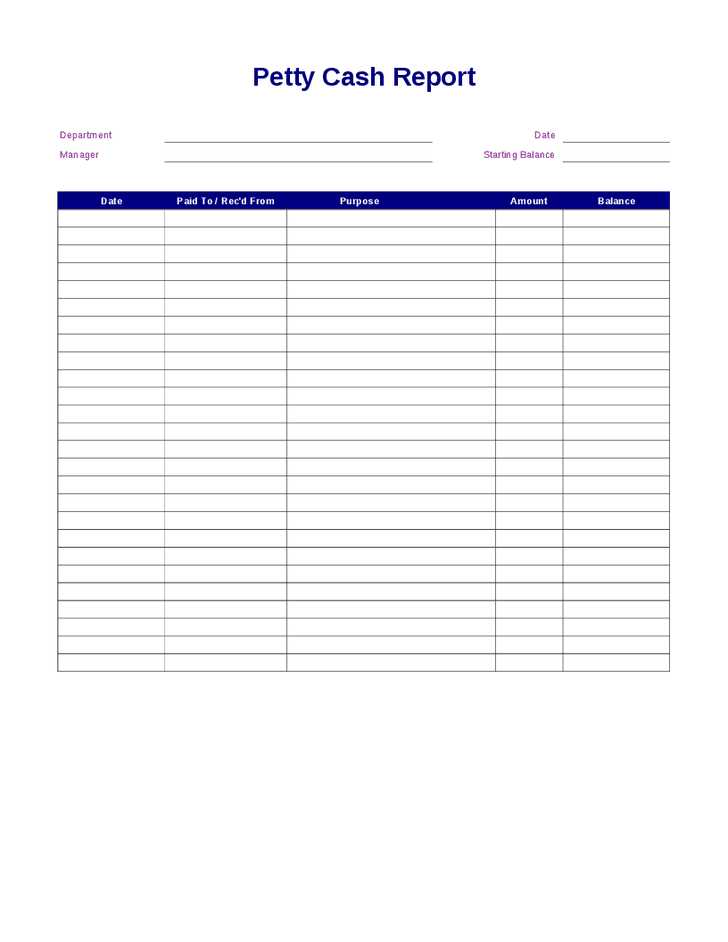

To ensure smooth cash handling in your business, use a daily cash receipt log template. This template helps you document each cash transaction as it happens, providing a clear and organized record. Include columns for the date, receipt number, payer’s name, description of the payment, amount received, and method of payment. This straightforward format allows quick tracking and easy reference for accounting or auditing purposes.

In addition to tracking daily receipts, make sure to note any discrepancies between recorded amounts and physical cash. Having a section for comments or notes can also be useful if you need to explain unusual transactions or adjustments. With this simple yet powerful tool, you can maintain accurate financial records without unnecessary complexity.

Here is the revised version:

To maintain accuracy and consistency in your daily cash receipt log, update the template by incorporating these adjustments:

Structure the Table for Clarity

Ensure that the table includes the following columns:

| Date | Receipt Number | Amount | Source of Funds | Payment Method | Comments |

|---|---|---|---|---|---|

| 2025-02-12 | 1001 | $500 | Client A | Cash | Initial deposit |

| 2025-02-12 | 1002 | $200 | Client B | Check | Payment for invoice #334 |

Include a Consistent Format for Entries

Use a clear date format (e.g., YYYY-MM-DD) and ensure all fields are filled out. This will prevent confusion and facilitate quick tracking of receipts.

Additionally, include a notes section where any discrepancies or special instructions can be added for further reference.

