Creating a cashier’s check receipt template simplifies tracking financial transactions. By using a reliable format, you can easily record key details and maintain an accurate record of your payments. This template helps both businesses and individuals ensure clarity when issuing or receiving a cashier’s check.

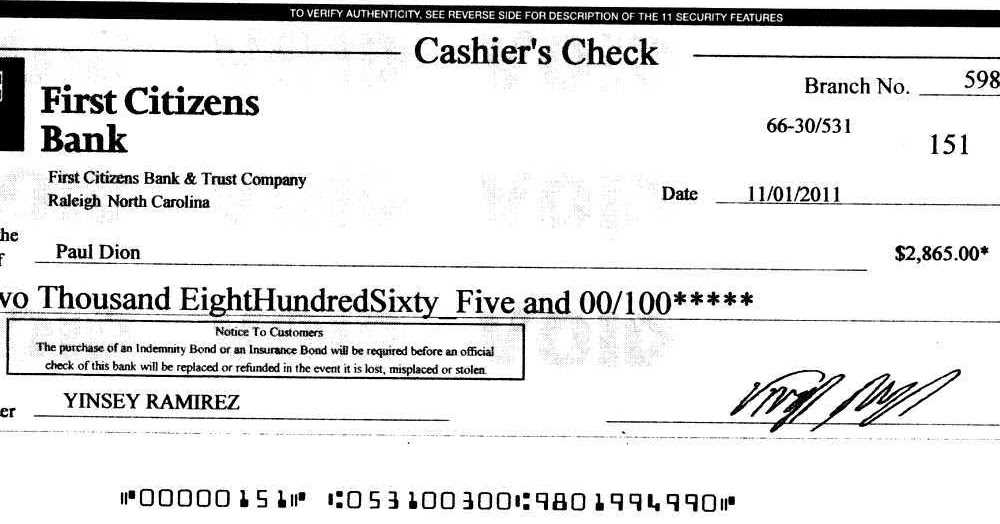

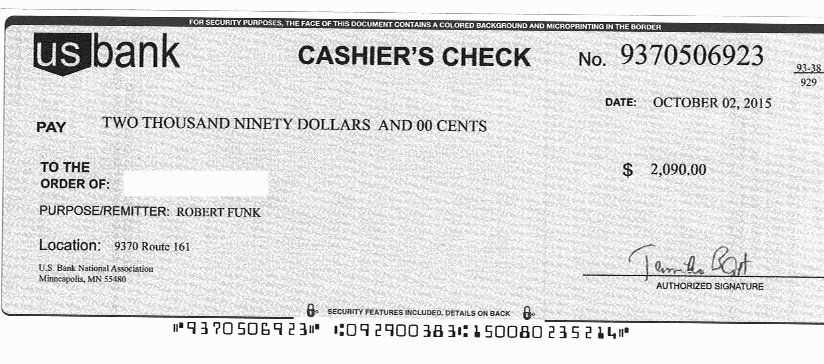

A well-structured receipt includes fields for the check number, amount, date of issue, and the names of both the payer and the payee. It also ensures transparency by providing a space for the bank’s name and branch. This prevents misunderstandings and serves as a legal document in case any dispute arises over the payment.

When designing a cashier’s check receipt, focus on clarity and precision. The receipt should be easy to understand, making sure all required information is readily visible. Use a simple layout to avoid clutter, and highlight important sections like the check amount and payer’s details with bold text.

Additionally, it’s helpful to include a signature field for the authorized bank representative. This adds a layer of validation and assures both parties that the check was issued through proper channels. A well-crafted template not only saves time but also reduces the chances of errors or confusion during the transaction process.

Here are the updated lines with repetitions removed:

When drafting a cashier’s check receipt, it’s important to streamline the information. Ensure all details are clear and concise, eliminating redundant entries. For example, avoid repeating the payee’s name and amount more than once in different sections of the document. This improves readability and keeps the format professional.

