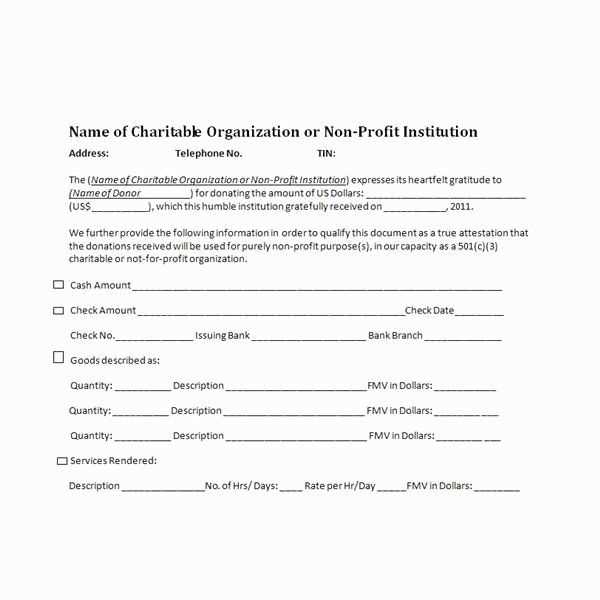

For a smooth donation process, create a clear and accurate non-cash donation receipt. The document should include essential details such as the description of the item donated, its fair market value, and the date of the donation. Make sure to specify that no goods or services were provided in exchange for the donation to comply with tax regulations.

Include the following details: donor’s name, contact information, and a statement confirming the donation. Add a brief description of each item donated, including its condition. Donors may request the value of the donation for tax purposes, so it’s crucial to note that the donor determines the value unless an appraisal is required for more valuable items.

Example format: “This is to acknowledge the donation of [description of items], totaling an estimated value of [donor-provided value], made on [date]. No goods or services were provided in exchange for this donation.”

Tip: For a more professional appearance, include your organization’s name and logo. Keep the receipt concise and easy to read, ensuring it meets both legal and practical needs for the donor and your nonprofit.

