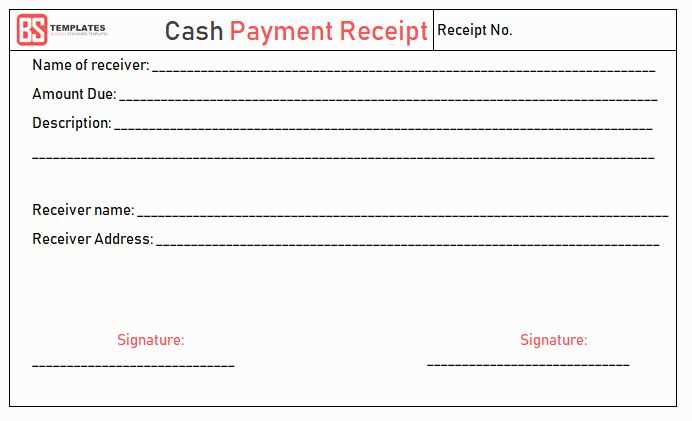

- Payment method

- Return policy or additional info

2. Choose the Layout and Style

Once the content is defined, arrange it in a clean and readable way. Typically, the layout of a receipt is vertical, with details flowing from top to bottom. Consider these tips for your layout:

- Keep business details at the top.

- Display the purchased items in a simple list, with clear spacing for readability.

- Ensure that the total amount is easily noticeable, often placed at the bottom.

- If applicable, add a footer with return instructions or additional promotions.

3. Use HTML to Create the Template

HTML provides the flexibility to create a structured and readable template. Here’s a basic example of how to organize the fields in a receipt template:

| Business Name | |

|---|---|

| Address: | 1234 Business St., City |

| Transaction #: | #123456 |

| Date: | 02/12/2025 |

| Item 1: | $10.00 |

| Item 2: | $5.00 |

| Tax: | $1.50 |

| Total: | $16.50 |

| Payment Method: | Credit Card |

| Thank you for shopping with us! | |

Adjust the table as needed to include any specific information or branding elements. HTML tags such as <tr>, <td>, and <th> are perfect for structuring the receipt in a way that can be easily adapted for different styles or data fields.

4. Customize the Visual Design

Once the content is in place, you can further customize the receipt by adjusting the font size, text alignment, and adding your brand’s colors or logo. Make sure the design is clear and easy to read, as a cluttered receipt may confuse customers.

Finally, save the template in a format that can be easily integrated into your point-of-sale system. Many systems allow you to upload custom receipt templates, so you can make adjustments without needing a developer.

A receipt should clearly communicate all transaction details to avoid confusion and ensure legal compliance. These are the critical elements to include in a cash register receipt template:

1. Business Information

Include your business name, address, phone number, and website if applicable. This helps customers identify your business and easily contact you if needed.

2. Date and Time of Purchase

Ensure the date and time are clearly visible. This is important for both customers who need to keep track of purchases and businesses that need to maintain accurate financial records.

3. Itemized List of Products or Services

Break down each product or service with its name, quantity, unit price, and total. This transparency ensures customers understand exactly what they’re being charged for.

4. Total Amount and Taxes

Clearly display the subtotal, any applicable taxes, and the final total. Make sure tax rates are listed separately to avoid confusion.

5. Payment Method

Indicate the method of payment used, whether it’s cash, credit, or debit. If a card was used, include the last four digits of the card number for verification.

6. Receipt Number or Transaction ID

A unique receipt number or transaction ID helps with easy tracking in case of returns, exchanges, or disputes.

7. Return and Refund Policy

Briefly note your store’s return and refund policy. This can prevent misunderstandings and set clear expectations for the customer.

8. Additional Promotions or Loyalty Program Information

If applicable, include details about ongoing promotions or customer loyalty programs to encourage repeat business.

Receipt templates must include specific information required by law and tax regulations. Start by ensuring that your receipts display the business name, address, and tax identification number. In many jurisdictions, receipts must clearly show the date of the transaction, an itemized list of goods or services, their corresponding prices, and the applicable tax rate. Tax authorities often require that the total amount includes taxes (e.g., VAT) or separate line items for clarity.

For businesses registered for VAT or sales tax, the tax rate applied and the total tax amount should be visible on every receipt. Avoid vague terminology; use clear descriptions for products and services. Misleading or incomplete receipts can lead to audits or fines.

In some regions, receipts may need to include a unique serial number or barcode for record-keeping. This helps with tracking and ensures transparency in business operations. Make sure your template can generate this information dynamically to remain compliant.

Keep in mind that digital receipts, whether sent by email or provided through apps, often follow the same legal requirements. Ensure that these receipts also include the necessary tax details and are accessible for future reference.

Lastly, always stay updated on local laws that govern receipts and tax reporting. What’s required in one area may differ in another, so regularly review and adjust your templates as necessary.

Design your cash register receipts with clarity by organizing information in a logical, readable manner. Avoid clutter by selecting only the most relevant details. A typical receipt should feature:

- Store Name and Address: Place the store name, physical address, and contact information at the top. This ensures customers can easily reach out if necessary.

- Transaction Date and Time: Include the exact time and date of the purchase to keep records precise. This helps both the customer and business track the purchase history.

- Items Purchased: List each item along with the quantity, unit price, and total price. This helps customers verify the items and prevents misunderstandings.

- Total Price: Always display the total amount clearly, including taxes, discounts, or any additional fees.

- Payment Method: Specify whether the transaction was paid by cash, credit card, or another method. This avoids confusion about how payment was made.

- Receipt Number: Assign a unique number to each receipt. This allows for easy tracking and referencing in case of returns or disputes.

- Return/Exchange Policy: Include a brief note on the store’s return or exchange policy to avoid future issues.

Customize these elements according to the specific needs of your business. Prioritize readability by using a clean, straightforward layout and clear fonts. Test your templates across different devices and printers to ensure they look great in all settings.