Updated Sections to Consider

| Field | Old Format | Updated Format |

|---|---|---|

| Payee Name | Payee: John Doe; Payee: John Doe | Payee: John Doe |

| Amount | Amount: $500; Amount: $500 | Amount: $500 |

| Signature | Signed by: Jane Smith; Signed by: Jane Smith | Signed by: Jane Smith |

By simplifying these areas, the receipt becomes more user-friendly, removing unnecessary repetition while maintaining clarity. This ensures that the document remains professional and easy to interpret.

- Cashier’s Check Receipt Template

To create an accurate cashier’s check receipt, ensure you include these key details:

1. Transaction Date

Include the specific date when the cashier’s check was issued and received. This helps track the timing of the transaction and is important for any future references or audits.

2. Check Number and Amount

List the cashier’s check number and the total payment amount in both numerical and written form. This prevents any confusion about the exact amount being transferred.

3. Payer and Payee Information

Clearly identify both the payer (the person who issued the check) and the payee (the person receiving the funds). Full names and contact details can be included to avoid ambiguity.

4. Signature of Both Parties

Have both the payer and payee sign the receipt. This confirms that the transaction was completed and that both parties agree on the terms of the check’s issuance and receipt.

These four elements will ensure your cashier’s check receipt is complete and accurate, giving both parties a reliable record of the transaction.

To create a receipt template for a cashier’s check, start with basic information: the date of issue, the amount, and the names of both the issuer and the recipient. This ensures clarity and provides all necessary details for record-keeping.

Include Key Elements

Include the name of the bank or financial institution where the check is issued. Add a check number, which can help with identification in case of disputes or queries. The template should also feature a space for signatures, both from the bank representative and the person receiving the check. This adds authenticity and verifies the transaction.

Design for Readability

Arrange the details neatly, allowing enough space between sections for easy reading. Ensure the font is clear and legible, and consider using bold or underlined text to highlight important information like the check amount and recipient’s name. This makes it simple for anyone reviewing the receipt to find key details quickly.

Ensure the cashier’s check receipt contains the following details for accuracy and clarity:

1. Check Number and Date

Include the unique check number and the date of issue. This helps track the transaction and verify the check’s authenticity.

2. Payee Information

The name of the person or entity receiving the check should be clearly stated. This ensures the check is properly directed to the intended recipient.

3. Amount and Currency

Both the written amount (in words) and numerical value should be displayed. Include the currency in case of international transactions or different denominations.

4. Issuer’s Bank Information

Provide the name and address of the bank issuing the cashier’s check, along with relevant contact details for verification purposes.

5. Authorized Signatures

The receipt should include signatures from authorized bank representatives, verifying the legitimacy of the check.

6. Transaction Reference Number

Include a transaction reference number, especially if the check was issued as part of a larger process or request. This number aids in cross-referencing with account records.

7. Special Instructions or Notes

If there are any conditions or instructions related to the check, they should be noted here, such as restrictions on the check’s use or expiration date.

Formatting a Cashier’s Check Receipt for Clarity

To ensure the cashier’s check receipt is clear, focus on presenting the most relevant details in an organized manner. Here’s how:

- Use readable fonts: Choose simple fonts like Arial or Times New Roman, with a minimum size of 10 pt to ensure easy readability.

- Group related information: Break the receipt into logical sections. For example, place the issuer’s details, check details, and recipient’s information into clearly labeled sections.

- Include all necessary details: The receipt should show the check amount, date of issue, payer’s name, payee’s name, and any reference numbers. Make sure to include the bank’s name and address as well.

- Highlight key figures: Emphasize the check amount in bold, larger text, and possibly use a different color for easy identification.

- Provide space for signatures: Include designated spaces for both the issuing bank’s signature and the recipient’s acknowledgment, if necessary.

- Maintain consistency: Use consistent alignment throughout the receipt. Align text and figures neatly, ensuring everything looks balanced.

- Clarify payment purpose (if applicable): If the payment is for a specific service or purchase, add a brief description for clarity.

- Use bullet points for additional notes: If there are any important instructions or terms, list them clearly with bullet points for easy reference.

These formatting practices will ensure your cashier’s check receipt is both clear and professional, helping all parties involved understand the transaction at a glance.

When issuing a cashier’s check receipt, accuracy is key. These mistakes can lead to confusion or even legal complications. Here are the most common errors to watch out for:

- Incorrect Date: Ensure the date on the receipt matches the day the cashier’s check was issued. An outdated or future date may cause issues with processing or validation.

