Ensure clarity and transparency in your financial transactions with a well-structured cash receipt template. This document serves as a written acknowledgment of cash payments made, providing both the payer and the payee with a record for their reference.

Customize the template based on your business’s specific needs, including the date, payer’s details, amount received, and any other relevant notes. This eliminates confusion and helps in maintaining proper accounting records.

Make sure to include unique identifiers such as receipt number, which can streamline future reference or audits. These identifiers provide an easy way to track and verify payments, ensuring transparency in your financial management.

By utilizing a detailed and accurate template, you create a clear paper trail, supporting both parties in case of discrepancies and ensuring accountability for the funds received.

Here’s a version with reduced repetition:

To improve clarity and reduce repetition in a cash receipt template, simplify the wording and focus on key details. Use concise language to convey important information without redundancy.

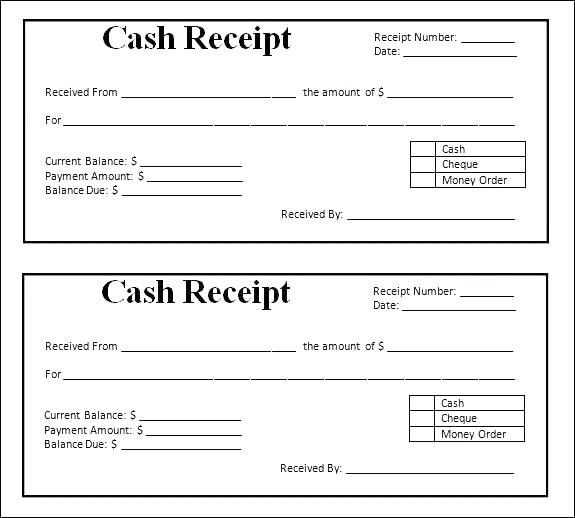

- Receipt Date: Clearly state the date of the transaction.

- Amount Received: Specify the exact amount without unnecessary descriptions.

- Payment Method: Indicate how the payment was made (e.g., cash, check, credit card).

- Payee Information: Include the name of the individual or company receiving the payment.

- Transaction Reference: Provide a unique reference number for tracking purposes.

Avoid using excessive adjectives or repeated phrases. Each section should provide only the necessary information for clarity.

- Signature: Include space for both parties to sign, confirming the transaction.

- Thank You: Close the template with a brief note of appreciation for the transaction.

By focusing on these key components, the template becomes more streamlined, reducing clutter while maintaining its purpose and clarity.

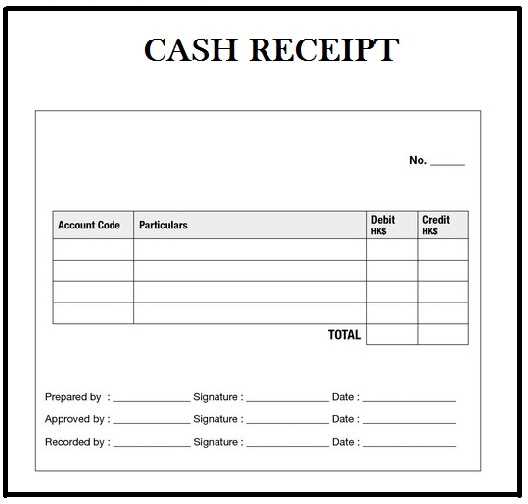

- Certification of Cash Receipt Template

Using a clear and structured template for certifying cash receipts helps ensure proper record-keeping and minimizes errors. A well-organized template includes the necessary details to verify the transaction’s legitimacy. Here’s what to include in a reliable certification template:

- Date of Transaction: Specify the exact date when the cash receipt occurred to avoid confusion.

- Amount Received: Clearly state the amount received in both numerical and written formats for clarity.

- Recipient Information: Include the name of the individual or entity receiving the cash.

- Purpose of Payment: Mention the reason for the payment to clarify the transaction’s nature.

- Payment Method: Indicate the form of payment (e.g., cash, check, bank transfer).

- Signature of Receiver: The person receiving the cash should sign the template to confirm receipt.

- Authorized Personnel’s Signature: Include a signature from an authorized person to validate the transaction.

Ensure the template is clear, precise, and easy to understand, preventing any ambiguity in the records. This template serves as both a receipt for the recipient and a verification tool for the organization.