- Daily Cash Receipt Log Template

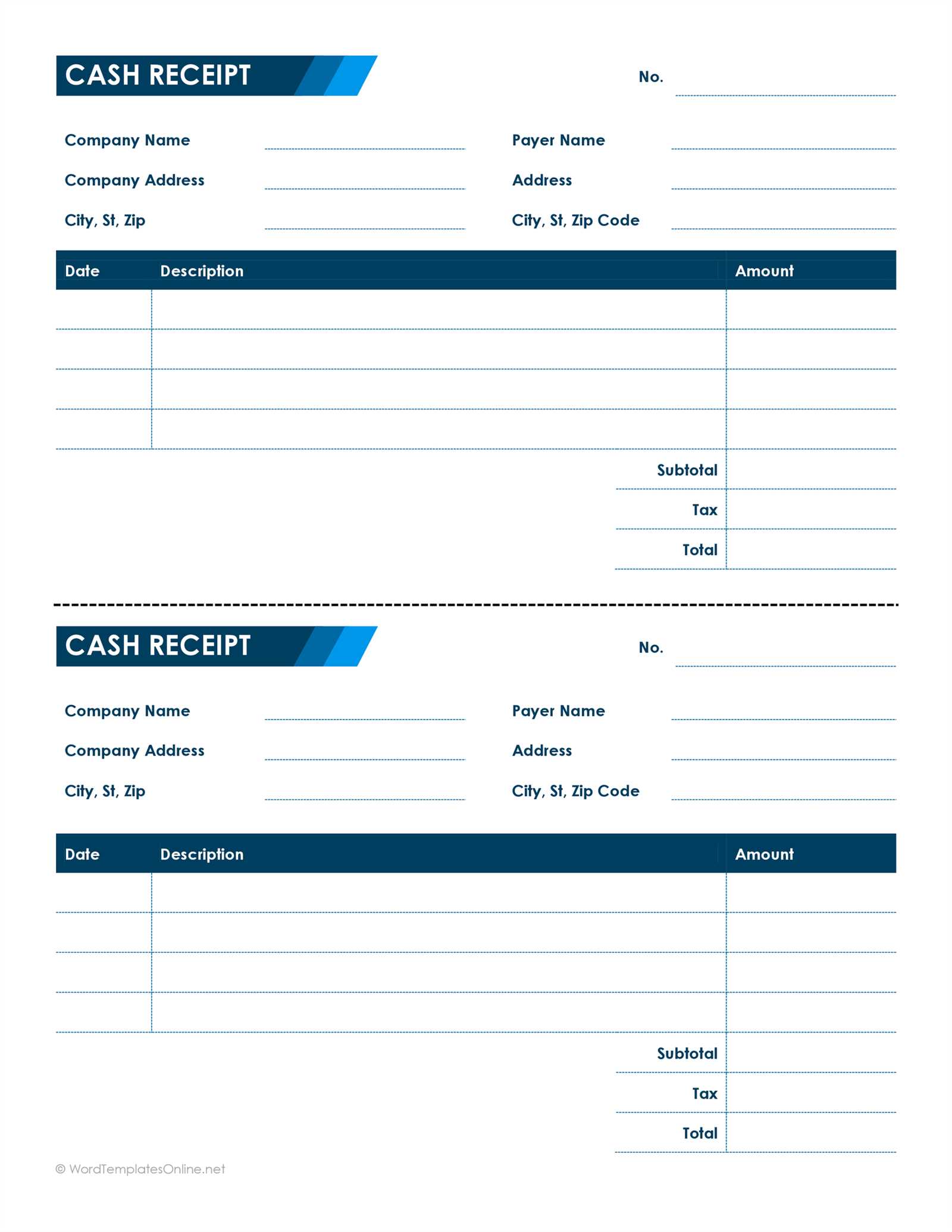

To maintain accurate financial records, a daily cash receipt log should capture all incoming payments. This log can be a simple table or spreadsheet that includes specific columns for essential data points. Each entry should include the date, source of the payment (e.g., customer name or reference number), amount received, payment method (cash, check, or other), and the name of the employee who processed the payment.

Template Structure

Your log should have the following columns:

- Date – Record the date the payment is received.

- Receipt Number – Assign a unique number to each transaction for easy tracking.

- Source of Payment – List the payer’s name or a reference number for future identification.

- Amount – Clearly state the exact amount received.

- Payment Method – Indicate how the payment was made (e.g., cash, check, or electronic).

- Employee Initials – Document who handled the transaction.

Organizing the Log

After logging payments, review entries at the end of the day to verify accuracy. This practice helps identify discrepancies and ensures all payments are accounted for. A daily cash receipt log also helps simplify end-of-month reconciliation by providing a clear record of cash flow.

Start by creating a table with clear columns: Date, Description, Amount Received, Payment Method, and Balance. This helps you track each transaction efficiently. Use the “Date” column for the date of each entry, ensuring accuracy. The “Description” column should briefly explain the source of the cash, whether it’s from a sale, service, or other. In the “Amount Received” column, record the exact cash amount received. This is where you note the payment in the proper format, such as “$50” or “€30”. “Payment Method” should indicate whether the cash was received via cash, check, or other methods.

After each transaction, update the “Balance” column by adding the new amount to the previous balance. This will show the running total of all cash received, helping you maintain clarity in financial tracking. Double-check the calculations to ensure there are no discrepancies. This method is simple, direct, and keeps all cash inflows visible at a glance.