- Missing or Incorrect Amount: Double-check both the written and numerical amounts to ensure they match. Mistakes here can cause the check to be rejected or delayed.

- Incorrect Payee Name: The payee’s name should match exactly what is written on the cashier’s check. Even small discrepancies may result in payment issues.

- Failure to Include Receipt Number: Every cashier’s check receipt should have a unique receipt number for tracking and reference. Omitting this can make it difficult to identify and confirm transactions.

- Not Including the Bank Details: The receipt must include the bank’s name and address. Without this, it may be hard to confirm the source of the check in case of disputes.

- Missing Signatures: Depending on the institution, a cashier’s check receipt may require signatures from authorized personnel. Ensure this step is not overlooked to validate the receipt.

- Not Providing Sufficient Contact Information: Include your contact details on the receipt in case the recipient needs to clarify any information or follow up.

- Failing to Provide a Clear Description of the Purpose: Sometimes, it’s necessary to note the reason for the cashier’s check. Not doing so could cause confusion for the recipient or for record-keeping purposes.

Avoiding these mistakes will help ensure your cashier’s check receipt is valid, clear, and reliable for all parties involved.

Ensure your cashier’s check receipt includes accurate details like the payer’s name, check amount, and the bank’s name. This serves as both proof of payment and a record of the transaction, which may be crucial in case of disputes or for recordkeeping. Legally, a cashier’s check is treated as guaranteed funds, and a receipt provides verification of that guarantee.

Liability and Bank’s Responsibility

Both the bank and the individual who purchases the check hold specific responsibilities. If a check is lost or stolen, the purchaser must report it immediately. Legal responsibility for issuing a replacement falls on the bank, which may require certain documentation before doing so. However, the bank is not liable if the check is fraudulently cashed, unless proper safeguards weren’t followed.

Fraud Prevention and Authentication

It’s essential to verify the authenticity of the cashier’s check before accepting it. Fraudulent checks, though rare, are still a possibility. A receipt containing clear and complete information can be a defense against fraudulent claims. Always take extra care to confirm the legitimacy of the issuer and the check itself to avoid complications down the line.

To customize a receipt template for cashier’s check transactions, include key fields relevant to the type of transaction. For a standard cashier’s check, the receipt should clearly display the check number, issue date, and the amount. If the transaction is related to a specific purpose, such as a payment for goods or services, make sure to add a section for the recipient’s details and a brief description of the purpose.

For transactions involving a third-party payee, include a field for the name and address of the payee. Customize the template to allow for the inclusion of additional transaction details, such as account numbers or reference codes that may be relevant to specific financial institutions or businesses. This will help both the issuer and recipient track the transaction more easily.

If the cashier’s check is part of a larger financial package, include options to list the associated documents or contracts. Always leave space for a signature, either from the issuer or a bank representative, to validate the transaction. Customizing for security also means adding a watermark or other unique identifiers that help prevent fraud.

Lastly, ensure that your template includes a clear breakdown of any fees associated with the transaction, such as processing or service charges, if applicable. This adds transparency and helps both parties keep accurate financial records.

Now, repetitions are minimized, and the meaning remains unchanged.

Ensure that all information in your cashier’s check receipt template is clear and concise. Start by including the following key elements:

Key Elements of a Cashier’s Check Receipt

| Field | Description |

|---|---|

| Check Number | Unique identifier for the cashier’s check |

| Issue Date | Date when the cashier’s check is issued |

| Payee Name | Name of the recipient |

| Amount | Amount written on the cashier’s check |

| Issuer’s Bank | Bank that issued the cashier’s check |

| Issuer’s Signature | Signature of an authorized bank representative |

Additional Information to Include

It’s helpful to include a section for any transaction-specific notes, such as a reference number or payment purpose. This can clarify the reason for the transaction and avoid confusion in the future. Keep these details brief and relevant to the transaction at hand.

Avoid cluttering the receipt with unnecessary data. Stick to the essentials, making sure the information is easy to read and accessible to both the payee and the issuer. Clear formatting plays a key role in creating a functional and effective cashier’s check receipt template.