To ensure that a receipt is legally valid, it must meet specific criteria depending on the jurisdiction and transaction type. Here are key aspects to consider:

- Accuracy of Details: The receipt should include the date of the transaction, the name of the seller and buyer, a description of the items or services purchased, and the total amount paid. This ensures transparency and traceability.

- Signature or Seal: Depending on the region, a certified receipt might require a signature or official seal to confirm authenticity. This is often mandatory for transactions involving larger amounts or business dealings.

- Compliance with Tax Laws: For certain transactions, especially those involving taxable goods or services, receipts must comply with local tax regulations. Ensure tax rates, exemption statuses, and other relevant details are clearly outlined on the document.

- Retention Period: Legal requirements may specify how long receipts need to be retained by both parties. This varies by country and transaction type, with some receipts required to be kept for several years in case of audits or disputes.

Familiarize yourself with your local laws to ensure all required information is included and certified properly. Failure to comply with legal requirements can lead to issues with refunds, disputes, or audits.

To create a cash receipt form, follow these specific steps:

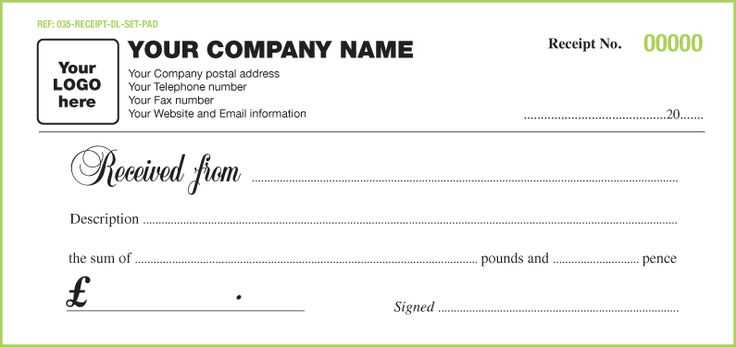

1. Include Basic Information

Start by adding the name of your business, address, and contact details. This ensures the form clearly represents your entity. Place this at the top of the document for easy reference.

2. Add Receipt Number

Generate a unique receipt number for each transaction. This provides a reference for tracking payments and organizing records efficiently.

3. Specify Payment Date

Clearly state the date the cash payment was made. This is important for accurate record-keeping and for matching payments to invoices.

4. Record Payer Details

Write the name of the person or entity making the payment. This information helps identify who provided the payment for proper accounting.

5. List the Payment Amount

Enter the exact amount of cash received. Ensure the figure is clearly stated in both numerical and written form to avoid confusion.

6. Describe the Purpose of Payment

Describe the reason for the payment. Whether it’s for a product, service, or another reason, specifying this detail helps both parties understand the transaction’s context.

7. Include Signature Lines

Provide space for both the payer and the receiver to sign. This confirms the transaction was completed and agreed upon by both parties.

8. Add Additional Notes

Leave space for any additional information or terms related to the transaction. This might include payment conditions, discounts, or payment plans.

By following these steps, you’ll have a structured and professional cash receipt form that serves both functional and legal purposes.

Begin with a clear and concise heading indicating that the document is a cash receipt. This ensures immediate recognition of the document’s purpose. The receipt should list the date and time the payment was made, along with the payment method used. This could be cash, cheque, or a digital transaction, depending on the context.

Next, include the payer’s full name or the company’s name, followed by their contact information if applicable. This step provides clarity on who made the payment. Specify the amount received, ensuring the amount is accurate and clearly presented. Include both numeric and written formats for better clarity.

Reference the purpose or description of the payment, specifying what it’s for, whether it’s for goods, services, or other purposes. This helps identify the nature of the transaction for future reference. Provide details about the transaction number, invoice number, or any other reference number that ties the payment to a specific record or agreement.

Conclude by adding the signature of the recipient or authorized person, which helps authenticate the transaction and confirm receipt of the payment. Ensure that all fields are filled accurately to prevent discrepancies or misunderstandings in the future.

One of the most frequent errors is failing to verify all the necessary details on the receipt before certifying it. Double-check the transaction date, amounts, and any relevant reference numbers. Small discrepancies can lead to significant issues later.