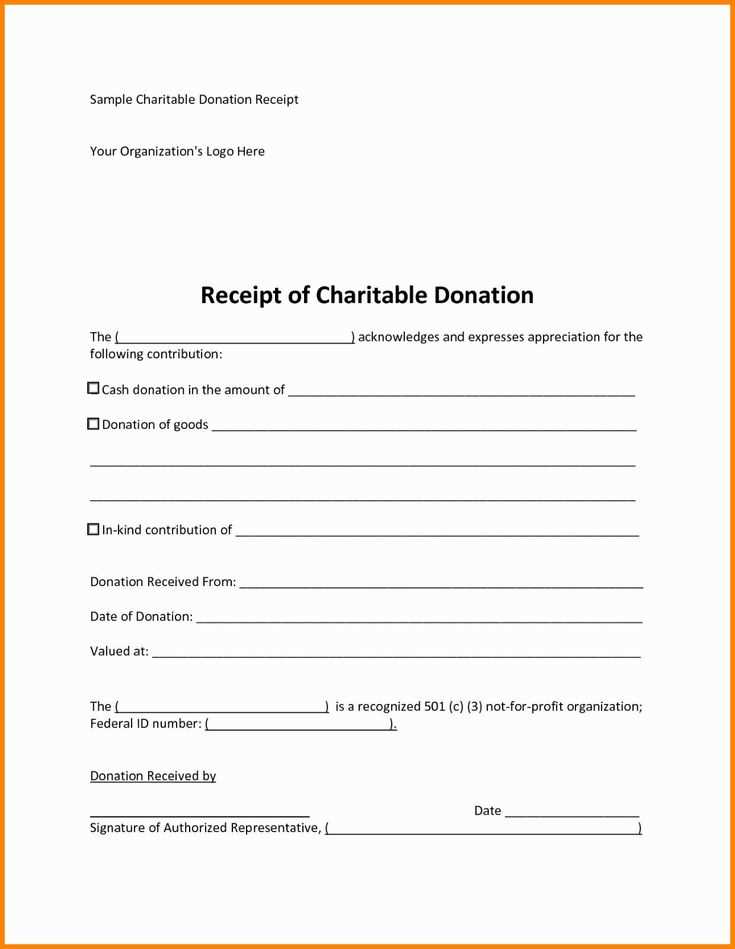

Charitable Non-Cash Donation Receipt Template

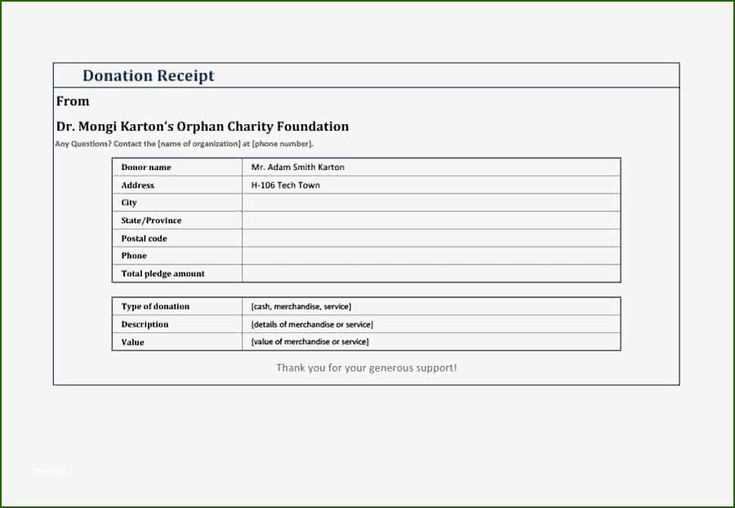

Provide a clear and accurate non-cash donation receipt to your donors. Ensure the document includes the donor’s name, donation description, and the estimated value of the items donated. The receipt should also contain the organization’s name, address, and tax identification number, ensuring that the donor has all necessary information for tax purposes.

Key Elements to Include

- Donor Information: Full name, address, and contact details of the donor.

- Donation Description: A detailed list of items donated with clear descriptions.

- Estimated Value: The fair market value of the items at the time of donation. Be precise and avoid estimates that could cause confusion.

- Organization Information: Include the full name, address, and tax ID of the charitable organization.

- Date of Donation: Record the exact date the donation was made.

- Statement of Goods: Clearly state that no goods or services were provided in exchange for the donation.

Why Accuracy Matters

Accurate receipts help maintain transparency and trust with donors. By providing all the necessary details, donors can easily claim their tax deductions. This also helps the organization remain compliant with legal and tax reporting requirements. If the receipt is missing key information, it may lead to issues with the IRS or other tax authorities.

Creating a Basic Template for Non-Cash Donations

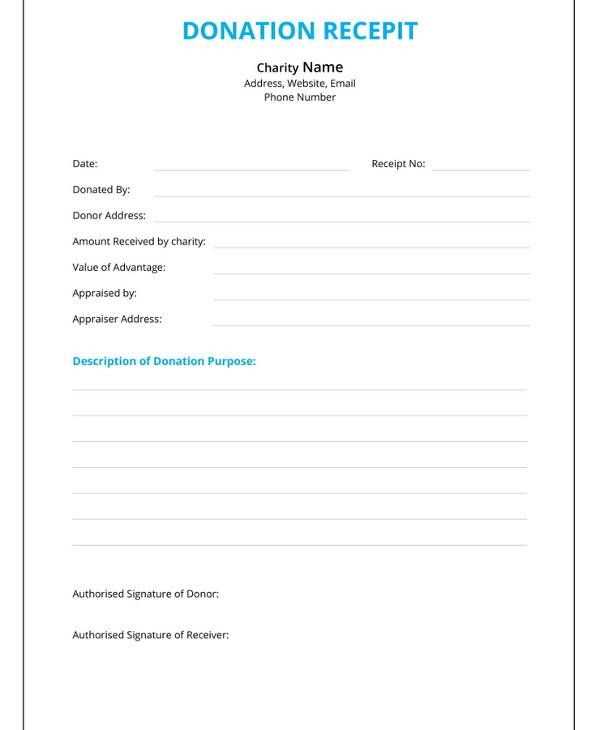

Design your non-cash donation receipt template with a clear structure to ensure it serves its purpose. Start by including the name and address of your organization at the top, along with the date of the donation. This ensures the document is traceable and formal. Next, add a brief description of the donated items, including their condition if relevant. For transparency, it’s useful to specify if the donor is providing an estimated value or if it will be assessed by the organization later.

Information to Include

- Donor’s Name: Clearly list the name of the person or organization making the donation.

- Description of the Donation: Include specifics like quantity, type, and condition of the donated items.