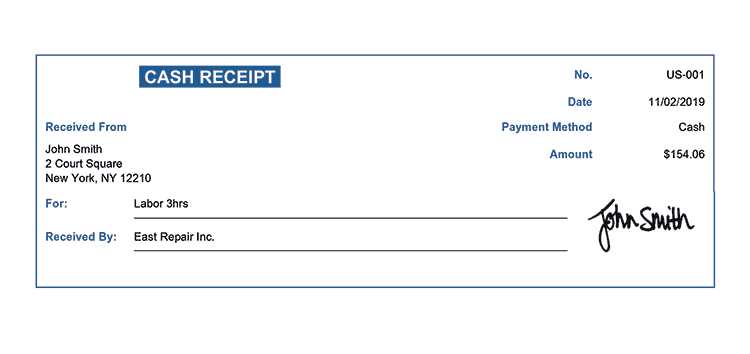

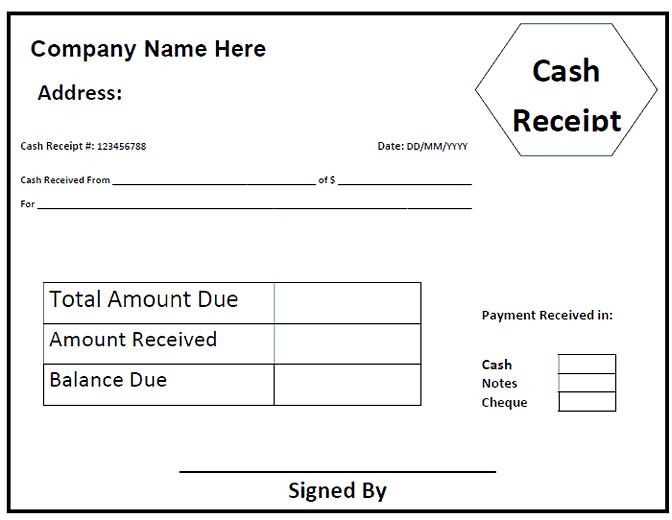

Include the transaction date for accurate record-keeping. This ensures a clear timeline of payments, allowing for easy tracking and audit purposes.

List the payer’s name or business name. This identifies the source of funds and helps avoid confusion when multiple payers are involved.

Provide a description of the payment or service provided. It gives context to the transaction, making it easier to understand the purpose of the receipt later.

Include the amount received, clearly stating the currency. This prevents errors and ensures both parties are on the same page regarding the financial exchange.

Record the payment method (e.g., cash, credit card, check). This helps distinguish between different forms of payment and streamlines reconciliation.

If applicable, include the receipt number for reference. A unique identifier can simplify tracking, especially in larger businesses with frequent transactions.

Incorporate the name and contact information of the recipient. This establishes accountability and provides a point of contact for any future inquiries or issues.

Provide a thank-you note or acknowledgment of payment. While optional, this adds a personal touch and encourages positive customer relations.

To ensure accuracy in your daily cash receipt log, always document transactions immediately after they occur. This minimizes the risk of forgetting details or making errors later. Double-check amounts, dates, and payment methods to ensure all entries are correct. Avoid relying on memory for cash receipt details, as human error is inevitable over time.

Utilize Clear and Consistent Formats

Adopt a standardized format for your records. This means using the same column order, date formats, and consistent terminology for every entry. Standardization makes it easier to spot discrepancies and prevents confusion. It’s also helpful for any future audits or reviews, ensuring data is easy to interpret quickly.

Implement Regular Reconciliations

Schedule daily or weekly reconciliations to match your recorded cash receipts with actual bank deposits. This ensures that no discrepancies go unnoticed. If there’s a mismatch, address it immediately rather than letting it accumulate. Keeping a running total of your cash receipts will help identify any issues early on.

Keep backup records for every transaction, such as receipts or invoices, to verify amounts in case of discrepancies. This provides a reliable reference if questions arise about specific transactions. Finally, educate everyone involved in logging receipts to follow the same procedures and encourage a team-oriented approach to ensuring accuracy.

Best Practices for Structuring a Daily Cash Receipt Log

A daily cash receipt log is crucial for tracking all cash transactions within a business. To maintain accuracy and ensure transparency, follow these steps:

- Keep a Clear Header: Label each entry with a unique identifier, such as the transaction number or receipt number. This helps easily trace and reference specific transactions later.

- Record Date and Time: Each log entry should include the date and time of the transaction. This ensures you can track the flow of cash throughout the day.

- Detail the Amount Received: Specify the exact amount of money received. Include both the denomination breakdown (e.g., $20 bills, coins) and the total value.

- Specify the Source: Always note who made the payment and the reason for it. This provides clarity in case of discrepancies or inquiries later.

- Record Payment Method: Indicate whether the payment was made by cash, check, or other methods. This helps separate cash receipts from non-cash transactions.

- Monitor Daily Totals: Add a section for the daily total, where you sum all cash receipts at the end of the day. This ensures that the cash on hand matches your records.

- Ensure Regular Reconciliation: Regularly compare the log entries with actual cash in the register. This prevents errors and highlights potential issues early.

- Keep It Organized: Use a consistent format, whether digital or physical, so all entries are easy to follow. Create a template that can be reused daily to avoid confusion.