Incorrect or Missing Signatures

Certifying receipts without proper signatures can invalidate the entire process. Always ensure that the correct individual has signed the receipt, confirming they are authorized to approve the transaction. Additionally, avoid signing receipts without verifying the details first.

Failure to Match Receipts with Supporting Documentation

Ensure the receipt corresponds with the supporting documentation, such as invoices or contracts. If these do not match, it may indicate an error or inconsistency, which can complicate the certification process.

| Issue | Solution |

|---|---|

| Missing information | Cross-check receipt details with the original purchase records. |

| Unverified signatures | Ensure the authorized individual signs the receipt after verifying all details. |

| Mismatch with supporting documents | Compare the receipt with invoices or contracts to confirm consistency. |

Store certified receipts in a secure and organized manner to ensure easy retrieval and protection against loss or damage. Consider using digital storage solutions like cloud services for backup and quick access. Ensure that physical receipts are kept in a moisture-free, temperature-controlled environment to prevent deterioration.

Physical Storage Guidelines

For physical copies, use fireproof and waterproof filing cabinets. Label each receipt clearly with the date and relevant details for quick identification. Ensure that the storage area is free from pests and direct sunlight, which can fade or damage the documents.

Digital Storage Guidelines

Digitize receipts and store them in cloud-based systems with secure encryption. Ensure that backups are performed regularly, and organize the receipts by categories and dates for easy retrieval. Set up a version control system to track updates or changes made to digital copies.

| Storage Type | Advantages | Considerations |

|---|---|---|

| Physical | Easy to access and verify, no risk of data loss due to technology failure | Prone to physical damage, requires space, and ongoing maintenance |

| Digital | Easy to store, search, and back up; less physical space required | Requires proper security measures and backup strategies |

Certified receipts play a key role in supporting your financial records and ensuring accuracy during tax filings. To maximize their utility, keep certified receipts for all business-related transactions and ensure each receipt is clearly labeled with the transaction details, such as the date, amount, and seller information.

Organizing Receipts for Reporting

Organize certified receipts in a way that aligns with your accounting periods. Use digital or physical filing systems that categorize receipts by month, quarter, or year. This practice simplifies the process of tracking expenses and supports your tax claims with clear documentation.

Utilizing Certified Receipts for Deductions

Certified receipts verify the legitimacy of your expenses, making them vital for claiming deductions. Ensure that all receipts are from authorized vendors and reflect accurate details, as discrepancies could lead to complications during audits. Keep copies of the receipts alongside relevant accounting records to easily reference them when needed.

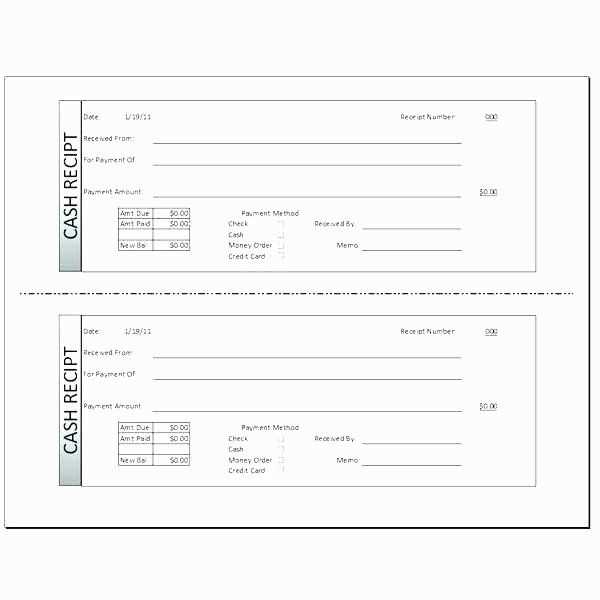

Ensure that the list items within the receipt template are clearly defined. Use bullet points or numbered lists to highlight key details such as the receipt number, date, amount, and the payer’s information. This will improve readability and make it easier for both parties to verify the transaction details.

Key Elements of the List

Each list item should be concise and contain only relevant information. Avoid unnecessary details that might clutter the document. For example, if a receipt involves multiple payments, list each payment separately with its own details.

Consistency in Formatting

Maintain uniform formatting throughout the receipt. This includes consistent use of bullet points, numbering, and alignment of text. A clean, structured format enhances the document’s professional appearance and makes it easier to follow.