- Value Estimate: Indicate if the donor provided a value or if the organization will assign one.

- Date of Donation: Mark the date when the donation was received.

- Signature Section: Provide space for both the donor and a representative from your organization to sign, confirming the transaction.

Clarity and Accuracy

Make sure the template is easy to read and all information is accurate. Avoid ambiguity about the value of the donation by being clear about whether it’s a donor-provided estimate or your own evaluation. This reduces misunderstandings and maintains professionalism in your records.

Key Information to Include on the Donation Receipt

The donation receipt must clearly state the donor’s name, the charity’s name, and the date of the donation. Include a detailed description of the items or services donated if it’s a non-cash contribution. This provides transparency and avoids ambiguity.

Donor and Charity Details

Ensure the donor’s full name and the charity’s legal name are included. The address of the charity, and the donor’s contact details can be helpful for future communications. If the donation is monetary, include the amount given.

Description of Donated Goods or Services

For non-cash donations, describe the items or services donated. Be specific, listing each item or its category. If an appraisal is required for high-value donations, mention it clearly. This avoids misunderstandings during tax filing.

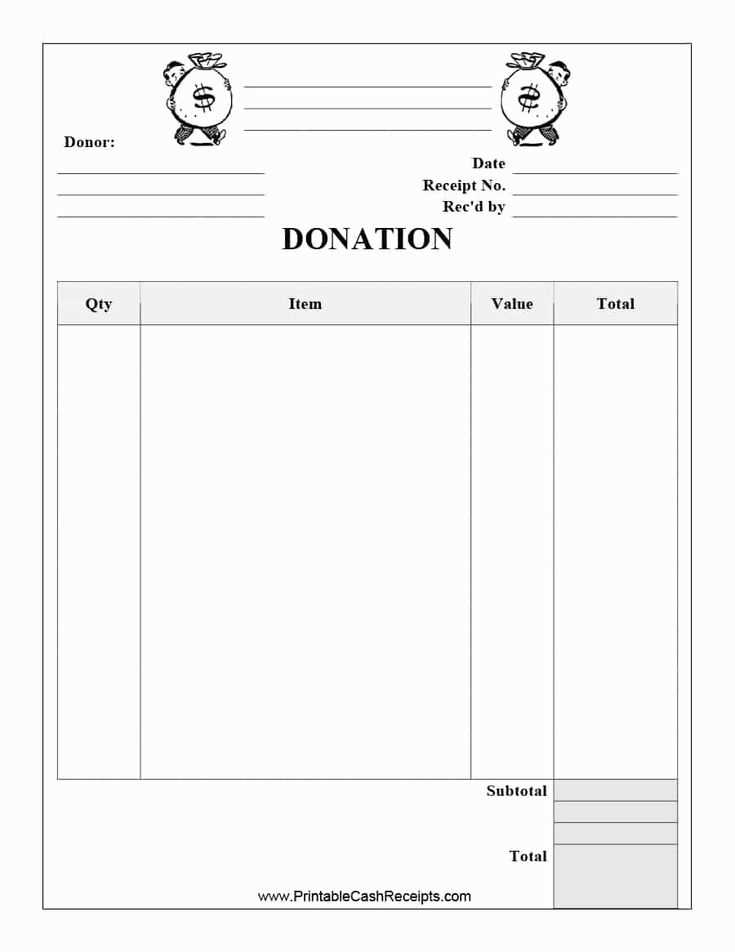

Customizing Templates for Different Donation Types

Tailor your donation receipt templates to match the type of contribution being made. This helps ensure clarity and compliance with tax regulations. Each donation type has its own set of requirements that should be reflected in the receipt.

- Monetary Donations: Clearly state the exact amount of money donated. If the donor wishes, include a breakdown of how the funds will be used.

- Material Donations: List the donated items with descriptions and their estimated value. This provides transparency and helps donors track their charitable contributions.

- Services: If a donor provides professional services, outline the hours donated and the equivalent monetary value based on standard rates. Make sure this is clearly identified as an in-kind donation.

- Event Tickets or Passes: If event tickets or passes are donated, list them along with the equivalent cash value. Specify any restrictions on the tickets, such as expiration dates or usage terms.

Customize your template to reflect these details, ensuring donors receive an accurate and professional receipt for their specific type of donation. Be mindful of any local legal requirements for each donation type.